First Advantage Intrinsic Value – First Advantage to Release Quarterly Earnings Data Ahead of Market Open on May 10th

May 4, 2023

Trending News ☀️

First Advantage ($NASDAQ:FA) Corporation is a global leader in background screening and identity solutions, providing customers with fast and accurate insights to help make informed decisions. On Wednesday, May 10th, the company is set to release its quarterly earnings figures prior to the opening of the stock market. Analysts anticipate that the data released will reflect the company’s strong financial performance this quarter. Traders, investors, and analysts alike are keenly watching for any clues about the company’s financial health.

Many believe that a positive earnings report from First Advantage could signal good news for the broader stock market. As such, investors should keep a close eye on the data when it is released on Wednesday. By monitoring the earnings report, they can gain valuable insights into the future of First Advantage’s stock and make well-informed decisions about their own investments.

Earnings

According to their latest earning report of FY2022 Q4 as of December 31 2022, FIRST ADVANTAGE earned 212.6M USD in total revenue and 20.15M USD in net income. Compared to the same period from the previous year, FIRST ADVANTAGE achieved a 0.0% increase in total revenue and a 31.0% increase in net income. It is clear that FIRST ADVANTAGE has had a strong year, despite the challenges of a global pandemic.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for First Advantage. More…

| Total Revenues | Net Income | Net Margin |

| 810.02 | 64.6 | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for First Advantage. More…

| Operations | Investing | Financing |

| 212.77 | -48.6 | -59.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for First Advantage. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.89k | 759.21 | 7.57 |

Key Ratios Snapshot

Some of the financial key ratios for First Advantage are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.9% | 0.8% | 11.6% |

| FCF Margin | ROE | ROA |

| 22.7% | 5.2% | 3.1% |

Price History

The announcement comes as a surprise, as stockholders had received no prior notification. Investors are now eagerly awaiting the quarterly report to determine whether FIRST ADVANTAGE‘s market performance has changed since the beginning of the week. The report will be closely monitored to assess how FIRST ADVANTAGE has fared during this quarter and to gain insight into the company’s plans for the future. Live Quote…

Analysis – First Advantage Intrinsic Value

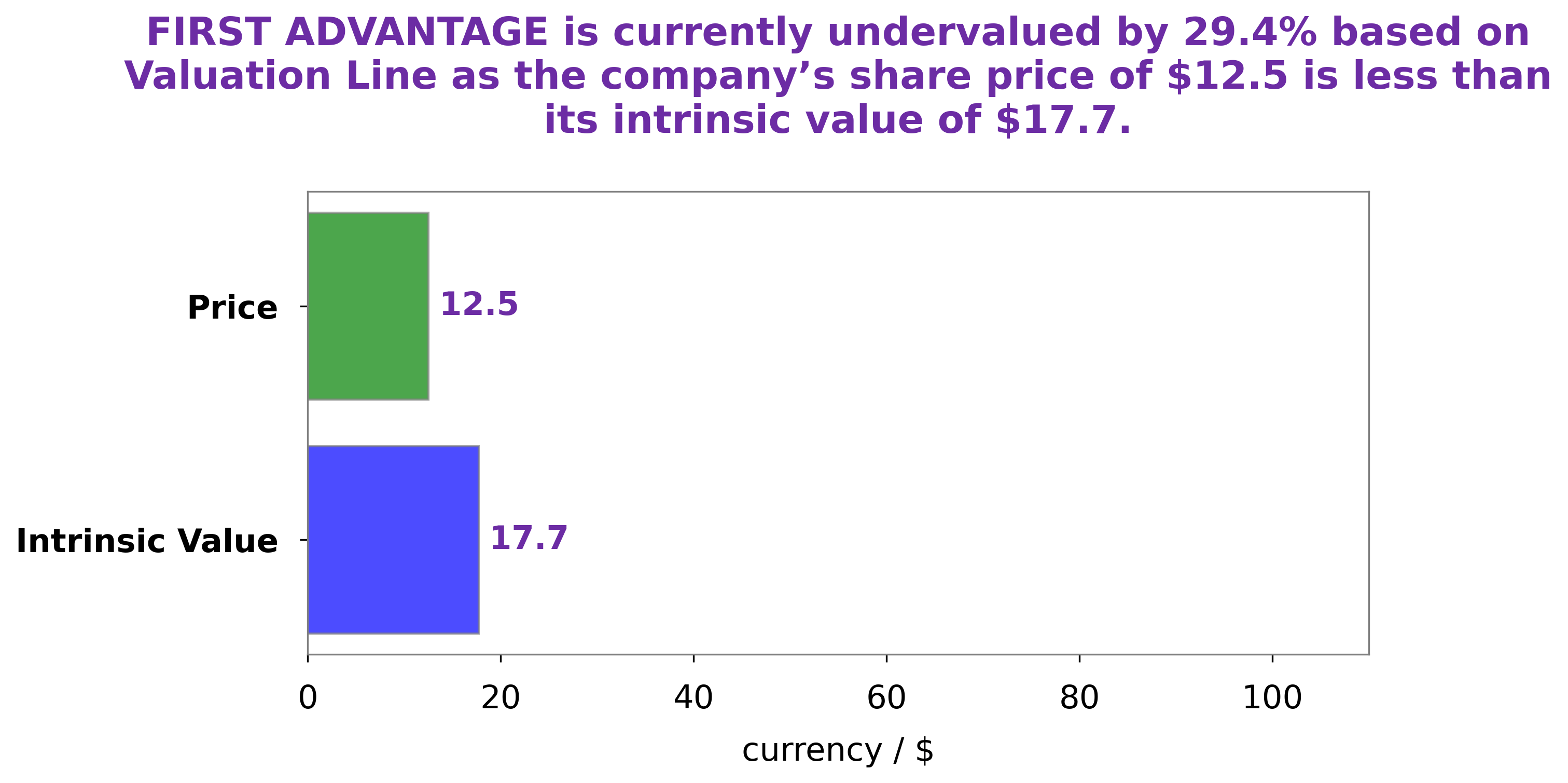

At GoodWhale, we have taken a look at the fundamentals of FIRST ADVANTAGE and performed an analysis. Our proprietary Valuation Line has indicated that the fair value of FIRST ADVANTAGE share is around $17.7. However, FIRST ADVANTAGE stock is currently trading at $12.5, which means it is undervalued by 29.5%. This presents a great opportunity for investors to buy in and benefit from a potential upside in the coming days. We believe that FIRST ADVANTAGE is an excellent long term investment and that it would yield great returns to investors who decide to invest in it. More…

Peers

Its competitors include Zeuus Inc, Anacomp Inc, and Spire Global Inc.

– Zeuus Inc ($OTCPK:ZUUS)

Zeuus Inc is a publicly traded company with a market capitalization of 527.55 million as of 2022. The company has a return on equity of 1191.01%. Zeuus Inc is a provider of online marketing and advertising services. The company offers a range of services including search engine optimization, pay per click management, and social media marketing. Zeuus Inc is headquartered in San Francisco, California.

– Anacomp Inc ($OTCPK:ANMP)

Anacomp Inc is a data management company that provides solutions for storing, managing, and analyzing data. The company has a market cap of 3.74M as of 2022 and a return on equity of 55.96%. Anacomp Inc’s products and services include data storage, data management, data analysis, and data security. The company serves customers in the United States, Canada, and Europe.

– Spire Global Inc ($NYSE:SPIR)

Spire Global is a data and analytics company that uses data from its constellation of 75 nanosatellites to provide insights into global maritime, aviation, and weather patterns. The company has a market cap of 180.46M as of 2022 and a return on equity of -7.96%.

Summary

Investors will be closely monitoring First Advantage’s quarterly earnings data, set to be released before the market opens on Wednesday, May 10th. Analysts anticipate that the company’s profits will be up from the previous quarter. The company’s stock price has been steadily climbing in recent months, with many investors expecting a strong showing in the coming earnings report. Those who decide to invest in First Advantage will be looking for continued growth in the quarterly report and any potential signs of a potential return on their investment. Investors will be analyzing the company’s financials, such as revenue, operating margins, and net income.

Additionally, they will be looking at the company’s cash flow situation, competitive landscape, debt levels, and management effectiveness. With a carefully considered analysis of these factors, investors can make an informed decision on whether or not to invest in First Advantage.

Recent Posts