most recent filing with the Securities and Exchange Commission.

May 2, 2023

Trending News ☀️

Toast ($NYSE:TOST), Inc. is a restaurant technology company that provides customers with an all-in-one platform including point of sale, payments, and analytics. Berylson Capital Partners LLC, a major shareholder in Toast Inc., recently reduced its stake in the company by 77.9%, as revealed in its most recent Form 13F filing with the Securities and Exchange Commission (SEC).

Stock Price

As a result, the stock of Toast, Inc. opened at $18.1 and closed at $17.5, a decrease of 3.7% from its prior closing price of 18.2. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Toast. More…

| Total Revenues | Net Income | Net Margin |

| 2.73k | -275 | -13.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Toast. More…

| Operations | Investing | Financing |

| -156 | -98 | 38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Toast. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.76k | 663 | 2.1 |

Key Ratios Snapshot

Some of the financial key ratios for Toast are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 60.1% | – | -14.1% |

| FCF Margin | ROE | ROA |

| -6.9% | -21.7% | -13.6% |

Analysis

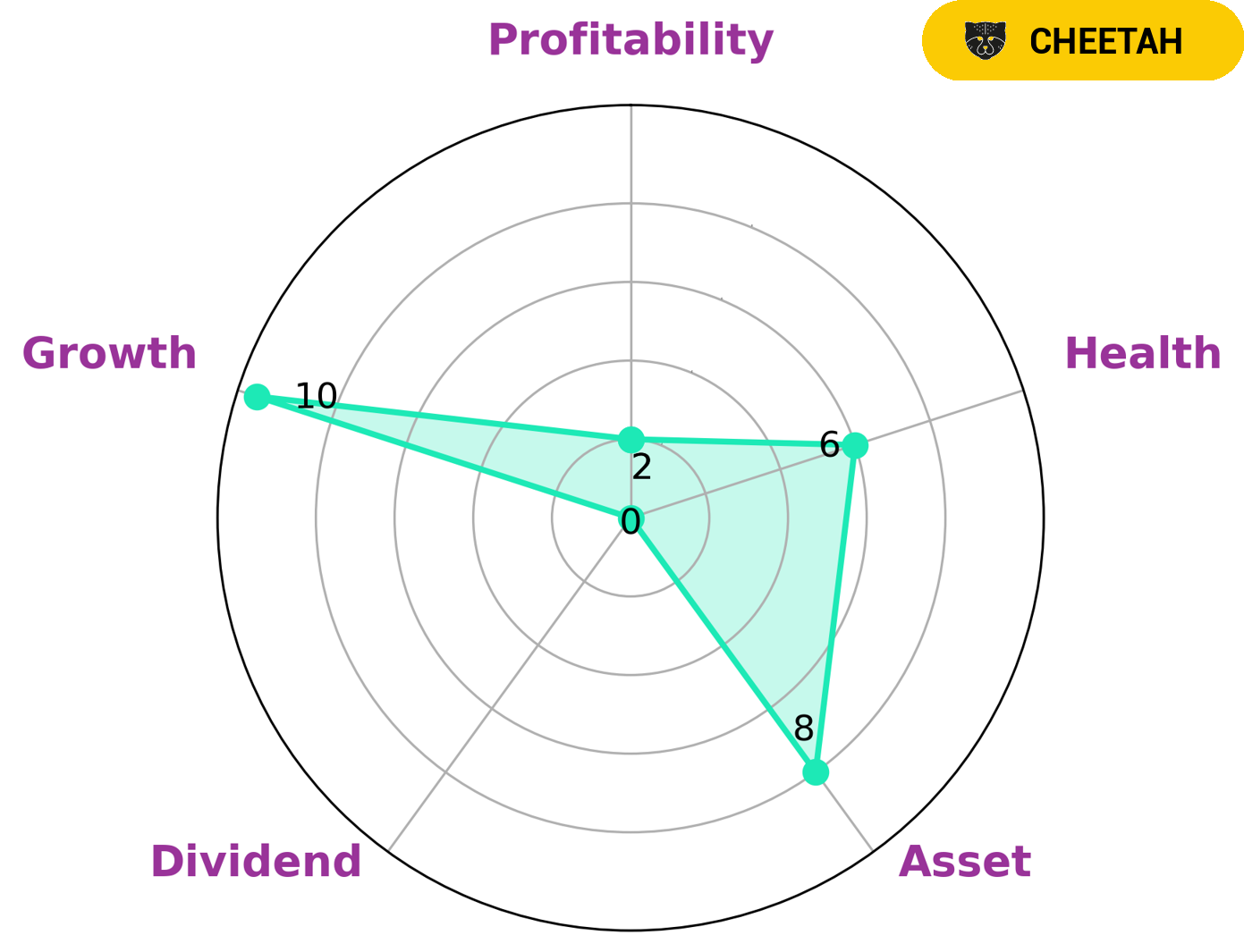

GoodWhale has conducted an analysis of TOAST‘s finances and classified it as a ‘cheetah’ company based on the Star Chart. This type of company typically has high revenue or earnings growth, but is considered less stable due to lower profitability. As such, investors looking for fast-growth business opportunities may be interested in TOAST. Our analysis shows that TOAST is strong in terms of assets and growth, but weaker in terms of dividends and profitability. Additionally, TOAST has an intermediate health score of 6/10 considering its cashflows and debt, which indicates it is likely to safely ride out any crisis without the risk of bankruptcy. More…

Peers

In the market for point-of-sale (POS) systems, there is intense competition among a few major players. Toast Inc, GreenBox POS, Rs2 Software PLC, and Hank Payments Corp are all vying for a share of the market. All of these companies offer POS systems that are feature-rich and competitively priced.

– GreenBox POS ($NASDAQ:GBOX)

PLC is a publicly traded company with a market capitalization of 266.3 million as of 2022. It has a return on equity of 6.98%. PLC is engaged in the development, manufacture and sale of software products and services. The company’s products and services are used by businesses and organizations of all sizes, in a variety of industries, including healthcare, financial services, manufacturing, retail, and education.

– Rs2 Software PLC ($LTS:0MVH)

Hank Payments Corp is a publicly traded company that provides mobile payment solutions. The company has a market capitalization of 4.02 million as of 2022. Hank Payments Corp’s primary product is Hanko, a mobile payment application that allows users to make payments using their smartphone. Hanko is available for both Android and iOS devices.

Summary

Investors are closely monitoring Toast, Inc. as recent trading activity indicates a 77.9% decrease in Berylson Capital Partners LLC’s holding in the company. The stock price has also taken a dip, suggesting that investors may be cautious with Toast’s future prospects. Analysts are recommending that investors watch the company closely and carefully assess the risk before making an investment decision.

Recent Posts