Toast Soars 1% as CNBC’s Josh Brown Bullishly Endorses Stock

February 13, 2023

Trending News ☀️

Shares of Toast ($NYSE:TOST) Inc. have been on the rise since CNBC’s Josh Brown gave the company his bullish endorsement. Toast Inc. is a small-cap technology stock that specializes in developing enterprise-level software for businesses. They have a wide variety of products and services, including cloud-based software, mobile applications, and business intelligence. Brown’s endorsement was a major catalyst for the stock, causing it to soar one percent in a short period of time. According to Brown, Toast Inc. is well-positioned to take advantage of some of the technology trends that are driving the market, such as cloud computing and mobile applications. He also believes that the company’s growth trajectory is on the rise, and that now is the time to invest in their stock. The stock has been trading near its all-time high during the past few weeks, and Brown believes that this momentum is likely to continue.

He also noted that Toast Inc. is in the process of introducing new products and services that could further drive their growth. With their current trajectory, Brown expects them to become a major player in the technology space in the near future. Brown’s endorsement was a major boon for Toast Inc., and investors are now taking a closer look at the company’s potential. It’s clear that they have an innovative product lineup and a bright future ahead of them. The stock is currently trading near its highs, but it may be wise to invest now before its prices soar even higher. If Brown’s prediction is correct, Toast Inc. could be an incredible success story.

Share Price

On Thursday, Toast Inc. saw its stock open at $23.5 and close at $22.8, down by 2.6% from the prior closing price of 23.4. This came despite bullish comments on the stock, made by CNBC’s Josh Brown. Until now, media exposure for Toast Inc. has been mostly positive, with analysts and other investors expressing enthusiasm for the company’s prospects. Toast Inc.’s stock had seen a surge of 1% earlier in the day, before news of Brown’s bullish endorsement had been reported. Despite the short-lived surge, Toast Inc.’s stock closed at a lower rate than it had opened.

However, it is expected that the positive comments from Brown will have a positive effect on the company’s stock in the long run. The endorsement from Brown is further evidence that the market continues to be bullish on Toast Inc., despite the short-term drops in the company’s stock. Investors will continue to look to Toast Inc. as a viable option for investments and many analysts are hoping that Brown’s endorsement will spur more bullish sentiment for the company’s stock. Overall, it appears that Toast Inc. is well positioned to benefit from increased media attention and bullish endorsements. The fact that Brown has publicly expressed his confidence in the company’s stock should provide investors with some degree of comfort as they decide whether or not to invest in the company’s stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Toast. More…

| Total Revenues | Net Income | Net Margin |

| 2.48k | -174.85 | -14.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Toast. More…

| Operations | Investing | Financing |

| -168.97 | -485.58 | 39.09 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Toast. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.74k | 622 | 2.24 |

Key Ratios Snapshot

Some of the financial key ratios for Toast are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -28.0% |

| FCF Margin | ROE | ROA |

| -7.9% | -15.7% | -10.2% |

Analysis

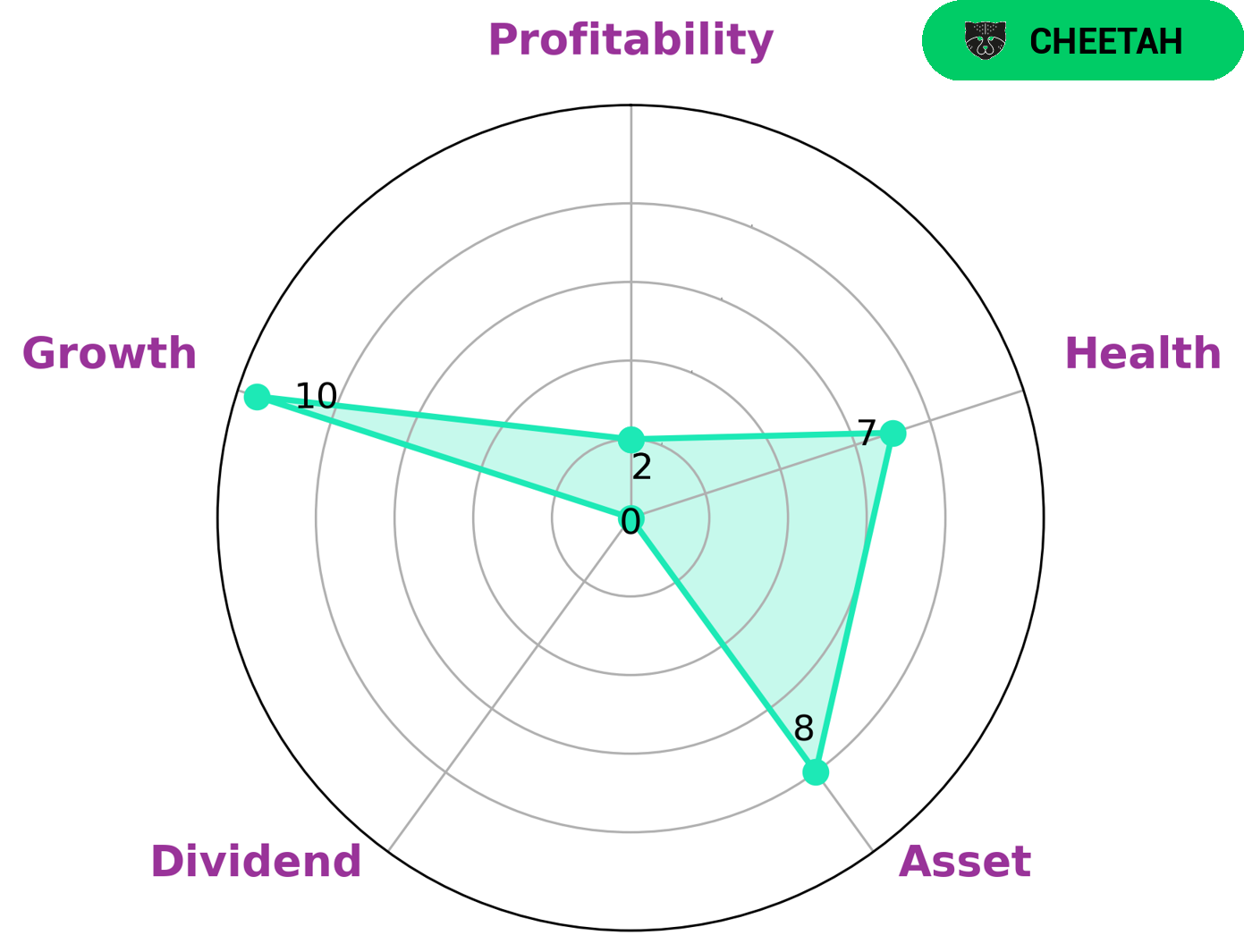

GoodWhale has conducted an analysis of TOAST‘s financials, revealing a high health score of 7/10 with regard to its cashflows and debt. This indicates that the company is financially sound and capable to sustain future operations in times of crisis. TOAST is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Such companies attract investors who expect appreciation in value over time, as these companies focus on expanding their business rather than paying out dividends. Toast’s financial health is strong in asset growth, and weak in dividend and profitability. These are elements that investors should consider before investing in the company. Assets, for instance, refer to a company’s long-term investments and resources that could bring value to the business. Financial growth, on the other hand, may provide a measure of the company’s success in terms of expanding its customer base and increasing sales. Profitability also reflects how well a company is doing financially, while dividends indicate how well the company is managing its resources and how it distributes its profits. In short, TOAST may be suitable for investors who are looking to benefit from the company’s future expansions, asset growth and sales performance. Investors should look at the company’s financial statements to assess the various risks associated with such an investment. More…

Peers

In the market for point-of-sale (POS) systems, there is intense competition among a few major players. Toast Inc, GreenBox POS, Rs2 Software PLC, and Hank Payments Corp are all vying for a share of the market. All of these companies offer POS systems that are feature-rich and competitively priced.

– GreenBox POS ($NASDAQ:GBOX)

PLC is a publicly traded company with a market capitalization of 266.3 million as of 2022. It has a return on equity of 6.98%. PLC is engaged in the development, manufacture and sale of software products and services. The company’s products and services are used by businesses and organizations of all sizes, in a variety of industries, including healthcare, financial services, manufacturing, retail, and education.

– Rs2 Software PLC ($LTS:0MVH)

Hank Payments Corp is a publicly traded company that provides mobile payment solutions. The company has a market capitalization of 4.02 million as of 2022. Hank Payments Corp’s primary product is Hanko, a mobile payment application that allows users to make payments using their smartphone. Hanko is available for both Android and iOS devices.

Summary

Investors in Toast Inc. have been bullish on the stock recently, with CNBC’s Josh Brown endorsing the company. Recent media coverage has been largely positive, and this has been reflected in a 1% rise in its stock price. Analysts are confident that Toast has a bright future, with the potential for growth and strong returns for its investors.

They point to its strong focus on customer satisfaction, efficient operations and team of experienced management as sources of its success. Investors may want to consider purchasing some of Toast’s shares as the company looks set to continue to grow.

Recent Posts