Q4 2023 Non-GAAP EPS of $0.22 Misses by $0.08 for Block.

February 25, 2023

Trending News 🌧️

BLOCK ($NYSE:SQ): Recently, the U.S. Justice Department has taken steps to initiate an antitrust lawsuit that would prevent Adobe from acquiring Figma, a cloud-based web platform developer, for $20 billion. If the lawsuit prevents the acquisition from taking place, it could be deemed a major setback for Adobe Inc., which planned to purchase the company to bolster its software offerings. Adobe Inc. is no stranger to antitrust scrutiny, as it has been involved in several previous antitrust lawsuits throughout its long history. In this case, the Justice Department is reportedly trying to prevent the company from gaining a monopoly over web-based platforms with the acquisition of Figma. If the acquisition is blocked, Adobe Inc. would be losing out on a potential valuable asset, as well as the $20 billion they would have used to purchase it.

In order to prevent Adobe Inc. from potentially gaining an antitrust advantage, the Justice Department may take action that would prevent such an acquisition from taking place. Given the details of the proposed merger and Adobe’s history of antitrust violations, it’s not surprising that the Justice Department is taking steps to stop the acquisition from going through. With such a large amount of money at stake, it appears that the Justice Department is doing its best to ensure fair competition in the software market and protect consumers in the process.

Stock Price

On Thursday, the U.S. Department of Justice announced it will block Adobe’s planned acquisition of Figma, a popular graphic design software, for $20 billion. This news caused ADOBE INC’s stock to open at $350.4 and close at $347.0, down by 0.5% from its prior closing price of 348.7. The Department of Justice argued that this merger would reduce competition in the digital design and collaboration software industry, potentially leading to increased prices for customers and reduced market innovation. The Department of Justice stipulated that for the deal to go through Adobe would have to sell off two of its products, Adobe XD and Creative Cloud.

Adobe declined this proposal and the merger was blocked. The failed merger represents a setback for Adobe and its shareholders, who were expecting a benefit in revenue from the deal. Despite this blow, Adobe remains one of the most prominent players in the digital design and collaboration software industry, likely maintaining its status in the industry for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Block. More…

| Total Revenues | Net Income | Net Margin |

| 16.96k | -503.75 | -2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Block. More…

| Operations | Investing | Financing |

| 324.89 | 1.45k | -839.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Block. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.12k | 12.59k | 27.66 |

Key Ratios Snapshot

Some of the financial key ratios for Block are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 57.6% | – | -2.8% |

| FCF Margin | ROE | ROA |

| 1.0% | -1.8% | -1.0% |

Analysis

At GoodWhale, we have conducted an analysis of ADOBE INC’s financials to calculate the fair value of their stock. Our proprietary Valuation Line has determined the fair value of ADOBE INC shares to be around $563.3. However, currently ADOBE INC stock is traded at $347.0, which is significantly lower than its fair value and represents an undervaluation of 38.4%. More…

Summary

Adobe Inc (NASDAQ: ADBE) has seen its stock price rise significantly over the past few years, driven by strong fundamentals and a robust product portfolio. The company’s latest move, to acquire Figma for $20 billion, has been met with enthusiasm from Wall Street analysts who view the acquisition as a positive step as Adobe looks to dominate the user interface design market. The Justice Department has recently announced its intent to block the transaction, which could have a negative effect on investors. Analysts are now reassessing the stock’s immediate and long term prospects, taking into account any potential implications of the DOJ’s decision.

Additionally, investors should take into account the company’s current financial position, including its revenue growth, operating margin and cash flow, before making a decision to purchase or sell shares of Adobe.

Trending News 🌧️

The purpose of this analysis is to determine if AMD has an edge over Intel and Nvidia in terms of GPU performance. To compare the GPUs, benchmark scores will be used as the primary measure of performance. This analysis will look into AMD’s performance across different generations of both desktop and notebook GPUs, and compare it to the performance of Intel and Nvidia’s offerings in the same categories. It will be interesting to see if any patterns can be found in the benchmark scores between AMD, Intel and Nvidia. If a particular brand consistently performs better in one or more categories, this would be indicative of a competitive edge in the market.

Additionally, it would be worth noting any significant differences between the performance of each brand’s GPUs from different generations. This insight could help buyers make an educated decision when choosing which GPU will best suit their needs. Overall, this analysis should provide some clear insight on the relative strengths and weaknesses of AMD, Intel and Nvidia in terms of GPU performance across desktop and notebook generations. It should also help to determine which brand holds the greatest competitive edge in the market, allowing potential buyers to make an informed decision when selecting their GPU.

Share Price

Recent media coverage of ADVANCED MICRO DEVICES (AMD) has been largely positive, and that sentiment is reflected in stock prices; on Thursday, AMD opened at $80.6 and closed at $79.8, a 4.1% increase from last closing price of $76.6. This suggests that investors believe in the company’s competitive edge in GPU performance across desktop and notebook generations, relative to Intel and Nvidia. Furthermore, its GPUs have been designed to work well with both Windows and Linux operating systems, giving AMD a distinct competitive edge. Live Quote…

Analysis

If you’re looking for an in-depth analysis of ADVANCED MICRO DEVICES’s fundamentals, GoodWhale is here to help. Our Risk Rating system provides an overall assessment of the financial and business health of this company, and based on our assessment, ADVANCED MICRO DEVICES poses a high risk of investment. Additionally, GoodWhale has detected two risk warnings in the income sheet and balance sheet. To get further insight into the company, we invite you to register on goodwhale.com, where you can access our full range of features and analytics. With GoodWhale, you can rest assured that you’re making the right decision before investing in ADVANCED MICRO DEVICES. More…

Summary

Advanced Micro Devices (AMD) has recently been garnering attention due to an analysis showing its competitive edge in GPU performance across desktop and notebook generations compared to Intel and Nvidia. This has been met with largely positive media coverage, and the company’s stock prices have been trending upwards as a result. Investing in AMD is likely to be profitable, due to the company’s competitive advantage in the graphics processing unit market and increased attention in the media. However, investors should be aware of potential risks associated with the market and strategic decisions the company may make.

Trending News 🌧️

Netflix is cutting prices in multiple markets around the world as the streaming giant faces increased competition from emerging streaming services. This move is likely in a bid to boost subscriber numbers and increase its market presence in order to remain ahead of the competition. Prices have been slashed by as much as 50% in countries such as the Middle East, sub-Saharan Africa, Europe, Latin America, and parts of Asia. This follows a trend started by streaming services like Peacock, which has recently been raising prices to make its direct-to-consumer services viable.

The reduction in prices could potentially assist Netflix in gaining or retaining subscribers in countries where streaming services are costly. It also plays into the company’s long-term strategy of increasing its global coverage and ultimately offer access to its vast library of content to as many users as possible. It remains to be seen whether this move will be enough to help Netflix keep its edge over competitors in the increasingly saturated streaming market.

Stock Price

Netflix has recently announced their decision to reduce prices in various countries around the world in the attempt to attract more subscribers amidst increasing competition from other streaming services. So far, news coverage of this move has been mostly neutral, focusing on the implications this could have on the streaming landscape. On Thursday, after news of the price slash had spread across the market, Netflix stock opened at $331.2 and closed at $323.6, down by 3.4% from its previous closing price of $334.9. This was likely in part due to the increasing competition in the market and investor uncertainty regarding the success of the new pricing strategy. Live Quote…

Analysis

After analyzing Netflix’s fundamental data, GoodWhale has assigned the company an intermediate health score of 5/10. This score takes into account the company’s cashflows and debt, indicating that it should be able to safely ride out any economic crisis without the risk of bankruptcy. Further, according to our Star Chart assessment, Netflix is a ‘rhino’ type of company- one that has achieved moderate revenue and earnings growth. For potential investors, this data suggests that Netflix might be a good investment. Although its asset and dividend scores are weaker than its profitability and growth scores, Netflix is still well-positioned to weather any storms that come its way. As such, investors looking for a steady-yet-stable investment with the potential to yield moderate profits should take a closer look at Netflix. More…

Summary

Netflix, one of the leading streaming services in the world, recently slashed prices in order to attract more subscribers. This move was made in response to increasing competition in the streaming space. Despite the news of the price cuts, the company’s stock price went down on the same day and has yet to show signs of recovery. Analysts are divided on whether this decision is a wise one, as it could potentially reduce Netflix’s profits.

However, some argue that the increase in subscribers could offset this impact. It remains to be seen whether this strategy pays off in the long run, and investors should diligently watch further developments in this space.

Trending News 🌧️

This marked the first time in the company’s history that their quarterly Non-GAAP EPS has failed to meet analyst targets. The primary cause of the earnings miss was a combination of lower than anticipated sales, increased costs of goods sold, and higher than expected operating expenses. This caused the company to fall short of its expected earnings by $0.08. The company is already making efforts to regain financial stability, such as cutting back on their operating expenses and increasing their marketing expenditures.

Additionally, Block has announced plans to invest in research and development to remain competitive within the tech market. Despite the lowered expectations for fourth quarter earnings, analysts are still optimistic about the potential for Block to rebound given the steps they have taken to strengthen their business. As long as the company can successfully execute their plans and initiatives, they should be able to make up for this current earnings miss and return to consistent profitable growth in the future.

Price History

Despite this, BLOCK stock opened Thursday at $74.3 and closed at $74.2, an increase of 1.7% from its previous closing price of $72.9. Analysts have attributed this bump to the fact that the results weren’t as poor as expected by the markets. Live Quote…

Analysis

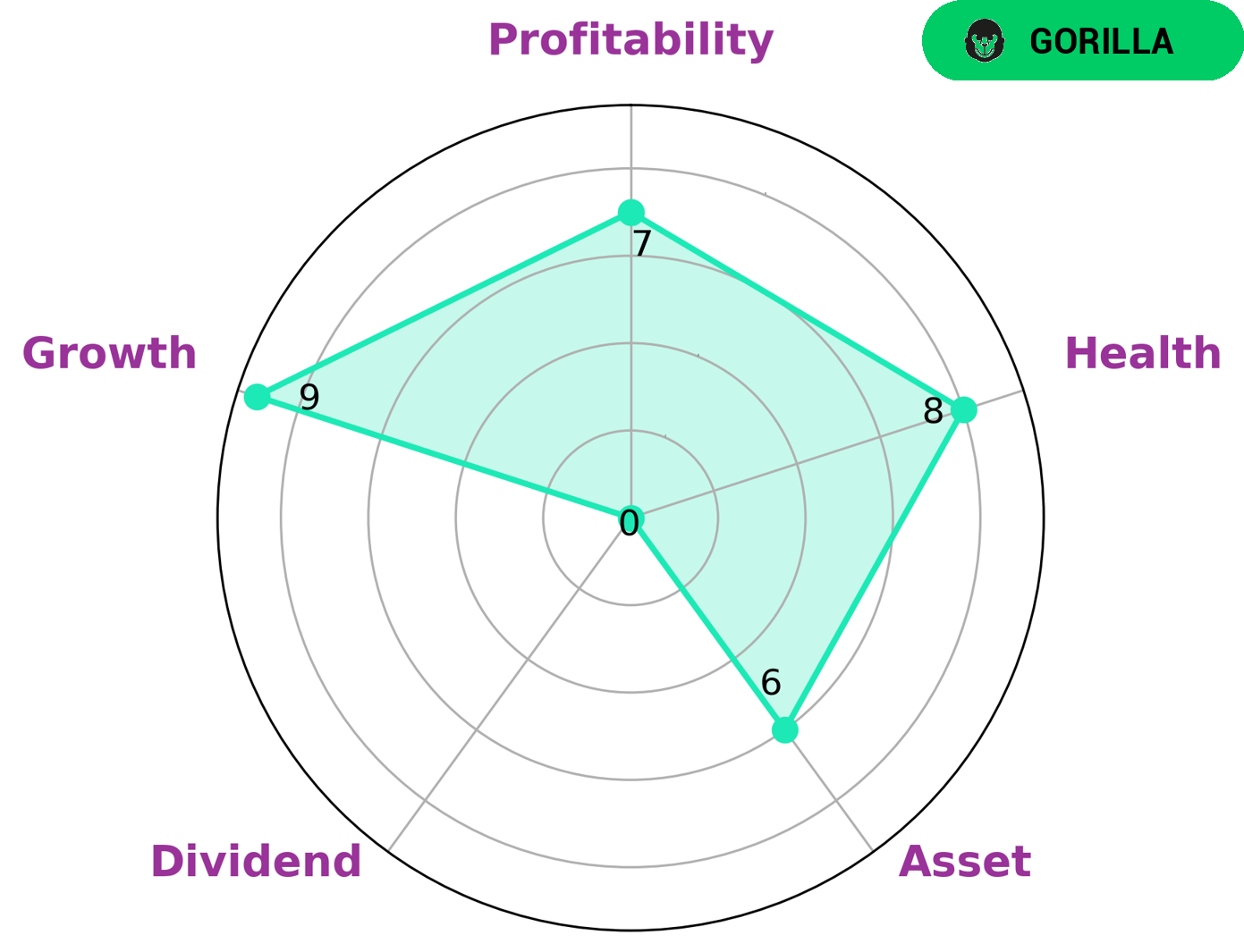

GoodWhale conducted an analysis of BLOCK‘s financials. The results showed that BLOCK is classified as a ‘Gorilla’ – a type of company that has achieved stable and remarkable growth due to its strong competitive advantage. This type of company is particularly attractive to investors who are looking for long-term, sustainable investments. In addition to its strong growth potential, the analysis showed that BLOCK is also strong in profitability, medium in assets, and weak in dividend. It is important to note that BLOCK scored 8 out of 10 on the health score metric with regard to its cashflows and debt, which indicates that the company is capable of sustaining its future operations during times of crisis. Overall, the analysis of BLOCK’s financials indicate that it is an attractive prospect for investors due to its strong liquidity and competitive advantages. Investors seeking long-term growth can be confident that BLOCK has the resources and capabilities to maintain financial stability during uncertain times. More…

Peers

Its competitors are Affirm Holdings Inc, Fiserv Inc, Shopify Inc.

– Affirm Holdings Inc ($NASDAQ:AFRM)

Affirm Holdings Inc is a provider of financing options for consumers at the point of sale. Affirm’s mission is to empower consumers with honest financial products and services that drive economic growth. Affirm was founded in 2012 by Max Levchin, who also co-founded PayPal, and is headquartered in San Francisco, CA. Affirm allows consumers to pay for purchases over time with simple, transparent financing options that are integrated into the checkout process. Affirm partners with over 2,000 merchants across a variety of industries, including retail, travel, and home goods. Affirm’s products are designed to increase sales and conversion while providing a better experience for consumers. As of 2022, Affirm has a market cap of 5.11B and a return on equity of -19.16%.

– Fiserv Inc ($NASDAQ:FISV)

Fiserv, Inc. is a leading global provider of financial services technology solutions. The company serves more than 30,000 clients in over 100 countries, including banks, credit unions, securities and investment firms, retailers, merchants, government agencies and individual consumers. Fiserv is a member of the S&P 500® Index and the FORTUNE® 500, and is among FORTUNE World’s Most Admired Companies®. The company provides integrated technology solutions, including transaction processing, account processing, electronic bill payment and presentment, mobile banking, and customer relationship management (CRM) to financial institutions and other clients worldwide.

– Shopify Inc ($TSX:SHOP)

Shopify Inc is a Canadian e-commerce company headquartered in Ottawa, Ontario. It is also the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems. Shopify offers online retailers a suite of services “including payments, marketing, shipping and customer engagement tools to simplify the process of running an online store for small merchants.

Summary

This miss has been met with a swift reaction from investors, with stocks falling substantially. Although the company has taken steps to improve its performance, it appears these measures have not had the desired effect. Going forwards, investors may want to watch BLOCK closely, particularly if they are considering entering or exiting any positions. Going forward, they should also consider the risks before investing in the company and pay close attention to the changing sentiment of the market.

Recent Posts