AMF Tjanstepension AB Makes Unexpected Move, Decreases Holdings in Copart,: A Closer Look

July 14, 2023

🌥️Trending News

AMF Tjanstepension AB’s recent decision to decrease their holdings in Copart ($NASDAQ:CPRT), Inc. has been met with much surprise and speculation throughout the investment world.

In addition, Copart provides vehicle sellers with a full suite of services, from secure storage to transportation and titling. With such an impressive track record of success, many have been left wondering why AMF Tjanstepension AB has chosen to reduce their stake in the company. This move has been described as a “closer look” as investors seek to gain insight into the decision-making process of the renowned investment firm. Some have suggested that the firm’s leadership was simply looking to diversify their portfolio and reduce their risk exposure by decreasing their exposure to any one stock. Others believe that the firm may have received information that caused them to be cautious about Copart’s future performance. Regardless of the rationale behind AMF Tjanstepension AB’s decision, the move has certainly been met with much intrigue and speculation. In a market as unpredictable as the stock market, any unexpected move such as this can cause investors to take a closer look at the underlying factors. As such, it is likely that AMF Tjanstepension AB’s decision will be closely examined in the days and weeks to come.

Market Price

On Monday, COPART stock opened at $89.1 and closed at $90.3, registering a 2.5% increase from its previous closing price of 88.1. This rise came as a surprise to many, considering the fact that AMF Tjanstepension AB had recently decreased its holdings in the company. While the decrease in holdings from AMF Tjanstepension AB suggests a lack of confidence in the company, the rise of 2.5% in COPART’s stock could be indicative of an overall positive sentiment among investors.

This could be due to the company’s excellent financial performance in recent months, as well as their impressive portfolio of products and services they offer. Overall, the unexpected move by AMF Tjanstepension AB has created some speculation in the market, with many investors and analysts taking a closer look at COPART’s performance and future outlook. Copart_A_Closer_Look”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Copart. More…

| Total Revenues | Net Income | Net Margin |

| 3.76k | 1.15k | 31.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Copart. More…

| Operations | Investing | Financing |

| 1.32k | -313.5 | -350.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Copart. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.35k | 757.38 | 10.94 |

Key Ratios Snapshot

Some of the financial key ratios for Copart are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.1% | 20.9% | 37.3% |

| FCF Margin | ROE | ROA |

| 23.1% | 16.2% | 13.8% |

Analysis

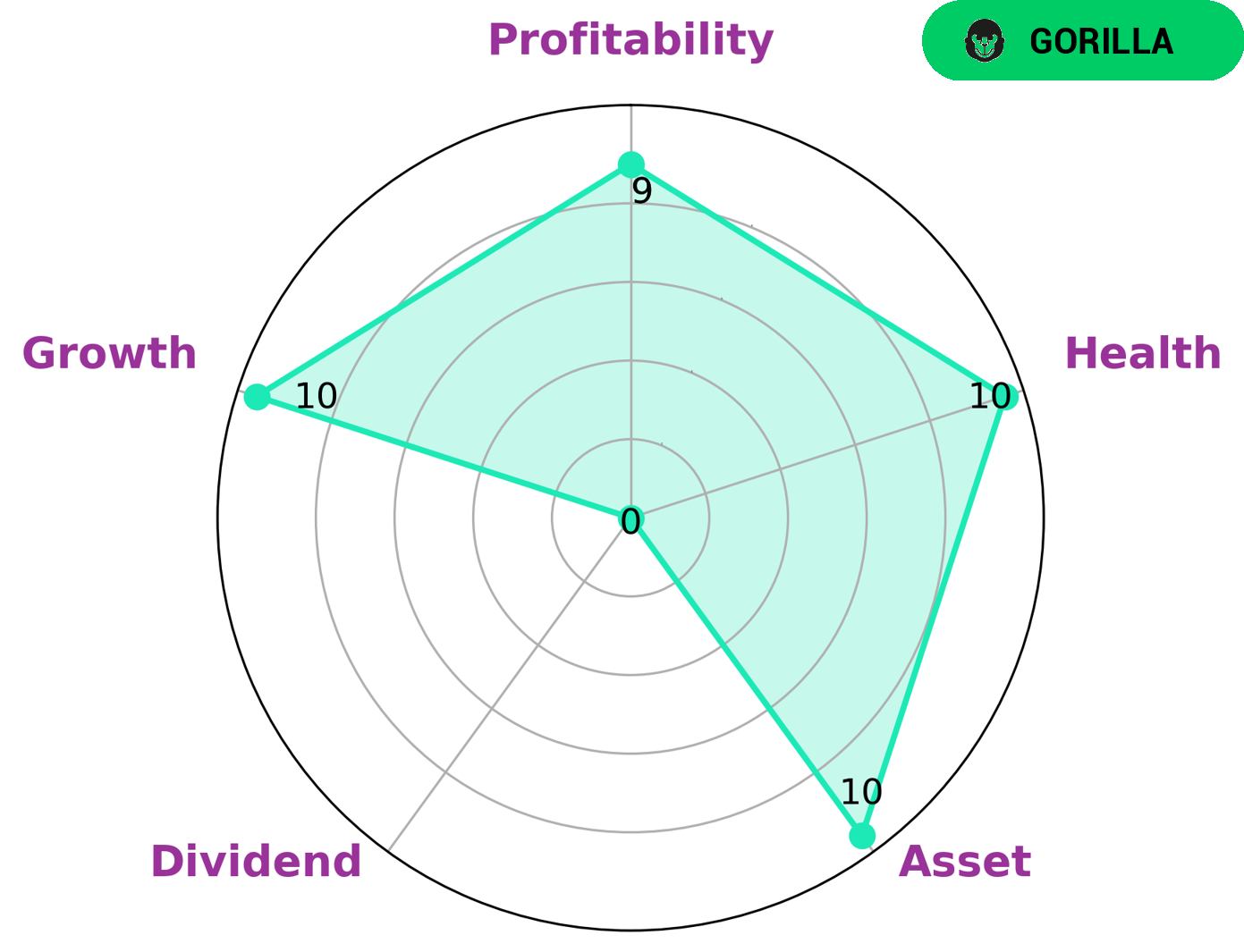

At GoodWhale, we conducted an analysis of COPART’s financials and discovered that it is classified as a ‘gorilla’, a type of company we conclude that achieved stable and high revenue or earning growth due to its strong competitive advantage. This type of company is attractive to a variety of investors, such as those seeking growth and those who are looking for stability. COPART is strong in terms of asset, growth, and profitability, although it is weak in terms of dividend. Despite this, we found that COPART has a high health score of 10/10 with regard to its cashflows and debt, which suggests that it is capable to safely ride out any crisis without the risk of bankruptcy. Copart_A_Closer_Look”>More…

Peers

Some of its competitors are Alpine Auto Brokers Inc, NowAuto Inc, and Vaksons Automobiles Ltd.

– Alpine Auto Brokers Inc ($OTCPK:ALTB)

Alpine Auto Brokers Inc is a publicly traded company with a market capitalization of 1.61 billion as of 2022. The company has a return on equity of 672.61%. Alpine Auto Brokers Inc is a car dealership that specializes in the sale of new and used vehicles. The company has a network of dealerships across the United States. Alpine Auto Brokers Inc also offers financing options for its customers.

– NowAuto Inc ($OTCPK:NWAU)

Vaksons Automobiles Ltd is an Indian company that manufactures and sells passenger cars, trucks, and buses. The company has a market cap of 167.28M as of 2022 and a Return on Equity of -0.15%. Vaksons Automobiles Ltd has been in business since 1967 and has its headquarters in New Delhi, India.

Summary

Investment analysis of COPART, Inc. is undergoing a shift, with AMF Tjanstepension AB reducing its holdings in the company. This move indicates a shift in investor sentiment, as they are decreasing their exposure to the stock. It is important to consider the potential implications of this move, including how it may influence share prices and investor confidence in the company.

Additionally, investors should consider the broader market trends and the impact of macroeconomic factors on their investment decision. Understanding these trends can provide insight into the future of the company and the best strategies for managing one’s investments.

Recent Posts