Fortinet Set to Thrive in Growing Network Security Market

April 14, 2023

Trending News ☀️

Fortinet ($NASDAQ:FTNT) is set to thrive in the growing network security market, as the demand for security solutions continues to rise. As the world becomes increasingly interconnected, more organizations are investing in network security solutions to protect their data and systems. Fortinet has long been a leader in offering comprehensive solutions to meet this demand, making it well-positioned for continued and lasting growth. It provides a comprehensive portfolio of secure access, detection and response, cloud security, and secure access solutions to help customers protect their networks, data, and applications.

Fortinet’s solutions enable organizations to defend against advanced threats, maintain compliance, and reduce operational costs. The company has received numerous awards for its innovative products and services, further establishing it as a leader in the network security market. With its robust portfolio of solutions, Fortinet is set to remain a key player in the network security industry and continue to be a leader in providing secure access, detection and response solutions.

Market Price

On Wednesday, FORTINET’s stock opened at $67.6 and closed at $67.2, up by 0.3% from its previous closing price of 67.0. FORTINET provides network security solutions to businesses, helping to ensure the safety, performance, and compliance of corporate networks. Its offerings include FortiGate, a suite of integrated threat management solutions designed to protect networks from malicious intrusions and data theft. With its strong product portfolio, customer base, and partnerships, the company is well-positioned to capitalize on the growing demand for network security solutions and services. Fortinet_Set_to_Thrive_in_Growing_Network_Security_Market”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fortinet. More…

| Total Revenues | Net Income | Net Margin |

| 4.42k | 857.3 | 19.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fortinet. More…

| Operations | Investing | Financing |

| 1.73k | 763.9 | -2.13k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fortinet. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.23k | 6.51k | -0.36 |

Key Ratios Snapshot

Some of the financial key ratios for Fortinet are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.0% | 41.0% | 22.0% |

| FCF Margin | ROE | ROA |

| 32.8% | -132.8% | 9.8% |

Analysis

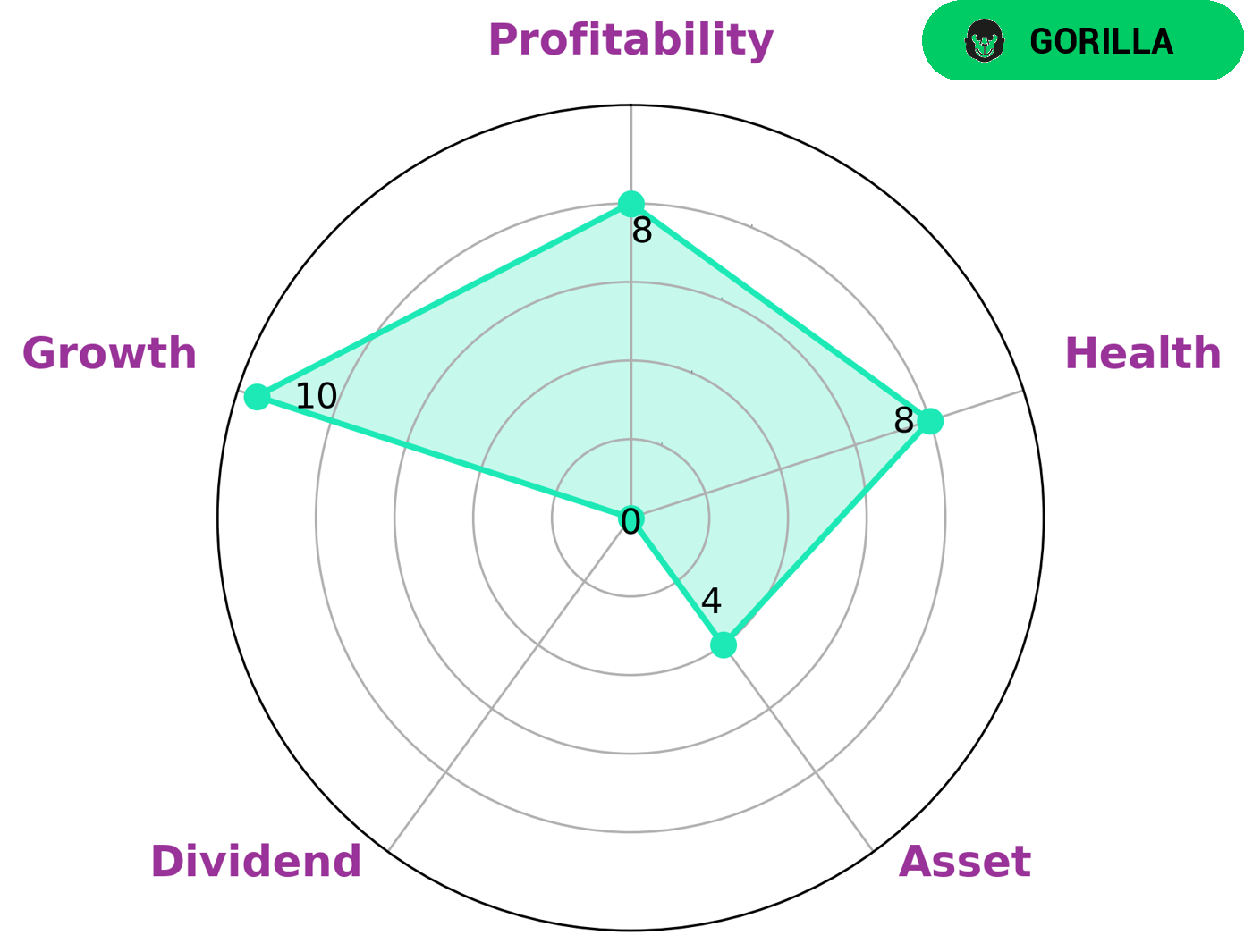

At GoodWhale, we analyzed the wellbeing of FORTINET and found it to be of high quality. We looked at the Star Chart, which placed FORTINET in the ‘gorilla’ category of companies, indicating that it has achieved stable and high revenue or earnings growth due to its strong competitive advantage. As a result, we believe that FORTINET is an attractive investment opportunity for investors looking for strong returns. Furthermore, GoodWhale’s health score for FORTINET was 8/10, indicating that it is very capable of sustaining future operations in times of crisis. In terms of company health, FORTINET is strong in growth, profitability, and medium in asset, but weak in dividend. Fortinet_Set_to_Thrive_in_Growing_Network_Security_Market”>More…

Peers

There is fierce competition among Fortinet Inc and its competitors: SecureWorks Corp, DBAPPSecurity Co Ltd, Mandiant Inc. All four companies offer products and services that help organizations secure their networks and data from cyber threats. Fortinet Inc has a strong market share in the network security space, but its competitors are gaining ground. Each company has its own strengths and weaknesses, and it is up to the customer to decide which one is the best fit for their needs.

– SecureWorks Corp ($NASDAQ:SCWX)

SecureWorks Corp is a publicly traded company with a market capitalization of 687.41 million as of 2022. The company has a return on equity of -9.05%. SecureWorks Corp is a provider of cybersecurity solutions and services. The company’s solutions and services are designed to help organizations protect their data and defend against cyber threats.

– DBAPPSecurity Co Ltd ($SHSE:688023)

DBApps Security Co Ltd has a market cap of 13.74B as of 2022, a Return on Equity of -5.12%. DBApps Security Co Ltd is a provider of online security solutions. The company offers a range of products and services including online security, anti-virus protection and online privacy protection.

Summary

Fortinet is an established leader in the fast-growing network security market and poised for sustainable growth. Its suite of products are top-of-the-line solutions that are popular among enterprises, large and small. With an investment focus on product innovation, they have developed a strong portfolio of solutions that are well-positioned to meet the changing needs of their customers. Their financials are strong, showing a consistent increase in revenue over the past few years.

The company is also focused on expanding its presence in emerging markets, giving investors further confidence in their growth prospects. Altogether, Fortinet looks to be a good investment option with strong long-term potential.

Recent Posts