Cintas Corporation Prepares to Bid Farewell to Chief Administration Officer Michael Thompson

April 7, 2023

Trending News 🌥️

Cintas Corporation ($NASDAQ:CTAS) is an American supplier of corporate identity uniform programs, providing rental and direct sale of uniforms, and other business services such as restroom supplies, first aid and safety products, fire protection services, and document management services. Recently, the company announced that its Chief Administration Officer, Michael Thompson, is set to retire in August. He has been instrumental in driving the company’s strategic initiatives, including the implementation of projects to improve customer service and reduce costs. During his tenure at Cintas, Thompson also worked to increase employee engagement and build a culture of recognition and appreciation. As Chief Administration Officer, Thompson was responsible for overseeing the company’s day-to-day operations such as finance, human resources, legal affairs, and information technology. He successfully guided the organization’s growth across its North American, European, and Pacific markets.

Thompson will be succeeded by current executive vice president of operations Paul Brockman. Thompson’s retirement marks the end of an era for Cintas Corporation. His departure leaves behind a legacy of innovation, efficiency, and collaboration that will undoubtedly influence the future of the company. He will be missed by his colleagues and customers alike.

Market Price

Cintas Corporation announced on Thursday that current Chief Administration Officer Michael Thompson will be leaving the company. The news came as the company’s stock opened at $451.5 and closed at $451.7 on the same day. This marks Thompson’s departure from the company after he has served in the role for six years. During his tenure, Thompson was instrumental in establishing Cintas Corporation as a leader in its industry. He was credited with helping to drive key initiatives such as the expansion of Cintas’ service offerings, the launch of their new sustainability program, and the development of their digital transformation strategy. In addition, Thompson also worked to strengthen the company’s corporate culture, enabling them to attract top talent and providing employees with a workplace environment that allows them to reach their potential. The company has not yet announced a replacement for Thompson.

However, with his departure, Cintas Corporation is bidding farewell to a leader who helped turn the company into a highly successful and respected organization. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cintas Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 8.61k | 1.29k | 15.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cintas Corporation. More…

| Operations | Investing | Financing |

| 1.59k | -354.94 | -1.23k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cintas Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.47k | 4.83k | 35.73 |

Key Ratios Snapshot

Some of the financial key ratios for Cintas Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.8% | 11.0% | 20.2% |

| FCF Margin | ROE | ROA |

| 15.1% | 30.7% | 12.8% |

Analysis

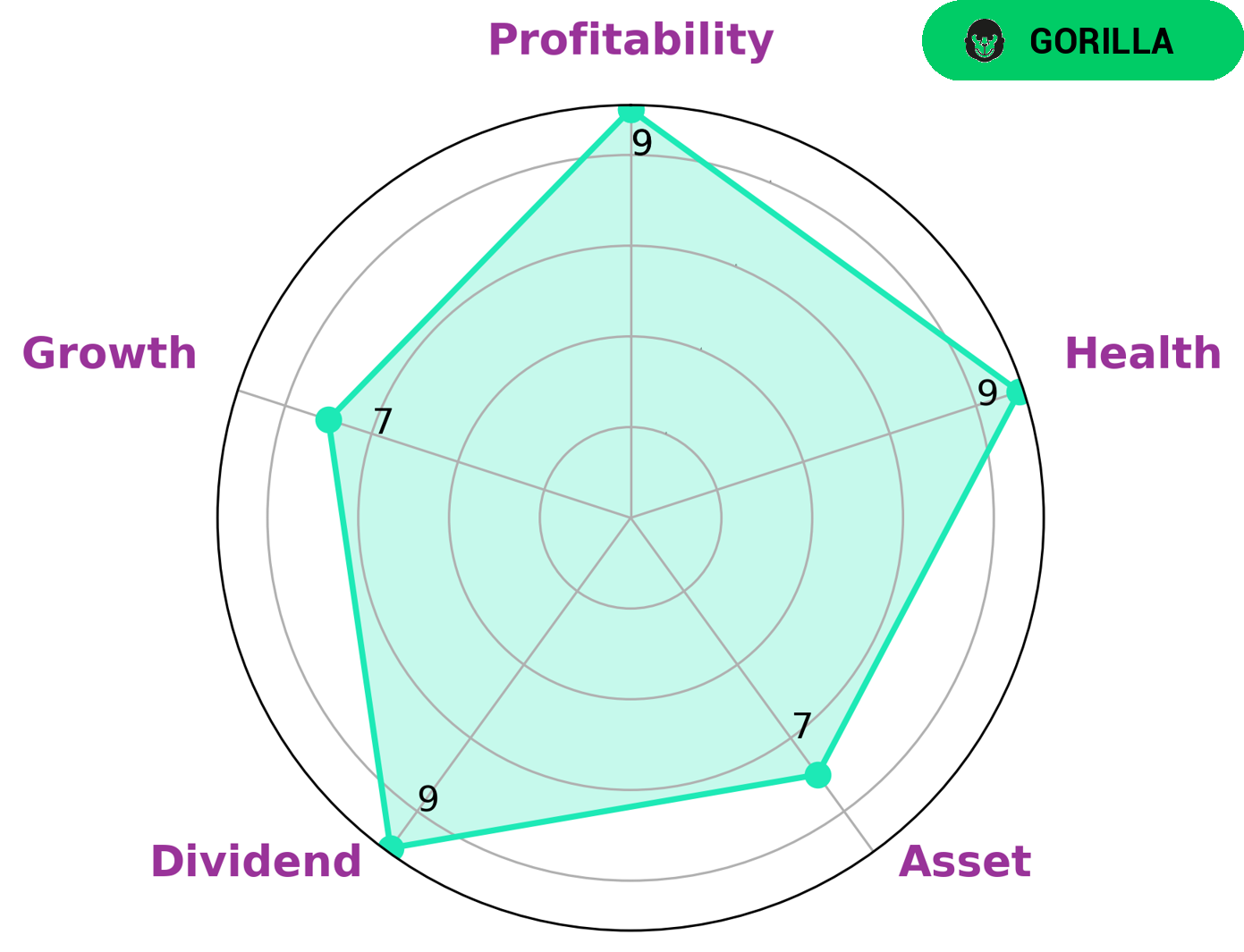

GoodWhale has conducted a comprehensive analysis of CINTAS CORPORATION‘s wellbeing and the results are highly positive. According to our Star Chart, CINTAS CORPORATION is strong in terms of its assets, dividends, growth and profitability. With a health score of 9/10 considering its cashflows and debt, we conclude that the company is capable of riding out any crisis without the risk of bankruptcy. Furthermore, CINTAS CORPORATION is classified as a ‘gorilla’ – a type of company we categorize as having achieved stable and high revenue or earnings growth due to its strong competitive advantage. We believe that this company may be of great interest to both institutional and retail investors who are looking for companies with a resilient financial standing and strong fundamentals. Moreover, investors who are seeking to invest in reliable and profitable companies in the long-term may find this to be very attractive. More…

Peers

Cintas Corp is a provider of uniforms and facility services to businesses worldwide. Its competitors are HITO-Communications Holdings Inc, White Fox Ventures Inc, and Nihonwasou Holdings Inc.

– HITO-Communications Holdings Inc ($TSE:4433)

HITO-Communications Holdings Inc is a Japanese telecommunications company with a market cap of 28.76B as of 2022. The company has a Return on Equity of 21.29%. HITO-Communications provides mobile phone, fixed-line telephone, and Internet services in Japan. The company was founded in 1985 and is headquartered in Tokyo, Japan.

– White Fox Ventures Inc ($OTCPK:AWAW)

As of 2022, White Fox Ventures Inc has a market cap of 1.03M and a return on equity of 318.93%. White Fox Ventures Inc is a venture capital firm that specializes in investments in the technology, healthcare, and media industries.

– Nihonwasou Holdings Inc ($TSE:2499)

Nihonwasou Holdings Inc is a Japanese real estate company with a market cap of 2.79B as of 2022. The company’s Return on Equity is 10.05%. The company engages in the business of leasing, selling, and managing apartments and other properties.

Summary

Cintas Corporation (NASDAQ:CTAS) is a leading provider of corporate identity uniforms and related business services. Cintas is expected to continue growing in revenue and earnings as it benefits from a strong macroeconomic environment. The company has robust fundamentals with a solid track record of earnings growth and a steady balance sheet.

Recent Posts