Sunpower Corporation Intrinsic Value – SunPower Corporation Prices Soar as Analysts Predict Spike in Stock Value

June 15, 2023

☀️Trending News

SUNPOWER ($NASDAQ:SPWR): SunPower Corporation is an American energy company that designs, manufactures, and delivers solar systems to businesses and homeowners worldwide. On Wednesday, June 07, their stock prices soared higher than the day before, with buyers driving the share price up 0.90%, as analysts were predicting a spike in stock value. The surge in SunPower Corporation’s stock prices has prompted many investors to take notice of the company and its potential. Analysts have recently issued statements that the long-term prospects of the company appear to be very strong, as more companies and homeowners are looking to solar power for their energy needs. SunPower is one of the longest-standing solar energy companies in the industry and has developed a number of solar technology products that have helped drive growth in the industry. SunPower Corporation has also committed itself to sustainability, with several of its recent projects and initiatives designed to reduce the environmental impact of its operations.

In addition, the company’s commitment to renewable energy sources provides buyers a reliable, affordable alternative to traditional energy sources. Overall, the combination of strong financial performance, technology innovations, and a commitment to sustainability have led analysts to predict a further rise in SunPower Corporation’s share price. It appears that investors are gravitating towards the company’s potential and are eager to take advantage of what looks to be a very promising future for SunPower Corporation.

Price History

Thursday was a volatile day for SunPower Corporation, the leading global solar energy company. SunPower’s stock opened at $11.3 and closed at $11.2, down by 0.4% from its prior closing price of 11.2.

However, the stock prices have been on an upward trajectory in the past week, driven by bullish analyst predictions. This has led to an overall surge in share prices and a corresponding surge of confidence in the company from investors. The news is a testament to SunPower’s focus on producing innovative solar products and solutions that meet both customer and environmental needs. With a strong portfolio of products and services, a growing customer base, and a continued commitment to sustainability, SunPower is well-positioned to capitalize on the growing demand for renewable energy sources. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sunpower Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.83k | 33.22 | 2.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sunpower Corporation. More…

| Operations | Investing | Financing |

| -207.81 | 467.99 | -281.47 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sunpower Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.49k | 989.12 | 2.87 |

Key Ratios Snapshot

Some of the financial key ratios for Sunpower Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.3% | 5.2% | 4.5% |

| FCF Margin | ROE | ROA |

| -14.5% | 9.7% | 3.5% |

Analysis – Sunpower Corporation Intrinsic Value

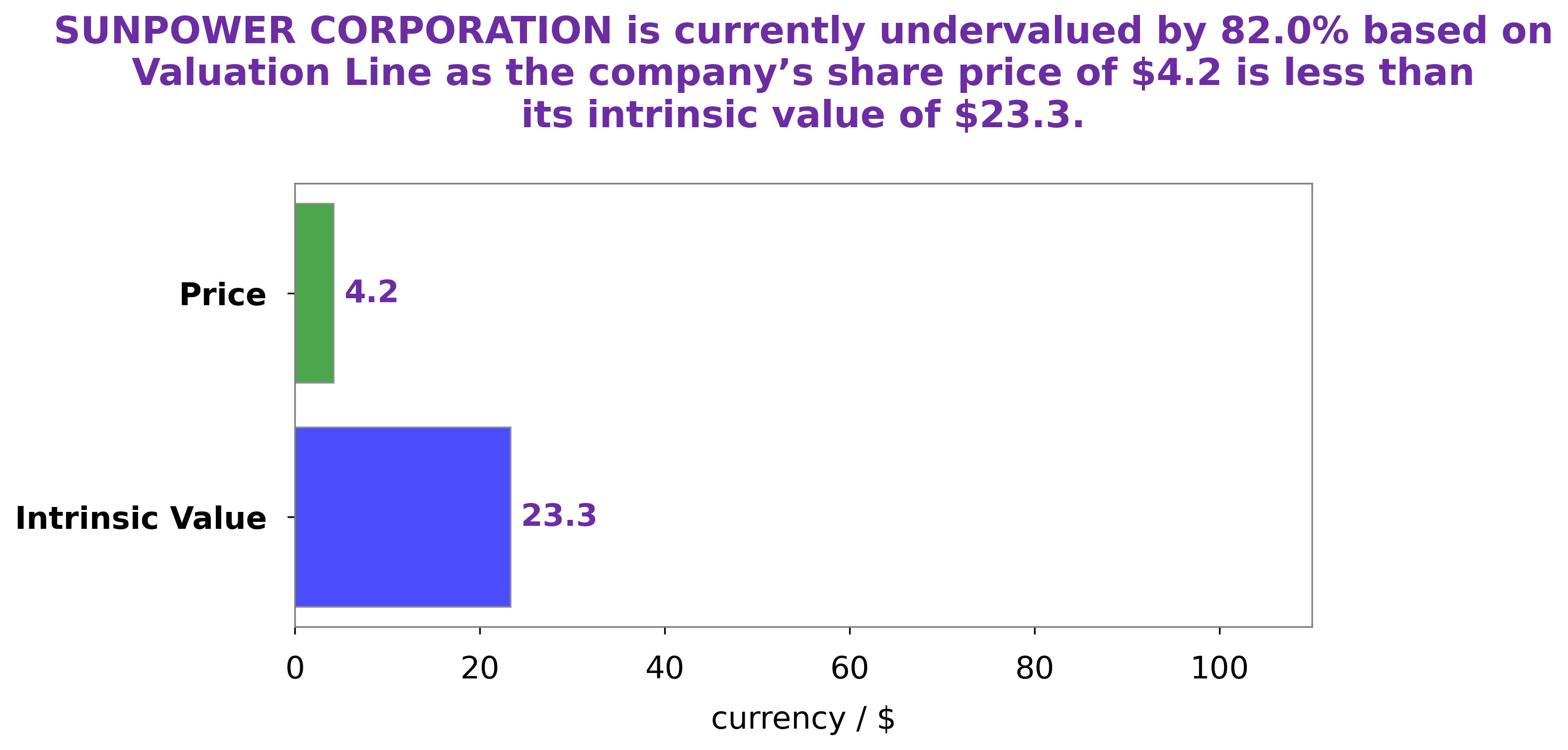

At GoodWhale, we’ve been hard at work analyzing the financials of SUNPOWER CORPORATION. After careful examination, we calculate that the intrinsic value of SUNPOWER CORPORATION’s stock is around $25.5, using our proprietary Valuation Line. Currently, the stock is traded at $11.2, which is drastically undervalued by 56.1%. This would suggest that it is a great time to buy into SUNPOWER CORPORATION and benefit from its future growth potential. More…

Peers

Solar panel technology has come a long way in recent years, and SunPower Corp has been at the forefront of this innovation. The company’s unique technology has allowed it to become one of the leading manufacturers of solar panels in the world. However, SunPower Corp is not without competition. Enphase Energy Inc, Central Development Holdings Ltd, and PT Sky Energy Indonesia Tbk are all leading solar panel manufacturers that are vying for market share.

– Enphase Energy Inc ($NASDAQ:ENPH)

Enphase Energy Inc is a publicly traded company that designs, manufactures and sells microinverters for the solar photovoltaic industry. Enphase has a market cap of $32.82B as of 2022 and a Return on Equity of 58.92%. The company was founded in 2006 and is headquartered in Fremont, CA.

– Central Development Holdings Ltd ($SEHK:00475)

Central Development Holdings Ltd is a property development and investment company based in Hong Kong. The company’s market cap as of 2022 was 251.92M and its ROE was -15.66%. Central Development Holdings Ltd’s primary business activity is the development of residential and commercial properties in Hong Kong. The company also has a portfolio of investment properties in Mainland China.

– PT Sky Energy Indonesia Tbk ($IDX:JSKY)

Sky Energy Indonesia Tbk is the largest Indonesian-based integrated energy company with operations in exploration and production, refining, marketing and trading, power generation, and mining. The company has a market capitalization of $105.69 billion as of 2022 and a return on equity of -22.56%.

Sky Energy Indonesia Tbk is a vertically integrated energy company with operations in exploration and production, refining, marketing and trading, power generation, and mining. The company has a strong presence in the Indonesian energy market and is the largest Indonesian-based integrated energy company. The company has a market capitalization of $105.69 billion as of 2022 and a return on equity of -22.56%. Sky Energy Indonesia Tbk is a well-positioned to benefit from the growing demand for energy in Indonesia and the Asia Pacific region.

Summary

SunPower Corporation stock rose 0.90% on Wednesday, June 07, as investors began to show positive sentiment in the company. This is likely due to analysts foreseeing higher potential returns for SunPower Corporation in the near future. Investors should do their own research and consider factors such as the company’s financial performance, product offerings, competitive landscape, and other industry news before deciding whether to invest in the company.

Additionally, investors should assess their risk tolerance and take into account the volatility of the stock market before investing. Overall, SunPower Corporation appears to be a promising investment opportunity for those who are willing to take on the risk.

Recent Posts