Enphase Energy Reports Strong Earnings with Non-GAAP EPS of $1.37 and $726.02M in Revenue

April 26, 2023

Trending News ☀️

Enphase Energy ($NASDAQ:ENPH), a publically traded clean energy company, recently reported strong earnings with Non-GAAP earnings per share (EPS) of $1.37 and total revenue of $726.02M. These results exceeded estimates with EPS beating projections by $0.15 and revenue surpassing forecasts by $5.51M. Enphase Energy has been pushing the boundaries of clean energy technology for over a decade. Their solar energy solutions improve energy efficiency, reduce costs, and offer a reliable, easy-to-use alternative to traditional energy sources.

The company’s financial performance reflects the continued growth of the industry and the increasing demand for sustainable clean energy solutions. It is an exciting time to be part of the Enphase Energy family and their strong earnings report proves that their products and solutions are in high demand across the world.

Stock Price

The company’s stock opened at $222.4 and closed at $220.6, down 1.8% from the last closing price of $224.6. The news of the strong earnings did not appear to have a major impact on the stock price as it remained relatively unchanged for the day. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Enphase Energy. More…

| Total Revenues | Net Income | Net Margin |

| 2.33k | 397.36 | 17.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Enphase Energy. More…

| Operations | Investing | Financing |

| 744.82 | -371.91 | -17.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Enphase Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.08k | 2.26k | 6.05 |

Key Ratios Snapshot

Some of the financial key ratios for Enphase Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 55.1% | 62.3% | 19.8% |

| FCF Margin | ROE | ROA |

| 30.0% | 40.2% | 9.4% |

Analysis

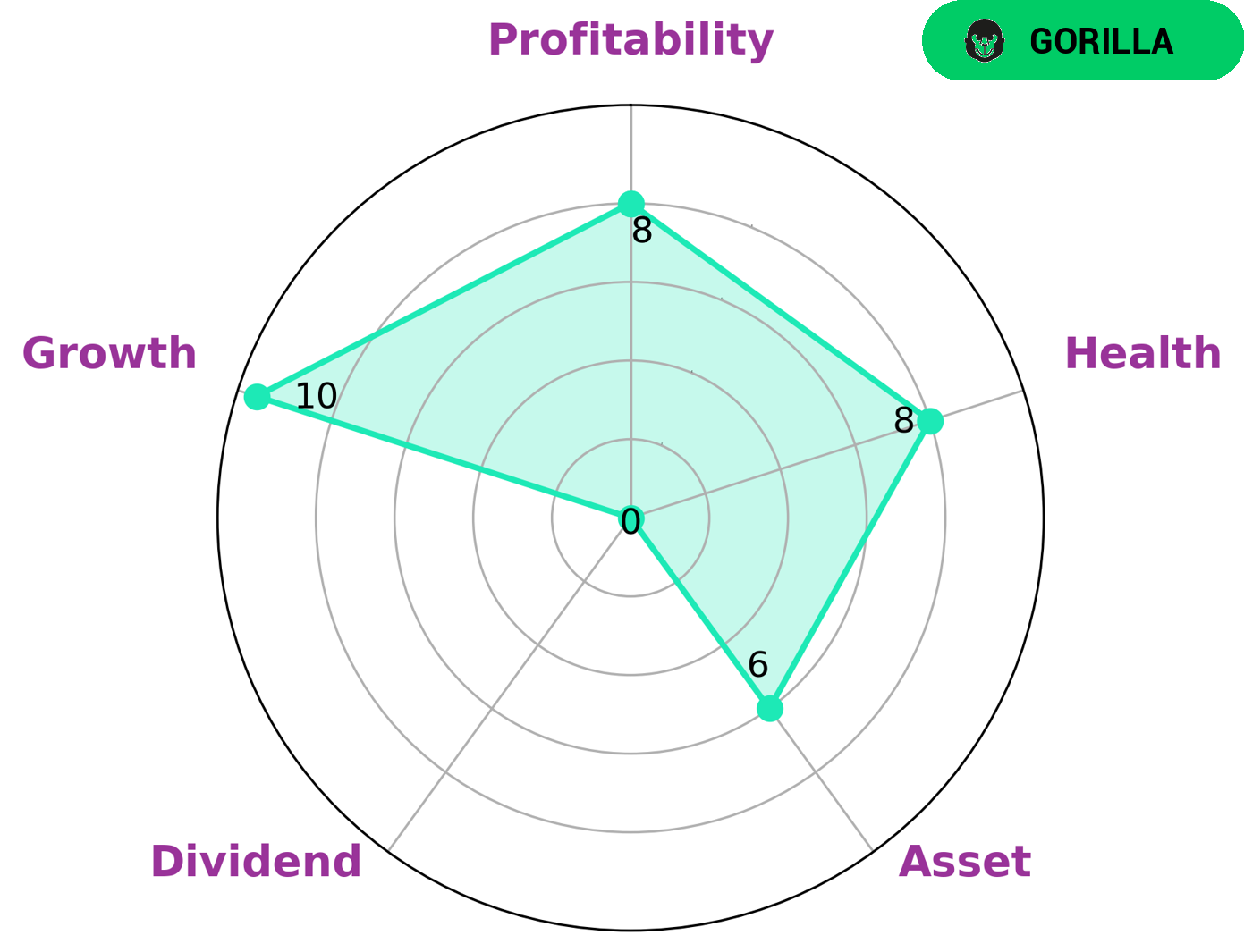

After analyzing ENPHASE ENERGY‘s financials, GoodWhale found that the company is strong in growth and profitability, while it is medium in asset and weak in dividend. Through the Star Chart, GoodWhale concluded that ENPHASE ENERGY has a high health score of 8/10 with regard to its cashflows and debt, demonstrating its ability to pay off debt and fund future operations. Additionally, based on GoodWhale’s classification of ‘gorillas’, companies with stable and high revenue or earning growth due to their strong competitive advantage, we believe that ENPHASE ENERGY has achieved this status. Investors who are looking for long-term investments and are focused on companies with strong competitive advantage may be interested in ENPHASE ENERGY. Furthermore, due to the high health score, investors may have assurance that their investment is in good hands. More…

Peers

Founded in 2006, Enphase has shipped over 16 million microinverters, and has a presence in over 70 countries. Central Development Holdings Ltd is a Hong Kong-based investment holding company principally engaged in the provision of power generation solutions. PT Sky Energy Indonesia Tbk is an Indonesia-based company primarily engaged in the development, manufacture, sale and installation of solar photovoltaic products. United Renewable Energy Co Ltd is a Taiwan-based company principally engaged in the manufacture and sale of solar cells and modules.

– Central Development Holdings Ltd ($SEHK:00475)

As of 2022, Central Development Holdings Ltd has a market cap of 244.17M and a Return on Equity of -16.31%. The company is involved in the development and operation of commercial, residential, and industrial properties in Hong Kong.

– PT Sky Energy Indonesia Tbk ($IDX:JSKY)

Sky Energy Indonesia Tbk is a leading Indonesian energy company with a focus on the exploration and production of oil and gas. The company has a market capitalization of $105.69 billion as of 2022 and a return on equity of -22.56%. Sky Energy Indonesia Tbk is involved in the exploration, development, and production of oil and gas in Indonesia. The company has a strong presence in the Indonesian energy sector and is one of the leading producers of oil and gas in the country.

– United Renewable Energy Co Ltd ($TWSE:3576)

As of 2022, United Renewable Energy Co Ltd has a market cap of 34.16B and a Return on Equity of 2.02%. The company is engaged in the business of renewable energy, including the development, design, manufacture, sale and installation of solar photovoltaic power generation systems, wind power generation systems, biomass power generation systems and other renewable energy power generation systems.

Summary

Enphase Energy, a leading global energy technology company, recently reported strong quarterly earnings results. The company reported Non-GAAP EPS of $1.37 which exceeded expectations by $0.15, and higher-than-anticipated revenue of $726.02M, beating estimates by $5.51M. Investors reacted positively with the stock closing higher after the earnings report was released.

ENPHASE has positioned itself as a leader in the energy technology sector and is well-positioned to succeed in the current market environment. With a strong financial position, innovative approach and a pipeline of new products and technologies, ENPHASE offers investors an exciting opportunity for long-term growth.

Recent Posts