Telos Co. Earns ‘Hold’ Rating from Leading Research Firms

April 14, 2023

Trending News 🌥️

Telos Corporation ($NASDAQ:TLS), a leading provider of information technology solutions and services, has recently earned a ‘Hold’ rating from six leading research firms. This average rating reflects a consensus of analyst opinion on the stock’s potential for short-term growth and performance. The analysts have noted that Telos Co.’s current market value does not justify additional investments in their current business model, although potential future investments in new products or services may offer investors better returns. The research firms have noted that the company has experienced a decline in revenue growth in recent quarters and that they do not expect any major change in this trend in the near future. This decline has been due to a variety of factors, such as increased competition, an ageing portfolio of products, and a weakened global economy. Telos Co. is currently focused on improving its core products and services, expanding market share, and developing innovative solutions to help meet customer demands.

Despite the current market sentiment, Telos Co. remains an attractive long-term investment option. The company has a strong balance sheet and a healthy cash flow, which suggests that it is well-positioned to weather any temporary economic downturns. Furthermore, the company is investing in new products and services to expand its market share, as well as focusing on emerging markets for future growth. Investors should keep an eye on Telos Co.’s progress and consider it as a potential opportunity for long-term returns.

Stock Price

On Thursday, TELOS CORPORATION (TELOS) stock opened at $2.4 and closed at $2.6, a 6.7% rise from the previous closing price of $2.4. This increase in stock value was largely attributed to news that leading research firms have given the company a ‘Hold’ rating. This marks a significant shift from the previously ‘Sell’ rating the firm had been receiving for the past few weeks.

Investors now have more confidence in TELOS and the stock has increased as a result. Despite this shift in ratings, the long-term outlook for TELOS remains uncertain and investors are cautioned to monitor the situation closely. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Telos Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 216.89 | -53.43 | -24.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Telos Corporation. More…

| Operations | Investing | Financing |

| 16.51 | -13.72 | -9.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Telos Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 237.4 | 65.04 | 2.63 |

Key Ratios Snapshot

Some of the financial key ratios for Telos Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.9% | -10.5% | -24.2% |

| FCF Margin | ROE | ROA |

| 1.3% | -18.8% | -13.8% |

Analysis

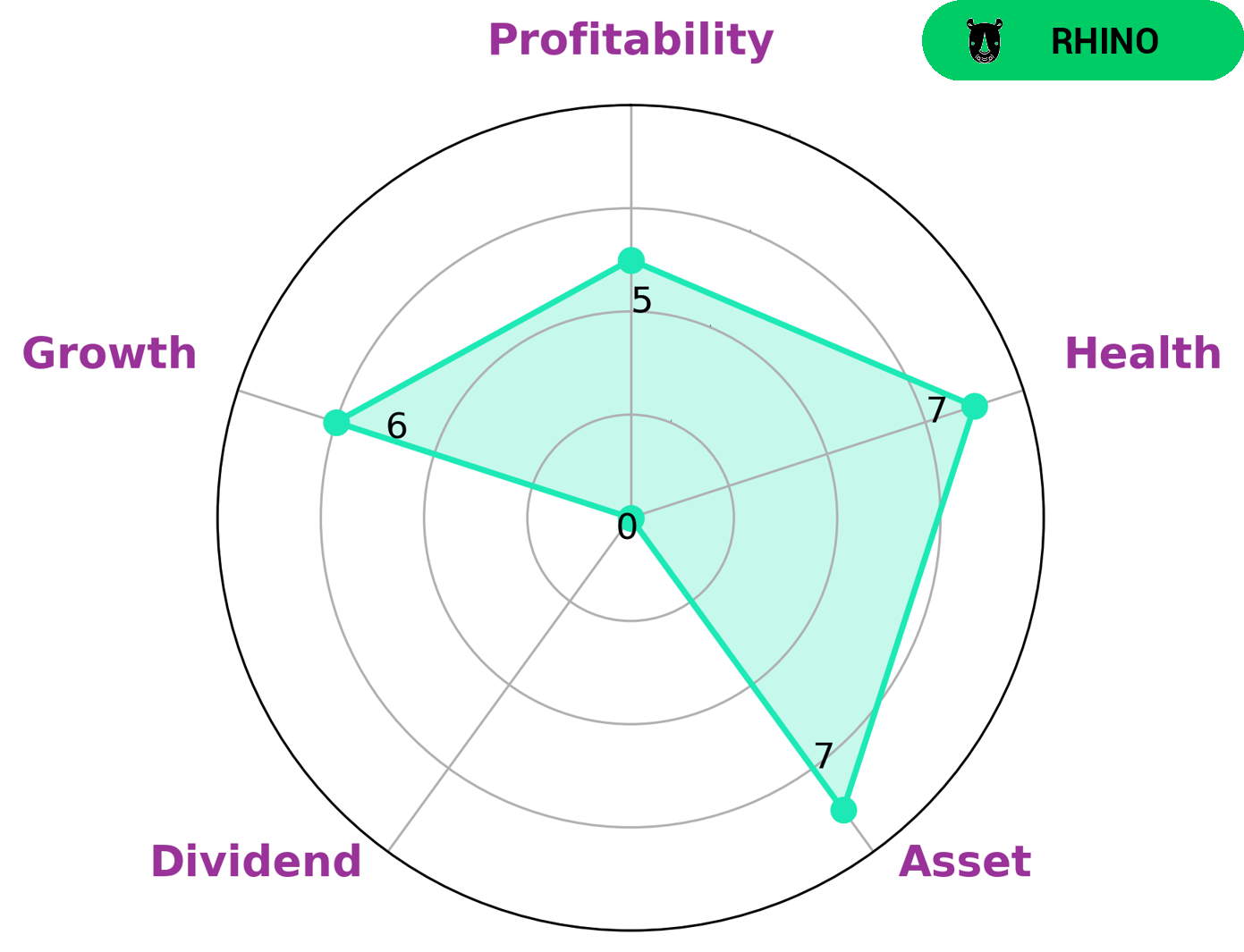

At GoodWhale, we conducted an analysis of TELOS CORPORATION‘s wellbeing, where we used our proprietary Star Chart methodology. According to the results, TELOS CORPORATION has a high health score of 7/10 with regard to its cash flows and debt, meaning they are capable of sustaining future operations in times of crisis. Based on the Star Chart, we classified TELOS CORPORATION as ‘rhino’ which implies that they have achieved moderate revenue or earnings growth. TELOS CORPORATION is particularly strong in assets, but medium in growth, profitability and dividend. This makes it an attractive prospect for investors looking for value from assets and a steady, albeit moderate return. They are likely to be of interest to value investors, as well as those looking for long-term investments, who are patient and are more interested in growing their portfolio than achieving quick returns. More…

Peers

In the cybersecurity industry, there is intense competition between Telos Corp and its competitors: Cognyte Software Ltd, Bluedon Information Security Technologies Co Ltd, and SecureWorks Corp. All four companies are vying for market share in the provision of cybersecurity solutions and services. This competition is likely to continue to heat up in the coming years as the global cybersecurity market is expected to grow at a compound annual growth rate of 10.2% from 2019 to 2025, according to MarketsandMarkets.

– Cognyte Software Ltd ($NASDAQ:CGNT)

Cognyte Software Ltd is a publicly traded company with a market capitalization of 192.04 million as of 2022. The company has a return on equity of -11.63%. Cognyte Software Ltd is a provider of enterprise software solutions. The company’s products are used by organizations to manage their business operations, including financials, supply chain, human resources, and customer relationship management.

– Bluedon Information Security Technologies Co Ltd ($SZSE:300297)

As of 2022, Bluedon Information Security Technologies Co Ltd has a market cap of 2.27B. The company’s return on equity is -108.9%. Bluedon Information Security Technologies Co Ltd is a provider of information security products and services. The company offers a range of products and services, including firewalls, intrusion detection and prevention systems, and antivirus and antispam solutions.

– SecureWorks Corp ($NASDAQ:SCWX)

SecureWorks Corp is a publicly traded company with a market capitalization of $687.41 million as of 2022. The company has a return on equity of -9.05%. SecureWorks is a provider of cybersecurity solutions and services. The company offers a range of services, including managed security, threat intelligence, and incident response. SecureWorks serves customers in a variety of industries, including healthcare, finance, and retail.

Summary

Telos Corporation is a publicly-traded company whose shares have been assigned an average rating of “Hold” by the six research firms covering it. Despite this, the stock price moved up the same day. For investors looking to make a decision on Telos Corporation, it is important to consider the company’s financials, management, and competitive landscape.

Additionally, the investor should assess risks associated with the stock, such as changes in economic conditions, general market volatility, and other macroeconomic factors. It is also important to consider the company’s future prospects and whether the current valuation is justified. By considering these factors, investors can make an informed decision on whether or not to invest in Telos Corporation.

Recent Posts