SolarEdge Technologies Reports Record-Breaking Q4 Non-GAAP EPS of $2.86 in 2023, Beating Expectations by $1.27.

February 14, 2023

Trending News 🌧️

SOLAREDGE ($NASDAQ:SEDG): SolarEdge Technologies, a leading global provider of solar power optimization solutions, recently announced that Q4 Non-GAAP Earnings Per Share (EPS) of $2.86 exceeded expectations by $1.27. This is a record-breaking result and demonstrates the company’s commitment to delivering superior shareholder value. SolarEdge Technologies is a leading provider of inverters and monitoring systems for photovoltaic (PV) systems. The company’s solutions are designed to maximize solar production, reduce system installation costs, and enable efficient monitoring and maintenance of PV systems. SolarEdge’s proprietary technology optimizes the performance of each module in the system, making it the perfect choice for residential, commercial and utility-scale PV installations. This rapid growth can be attributed to SolarEdge’s technologically advanced solutions, which offer superior performance, reliability and efficiency compared to traditional string inverters.

In addition, SolarEdge’s software-as-a-service business model has enabled the company to take advantage of the booming solar market. The record Q4 Non-GAAP EPS of $2.86 is yet another testament to SolarEdge’s strong performance and impressive growth. Thanks to its innovative products and its dedication to providing superior customer service, SolarEdge is well positioned to continue its impressive growth in the coming years.

Price History

On Monday, SOLAREDGE TECHNOLOGIES stock opened at $303.7 and closed at $310.7, up by 3.3% from the previous closing price of 300.7. The company attributed this success to an increase in sales and margin growth driven by strong demand for its power optimizers, inverters and energy storage solutions in both residential and non-residential segments. SolarEdge Technologies saw impressive growth in all of its major markets such as North America, Europe, Asia Pacific, Central/South America and Middle East/Africa during the quarter. Specifically, the company’s residential segment accounted for over two-thirds of its total revenues, while the non-residential segment accounted for one-third, up from the previous quarter’s one-fourth. SolarEdge enjoyed a particularly strong performance in the Asian markets due to increased demand for its power optimizers and energy storage solutions in these regions. The company is confident that with increasing customer demand, its technological innovations and strategic partnerships, it will continue to drive strong performance across all its major markets.

Additionally, it is also investing in research and development in order to expand its product portfolio and enter into new markets such as electric vehicles, energy solutions for commercial buildings and industrial applications. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Solaredge Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 3.11k | 93.78 | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Solaredge Technologies. More…

| Operations | Investing | Financing |

| 31.28 | -417.04 | 654.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Solaredge Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.27k | 2.09k | 36.71 |

Key Ratios Snapshot

Some of the financial key ratios for Solaredge Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.7% | -4.4% | 5.3% |

| FCF Margin | ROE | ROA |

| -4.4% | 4.9% | 2.4% |

Analysis

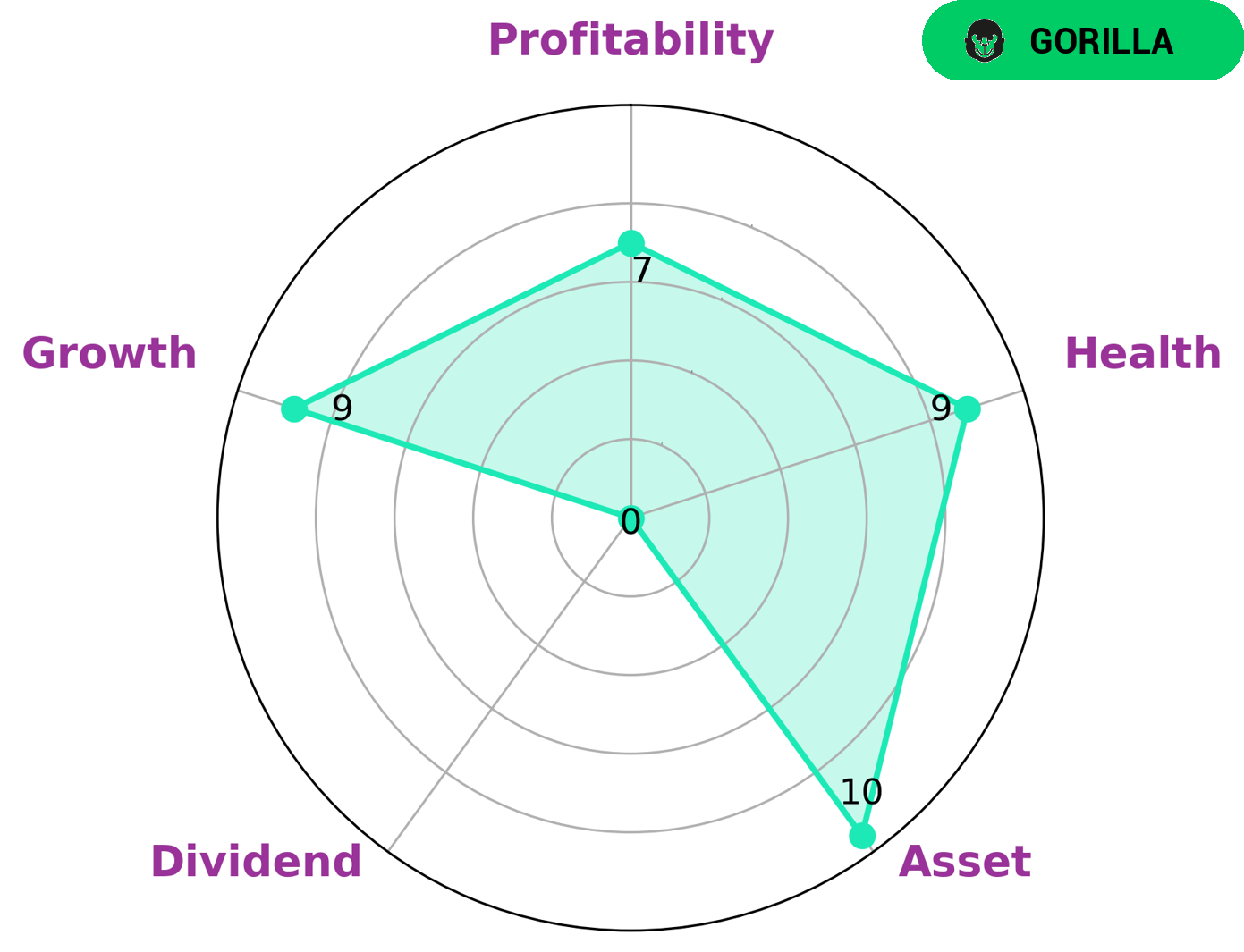

GoodWhale has conducted an analysis of SOLAREDGE TECHNOLOGIES‘ financials and found that the company has a high health score of 9/10 with regard to its cashflows and debt. This indicates that the company is likely to be able to sustain future operations in times of crisis. Furthermore, GoodWhale has classified SOLAREDGE TECHNOLOGIES as a ‘gorilla’ company; this is a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This could be a great opportunity for investors looking for a secure long term investment. The financial analysis also revealed that SOLAREDGE TECHNOLOGIES has good assets and is growing steadily, as well as being profitable. However, in terms of dividends, the company is seen to be weaker than its other metrics. This could make it a less attractive option for investors who are only interested in dividend returns. Overall, SOLAREDGE TECHNOLOGIES appears to be a well-positioned company with a stable outlook for future operations and growth. Investors who are looking for a secure long-term investment and don’t rely solely on dividends may be interested in this company. More…

Peers

In the solar energy industry, there is intense competition between SolarEdge Technologies Inc and its main competitors United Renewable Energy Co Ltd, Folkup Development Inc, and Tainergy Tech Co Ltd. All four companies are striving to be the leading provider of solar energy solutions and each has its own unique strengths and weaknesses. SolarEdge Technologies Inc has a strong focus on innovation and has developed several industry-leading products, while United Renewable Energy Co Ltd has a large customer base and a strong financial position. Folkup Development Inc has a strong research and development team, while Tainergy Tech Co Ltd has a large manufacturing capacity.

– United Renewable Energy Co Ltd ($TWSE:3576)

As of 2022, United Renewable Energy Co Ltd has a market cap of 34.73B and a Return on Equity of 2.02%. The company is engaged in the business of developing, manufacturing and marketing of solar photovoltaic products. It also provides engineering, procurement and construction services for solar power projects.

– Folkup Development Inc ($OTCPK:FLDI)

Folkup Development Inc is a publicly traded company with a market capitalization of $49 million as of 2022. The company has a return on equity of 40.0%, indicating that it is a profitable company that is generate shareholder value. Folkup Development Inc is engaged in the business of real estate development and management. The company has a portfolio of properties in the United States and Canada.

– Tainergy Tech Co Ltd ($TWSE:4934)

Tainergy Tech Co Ltd is a Taiwanese company that manufactures lithium batteries and energy storage systems. The company has a market cap of 5.65 billion as of 2022 and a return on equity of -26.54%. Tainergy Tech Co Ltd manufactures lithium batteries and energy storage systems for a variety of applications, including electric vehicles, power tools, and consumer electronics. The company has a strong presence in the Asia-Pacific region and is expanding its operations globally.

Summary

SolarEdge Technologies is an attractive investment for those looking for a reliable return. The company recently reported record-breaking non-GAAP earnings per share of $2.86 in 2023, beating expectations by $1.27. This resulted in an immediate increase in the stock price. SolarEdge has continued to show strong growth over the years and offers investors a dependable and profitable option in the renewable energy industry.

Their smart energy products, including solar inverters and advanced energy monitoring, have enabled them to remain competitive and profitable. With their consistent growth and reliable returns, SolarEdge Technologies is a sound investment for those looking for a secure return on their investment.

Recent Posts