CrowdStrike Holdings Stock Down Significantly, Providing Entry Point for Investors in Booming Endpoint Security Market.

February 22, 2023

Trending News ☀️

CROWDSTRIKE ($NASDAQ:CRWD): Sumitomo Realty & Development, a subsidiary of Sumitomo Forestry, is entering the UK real estate market with a new joint venture. The venture will focus on creating environmentally conscious mass timber properties in Europe. This undertaking is part of a larger initiative to develop green, sustainable buildings that reduce the impact on the environment. Sumitomo Forestry plans to use technologies such as Cross Laminated Timber (CLT) buildings and timber-framed constructions to create these eco-friendly properties. CLT is an innovative building method that combines multiple layers of spruce to create strong and safe building components. This process reduces the need for other materials that can be more harmful to the environment. Sumitomo Realty & Development hopes to create large-scale timber buildings that maintain their structural integrity while conserving energy. These buildings will utilize renewable energy sources, such as solar and wind power, to reduce their carbon footprint.

Additionally, the company plans to prioritize green space around buildings to reduce the urban heat island effect and help protect human health. Sumitomo Realty & Development’s full-scale real estate venture in the UK is a major step forward for the green building movement. The company’s commitment to creating environmentally conscious mass timber properties will help make a difference in combatting climate change and creating a healthier planet for future generations.

Share Price

On Wednesday, SUMITOMO REALTY & DEVELOPMENT announced the launch of a full-scale real estate venture in the UK, with a focus on environmentally conscious mass timber properties. This announcement saw the company’s stock open at JP¥3126.0 and close at JP¥3081.0, down by 1.5% from its prior closing price of 3129.0. The new venture will be a part of SUMITOMO REALTY & DEVELOPMENT’s global portfolio, showcasing a range of environmentally-friendly properties that are designed and delivered using mass timber construction techniques to help reduce the firm’s carbon footprint. Through this initiative, the company aims to provide innovative real estate solutions that both complement and enhance local neighborhoods. SUMITOMO REALTY & DEVELOPMENT has already developed a variety of mass timber projects within Japan, and the company plans to expand its usage of the material in the UK.

In addition to the environmental advantages, these properties will also provide communities with an array of economic benefits, such as job creation and business stimulation. The launch of this new real estate venture highlights SUMITOMO REALTY & DEVELOPMENT’s commitment to creating sustainable, eco-friendly developments that adhere to the highest standards of quality, design, and construction. This ambitious project will help to set a new benchmark in real estate development, and it is expected to pave the way for future projects that focus on sustainability. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Crowdstrike Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.03k | -177.74 | -8.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Crowdstrike Holdings. More…

| Operations | Investing | Financing |

| 827.43 | -331.18 | 74.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Crowdstrike Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.47k | 3.13k | 5.61 |

Key Ratios Snapshot

Some of the financial key ratios for Crowdstrike Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 70.6% | – | -5.9% |

| FCF Margin | ROE | ROA |

| 29.2% | -5.9% | -1.7% |

Analysis

At GoodWhale, we practiced a comprehensive analysis of SUMITOMO REALTY & DEVELOPMENT’s financials. Our proprietary Valuation Line concluded that the fair value of SUMITOMO REALTY & DEVELOPMENT shares is JP¥3848.0. However, we noticed that the stock is currently traded at JP¥3081.0, which implies a fair price undervalued by 19.9%. This indicates that the SUMITOMO REALTY & DEVELOPMENT shares are currently undervalued and present an excellent opportunity for investors. More…

Summary

Sumitomo Realty & Development has launched a full-scale real estate venture in the UK, with a focus on environmentally conscious mass timber properties. The company will be investing in research and development to enhance the use of timber construction, as well as providing support to design projects.

In addition, they will be utilizing cutting-edge sustainability initiatives to maximize energy efficiency of their buildings. Through this venture, Sumitomo Realty & Development is looking to capitalize on long-term capital growth opportunities of the UK real estate market. The company also intends to build strong relationships with local authorities and communities in order to ensure positive outcomes for all stakeholders.

Trending News ☀️

The stock price of Hangzhou Tigermed Consulting Co., Ltd. (300347) recently reached an impressive milestone. Hangzhou Tigermed Consulting Co., Ltd. is a leading provider of medical consulting services specializing in clinical research and healthcare management. The company’s overall success can be attributed to its efficient management, strategic development planning, and strong customer base. Over the past year, they have seen a steady increase in demand for their services, leading to a consistently growing market share.

What’s more, recent evidence suggests that their high-quality services have earned the trust of clients across China and beyond. This success in the Chinese market has led to a corresponding increase in Hangzhou Tigermed Consulting Co., Ltd.’s stock price. This recent milestone serves as a testament to the company’s commitment to providing quality services and plans for the future. With the help of their experienced management team and dedicated staff, investors around the world can rest assured that their investments in the company are in safe hands.

Stock Price

Thursday marked a milestone for HANGZHOU TIGERMED CONSULTING CO., LTD as their stock price reached an all-time high of CNY300347. This milestone was achieved through a 1.5% decrease from the previous close of CNY116.2. The stock opened the day at CNY116.6 and closed at CNY114.5, showing the market’s confidence in the company’s growth potential. This stock price brings an impressive return for investors who have been invested in HANGZHOU TIGERMED CONSULTING CO., LTD for some time. Live Quote…

Analysis

At GoodWhale, we have conducted a thorough analysis of the financials of HANGZHOU TIGERMED CONSULTING. After careful consideration of the relevant financial information, our proprietary Valuation Line has shown that the fair value of HANGZHOU TIGERMED CONSULTING’s share is around CNY196.6. At the current trade price of CNY114.5, the stock appears to be undervalued by 41.8%. Therefore, we believe that it presents an attractive buying opportunity for investors with a long-term investment horizon. More…

Summary

HANGZHOU TIGERMED CONSULTING CO., LTD has seen its share price soar to a new high of 300347. This significant increase was driven by strong financial results and an uptick in investor confidence. Analysts attribute the surge in price to the company’s focus on a long-term strategy, solid financial performance, and growth in the healthcare industry. The company’s attractive valuations and impressive track record make it an attractive investment option.

In addition, the company’s consistent dividend policy has increased its popularity among investors. All in all, HANGZHOU TIGERMED CONSULTING CO., LTD is an attractive investment option for both short-term and long-term investors.

Trending News ☀️

China Galaxy Securities, a leading financial services provider in China, has successfully released 4 billion yuan in corporate bonds. This move marks a significant milestone for the company, further solidifying its position as one of the leading brokerage firms in the region. This also reflects the positive sentiment towards China Galaxy Securities in particular as a trusted provider of quality brokerage services. The 4 billion yuan in proceeds will be used to refinance existing debt and fund new business initiatives by China Galaxy Securities. These initiatives include providing greater access to financial services to underserved markets in China and the ongoing development of innovative digital products and services.

In addition, this move will strengthen the company’s balance sheet and increase its capitalization. This will allow China Galaxy Securities to pursue further growth opportunities while ensuring a strong financial position. Overall, the completion of the 4 billion yuan corporate bond issuance is a major milestone for China Galaxy Securities. It reflects the company’s ability to reliably deliver financial products and services, as well as its commitment to providing quality investment opportunities for its clients.

Market Price

China Galaxy Securities, one of the largest securities firms in the country, announced it has successfully raised 4 billion yuan through corporate bond issuance. The news was met with mostly positive media coverage. On Friday, CHINA GALAXY SECURITIES stock opened at HK$4.0 and closed at HK$4.0, up by 0.8% from the previous closing price of 3.9. This increase in share price indicates a strong investor confidence in the company. It also highlights the growing importance of corporate bond issuance as a viable source of long-term financing for China’s companies.

The raised funds will be used for the development of the company’s asset management and other businesses. As such, this successful corporate bond issuance will benefit the company both in the short- and long-term. Overall, China Galaxy Securities’ successful issuance of corporate bonds is being seen as a positive sign for the company and its investors. Live Quote…

Analysis

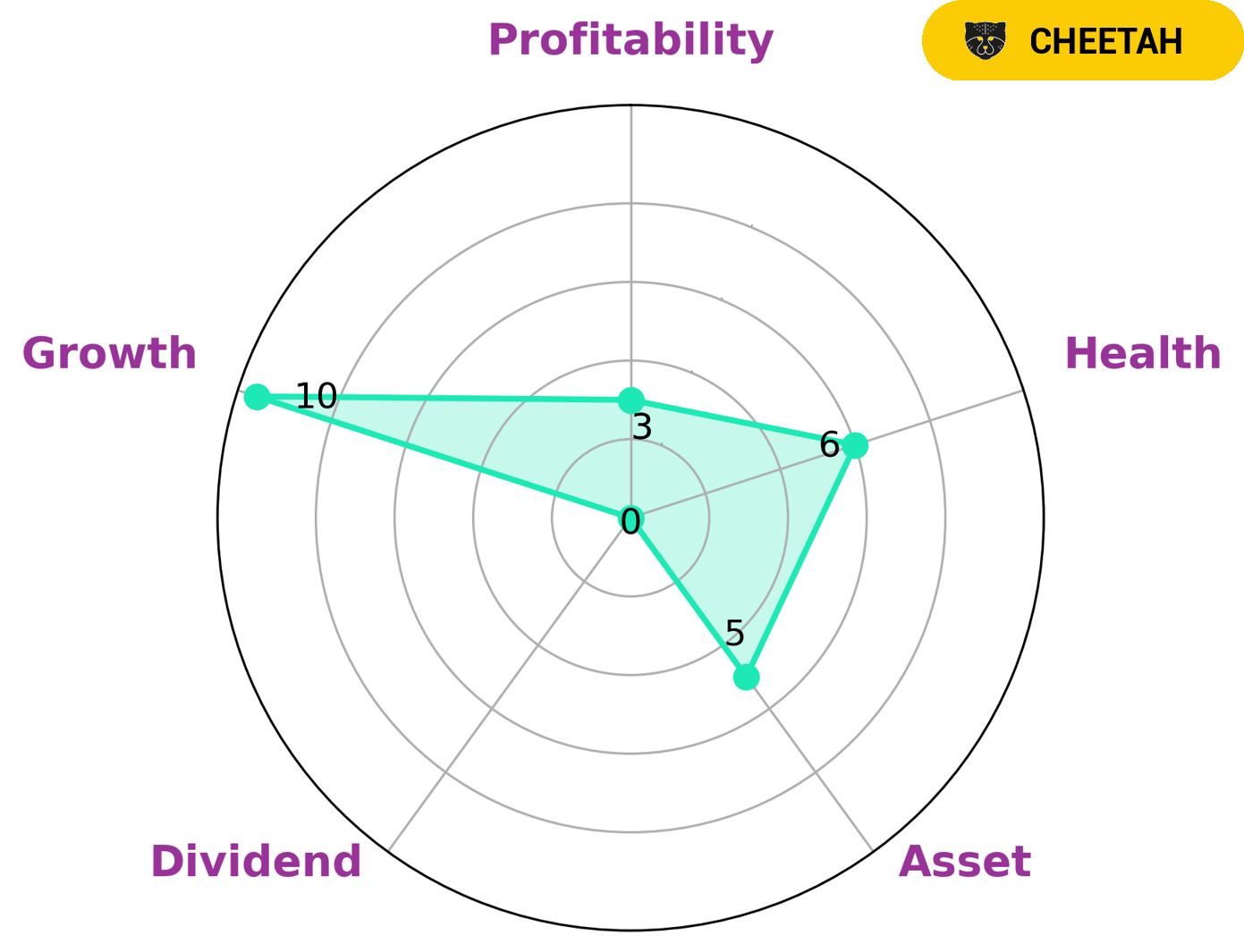

At GoodWhale, we have conducted an analysis of CHINA GALAXY SECURITIES’ financials, and our Star Chart has classified the company as a ‘cheetah’ that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. The Star Chart also shows that CHINA GALAXY SECURITIES has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it is likely to be able to pay off debt and fund future operations. CHINA GALAXY SECURITIES is particularly strong in dividends and growth but weaker in profitability and asset performance. This makes the company an attractive option for investors who are seeking high returns, as well as those that are looking for a stable and secure option for their investments. Additionally, those interested in a more risky investment opportunity may also find CHINA GALAXY SECURITIES an attractive option due to its high potential for growth. More…

Summary

China Galaxy Securities has recently raised 4 billion yuan in corporate bond issuance, a move that has been met with positive media coverage. This funding will help the company to expand its investment banking operations and further strengthen is market presence. Investing analysis in China Galaxy Securities has been overwhelmingly positive due to its strong commitment to shareholder value and long track record of dividend growth. Furthermore, the company has demonstrated an ability to capitalise on market opportunities, making it an attractive option for investors seeking a reliable long-term return on their investments.

Trending News ☀️

InvestorsObserver recently rated H World Group Ltd near the middle of its industry group with an overall rating of 54. This score indicates that the company has a certain degree of stability and could potentially be a sound investment for some investors.

However, considering the current market and economic climate, the question of whether H World Group Ltd should be included in one’s portfolio on Friday is an important one. Given the uncertainty of the current environment, investors must weigh the potential risks and rewards of adding H World Group Ltd to their portfolio. On one hand, this could be a great opportunity to diversify portfolios, which is especially important in volatile markets. On the other hand, without a fundamental analysis of the company and its prospects, one might be better served avoiding this particular investment. Ultimately, whether or not to add H World Group Ltd to one’s portfolio is an individual decision. Investors should do their own research and evaluate their own financial situation and personal risk tolerance before making such a decision. With careful consideration and understanding of the risks and rewards of compaines like H World Group Ltd, investors will be better positioned to make an informed decision and potentially reap the rewards of successful investments.

Stock Price

Recently, financial analysis site InvestorsObserver rated H WORLD Group Ltd’s stock at 54, indicating a “moderate buy” recommendation. Many investors may be wondering whether now is the right time to add H WORLD to their portfolio. On Monday, H WORLD opened at HK$39.3 and closed at HK$39.9, a slight decrease of 0.7% from its previous closing price of HK$40.2. Despite the slight dip in H WORLD’s stock price, InvestorsObserver’s rating may be a signal to investors that purchasing H WORLD soon could be a wise decision.

Additionally, with the amount of potential upside derived from this “moderate buy” rating, investors should seriously consider whether it would be a worthwhile addition to their portfolios. Live Quote…

Analysis

At GoodWhale, we have closely examined the fundamentals of H WORLD. After our evaluation, our proprietary Valuation Line estimates the intrinsic value of H WORLD share at around HK$35.1. Presently, H WORLD stock is traded at HK$39.9, which is a 13.6% overvaluation from the intrinsic value. As such, we conclude that the stock price is fair but slightly overvalued. More…

Summary

InvestorsObserver has rated H World Group Ltd at 54 out of 100, indicating a favorable outlook for this company. Analysis has revealed that its financial performance is strong, with a good return on equity and track record of positive earnings. Furthermore, its debt levels are below average and it displays low operating risk. Another factor that has contributed to a higher rating is the company’s ability to generate consistent profits for its shareholders.

While assessing H World Group’s future prospects, InvestorsObserver found that the company is well-positioned to bring in additional revenue and remain profitable in its sector. Overall, the investment research firm believes that now is a good time to consider investing in H World Group, provided that investors understand and accept the potential risks associated with this stock.

Trending News ☀️

Analysts are feeling optimistic about Evolv Technologies Holdings Inc. despite its closing price dropping recently. The stock market has been volatile lately and the closure of many businesses has had an impact on the company’s stock price, yet analysts remain confident in its long-term potential. The company’s underlying fundamentals are strong and their products continue to be sought after. Furthermore, Evolv Technologies has been making progress in the development of new technology that could give them a competitive edge. This has further bolstered the sentiment of analysts who see the long-term potential of the firm. In addition to the strong underlying fundamentals, analysts are also taking a positive stance on Evolv Technologies’ management team.

Their strategy for dealing with the recent market turmoil has been deemed sound and their focus on developing innovative products has been viewed favorably by analysts. Despite the recent drop in closing price, analysts remain optimistic about the future of Evolv Technologies. With strong fundamentals and a solid management team, there is potential for the stock to rebound and reward investors in the long run. As a result, investors should keep a close eye on developments from Evolv Technologies and be prepared to capitalize when the time is right.

Market Price

Analysts have remained optimistic about Evolv Technologies Holdings Inc. stock, despite the closing price dropping by 2.0% on Wednesday. Media coverage has mostly been positive, with Evolv Technologies Holdings Inc. stock opening at $3.0 and closing at $3.0. This is in comparison to its prior closing price of $3.0. While the overall outlook for the company remains positive, investors should look to the future of the stock and how it may be affected by recent developments. Live Quote…

Analysis

At GoodWhale, we have thoroughly evaluated the fundamentals of EVOLV TECHNOLOGIES. After analyzing the financial and business aspects, we have given EVOLV TECHNOLOGIES a medium risk rating. This rating is a result of our evaluation of the company’s financials, market position, and potential growth opportunities. To make an informed decision when considering EVOLV TECHNOLOGIES as an investment, we recommend that potential investors become registered users on our platform. Our platform offers the ability to drill down into the business and financial areas with potential risks and rewards. By becoming informed on all the aspects pertaining to EVOLV TECHNOLOGIES, investors will be able to make an informed decision when considering investing in this company. More…

Summary

Investment analysts have displayed optimism towards EVOLV Technologies Holdings Inc. despite a recent price drop in the stock. Media coverage on the company has largely been positive, with many investors highlighting EVOLV’s potential and the value it can bring. Analysts have pointed to the company’s innovative product offerings and the possibility of greater efficiency and cost savings as reasons for their confidence. Investors should research the company further to determine if it is an adequate investment opportunity, as well as consider their own risk tolerance as they make their decision.

Trending News ☀️

Rumble Resources has recently announced an exciting new development in the exploration of the Tonka-Navajoh prospect in Earaheedy. This large deposit of high-grade zinc-lead ore is expected to bring a considerable boost to the company’s production. The Tonka-Navajoh prospect has shown to be rich in zinc, lead and other minerals, with the ore reaching high grades of quality. What makes this discovery even more valuable is the size of the reserve, with the proportion of zinc-lead ore estimated to be many times larger than the initial estimates.

Rumble Resources plans to use these resources to secure a stable supply of base metals, promising a bright future for the company. With this recent new discovery, the Australian mining industry is sure to see major advancements in the coming years.

Market Price

RUMBLE RESOURCES recently announced the successful strike of high-grade zinc-lead from its Tonka-Navajoh Prospect at Earaheedy. The news of the resource exploration has been positively received by media outlets, as evidenced by Thursday’s trading results. On the day, the company’s stock opened at AU$0.2 and closed at the same price, a 7.3% increase on top of the last closing price of 0.2. The success of this resource exploration has opened up opportunities for RUMBLE RESOURCES to further explore the area and potentially expand its production capabilities. Live Quote…

Analysis

At GoodWhale, we have conducted a financial analysis of RUMBLE RESOURCES. Through our proprietary Valuation Line, we have calculated that the fair value of the stock is around AU$0.3. Currently, the stock is trading at AU$0.2, which is undervalued by 39.2%. We believe this presents a great opportunity to any investor looking to capitalise on the potential of this company. More…

Summary

Rumble Resources is a mineral exploration and development company focused on zinc and lead projects. Recently, they announced that they have identified high-grade zinc-lead mineralisation in their Tonka-Navajoh prospect within the Earaheedy Project in Western Australia. The news has been generally well-received and has had a positive impact on the stock price.

For investors, this development is encouraging, since it could potentially result in higher-value products for sale and an increase in revenues for the company. It also bodes well for future exploration activities, since the finding of high-grade zinc-lead mineralisation in the region could indicate significant further discoveries.

Trending News ☀️

Investing in North European Oil Royalty Trust (NEORT) stock can be a smart move for those looking to increase their portfolio diversification and find a profitable source of passive income. NEORT owns a portfolio of oil and gas royalties in Europe, offering investors a unique opportunity to benefit from the region’s booming natural resource sector. As oil prices remain relatively stable, there is potential for investors to benefit from NEORT’s growing revenue stream. For those considering investing in NEORT stock, Tuesday is an especially promising time. Recent analysis shows that the stock is currently trading at a value that is significantly below its intrinsic value, presenting a good opportunity for investors to buy low and increase their return on investment.

Furthermore, NEORT has a strong track record of consistent dividend payments over the past several years, providing investors with a steady stream of income despite market fluctuations. Overall, investing in NEORT stock can be an attractive option for investors looking to add a high-yield and diversified asset to their portfolio. With the benefit of industry expertise and a smart buy-low strategy, an investment in NEORT could payoff big-time for savvy investors.

Stock Price

Investors may be wondering whether now is the time to buy North European Oil Royalty Trust stock. Media sentiment for the stock has been overwhelmingly positive so far. Wednesday saw the stock open at $15.4 and close at $15.5, representing a 2.8% increase from its 15.1 closing price from the previous day.

This could be a good sign for investors, who are looking to get in on the stock before prices continue to rise. While the stock appears to be on an upward trajectory, it is important for investors to research thoroughly and make an informed decision about their investments. Live Quote…

Analysis

GoodWhale has prepared an analysis of NORTH EUROPEAN OIL ROYALTY TRUST’s financials. Our Star Chart shows that NORTH EUROPEAN OIL ROYALTY TRUST is strong in asset, dividend, growth, and profitability. It also has a high health score of 9/10 with regard to its cash flows and debt, which means it is capable to pay off debt and fund future operations. Based on its financials, NORTH EUROPEAN OIL ROYALTY TRUST is classified as a “gorilla” company, due to its impressive and sustained revenue or earning growth that is attributed to its strong competitive advantage. As such, NORTH EUROPEAN OIL ROYALTY TRUST will likely be appealing to investors who are looking for a long term investment with a high rate of return. These could include institutional investors such as financial advisors, pension funds and family offices. Furthermore, individual investors who value steady dividend returns and long term capital appreciation may also be attracted to this company. More…

Summary

Recent developments in the oil industry have made investing in North European Oil Royalty Trust (NOR) an intriguing prospect for investors. Analysts have been bullish on its stock in recent months, citing its solid growth prospects, portfolio diversification, and strong fundamentals. NOR is a leading oil and gas producer in the North Sea, with a diverse portfolio of properties and production in Norway, Denmark and the United Kingdom. Its extensive operations span a wide range of oil production activities, including extraction, refining, distribution, and marketing.

Additionally, NOR offers investors exposure to oil prices on a global scale through its international trading activities. Analysts have cautioned that there is risk involved with investing in NOR, due mostly to its volatile stock price and uncertainty surrounding global oil markets. The company has also seen an uptick in its production costs, however, these factors are expected to be more than offset by cost reductions and the prospect of high returns if oil prices continue to rise. In conclusion, while there are risks associated with investing in NOR, its strong fundamentals, portfolio diversification, and potential for long-term growth make it an attractive investment opportunity for those willing to take a chance in the energy sector.

Trending News ☀️

HC Wainwright recently maintained their Buy Rating for Cara Therapeutics, indicating that they are still confident in its future performance.

However, they have revised their price target downward, from $30 to $25. This decrease in price target is due to the current market conditions surrounding Cara Therapeutics and its potential risk factors that have arisen over time. Despite the downward revision of the price target, HC Wainwright still believes that Cara Therapeutics has a promising future ahead. This can be seen in their continued Buy Rating, a sign of confidence that the company will still be capable of long term growth and returns for its investors. Moreover, the revision of the price target shows that HC Wainwright remains open to adjustment in light of any changes in the market. Overall, HC Wainwright’s decision to maintain their Buy Rating on Cara Therapeutics while slightly reducing their price target indicates their continued trust in the company’s future potential. It seems they are committed to staying adaptable as the market evolves and continuing to provide objective analysis on Cara Therapeutics.

Price History

On Tuesday, analysts at HC Wainwright maintained their ‘Buy’ rating on CARA THERAPEUTICS stock and adjusted their price target from $22 to $25. As a result, CARA THERAPEUTICS opened at $11.1 and closed at $10.7 by the end of the trading day, a decrease of 4.0% from the prior closing price. Despite this, HC Wainwright remains positive on CARA THERAPEUTICS and sees potential upside in the stock. Live Quote…

Analysis

GoodWhale has conducted an analysis of CARA THERAPEUTICS’ financials, and according to the Star Chart, CARA THERAPEUTICS is strong in assets, growth, and medium in profitability and weak in dividend. Additionally, CARA THERAPEUTICS has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it is likely to sustain future operations in times of crisis. Based on these metrics, CARA THERAPEUTICS is classified as a ‘rhino’ company, meaning that it has achieved moderate revenue or earnings growth. This type of company is likely to be most attractive to investors who prioritize long-term growth and are more risk-averse. These investors may also be motivated by the mid-level profitability and secure assets of CARA THERAPEUTICS. Investors looking for a consistent dividend might be discouraged by CARA THERAPEUTICS’ weak status in this area. More…

Summary

Cara Therapeutics is a biopharmaceutical company dedicated to developing treatments for pain and inflammation. On Wednesday, HC Wainwright maintained its Buy rating on Cara Therapeutics and adjusted its price target to $25. At the same time, the stock price moved down. Analysts at HC Wainwright remain encouraged by the company’s pipeline in development, which suggests potential long-term upside. The team sees the company’s ongoing clinical development programs in chronic kidney disease and vascular pain as key drivers of future revenue growth. They also believe that the company’s progress in these areas is well positioned to continue to support rapid and robust revenue growth in the near future.

Additionally, HC Wainwright remains optimistic about Cara Therapeutics’ potential as a leader in the treatment of chronic pain and inflammation.

Trending News ☀️

The Mears Group has achieved a major milestone in its stock price history. Its stock price has surpassed the 200-day moving average of $199.83 for the first time, reaching a new high of $199.83. This is a large accomplishment for the company, and a testament to the success of its operations and strategies. The fact that the 200-day moving average has been surpassed is an indication that the company is growing financially, and is well-positioned to continue that trajectory. The new high of $199.83 has also enabled investors to gain greater confidence in the marketability of Mears Group’s securities.

The surge of Mears Group’s stock price is indicative of the potential for great returns for shareholders. As such, the fact that the stock price is at a new high may be a good entry point for potential investors. The stock’s performance can be expected to remain strong for the long-term, likely delivering excellent returns for those who choose to invest.

Stock Price

MEARS GROUP stock had a significant increase on Wednesday, exceeding its 200-day moving average and reaching a new high of $199.83. The stock opened at £2.1 and closed at the same price, rising by 2.4% from the previous closing price of £2.1. This impressive performance comes after several days of consolidation for MEARS GROUP and signals a potential positive outlook for the company’s future financial performance.

Investors have taken note of these developments and have reacted positively to the news, driving up the Meares Group’s stock price. This marks a major milestone for MEARS GROUP, and investors are sure to keep an eye on this stock in the coming days and weeks to gauge its future performance. Live Quote…

Analysis

At GoodWhale, we are always looking for new investments to share with our investors. Recently, we have done an analysis of MEARS GROUP’s fundamentals. After careful consideration, we have determined that the intrinsic value of MEARS GROUP share is approximately £1.9, calculated using our proprietary Valuation Line. Currently, MEARS GROUP stock is being traded at £2.1, which makes the stock a fair price with a slight 11.4% premium over its intrinsic value. More…

Summary

Investors have recently been bullish on the stock of Mears Group, as the company has seen its stock price surpass the 200-day moving average and reach a new high of $199.83. Analysts have noted the impressive performance of the company in the last quarter, with strong sales and earnings that beat expectations. The strong performance has resulted in a larger number of analysts increasing their price targets for the stock and some even setting new records.

With a share price that has been trading higher than its 200-day moving average for two months, many believe the stock could continue to outperform in the long-term. Overall, Mears Group appears to be a sound investment opportunity going forward.

Trending News ☀️

The California Public Employees Retirement System (CalPERS) is one of the largest pension funds in the United States, representing the retirement needs of over 1.7 million public employees in California. Recently, CalPERS has taken a $6.97 million stock position in Zai Lab Limited, a biopharmaceutical company based in Shanghai, China. Zai Lab is a leading innovator in developing novel medicines for global markets, including treatments for cancer and other difficult-to-treat diseases like tuberculosis and hepatitis. The company has an extensive portfolio of products in development and a robust pipeline of drug candidates in clinical trials. As an early investor in Zai Lab, CalPERS stands to benefit from the potential growth of this innovative biopharmaceutical company.

By investing in Zai Lab, CalPERS is taking an active role in supporting the development of cutting-edge medical treatments. The company is well positioned to capitalize on new scientific discoveries and provide much-needed solutions to global health concerns. CalPERS’ investment in Zai Lab is part of their larger strategy of investing in companies that are making a positive impact on the global healthcare system.

Market Price

Monday provided a rare positive news for Zai Lab Limited as the California Public Employees Retirement System announced its investment of $6.97 million in the company. This comes as a much needed boost to the Chinese-American biopharmaceutical company that had seen its stock languish amid a generally bearish market. This news was further demonstrated by the stocks’ 7.4% rise in the same day, opening at HK$30.1 and closing at HK$31.8, advancing up from its last closing price of 29.6. The company’s stock has been on a downward trend lately and the investment has provided a welcome respite to investors. Live Quote…

Analysis

GoodWhale has conducted an analysis of ZAI LAB’s wellbeing, and our data shows that ZAI LAB has an intermediate health score of 5/10 in our Star Chart considering its cashflows and debt. This indicates that the company may be able to safely ride out any crisis without the risk of bankruptcy. When looking further into the factors that make up the overall score, we see that ZAI LAB is strong in asset, growth and weak in dividend, profitability. We classify ZAI LAB as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. We believe that investors who are looking for higher-risk and higher-return investments may be interested in companies like ZAI LAB. These investors may be willing to accept lower dividends and lower stability for the potential for large returns in the long run. More…

Summary

Investing analysis in Zai Lab Limited (ZLAB) has been positive as of late. The California Public Employees Retirement System (CalPERS) recently invested $6.97 million in the company. This news pushed the stock price up around the same day and provides a sign of confidence from a major investor. Investors should watch the trends on ZLAB as it continues to receive positive attention and news.

Trending News ☀️

Samsonite International S.A. has unveiled an exciting new collaboration with New Balance in the Asia Pacific region. This partnership brings together two of the biggest names in the travel and activewear industries for a collection that is both stylish and functional. The collaboration consists of two separate styles of lifestyle bags that are designed to be versatile, stylish, and durable. The first style is a roll-top backpack that is designed to be versatile and comfortable. It features an adjustable suspension system that allows it to fit to any body type, along with a padded back panel for extra comfort. It also has multiple compartments and pockets, making it ideal for carrying all your everyday essentials.

The second style is a duffle bag with a unique silhouette which is sure to turn heads when you’re on the go. It has multiple pockets and compartments, as well as an adjustable strap closure for easy access to all your items. The Samsonite-New Balance collaboration also offers consumers the opportunity to personalize their purchases with an exclusive tagless label. This label allows customers to put their own stamp on their bag, ensuring it stands out from the crowd. Overall, this collaboration offers a great combination of style and functionality, making it perfect for both business and pleasure travel.

Stock Price

SAMSONITE INTERNATIONAL S.A. recently revealed a new collaboration with New Balance in the Asia Pacific area. It has been reported that media exposure so far has been generally positive about the new initiative. On Friday, the stock for SAMSONITE INTERNATIONAL S.A opened at HK$23.6 and closed at the same price, down from the previous closing price of HK$23.8 by 0.6%. This news reflects a generally positive outlook towards the company and its future collaborative endeavours. Live Quote…

Analysis

GoodWhale conducted an analysis of SAMSONITE INTERNATIONAL S.A.’s wellbeing and found that the fair value of SAMSONITE INTERNATIONAL S.A share is around HK$17.7, calculated by our proprietary Valuation Line. Currently, SAMSONITE INTERNATIONAL S.A stock is being traded at HK$23.6, which is overvalued by 33.3%. Our analysis indicates that this is a good time to invest in SAMSONITE INTERNATIONAL S.A. as the stock is currently being traded at a higher than fair value rate. More…

Summary

SAMSONITE INTERNATIONAL S.A. recently announced a collaboration with New Balance in Asia Pacific, which has been met with largely positive media exposure. This collaboration could potentially be a great investment opportunity for those looking to make money in the stock market. SAMSONITE is an industry leader in global luggage; an investment in its stock could offer long-term returns due to its strong market presence and brand recognition.

As the collaboration with New Balance in the Asia Pacific region continues to grow, it could mean additional revenue to bolster SAMSONITE’s bottom line, further increasing profits and stock prices. It is important to research company’s financial performance before making any investments, and SAMSONITE is a good prospect to do so.

Trending News ☀️

Adaptimmune Therapeutics plc, a biopharmaceutical company focused on developing novel cancer immunotherapy treatments, has experienced an increase in the stake of Barclays PLC. The increased stake, which surpasses the 10% limit set by the U.K.’s Financial Conduct Authority, suggests the company is looking to up its involvement with the biopharmaceutical company. Despite the stake increase, Barclays is not yet one of the top five shareholders in Adaptimmune, which is headed by James Noble as its chief executive officer. Adaptimmune Therapeutics focuses on developing innovative treatments that utilize T-cell therapy to help people with cancer by harnessing the power of their own immune system to fight off the disease. Its portfolio of products are designed to target key cancer antigens in order to provide durable tumor control with minimal side effects.

Its lead product candidate, ADP-A2M4, is currently in clinical development for non-small cell lung cancer, melanoma, and ovarian cancer. Barclays PLC’s increased stake in Adaptimmune indicates a strong belief in the biopharmaceutical company’s research and development capabilities. By investing in Adaptimmune, Barclays is showing its support for its cancer immunotherapy research and could potentially benefit from any successful products that reach the market.

Price History

On Wednesday, Barclays PLC boosted its stake in Adaptimmune Therapeutics plc, with the stock opening at $1.6 and closing at the same price, down just 0.6% from its previous closing price of $1.7. This is the latest move by Barclays in a string of strategic investments in the biotechnology sector and shows the company’s confidence in Adaptimmune’s potential. The financial ramifications of this investment are yet to be seen, but Adaptimmune’s stock performance this week indicates that the market is watching closely. Live Quote…

Analysis

At GoodWhale, we have conducted an analysis of ADAPTIMMUNE THERAPEUTICS’s financial well-being. Using our Star Chart, we have determined that ADAPTIMMUNE THERAPEUTICS is strong in assets and growth, but weak in dividend and profitability. As a result, ADAPTIMMUNE THERAPEUTICS is classified as a ‘cheetah’ type of company, which are companies that have achieved high revenue or earnings growth, but are considered less stable due to lower profitability. This type of company may be of interest to some investors who are looking to invest in high-growth companies. However, it is important to note that ADAPTIMMUNE THERAPEUTICS has an intermediate health score of 4/10 with regard to its cashflows and debt. This suggests that the company might be able to sustain future operations in times of crisis, but it would be wise for potential investors to take the company’s weaker profitability and dividend into consideration before making their investment decision. More…

Summary

With a focus on engineered T-cell therapy, Adaptimmune has multiple ongoing clinical trials to study therapies that may have efficacy in treating solid tumors and hematological malignancies. The company has a strong research and manufacturing capability and actively works with leading academic institutions and global pharmaceutical companies to develop its potential treatments. Investment analysts view Adaptimmune as a strong candidate for a takeover in the future due to its advanced pipeline, and potential success in the development of T-cell therapies.

With multiple ongoing clinical trials, the company’s potential success could lead to long-term revenue growth and improved stock value. Barclays PLC’s increased stake is seen as a positive sign for Adaptimmune’s future prospects.

Trending News ☀️

KDDI Corporation, one of Japan’s largest telecommunications service providers, and Samsung Electronics have recently partnered to launch 5G Open vRAN sites in Japan. This marks the start of the commercial deployment of next-generation 5G telecommunication networks in the country. These 5G Open vRAN sites, or virtualized radio access networks, will enable the faster transmission of data through the use of virtualization technology and open source software, allowing for the delivery of services such as high-speed mobile internet, video streaming, and cloud gaming. Moreover, these sites will also offer improved network performance and efficiency. This joint venture between KDDI and Samsung Electronics is a significant milestone in the deployment of 5G networks in Japan. Through this collaboration, the two companies are aiming to build an extensive 5G infrastructure that can meet the increasingly growing demands for faster data transmission and higher bandwidth requirements.

Furthermore, the two companies stated that they are also researching new ways to improve mobile network coverage and advanced technologies for mobile communication networks. This will not only help to increase the reliability of their services but also provide users with a more secure and efficient network experience. The launch of 5G Open vRAN sites in Japan by KDDI and Samsung Electronics is a major development in the telecom industry. With this initiative, they hope to create a more robust 5G infrastructure to serve their customers in Japan, while also exploring ways to make their mobile communications even more reliable and efficient.

Price History

KDDI CORPORATION, a Japanese telecommunications company, recently announced the launch of 5G Open vRAN sites with Samsung Electronics in Japan. So far, the media sentiment towards this news has been mainly positive. On Friday, the stock for KDDI opened at JP¥3979.0 and closed at JP¥3991.0, a drop of 0.4% from the day before closing price of 4008.0. This indicates the market’s cautious optimism towards the project, which could potentially revolutionize the telecommunications industry in Japan. Live Quote…

Analysis

GoodWhale recently conducted an analysis of KDDI CORPORATION’s wellbeing. According to the Star Chart classification, KDDI is a ‘Cow’ – a term used to define companies with a track record of paying out consistent and sustainable dividends. As such, this kind of company might be attractive to investors looking for sound dividend payouts. KDDI CORPORATION has a high health score of 8/10, indicating its ability to handle cashflows and debt, as well as potential to sustain its operations in times of crisis. The company is also relatively strong in terms of dividend, profitability, but medium in asset and weak in growth. With this information, prospective investors should be able to make a more informed decision when considering KDDI CORPORATION for investment. More…

Summary

KDDI Corporation is a leading telecommunications and ICT services provider in Japan. The company recently partnered with Samsung Electronics to launch five 5G Open vRAN sites in the country, signaling KDDI’s commitment to expanding its 5G infrastructure. This has resulted in positive media sentiment around the company, with investors noting the potential for long-term profitability. Furthermore, KDDI has a reputation for strong financial performance and dividend returns, which have made it an attractive choice for investors.

Additionally, KDDI has a diverse portfolio of services and products ranging from mobile networks to cloud computing that are helping drive further growth. Investors may also benefit from the company’s price-earnings ratio being below the industry average, which suggests a potential for further upside. Overall, investing in KDDI Corporation seems to present a lucrative opportunity for investors looking for long-term growth.

Trending News ☀️

NioCorp Developments, a leading producer of advanced materials for the aerospace and defense sectors, recently announced its acquisition by GX ACQUISITION CORP. II. The move is part of a larger strategy that NioCorp has adopted in recent years to expand its operations into new markets and geographies. The acquisition provides NioCorp with access to new capital and resources, allowing them to further develop and commercialize their products and technologies.

Additionally, it provides them with an increased base of customers as well as access to new markets and geographies. The acquisition is also expected to strengthen NioCorp’s competitive position in the industry by providing them with a global platform, which is expected to enable them to tap into new opportunities. The acquisition marks another major milestone in the growth and development of NioCorp Developments, as they continue to explore ways to expand their operations. With this latest acquisition, they further solidify their position as one of the leading producers of advanced materials in the aerospace and defense sectors.

Price History

On Tuesday, NioCorp Developments announced its acquisition of GX Acquisition Corp. II, a special purpose acquisition corporation (SPAC). The acquisition was made official by the closing of GX Acquisition Corp. II’s trading on the OTCQX marketplace at $10.1, which marks the stock’s opening and closing price of the day. The acquisition will not only help NioCorp expand its capabilities but will also provide abundant resources for innovation and development of its existing product offerings. The purchase of GX Acquisition Corp. II will also give NioCorp access to its extensive network of partners and investors. This access will allow NioCorp to further expand its existing operations and open up new opportunities.

The acquisition is beneficial for NioCorp as it seeks to become a leading technology and innovation company in the global market. As GX Acquisition Corp. II is a blank check company, the acquisition provides NioCorp with the resources to more effectively pursue their growth goals. By gaining access to GX Acquisition Corp. II’s network, NioCorp can now develop more sophisticated products and services to better meet the needs of their customers. NioCorp Developments has made a wise choice by acquiring GX Acquisition Corp. II and they are confident that this acquisition will help accelerate their journey to becoming a leader in the global technological landscape. Live Quote…

Analysis

GoodWhale has conducted an analysis of GX ACQUISITION’s fundamentals, and based on our star chart the company has an intermediate health score of 6/10 with regard to its cashflows and debt, which suggests that it is likely to safely ride out any crisis without the risk of bankruptcy. This is because GX ACQUISITION is classified as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. Investors who are looking for less risky opportunities may be interested in GX ACQUISITION. The company is strong in areas such as Return on Assets and Return on Equity, while it is weaker in areas such as growth and dividends. Despite this, the company is still likely to be of interest to many investors looking for stability. More…

Summary

GX Acquisition Corp. II, a Special Purpose Acquisition Company (SPAC), has been acquired by NioCorp Developments, a mining exploration and development company.

In addition, certain warrants issued by GX Acquisition Corp. II have been converted into warrants to purchase NioCorp common shares. This acquisition will enable greater access to capital in order to finance NioCorp projects, expanding their global reach and increasing the value for shareholders. The combined entity will also benefit from the expertise and abilities of both companies, as well as their existing customer and supplier base. Investors are optimistic about the increased growth prospects afforded by this acquisition.

Trending News ☀️

The month of January saw a significant increase in short positions for Carney Technology Acquisition Corp. II (CTACII). According to data from the U.S. Securities and Exchange Commission, the number of short positions held in CTACII rose significantly over the course of the month. The rise in short positions was likely caused by unfavorable market conditions, as well as broader investor sentiment and lack of confidence in CTACII’s growth prospects.

Additionally, the market has seen an overall trend of investors shifting away from traditional investments such as stocks and towards more speculative alternatives such as cryptocurrencies. Investors have become increasingly cautious when it comes to investing in technology companies due to a number of risk factors. This includes the possibility of rapid changes in the market, heightened competition and potential disruption from new entrants or technologies. These risks could have potentially caused investors to reduce their exposure to CTACII by increasing their short positions. This could suggest that investors are becoming more cautious when it comes to investing in tech companies, which could have a major impact on the total market value of CTACII shares going forward.

Price History

It appears that the news sentiment for Carney Technology Acquisition Corp. II has been largely positive until now. On Tuesday, the company’s stock opened at $10.2 and closed at the same price. This was reported as a notable increase in short positions for the company, suggesting that there may be some negative sentiment amongst investors in recent weeks. It will be interesting to see how this changes in the coming days and what effect it may have on the stock’s value. Live Quote…

Analysis

GoodWhale has conducted an analysis of CARNEY TECHNOLOGY ACQUISITION’s financials, and based on our Star Chart, the company has been given an intermediate health score of 6/10 with regard to its cashflows and debt. This means that the company may be able to sustain future operations in times of crisis. CARNEY TECHNOLOGY ACQUISITION is classified as a ‘cheetah’, meaning it has achieved high revenue or earnings growth but is considered less stable due to its lower profitability. This type of company often attracts investors who are more high-risk, as they have the potential to make high returns, but also come with a greater risk. Looking into the specifics of CARNEY TECHNOLOGY ACQUISITION’s financial performance, we can see that it is strong in liquidity, medium in growth and weak in asset coverage, dividend yield, and profitability. Investors who are looking for higher returns in the long term may consider investing in this company, as well as those who are comfortable with taking on the associated risks. More…

Summary

The news sentiment surrounding this investment has remained mostly positive, with potentially positive results in the future. Analysts have noted the company’s recent acquisitions, pointing to a business model that supports long-term growth and continued success. Other positive aspects highlighted include an experienced management team, strong financials, and attractive valuation metrics. Investors are looking for potential returns from Carney Technology Acquisition Corp. II, making it an attractive investment opportunity.

Trending News ☀️

BlackRock, the world’s largest asset manager, has added to the competition in the surging metaverse ETF space with the introduction of its iShares Future Metaverse Tech and Communications ETF. This ETF provides investors access to companies providing the hardware and software that power the metaverse – a virtual world that allows users to explore augmented and virtual reality, gaming, 3D software and social media platforms. With this ETF, investors are able to gain exposure to a range of high-growth tech companies that are powering the metaverse and are positioned to benefit from its continued expansion. The launch of the iShares Future Metaverse Tech and Communications ETF adds BlackRock to the roster of roundhill investments and ProShares in the ETF market, further solidifying BlackRock as a major player in this rapidly growing field.

This ETF offers investors an opportunity to diversify their portfolios by investing in a broad range of tech companies involved in the metaverse, and provides them access to potential long-term growth opportunities. This ETF is an ideal option for investors looking to benefit from the growth of the metaverse and capitalize on its future potential.

Stock Price

BlackRock has joined Facebook in the race to create the first ETF in the metaverse by launching the iShares Future Metaverse Tech and Communication ETF. Furthermore, Facebook stock opened at $174.3 and closed at $172.1, down by 0.5% from its prior closing price of 172.9. This suggests that the venture is being cautiously received by investors, who are likely waiting for more information about its success before committing to a longer-term investment. Live Quote…

Analysis

As GoodWhale, we recently carried out an analysis of Facebook’s fundamentals. We found that according to our Risk Rating criteria, Facebook is a low risk investment in terms of financial and business aspects. This doesn’t mean there are no potential risks involved, however. We have detected 1 risk warning in the balance sheet, and we urge those interested to register on goodwhale.com to check it out. We believe that our users should always be aware of all potential risks when it comes to investments, and we strive to provide them with the resources to do so. More…

Summary

Investors looking to capitalize on the opportunities offered by the expanding technological capabilities of the “metaverse” have new options available, as BlackRock recently launched the iShares Future Metaverse Tech and Communication ETF. This fund provides exposure to the emerging intersection of virtual and physical worlds, including gaming and cloud computing, as driven by companies such as Facebook. The fund offers potential for diversified exposure to a portfolio of established, leading companies in these spaces. So far investor sentiment from the ETF launch has been positive, with the fund having an outlook for future growth and potential returns.

Trending News ☀️

On Tuesday, Palantir Technologies saw its stock price plunge more than 8% following William Blair’s suggestion to investors to “curb their enthusiasm” due to upcoming contract renewals. Analyst Louie DiPalma highlighted the fact that six contracts, three of which being Palantir’s four largest, will be up for renewal in the next fifteen months. He also noted that the company is facing “legitimate competition” from an increasing number of open-sourced solutions.

These solutions are viewed by many agencies as a more economical and temporary option until a more permanent open-sourced data analytics system is developed. DiPalma has given Palantir an underperform rating based on the risk associated with these contract renewals and the emergence of open-source solutions.

Price History

Tuesday was a difficult day for investors of PALANTIR TECHNOLOGIES; their stock opened at $9.0 and closed at $8.5, resulting in a 7.9% drop from the previous day’s closing price of $9.2. This plunge came as six major contract renewals loomed, and the threat of open-sourced solutions became more visible. Despite the negative stock performance, media exposure of the company remains largely positive. While PALANTIR TECHNOLOGIES may have experienced a dip in their stock value this week, investors should remain optimistic for the future.

The looming contract renewals, combined with the threat of open-sourced solutions, are sure to keep investors on their toes as they monitor the progress of the company. Despite the short-term losses, PALANTIR TECHNOLOGIES may still be a viable investment option for those looking to diversify their portfolio. Live Quote…

Analysis

At GoodWhale, we recently performed an in-depth analysis of PALANTIR TECHNOLOGIES’ wellbeing. After consideration of various elements, such as balance sheet, cashflow statement, non-financial risks and more, we have come to the conclusion that PALANTIR TECHNOLOGIES is a medium risk investment. To be more specific, we have detected three risk warnings in the balance sheet, cashflow statement and non-financial areas. Our analysis has revealed that while the investment has opportunities, it also has potential risks that should be taken into account when considering this investment. If you’re interested in finding out what our analysis revealed about PALANTIR TECHNOLOGIES, please visit goodwhale.com for more detailed information. By signing up with us you can gain access to our full report. By understanding the risks and rewards associated with PALANTIR TECHNOLOGIES, you can make an informed decision when deciding whether to invest. More…

Summary

Palantir Technologies, a data analytics company, saw its share price decline 8% on news of six upcoming major contract renewals and the potential threat of open-source solutions. Despite generally positive media coverage, investors reacted negatively to the headlines and the stock experienced a sell-off. Investors may want to look closer at the details behind these contract numbers as well as the potential competition posed by open-sourced solutions before making a decision on how to move forward in this stock. Analyzing the financials, risks, and valuations of Palantir Technologies are essential steps before investing.

Trending News ☀️

This ‘lucky’ financing was instrumental in helping Amazon to stay afloat during a period of economic turmoil that caused many other businesses to fail.

However, this raises questions about the sustainability of Amazon’s success since there are no guarantees that it can receive similar amounts of funding should the market take a downturn again. It is well-known that Amazon has a strong brand and versatile offering, but without the right financial back-up it could easily be vulnerable to market conditions. This is especially true given the current precarious economic climate due to the ongoing pandemic. The company’s management must take steps to ensure that they have adequate levels of financial resources should another major disruption take place. The prolonged period of success that Amazon has enjoyed could come to an end if it does not secure sufficient funds for such an eventuality. In conclusion, Amazon has been fortunate to receive significant financing in the past, but this should not be seen as a guarantee of continued success for the business. It is important for the company to have a sound strategy for securing finances in order to remain resilient against future market upheavals. Only then can Amazon expect to maintain its status as an industry leader for years to come.

Market Price

A recent article on Amazon.com has raised questions about their resilience after it was reported that the company incurred “lucky” financing before the dot-com crash. News coverage of the company has been mostly negative in recent days, leading many to question their ability to weather the current market conditions. On Tuesday, Amazon.com stock opened at $95.3 but quickly fell by 2.7% to $94.6, closing at a lower price than its previous closing price of 97.2. While there is still support among investors for the company, it is yet to be seen how well Amazon.com will be able to withstand these volatility and uncertainty. Live Quote…

Analysis

At GoodWhale, we recently conducted an analysis of AMAZON.COM’s fundamentals. We found that when it comes to risk rating, AMAZON.COM is a low risk investment, both financially and business-wise. We did detect one particular risk warning in the income sheet, so to get more details, we recommend you become a registered user on our platform. Once you’ve signed up, you’ll get access to all the reports, data, and analytics related to this investment, so you can make the best decision for your investments. More…

Summary

Amazon.com experienced a financial boom prior to the dot-com crash which has raised questions about its ability to weather future market downturns. Investors have been closely analyzing the company’s financial condition, noting its low liquidity relative to other tech companies and a high debt-to-equity ratio that could make it vulnerable to market volatility. Amazon has also been facing increased competition from established retailers and e-commerce platforms, adding pressure to its balance sheet. Despite these challenges, Amazon is continuing to invest in new technologies and capabilities, offering investors a chance to speculate on its long-term fortunes.

Trending News ☀️

The acquisition of Sigma Lithium by Tesla is a major move on the part of the electric vehicle giant and experts are assessing the possible implications of such a move. Bank of America has estimated that the deal would provide Tesla enough lithium to produce up to 1.5 million electric vehicles on an annual basis. This is an impressive number when considering the number of electric vehicles Tesla has already managed to put out in recent years and it could further contribute to their already impressive catalogue. This move by Tesla is set to expand their market share by a significant margin and analysts are eager to learn how the acquisition of Sigma Lithium is going to influence the electric vehicle market. As one of the leading players in the industry, Tesla could capitalize on the potential growth this acquisition offers and expand their dominance in the industry even further.

Additionally, experts are also evaluating the long-term sustainability of this move. By gaining access to the lithium via Sigma Lithium, Tesla is seeking to secure an uninterrupted supply for their EV production and make sure their vehicles remain competitive in the market. This could be a crucial step for Tesla as they attempt to remain market leaders in the industry. Ultimately, the potential acquisition of Sigma Lithium by Tesla is a major story that experts are keeping a close eye on. With access to enough lithium for the production of up to 1.5 million electric vehicles per year, Tesla could make a significant impact on the industry if this deal goes through.

Share Price

Tesla has made a major move in the lithium market with its acquisition of Sigma Lithium, but analysts are currently evaluating the potential implications. News coverage of the acquisition has been mixed, but investors seem to be uncertain: on Tuesday, TESLA stock opened at $205.0 and closed at $197.4, a 5.3% drop from its last closing price of 208.3. Whether this move by Tesla will ultimately be beneficial for the company and its investors is still up in the air. Live Quote…

Analysis

At GoodWhale, we have conducted a detailed analysis of TESLA’s financials. After applying our proprietary Valuation Line, we have calculated the fair value of TESLA to be around $327.5. Currently, TESLA’s stock price is trading at $197.4, which is a 39.7% discount to its fair value. We believe that this presents an attractive opportunity for investors to capitalize on the current undervaluation of TESLA shares. More…

Summary

Investment analysts are closely watching Tesla’s recent acquisition of Sigma Lithium, as the move is seen as a potential major breakthrough in the lithium industry. Although news coverage of the acquisition has been mixed, Tesla’s stock price plummeted the same day. Analysts say the acquisition could give the electric car giant access to lithium resources and a competitive edge in the growing battery-powered vehicle market.

They emphasize that Tesla’s success in this endeavor could have major implications for the global auto industry, and ultimately, its investors. As such, a careful evaluation of the associated risks and potential rewards of investing in Tesla is advised.

Trending News ☀️

Unity Software’s fourth quarter financial results will be released on Wednesday, February 22nd after the stock market closes. Analysts predict that the quarter will be successful, with the company reporting an expected earnings per share (EPS) of $0.01 and total revenue of $438.5 million. These results demonstrate year-over-year growth for the company, and could make for a positive outlook heading into the next financial quarter. The company has reported success in the past few quarters, with an increasing revenue stream and renewed focus on customer satisfaction. These efforts have allowed them to maintain momentum, while also exploring new markets and expanding their product offerings.

Unity Software has seen an increase in customer engagement as well, with a growing presence in the gaming, e-commerce, and media industries. As they move into the next quarter, investors will be watching closely to see if Unity Software can maintain the momentum it has experienced in the last several quarters. Their Q4 results are a key indicator of the company’s ability to grow and remain competitive in the ever-evolving technology industry. With a predicted EPS of $0.01 and a projected revenue of $438.5 million, investors are hopeful that the upcoming quarter will be just as successful.

Stock Price

The news of UNITY SOFTWARE’s fourth quarter 2023 earnings report on February 22nd has been largely positive so far. On Tuesday, the UNITY SOFTWARE stock opened at $38.9 and closed at $36.5, which is a drop of 8.0% from the prior closing price of $39.7. Analysts are expecting the company to report earnings per share (EPS) of $0.01 and revenue of $438 for the quarter. However, investors will have to wait until February 22nd to find out if the company’s performance is truly above expectations. Live Quote…

Analysis

As part of our analysis of UNITY SOFTWARE, we have conducted an in-depth evaluation of the company’s financial and business wellbeing. Our Risk Rating has determined that UNITY SOFTWARE is a high risk investment. We have identified three risk warnings in the cashflow statement, nonfinancial journal, and financial journal that investors should be aware of. These include the company’s high debt-to-assets ratio, its failure to meet analyst expectations, and its slow revenue growth. To further understand the risks associated with investing in UNITY SOFTWARE, we invite investors to register with us so they can access our comprehensive analysis. Our team is available to provide further advice and guidance on the best course of action. More…

Summary

Investors may want to pay close attention to Unity Software as the company is due to release its fourth quarter 2023 financial results on February 22nd. Analysts expect the company to report an earnings per share (EPS) of $0.01, on revenue of $438. Despite mostly positive press coverage in the lead up to the report, the stock price moved down on the same day.

It is important for investors to consider this event as a potential buying opportunity when evaluating Unity Software. Furthermore, investors should consider any changes in their positions or outlooks on the company before, during, and after the release of the fourth quarter results.

Trending News ☀️

The stock of CrowdStrike Holdings has dropped significantly from its all-time peak, giving investors an entry point into the booming endpoint security market. This market has been experiencing rapid growth due to certain key trends, such as the increasing use of cloud-based solutions. According to Gartner’s prediction, 95% of all endpoint security solutions will be cloud-based by 2023, which puts CrowdStrike’s Falcon offering in a particularly advantageous position. These include Sentinel One, Windows Defender, and Cylance. Each of these solutions offers its own unique advantages, but CrowdStrike’s cloud-based approach gives it a significant edge in the space.

The company has used this money to expand its operations and further develop its technology, allowing it to compete more effectively in the market. Furthermore, its strong leadership team and experienced cybersecurity staff have positioned the company for long-term success. The company is well-positioned to take full advantage of the rapid expansion of the endpoint security sector, making it a prime candidate for long-term profits for investors.

Price History

The media coverage for CrowdStrike Holdings seems to be predominantly negative, as the stock experienced a sharp decline on Tuesday. The stock opened at $112.0 and ended the day at $112.4, representing a drop of 1.6% from its prior closing price of $114.2. This may present an opportunity for investors to get into the booming endpoint security market as the stock is trading near its recent all-time low. Live Quote…

Analysis

At GoodWhale, we conducted an analysis of CROWDSTRIKE HOLDINGS‘s wellbeing. Based on our Star Chart, CROWDSTRIKE HOLDINGS has an intermediate health score of 6/10 considering its cashflows and debt, indicating that the company is likely to safely ride out any crisis without the risk of bankruptcy. CROWDSTRIKE HOLDINGS is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. As a result, investors who are interested in capitalizing on short-term swings in the market and looking for high-growth companies may be interested in investing in CROWDSTRIKE HOLDINGS. Additionally, the company is strong in growth, medium in asset and weak in dividend, profitability. Therefore, investors who prioritize long-term stability and sustainability might be wise to look elsewhere. More…

Peers

It is no secret that the competition between CrowdStrike Holdings Inc and its competitors is fierce. Zscaler Inc, SentinelOne Inc, Palo Alto Networks Inc are all battling it out for market share in the cybersecurity industry. While each company has its own unique strengths and weaknesses, CrowdStrike seems to be gaining ground on its competitors.

– Zscaler Inc ($NASDAQ:ZS)

Zscaler Inc is a publicly traded American internet security company headquartered in San Jose, California. Zscaler provides cloud security, network security, and cybersecurity services for enterprises, government organizations, and service providers around the world. The company was founded in 2007 by Jay Chaudhry and K.K. Mookhey.

Zscaler has a market cap of $19.36 billion as of 2022 and a return on equity of -37.32%. The company provides internet security services for enterprises, government organizations, and service providers around the world.

– SentinelOne Inc ($NYSE:S)

SentinelOne is a cyber security company that specializes in endpoint security. The company was founded in 2013 and is headquartered in Mountain View, California. As of 2022, SentinelOne has a market cap of $5.82B and a return on equity of -12.5%. The company’s primary product is a security platform that uses machine learning and artificial intelligence to protect endpoint devices from malware and other threats.

– Palo Alto Networks Inc ($NASDAQ:PANW)

Palo Alto Networks is a publicly traded cybersecurity company with a market capitalization of $47.44 billion as of April 2021. The company’s return on equity (ROE) for 2020 was -42.69%. Palo Alto Networks provides a platform for secure network connectivity and security and operates in three segments: Enterprise Security, Network Security, and Cloud Security. The company was founded in 2005 and is headquartered in Santa Clara, California.

Summary

Investing in CrowdStrike Holdings can be a high-risk, high-reward opportunity. Its stock has recently dropped significantly, providing potential investors with an attractive entry point. Analysts predict that this technology sector will experience sustained growth over the coming years, and CrowdStrike may emerge as one of its biggest success stories. For investors willing to take the risk, now may be an ideal time to get in on the action.

Recent Posts