ABM Industries Investing Report: Analyzing the $ABM Performance

May 17, 2023

Trending News 🌥️

This report will analyze the performance of ABM ($NYSE:ABM) Industries ($ABM), a leading provider of integrated facility solutions, with a focus on their investments. Their services range from janitorial, energy solutions, HVAC and mechanical, and electrical to building engineering and lighting services. Investing in ABM Industries can provide investors with a consistent return, as their proven record of generating strong returns on invested capital demonstrates. The company’s diversified portfolio of service lines allows them to capitalize on market changes, while mitigating risk with their broad customer base.

In addition, their commitment to sustainability and energy efficient solutions has helped them to stay ahead of the competition. The company has achieved success through their long-term focus on investing in new technologies and expanding their portfolio of services. They also focus on research and development to improve existing products and services. This has resulted in ABM Industries being able to provide customers with high-quality products and services that meet their needs. The company’s track record of success is reflected in their financial performance. They have also been able to maintain a low debt to equity ratio, which indicates that their financial position is strong. As such, investors should consider ABM Industries when constructing their portfolios. With their focus on innovation and sustainable solutions, they are well-positioned to continue to generate strong returns on invested capital.

Market Price

On Monday, ABM Industries stock opened at $43.4 and closed at $43.5, giving a slight 0.3% increase from the previous closing price. This could be seen as a positive sign for ABM Industries and the overall market, indicating that investors are feeling confident about their investments and the potential for future profits. The positive performance of ABM Industries’ stock has been further boosted by the company’s recent announcements of investing in new technologies, such as artificial intelligence, to improve its customer experience.

In addition, the company has also been actively expanding its presence in different markets around the world. These steps taken by ABM Industries have given investors more confidence in the company and its ability to deliver strong returns in the future. Overall, ABM Industries has been performing well on the stock market, with a slight increase seen on Monday. This indicates that investors are feeling optimistic about the company’s future and its ability to deliver on its promises. As such, it is likely that ABM Industries will continue to see its stock price rise in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Abm Industries. More…

| Total Revenues | Net Income | Net Margin |

| 7.86k | 192.9 | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Abm Industries. More…

| Operations | Investing | Financing |

| 43.1 | -241.6 | 241.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Abm Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.92k | 3.18k | 26.27 |

Key Ratios Snapshot

Some of the financial key ratios for Abm Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.5% | 10.2% | 4.0% |

| FCF Margin | ROE | ROA |

| -0.2% | 11.5% | 4.0% |

Analysis

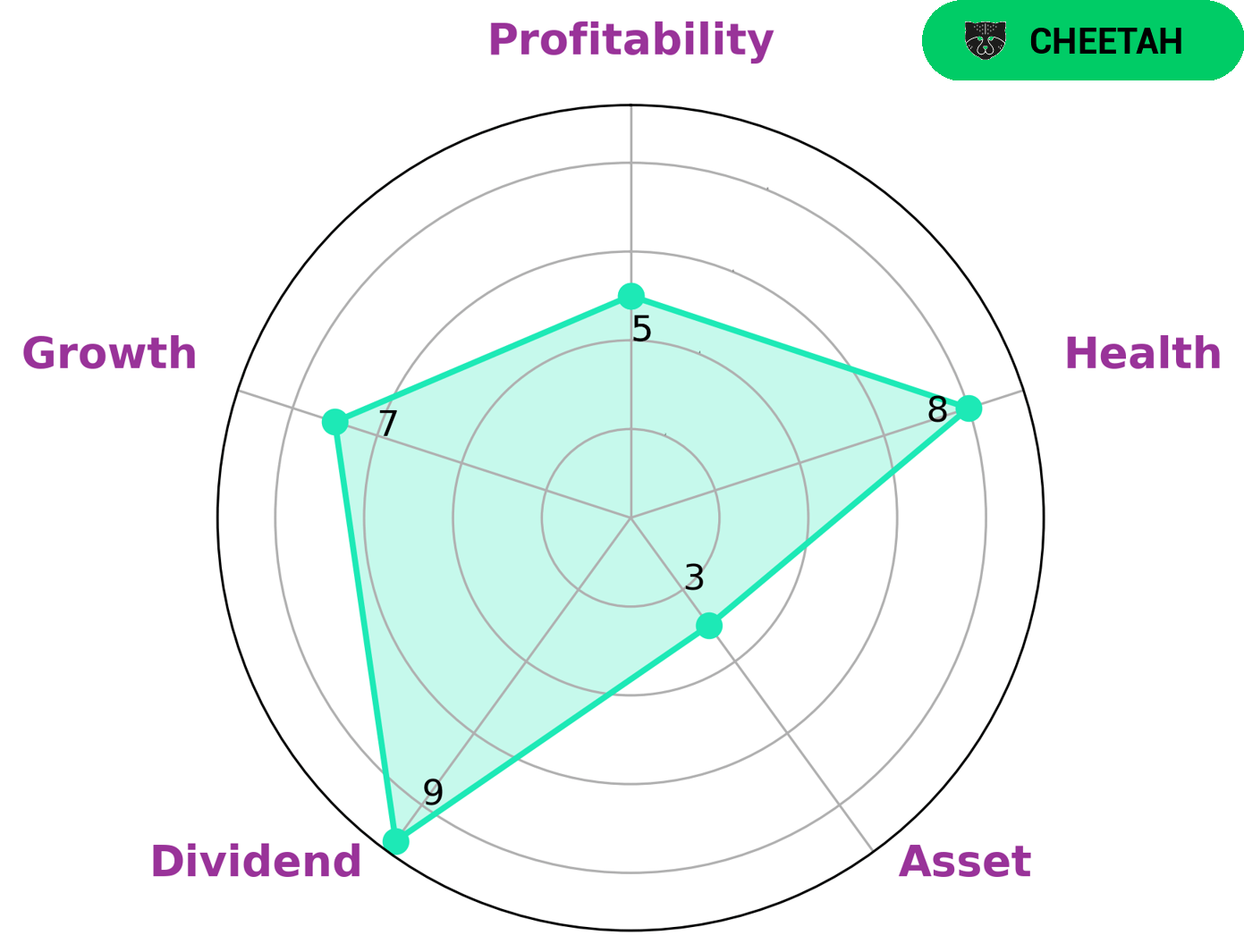

GoodWhale has conducted an analysis of ABM INDUSTRIES‘s wellbeing and, based on the Star Chart, we classify it as a ‘cheetah’ type of company – one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company could be attractive to investors who are looking for strong growth prospects but are comfortable with taking on additional risk. When assessing the company’s financial health, we found that ABM INDUSTRIES was strong in dividend and growth, medium in profitability, and weak in asset. Despite this, the company scored an 8/10 on GoodWhale’s health assessment as it is financially secure due to its positive cashflows and manageable debt. This suggests that ABM INDUSTRIES is able to safely ride out any crisis without the risk of bankruptcy. More…

Peers

As the competition heats up, ABM Industries Inc will have to make sure that their services remain the best in the industry in order to stay ahead of their competitors.

– Mader Group Ltd ($ASX:MAD)

Mader Group Ltd is a leading global provider of construction services, specializing in the mining and energy sectors. With a market cap of 714M as of 2022, the company is well positioned to continue to grow and expand its business. Mader Group Ltd has a very impressive Return on Equity (ROE) of 33.68%, which is significantly higher than the industry average of 14%. This indicates that the company is making effective use of its equity to generate excellent returns for its shareholders. Mader Group Ltd is well-positioned to capitalize on growth opportunities in the global construction and energy sectors.

– Teleperformance SE ($OTCPK:TLPFF)

Teleperformance SE is a global leader in customer experience management and business process outsourcing. Founded in 1978, the company specializes in providing customer care, technical support, and digital integrated services across multiple channels. As of 2022, Teleperformance SE has a market capitalization of 13.34B. Its return on equity (ROE) is 16.41%, which indicates a high return on the invested capital relative to its competitors. This strong ROE is testament to the company’s ability to generate value for its shareholders by efficiently using its resources.

– Dexterra Group Inc ($TSX:DXT)

Dexterra Group Inc is a Canadian company that specializes in providing enterprise mobility solutions and services to its clients. The company has a market cap of 335.95M as of 2022, which represents its current market value. Its Return on Equity (ROE) is 4.62%, which refers to the amount of net income earned compared to the company’s total equity. The company’s current ROE is lower than the industry average, indicating that it is creating less value for its shareholders than its peers. Overall, Dexterra Group Inc is a reliable provider of enterprise mobility solutions and services and its market cap and ROE can be taken as indicators of its stability and potential for growth.

Summary

ABM Industries is a facilities management and building services provider with operations in the United States, Canada, and select international locations. Investing in ABM Industries offers a potential for long-term growth and a steady dividend yield. The company has a wide range of services, from janitorial and landscaping to engineering and facility maintenance, giving it an edge over its competitors in terms of diversification and potential for growth. The balance sheet is sound, with a low debt-to-equity ratio and a healthy cash position.

ABM Industries has also been actively investing in technology to improve efficiency and productivity. With its focus on delivering high quality services and its proven track record of success, ABM Industries is an attractive option for investors looking for a long-term growth opportunity.

Recent Posts