Victory Capital Management Cuts Stake in Okta,

August 7, 2023

🌧️Trending News

Okta ($NASDAQ:OKTA), Inc. is a leading independent provider of identity for the enterprise. Recently, Victory Capital Management Inc. has cut its stake in the company’s shares. Victory Capital Management Inc. is a publicly traded asset management firm which provides investment management services to institutional and individual investors. This decrease comes at an uncertain time for the market, but Okta remains optimistic about its future prospects.

The company has recently seen strong growth, having reported record revenue in its most recent quarterly earnings report. This news serves as a testament to the strength of Okta’s product and its ability to meet customer needs. Despite Victory Capital Management Inc.’s decision to cut its stake, Okta’s long-term outlook remains positive.

Stock Price

On Friday, December 4th, Victory Capital Management Inc. revealed that it had reduced its stake in Okta, Inc. This caused Okta’s stock to open at $73.9 and close at $72.6, representing a decrease of 0.5% from its prior closing price of 72.9. This news caused some investors to be concerned as it was the first time Victory Capital Management Inc. had cut its stake in the cloud-based software company. okta&utm_title=Victory_Capital_Management_Cuts_Stake_in_Okta”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Okta. okta&utm_title=Victory_Capital_Management_Cuts_Stake_in_Okta”>More…

| Total Revenues | Net Income | Net Margin |

| 1.96k | -691 | -35.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Okta. okta&utm_title=Victory_Capital_Management_Cuts_Stake_in_Okta”>More…

| Operations | Investing | Financing |

| 196 | 17 | -283 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Okta. okta&utm_title=Victory_Capital_Management_Cuts_Stake_in_Okta”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.9k | 3.37k | 34.09 |

Key Ratios Snapshot

Some of the financial key ratios for Okta are shown below. okta&utm_title=Victory_Capital_Management_Cuts_Stake_in_Okta”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 45.0% | – | -33.9% |

| FCF Margin | ROE | ROA |

| 9.0% | -7.5% | -4.7% |

Analysis

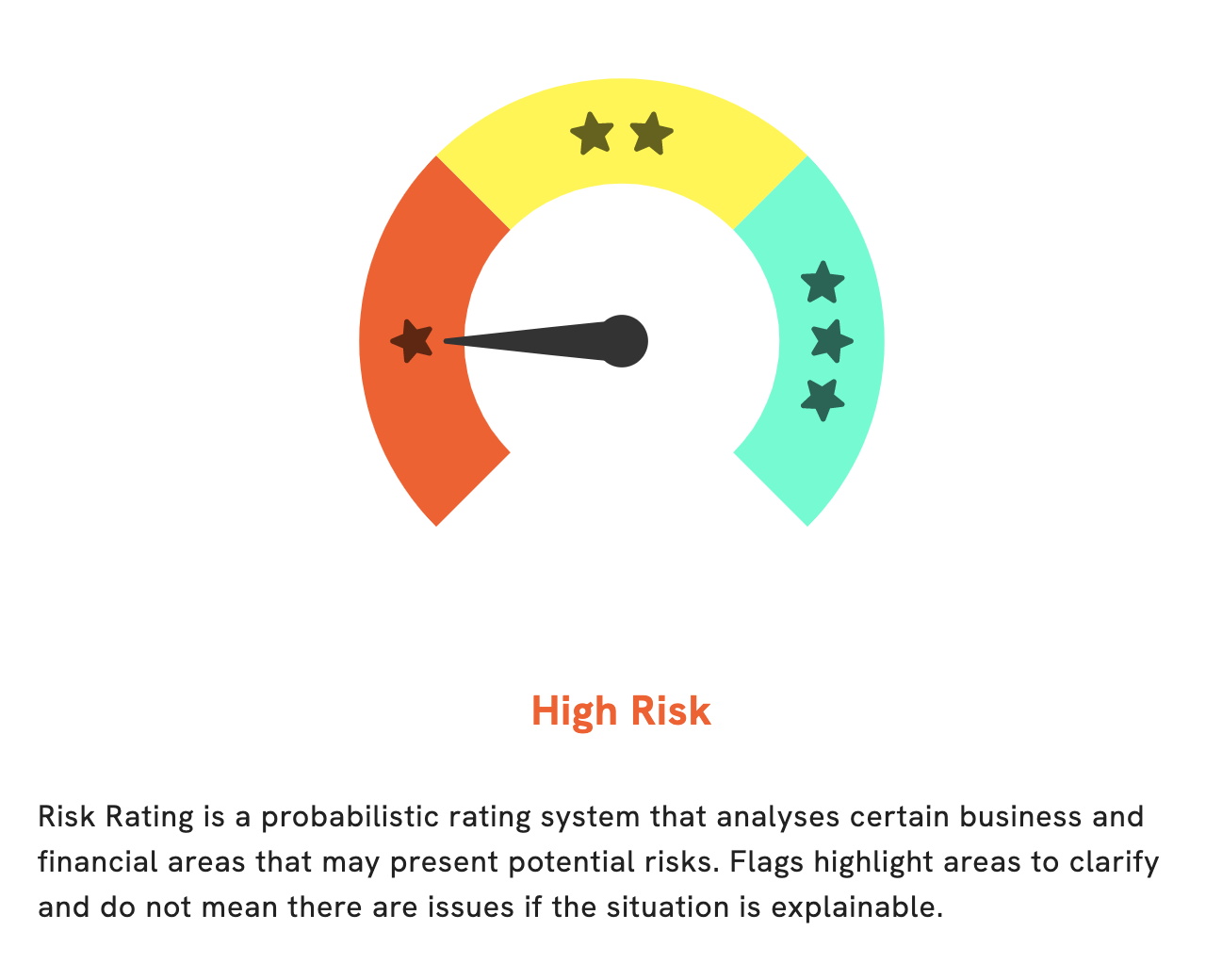

At GoodWhale, we recently conducted an analysis of OKTA’s financials and have come to the conclusion that OKTA is a high risk investment. Our Risk Rating has determined that OKTA is a high risk in terms of both financial and business aspects. Our detailed analysis has uncovered 3 risk warnings in the company’s balance sheet, cashflow statement, and non-financial indicators. If you’d like to take a look at our findings, be sure to register on goodwhale.com. Okta“>More…

Peers

Its competitors include Ping Identity Holding Corp, Zscaler Inc, and CrowdStrike Holdings Inc.

– Ping Identity Holding Corp ($NASDAQ:ZS)

Zscaler Inc is a cloud-based information security company that provides internet security, web security, next-generation firewalls, sandboxing, and zero-day protection. It has a market cap of 22.04B as of 2022 and a ROE of -37.32%. The company was founded in 2007 and is headquartered in San Jose, California.

– Zscaler Inc ($NASDAQ:CRWD)

CrowdStrike Holdings Inc is a cybersecurity technology company. The company provides software and services to protect against cyber threats. CrowdStrike Holdings Inc has a market cap of 37.62B as of 2022, a Return on Equity of -6.41%. The company’s products and services are used by organizations worldwide, including Fortune 500 companies, government agencies, and small businesses.

Summary

Investors have been keeping an eye on Okta, Inc, a leading provider of identity security solutions, as Victory Capital Management Inc. recently reduced its stake in the company. Analysts believe that the move could be a sign of the market’s sentiment towards Okta’s current performance, and it is important for potential investors to be aware of the current state of the company.

Additionally, Okta is continuing to expand its international presence. As such, investors should look to the company’s financial results to get an idea of the potential future performance. Lastly, Okta recently announced an update to its identity platform which could open up significant opportunities for the company moving forward.

Recent Posts