Trexquant Investment LP Lifts Holdings of WEX in 2023.

March 16, 2023

Trending News 🌥️

In 2023, Trexquant Investment LP announced that it had increased its holdings in WEX ($NYSE:WEX) Inc. This decision came as the company continues to expand its presence in the financial services industry. WEX Inc. is a global provider of payment processing, data analytics and financial services for businesses, governments, and individuals. Trexquant Investment LP is a leading global investment firm dedicated to providing comprehensive asset management and financial services. Their investment in WEX Inc. shows their confidence in the company’s ability to continue to provide innovative financial solutions. With this new investment, Trexquant Investment LP has cemented its commitment to WEX Inc. and the company’s future success. The increased investment in WEX Inc. is part of Trexquant Investment LP’s long-term strategy to diversify its portfolio and increase its holdings in innovative companies.

WEX Inc. has established itself as a leader in financial technology, and this new partnership will provide the company with access to additional capital and resources to continue its growth. With this investment, WEX Inc. will be better positioned to capitalize on emerging opportunities and further expand its global reach. WEX Inc’s innovative solutions have enabled the company to become a leader in the financial services industry, and this new partnership will help it maintain its competitive edge. This is an exciting time for WEX Inc. as they continue to expand their global presence, and this new investment will help secure their future success.

Market Price

The news sentiment of the announcement has largely been positive so far. The stock of WEX Inc. opened at 176.9 and closed at 170.9 on Monday, a 5.0% decrease from its previous closing price of 180.0. This could be a sign that investors are looking to take profits from the heightened activity around the stock, or that sentiment around WEX Inc. is softening. Nevertheless, it remains to be seen if Trexquant’s decision to lift its holdings of WEX Inc. has a lasting impact on the company’s valuation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wex Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.35k | 201.44 | 14.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wex Inc. More…

| Operations | Investing | Financing |

| 679.42 | -716.65 | 681.26 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wex Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.53k | 9.88k | 38.17 |

Key Ratios Snapshot

Some of the financial key ratios for Wex Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.9% | 16.3% | 16.6% |

| FCF Margin | ROE | ROA |

| 24.0% | 14.9% | 2.1% |

Analysis

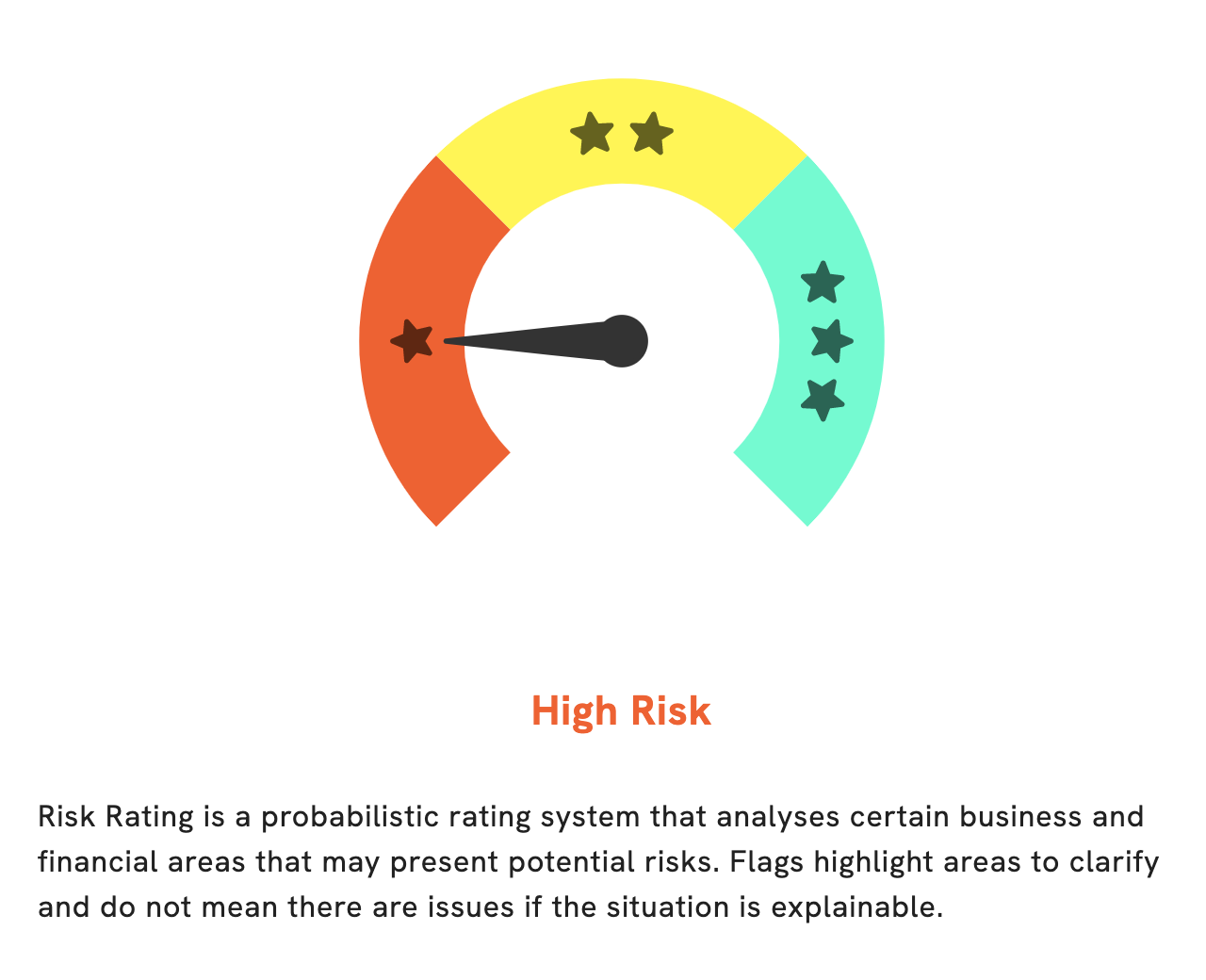

At GoodWhale, we have conducted an in-depth analysis of WEX INC’s wellbeing. The results of our analysis have shown that WEX INC is a high risk investment in terms of financial and business aspects. In particular, our analysis has revealed two risk warnings in the income sheet and balance sheet of WEX INC. To access more detailed information about the risk warnings, please visit our website at goodwhale.com. More…

Peers

The company operates in three segments: WEX Corporate Payments, WEX Virtual Payments, and WEX Travel Solutions. WEX Corporate Payments offers a suite of payment solutions to large and mid-sized businesses, government entities, and educational institutions. WEX Virtual Payments provides a complete virtual payments solution for businesses of all sizes. WEX Travel Solutions offers a full range of travel-related services, including airfare, hotel, car rental, and ground transportation. WEX Inc. competes with EVO Payments Inc, Paya Holdings Inc, Finablr PLC, and a number of other companies in the corporate payment solutions and travel-related services markets.

– EVO Payments Inc ($NASDAQ:EVOP)

Evo Payments Inc. is a provider of payment processing solutions. The company offers a range of services, including credit and debit card processing, ACH processing, and check processing. It also provides merchant services, such as point-of-sale solutions, mobile payments, and e-commerce solutions. In addition, the company offers fraud prevention and security solutions; and business management solutions, such as invoicing, accounting, and reporting.

– Paya Holdings Inc ($NASDAQ:PAYA)

Paya Holdings Inc is a publicly traded company with a market capitalization of 1.04 billion as of 2022. The company has a return on equity of 6.07%. Paya Holdings Inc is a provider of payment processing solutions and services. The company offers a range of solutions and services for businesses of all sizes, from small businesses to large enterprises. Paya Holdings Inc has a strong focus on customer service and providing a high level of customer satisfaction. The company is headquartered in Atlanta, Georgia, and has offices in the United States, Canada, Europe, and Asia.

Summary

Investing in WEX Inc. has been a popular choice in recent years, as evidenced by an increase in holdings by Trexquant Investment LP in 2023. Despite the overall positive sentiment the news has generated, the stock price of WEX dropped on the same day. An analysis of this investment decision should take into account the current market conditions, the company’s performance over time, and its competitive landscape.

Investors should also consider potential risks and rewards as well as any potential factors that could impact the stock price in the future. Research into these areas can help to inform an informed decision on whether investing in WEX is a smart choice.

Recent Posts