Liveramp Holdings Intrinsic Value Calculator – Liveramp Holdings Earnings Beat Expectations by 19 Cents, Revenue Surpasses Estimates

November 11, 2023

🌥️Trending News

This impressive performance also saw revenue surpass expectations, with the company performing well ahead of analyst expectations. This strong result came on the back of Liveramp ($NYSE:RAMP)’s recent investments in its technology platform and continued success in the digital marketing technology industry. Liveramp is a leading provider of data-driven marketing solutions for brands, marketing agencies, and publishers. They provide a suite of integrated products that connect online and offline data to uncover insights about consumer behavior. As technology advances, Liveramp has been able to help marketers maximize their investments in digital marketing technology to drive meaningful results.

Additionally, Liveramp provides innovative services such as identity resolution, audience segmentation, and attribution. With the company’s strong performance in the recent quarter, their stock has surged over the past year. The market reacted positively to the earnings beat, with investors recognizing the potential value of Liveramp’s products. Moreover, this strong performance in the quarter has increased confidence in the company’s ability to deliver future growth.

Earnings

LIVERAMP HOLDINGS recently released its FY2024 Q1 earnings report as of June 30 2021, and the results were impressive. The report showed that the company earned 119.04M USD in total revenue, with 17.36M USD in net income. This was a significant increase from the previous quarter, where total revenue was 119.04M USD and net income was 17.36M USD. Compared to the same period last year, LIVERAMP HOLDINGS saw a 16.3% decrease in total revenue and a 163.8% decrease in net income.

Despite this, the company has managed to achieve impressive growth over the last three years, with total revenue increasing from 119.04M USD to 154.07M USD during that time. This is an indication of the company’s strong performance and potential for future growth.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Liveramp Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 608.41 | -93.07 | -12.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Liveramp Holdings. More…

| Operations | Investing | Financing |

| 98.91 | -27.81 | -108.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Liveramp Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.16k | 245.4 | 13.76 |

Key Ratios Snapshot

Some of the financial key ratios for Liveramp Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.2% | -10.9% | -10.4% |

| FCF Margin | ROE | ROA |

| 15.8% | -4.3% | -3.4% |

Share Price

Despite the positive earnings report, the stock price of LIVERAMP HOLDINGS dropped 6.5% from the last closing price of 36.0 to open at 35.2 and close at 33.6 on Friday. Live Quote…

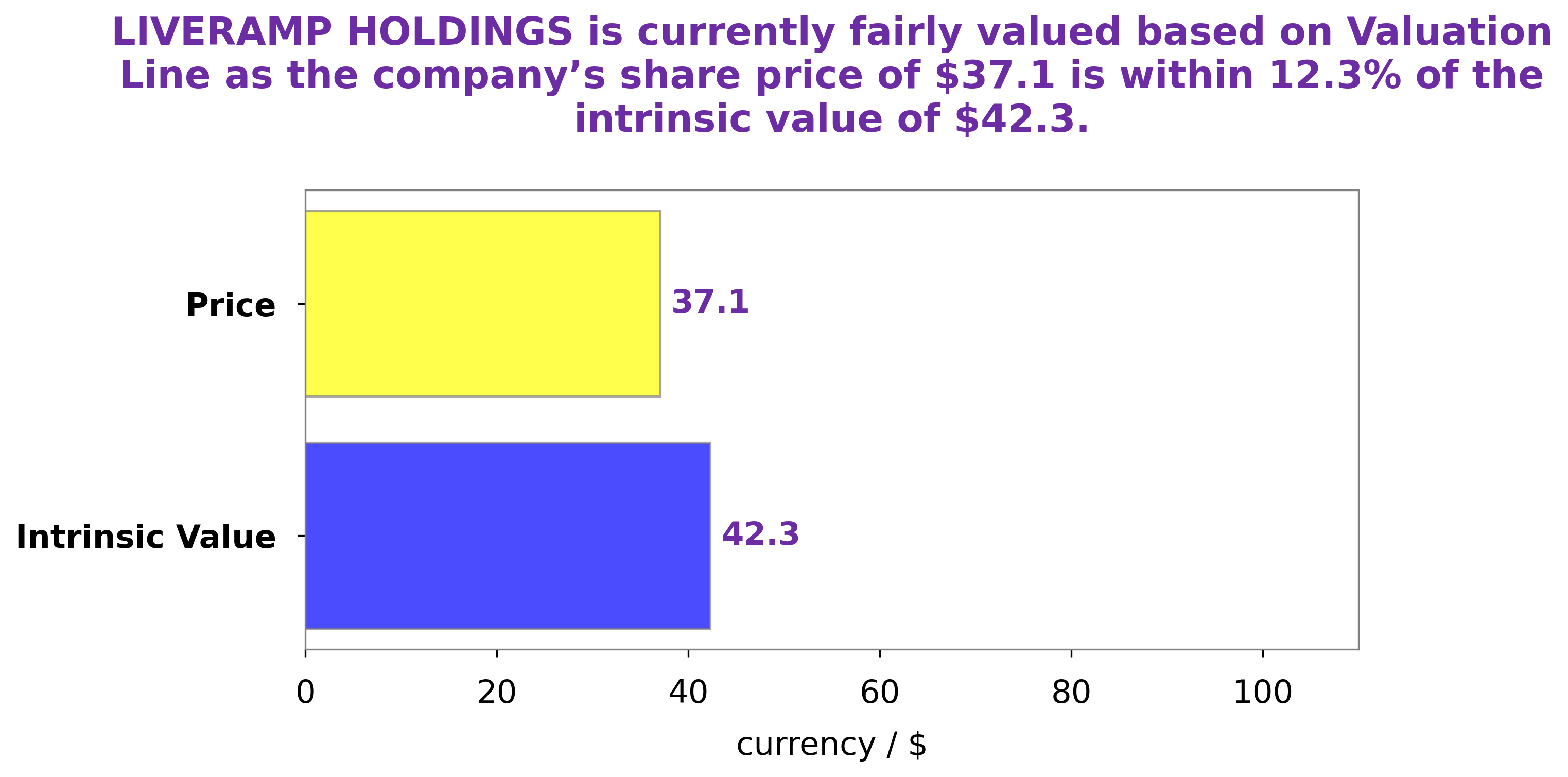

Analysis – Liveramp Holdings Intrinsic Value Calculator

At GoodWhale, we believe that analyzing a company’s fundamentals is key when it comes to assessing its intrinsic value. After analyzing the fundamentals of LIVERAMP HOLDINGS, we have determined that the intrinsic value of its share is around $44.9. This has been calculated using our proprietary Valuation Line. Currently, the LIVERAMP HOLDINGS stock is trading at $33.6, which is 25.2% lower than its intrinsic value. This presents an attractive opportunity for investors looking for a good value investment. More…

Peers

The competition between LiveRamp Holdings Inc and its competitors is fierce. Each company is trying to get a leg up on the others by offering better products and services. The competition is healthy, though, as it drives innovation and helps keep prices down.

– SponsorsOne Inc ($OTCPK:SPONF)

SponsorsOne Inc is a social media and digital marketing company. The company has a market capitalization of 7.27 million as of 2022 and a return on equity of -2645.75%. The company’s social media platform allows brands to connect with influencers and create marketing campaigns. The company also operates a digital marketing agency that provides services such as website design, social media management, and search engine optimization.

– Engagement Labs Inc ($LSE:ACT)

Actual Experience PLC is a United Kingdom-based company, which provides analysis of digital supply chains. The Company’s product, Actual Experience Analytics, is an enterprise software as a service (SaaS) platform, which allows customers to see how their digital services are experienced by end users, and to compare this with business objectives.

Summary

Liveramp Holdings Inc. was in the news recently after reporting its quarterly earnings. The company beat estimates by $0.19 and saw its revenue top estimates as well. Despite this news, the stock price of Liveramp fell the same day. This could indicate that investors had expected even better results than what was reported.

It is possible that this could lead to downward pressure on the stock price in the short-term. Investors should monitor the performance of Liveramp closely and assess the impact of the quarterly reports on the stock. With careful analysis, they can take advantage of any potential opportunities arising from the recent developments.

Recent Posts