Cintas Recognized for Third Year in a Row as One of Forbes’ Best Employers for Diversity

May 27, 2023

Trending News ☀️

Cintas Corporation ($NASDAQ:CTAS), a leader in first aid and safety products, corporate identity uniform programs, and facility services, has been honored by Forbes for a third consecutive year as one of the Best Employers for Diversity. On May 25th, 2023 in Cincinnati, OH, Forbes announced the recognition of Cintas Corporation for its commitment to promoting an inclusive workplace. Cintas Corporation prides itself on its commitment to inclusivity and diversity. Cintas works hard to ensure that all voices are heard and that everyone is given equal opportunities for success.

Forbes’ Best Employers for Diversity list is a testament to the hard work and dedication that Cintas puts into creating an equitable and diverse environment. Cintas is proud of its achievements in this area and looks forward to continuing to make the workplace more inclusive and welcoming for all.

Stock Price

As a result, Cintas’ stock opened at $464.0 and closed at $468.7, indicating an increase of 1.0% from the prior closing price of 464.2. This recognition highlights Cintas’ commitment to creating a workplace that celebrates diversity and inclusion. The company is proud to be at the forefront of championing diversity, recognizing the importance of fostering acceptance and belonging amongst its employees. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cintas Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 8.61k | 1.29k | 15.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cintas Corporation. More…

| Operations | Investing | Financing |

| 1.59k | -354.94 | -1.23k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cintas Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.47k | 4.83k | 35.73 |

Key Ratios Snapshot

Some of the financial key ratios for Cintas Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.8% | 11.0% | 20.2% |

| FCF Margin | ROE | ROA |

| 15.1% | 30.7% | 12.8% |

Analysis

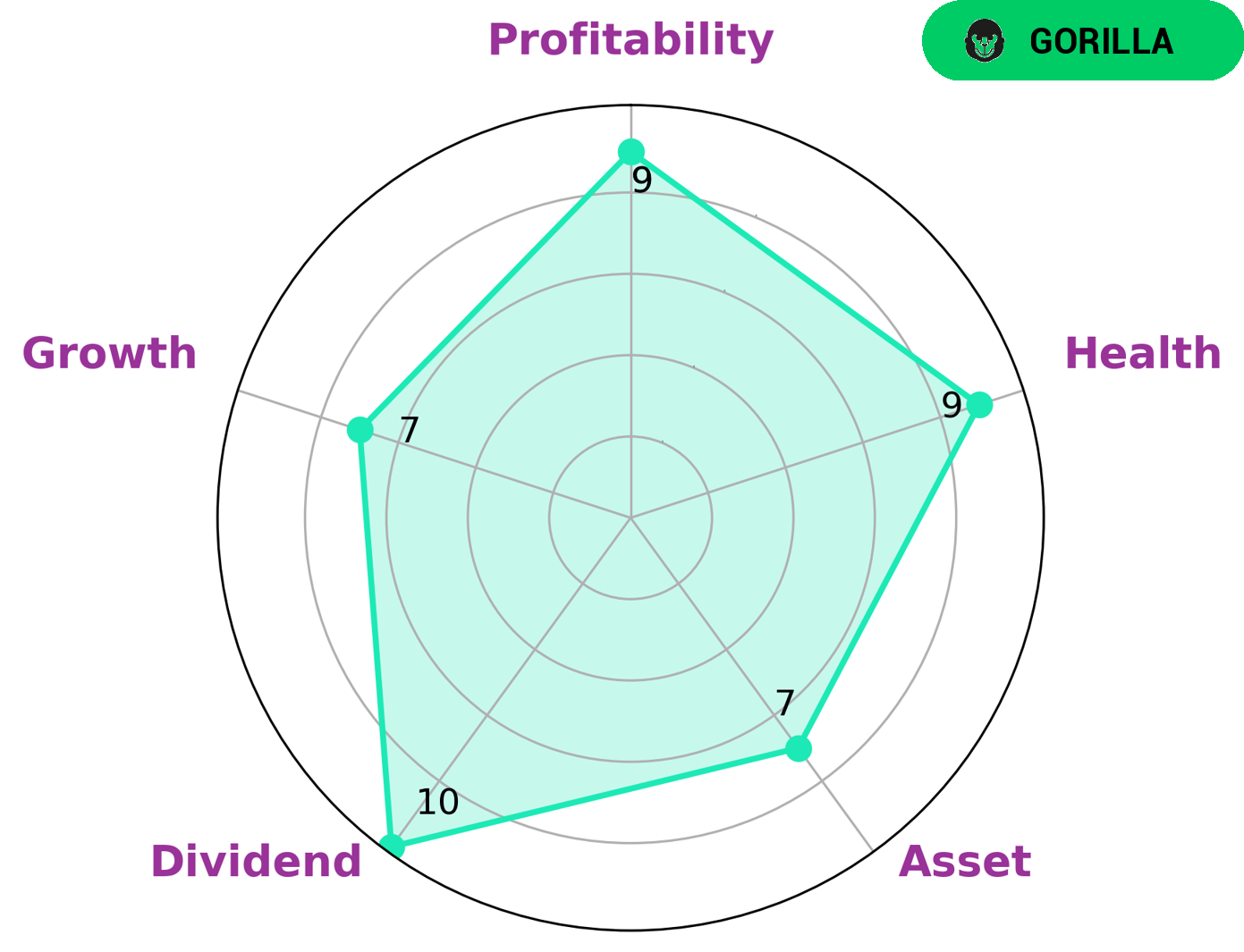

GoodWhale has conducted an in-depth analysis of the wellbeing of CINTAS CORPORATION, and our findings are highly encouraging. According to our Star Chart assessment, CINTAS CORPORATION has a high health score of 9 out of 10. This is mainly due to its strong cashflows and debt capacity, which indicate that the company is capable of sustaining future operations even in times of crisis. Furthermore, we classified CINTAS CORPORATION as a ‘gorilla’ type of company, which is characterized by its ability to achieve stable and high revenue or earning growth due to its strong competitive advantage. Given the company’s robust asset, dividend, growth, and profitability, we believe that investors with long-term objectives may find CINTAS CORPORATION an attractive investment option. For those who are interested in capital appreciation potential, CINTAS CORPORATION stands out as a great option due to its healthy financials and inherent competitive advantages. In addition, CINTAS CORPORATION has a consistent track record of dividend payments which makes it an ideal choice for dividend investors. Therefore, we believe that our analysis of CINTAS CORPORATION provides investors with invaluable insights into the company’s wellbeing and potential as an investment option. More…

Peers

Cintas Corp is a provider of uniforms and facility services to businesses worldwide. Its competitors are HITO-Communications Holdings Inc, White Fox Ventures Inc, and Nihonwasou Holdings Inc.

– HITO-Communications Holdings Inc ($TSE:4433)

HITO-Communications Holdings Inc is a Japanese telecommunications company with a market cap of 28.76B as of 2022. The company has a Return on Equity of 21.29%. HITO-Communications provides mobile phone, fixed-line telephone, and Internet services in Japan. The company was founded in 1985 and is headquartered in Tokyo, Japan.

– White Fox Ventures Inc ($OTCPK:AWAW)

As of 2022, White Fox Ventures Inc has a market cap of 1.03M and a return on equity of 318.93%. White Fox Ventures Inc is a venture capital firm that specializes in investments in the technology, healthcare, and media industries.

– Nihonwasou Holdings Inc ($TSE:2499)

Nihonwasou Holdings Inc is a Japanese real estate company with a market cap of 2.79B as of 2022. The company’s Return on Equity is 10.05%. The company engages in the business of leasing, selling, and managing apartments and other properties.

Summary

Cintas Corporation has been recognized as one of Forbes Best Employers for Diversity in 2023. An analysis of the company’s stock performance over the past few years has indicated a steady increase in share price. Cintas has a strong balance sheet, with the company’s cash balance increasing each year, and a consistent track record of paying dividends. As a result, Cintas Corporation provides investors with a stable and diversified investment option.

Recent Posts