Discover the Benefits of Investing in Array Technologies (NASDAQ:ARRY)

April 3, 2023

Trending News ☀️

Investing in Array Technologies ($NASDAQ:ARRY), Inc. (NASDAQ:ARRY) can be a lucrative and rewarding opportunity for those looking to diversify their portfolio. With a strong history of innovation, Array Technologies has grown to become one of the leading manufacturers of solar tracking solutions in the world. By investing in Array Technologies, you are not only investing in a company with a strong track record of success, but you are also investing in the future of renewable energy. The company has a market capitalization of more than $1 billion, and its share price has been steadily growing over the past few years. This growth can be attributed to its innovative approaches to solar tracking solutions and its commitment to developing and expanding its product offerings to meet the changing needs of customers. Its advanced technology and unique tracking systems provide businesses and individuals with an efficient, low-cost way to harness the power of the sun. By investing in Array Technologies, you are not only investing in a successful company, but you are also contributing to the development of sustainable, renewable energy sources.

Array Technologies provides a variety of solutions for businesses and individuals who want to take advantage of solar energy. The company offers fixed-tilt trackers, single-axis trackers, ground mount solutions, and more for residential, commercial, and utility-scale customers. Array Technologies is also consistently researching and developing new tracking technologies that can maximize energy output and streamline the installation process. If you are looking for an investment opportunity that will yield positive returns while contributing to the development of renewable energy sources, investing in Array Technologies is worth considering. With a strong track record of success and innovative technologies that drive cost savings, Array Technologies is positioned to continue being a leader in the solar tracking industry.

Share Price

Array Technologies Inc. (NASDAQ:ARRY) is a company worth investing in. On Monday, its stock opened at $18.8 and closed at $19.1, signifying an increase of 3.4% from the prior closing price of 18.5. The company produces solar tracking solutions for utility-scale photovoltaic power plants as well as commercial and residential solar projects. Its products are designed to optimize the amount of energy produced by a solar system and their proven technology has been used in thousands of solar projects all over the world. This experience makes Array Technologies an attractive investment option.

Array Technologies is well-positioned to benefit from the growth in the solar industry and its products have recently become the industry standard for solar tracking systems. With its products being so widely accepted, it’s no surprise that investing in Array Technologies Inc. can be profitable. In conclusion, Array Technologies Inc. is a company worth investing in, with a solid track record in the solar industry and a promising future outlook. Investing in Array Technologies can bring fruitful returns for investors, especially now that its stock has risen by 3.4%. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Array Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 1.64k | -43.62 | -1.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Array Technologies. More…

| Operations | Investing | Financing |

| 141.49 | -384.44 | 8.44 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Array Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.71k | 1.28k | 2.82 |

Key Ratios Snapshot

Some of the financial key ratios for Array Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 36.2% | – | 1.7% |

| FCF Margin | ROE | ROA |

| 8.0% | 4.6% | 1.0% |

Analysis

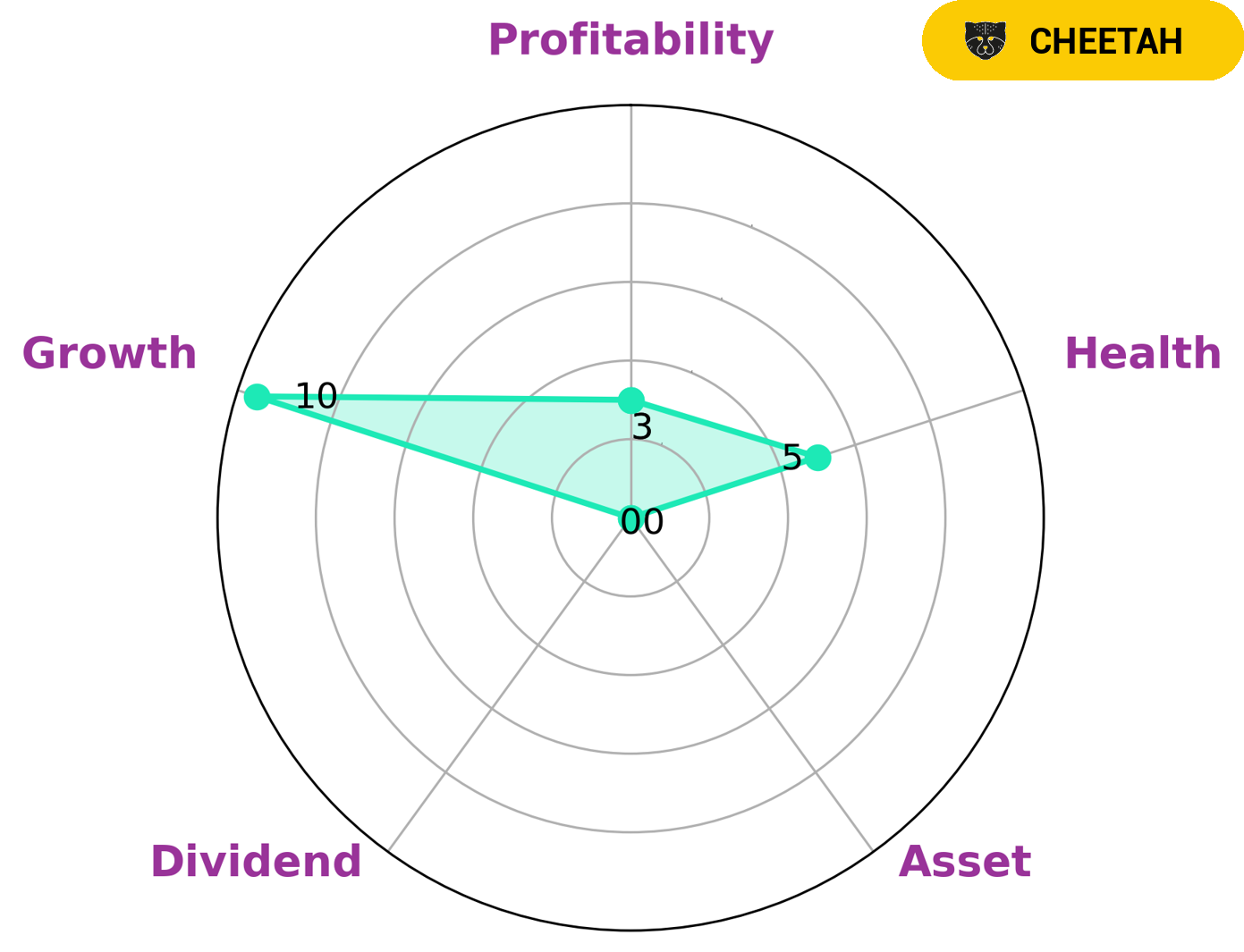

At GoodWhale, we’ve analyzed ARRAY TECHNOLOGIES‘ wellbeing and the results of our Star Chart show that the company is strong in growth, but weak in asset, dividend, and profitability. This results in an intermediate health score of 5/10 with regard to its cashflow and debt, suggesting that it may have the capacity to pay off debt and fund its future operations. We have classified ARRAY TECHNOLOGIES as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. This means that investors who are looking for high-growth potential, but are willing to accept greater risk, may be well-suited to investing in ARRAY TECHNOLOGIES. More…

Peers

It is a major competitor to other leading solar companies such as Solar Alliance Energy Inc, Shoals Technologies Group Inc, and Sunrun Inc. All of these companies are dedicated to harnessing the power of the sun and providing clean, renewable energy to their customers.

– Solar Alliance Energy Inc ($TSXV:SOLR)

Solar Alliance Energy Inc is a Canadian renewable energy provider that specializes in the design, acquisition, installation and maintenance of solar energy systems for commercial and residential customers. The company has a market cap of 22M as of 2023, and a Return on Equity (ROE) of 66.5%. This indicates that Solar Alliance Energy Inc is a highly profitable and efficient firm, as a high ROE reflects the ability of the company to generate profits from its shareholder’s investments. This also means that the company is able to effectively use its resources to generate returns for its shareholders. The market cap of 22M also demonstrates the company’s potential to grow and expand as it has a solid base of capital to draw on.

– Shoals Technologies Group Inc ($NASDAQ:SHLS)

Shoals Technologies Group Inc. is a leading developer of solar energy solutions and products for the utility, commercial, and residential markets. Founded in 2001, the company is headquartered in Nashville, Tennessee and has offices in China, India, and the US. As of 2023, Shoals Technologies Group Inc. had a market cap of 3.27B and a Return on Equity of 143.31%. This indicates that the company is performing well financially, as it is able to generate a large amount of profits compared to the amount of equity it has invested. The company’s success can be attributed to its focus on delivering innovative solar energy solutions that are reliable and cost-effective.

– Sunrun Inc ($NASDAQ:RUN)

Sunrun Inc is a leading provider of residential solar, battery storage, and energy services. As of 2023, the company has a market cap of 5.92B, indicating that it is one of the largest solar energy companies in the United States. Sunrun’s Return on Equity (ROE) of -3.98% indicates that the company has not been able to generate enough returns on its shareholders’ investment. The company is working towards increasing its ROE in order to improve shareholder returns.

Summary

Array Technologies, Inc. (NASDAQ:ARRY) is a solar tracking system provider that has seen a steady increase in share price over the past year. Analysts believe that their technology has the potential to improve the efficiency and output of solar panels, which should make it a viable long-term investment. The company’s financial health has also improved significantly since its IPO, with increasing cash flows, a solid balance sheet, and a much lower debt-to-equity ratio.

The stock price has responded positively to the news, climbing steadily since last summer. With strong fundamentals and improved market sentiment, now may be an opportune time for investors to consider buying ARRY stock.

Recent Posts