First Solar Secures Up to $700M in Tax Credits for 2023

December 28, 2023

☀️Trending News

First Solar ($NASDAQ:FSLR), Inc. is a leading American provider of comprehensive solar energy solutions, from the manufacturing of photovoltaic modules to the development and deployment of turnkey solar power plants. Recently, First Solar has announced an agreement to purchase up to $700 million in 2023 IRA tax credits over the coming year. The credits will be applied towards the cost of their solar technology projects, allowing them to maintain their competitive edge in the industry. The purchase of these credits is the latest step taken by First Solar to ensure long-term success in the renewable energy sector.

This strategic move will strengthen their financial position and provide them with greater flexibility when it comes to expanding their operations and reaching new markets. This will also help to secure First Solar’s position as a leader in the renewable energy industry.

Price History

As a result of this news announcement, FIRST SOLAR‘s stock opened at $173.2 and closed at $172.4, marginally higher by 0.3% from the prior closing price of 171.9. This increase in the stock price indicates the confidence of investors in the company’s future prospects. The tax credits will enable FIRST SOLAR to focus on developing new and improved solar energy technologies, while also providing them additional financial security. The credits are expected to help the company become even more competitive in the renewable energy space. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for First Solar. More…

| Total Revenues | Net Income | Net Margin |

| 3.16k | 473.99 | 16.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for First Solar. More…

| Operations | Investing | Financing |

| 836.37 | -869.68 | 376.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for First Solar. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.58k | 3.28k | 58.99 |

Key Ratios Snapshot

Some of the financial key ratios for First Solar are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.3% | -4.2% | 16.4% |

| FCF Margin | ROE | ROA |

| -16.8% | 5.2% | 3.4% |

Analysis

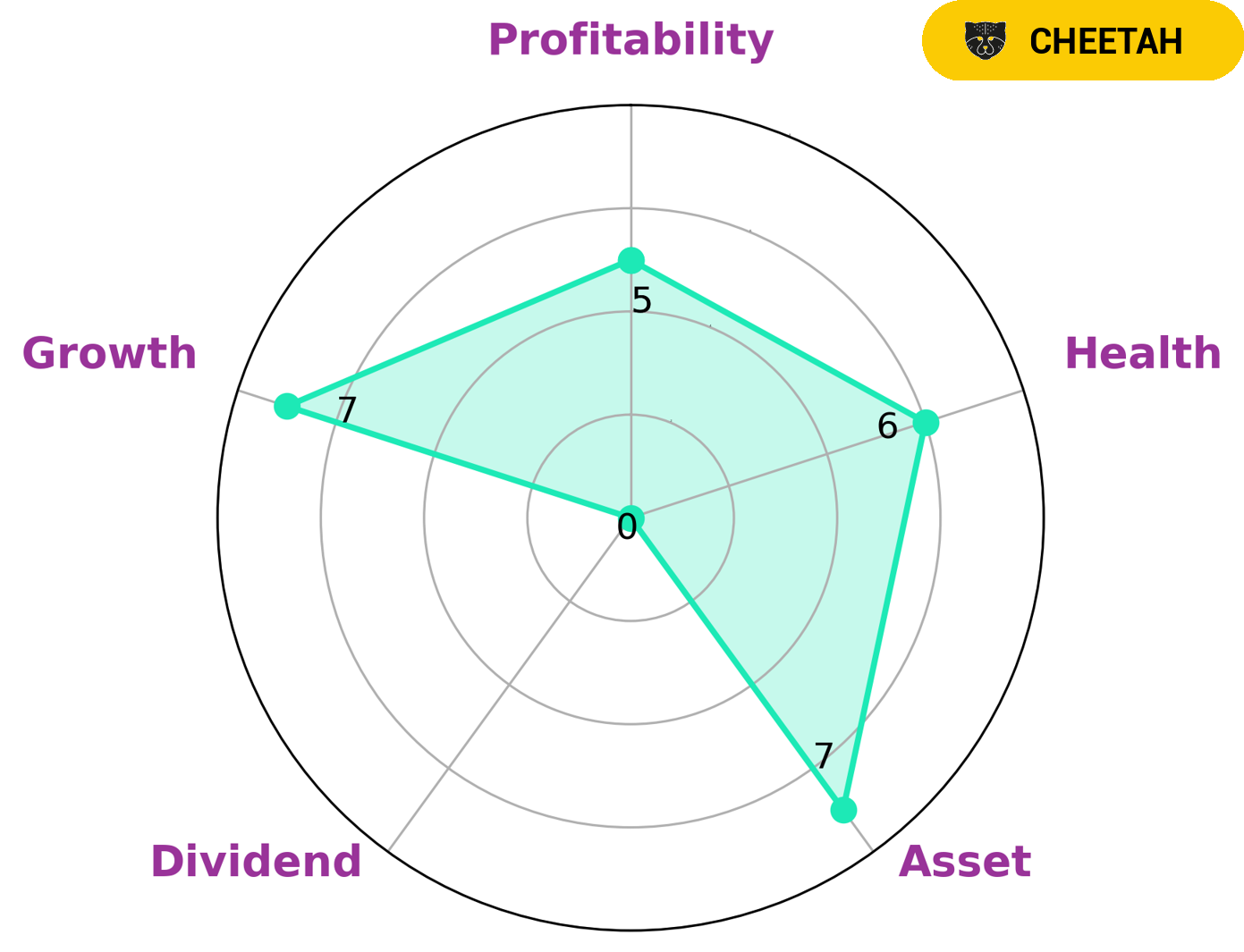

After analysing FIRST SOLAR‘s fundamentals, GoodWhale found that the company is classified as ‘rhino’ on our Star Chart. This type of company has achieved moderate revenue or earnings growth, and this could make them appealing to investors who are looking for a steady, reliable return. FIRST SOLAR also had an intermediate health score of 6/10. This implies that the company might be able to pay off debt and fund future operations. We found that the company is strong in assets and medium in growth, profitability, and dividends. This suggests that FIRST SOLAR has a reliable base of resources to sustain growth, and a reasonable chance of generating profits. More…

Peers

First Solar Inc is one of the world’s leading solar panel manufacturers. The company has a strong market presence in Asia, Europe, and the United States. First Solar’s main competitors are JA Solar Technology Co Ltd, Solar Philippines Nueva Ecija Corp, and Folkup Development Inc.

– JA Solar Technology Co Ltd ($SZSE:002459)

JinkoSolar Holding Co., Ltd. engages in the business of solar power products, services, and system solutions. It operates through the following segments: Module Products, Generating Systems, and Others. The Module Products segment designs, develops, manufactures, and sells solar modules. The Generating Systems segment provides solar generating systems that are connected to the power grid and generate electricity. The Others segment comprises of silicon wafers, solar cells, and other products. JinkoSolar was founded on September 28, 2006 and is headquartered in Shanghai, China.

– Solar Philippines Nueva Ecija Corp ($PSE:SPNEC)

Solar Philippines Nueva Ecija Corp is a solar power company that develops, builds, owns, and operates solar power plants in the Philippines. The company has a market capitalization of 11.9 billion as of 2022 and a return on equity of -3.62%. Solar Philippines Nueva Ecija Corp is engaged in the business of developing, constructing, owning, and operating solar power plants.

– Folkup Development Inc ($OTCPK:FLDI)

Folkup Development Inc has a market cap of 49M as of 2022, a Return on Equity of 40.0%. The company is engaged in the business of developing software applications. It has a strong focus on delivering high quality products and services to its clients. The company’s products are used by major corporations around the world. Folkup Development Inc has a strong reputation for delivering innovative and reliable software solutions.

Summary

First Solar, Inc. has recently announced an agreement to sell up to $700M in 2023 IRA tax credits. This is a significant investment opportunity for investors, as it provides the opportunity to benefit from the significant tax savings offered by the credits. Analysts have highlighted the company’s ability to take advantage of the solar energy industry’s growth potential.

Additionally, First Solar has diversified its offerings by introducing additional products and services related to solar energy, such as thin-film photovoltaic modules and inverters. This expansion of product lines is expected to further fuel growth in the future.

Recent Posts