Avidxchange Holdings Stock Fair Value Calculation – AvidXchange Holdings Outperforms Expectations with GAAP EPS and Revenue

May 4, 2023

Trending News 🌥️

AVIDXCHANGE ($NASDAQ:AVDX): AvidXchange Holdings, a provider of cloud-based business payment automation solutions, recently reported a GAAP EPS of -$0.08, surpassing the expected amount by $0.02.

Additionally, its revenue of $86.8M exceeded the estimated value by $4.04M. The company’s success is a testament to its innovative approach to business payment automation, which has allowed it to become one of the leading providers in the industry. The company’s cloud-based solutions allow businesses to automate their entire payment process from end-to-end, eliminating manual processes and reducing costs. AvidXchange also offers fraud-detection tools and advanced reporting capabilities that help customers better understand their spending patterns and be more informed when making payment decisions. Furthermore, its software is highly configurable, allowing customers to customize it to fit their organizational needs. AvidXchange Holdings has demonstrated its success in meeting the expectations of customers and investors alike. As the company continues to expand its presence in the market, it will become an increasingly attractive option for those looking for a reliable provider of cloud-based business payment automation solutions.

Earnings

AVIDXCHANGE HOLDINGS recently released its earnings report for FY2022 Q4 ending December 31 2022, which showed impressive results. The company earned 86.18M USD in total revenue, 24.4% more than the previous year, and posted a net income loss of 25.03M USD. This represents a significant improvement compared to the previous 3 years, in which total revenue increased from 52.86M USD to the current level of 86.18M USD. The company’s performance has exceeded expectations and is an encouraging sign of future success.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Avidxchange Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 316.35 | -101.28 | -32.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Avidxchange Holdings. More…

| Operations | Investing | Financing |

| -28.7 | -140.35 | -1.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Avidxchange Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.21k | 1.55k | 3.3 |

Key Ratios Snapshot

Some of the financial key ratios for Avidxchange Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.4% | – | -25.4% |

| FCF Margin | ROE | ROA |

| -17.9% | -7.5% | -2.3% |

Market Price

On Wednesday, AVIDXCHANGE HOLDINGS stock opened at $7.3 and closed at $7.7, representing a 9.0% increase from its previous closing price of $7.1. This significant increase reflects the company’s recent success in exceeding expectations for both its GAAP earnings per share and total revenue. AVIDXCHANGE HOLDINGS is continuing to expand its reach and capitalize on the increasing demand for its payment automation solutions and services. Investors are clearly pleased with the company’s performance, as evidenced by the strong close on Wednesday and overall positive outlook for the future. Live Quote…

Analysis – Avidxchange Holdings Stock Fair Value Calculation

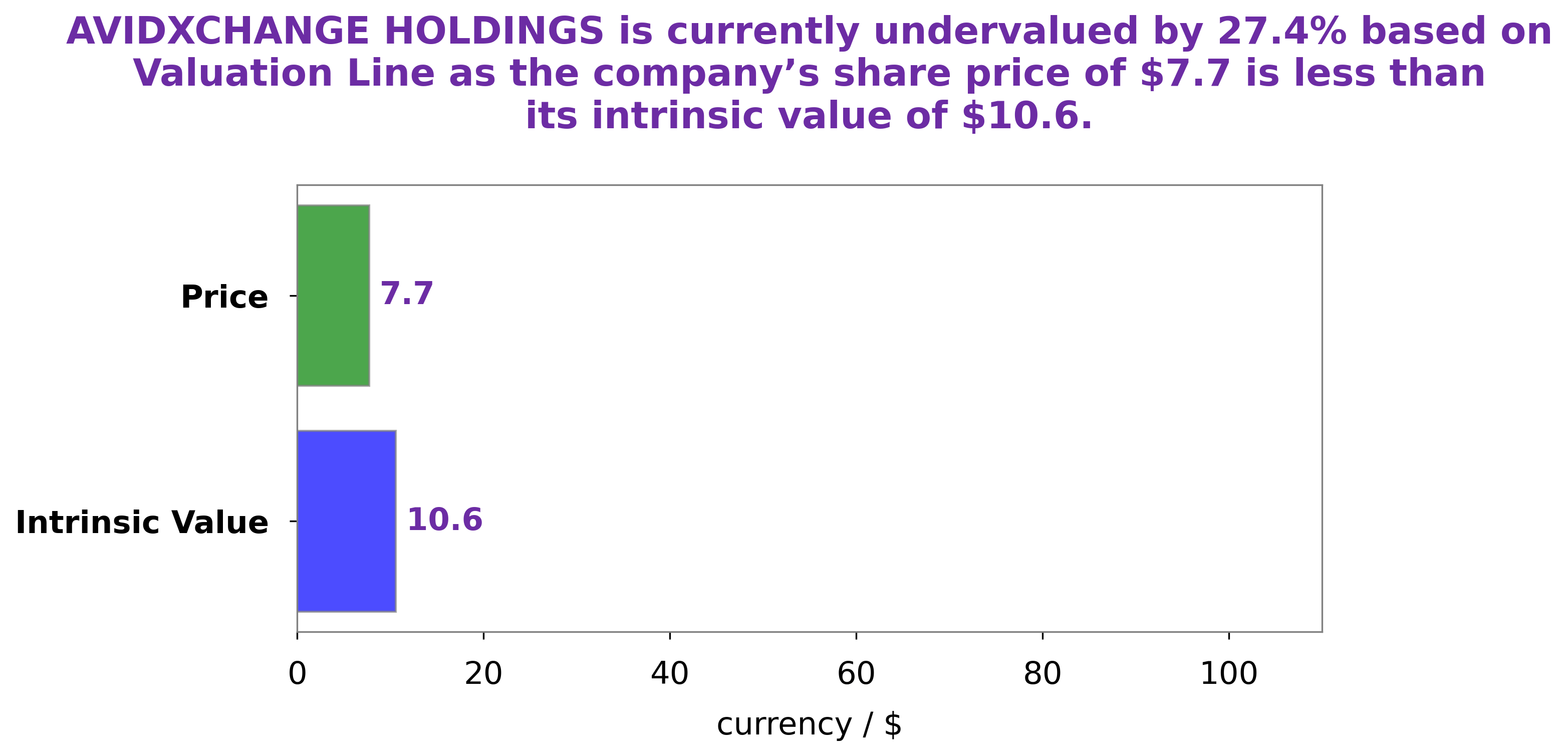

At GoodWhale, we have conducted an analysis of AVIDXCHANGE HOLDINGS fundamentals. Through our proprietary Valuation Line, we have determined the fair value of an AVIDXCHANGE HOLDINGS share to be around $10.6. Currently, the stock is traded at $7.7, undervalued by 27.5%. This presents an opportunity for investors looking to take advantage of the potential upside. More…

Peers

The company was founded in 2000 and is headquartered in Charlotte, North Carolina. AvidXchange has over 700 employees and serves over 6,000 customers in North America. AvidXchange’s main competitors are i3 Verticals Inc, GreenBox POS, and Avalara Inc. These companies are all similar to AvidXchange in that they provide software solutions for businesses.

However, each company has its own unique offerings that set it apart from the others.

– i3 Verticals Inc ($NASDAQ:IIIV)

Verticals Inc is a publicly traded company with a market capitalization of 506.04 million as of 2022. The company has a return on equity of -2.68%. Verticals Inc is a provider of cloud-based software and services for businesses. The company’s software and services enable businesses to manage their operations, customers, and employees.

Summary

AvidXchange Holdings recently reported its second quarter GAAP EPS of -$0.08, which beat analyst’s expectations by $0.02. Revenue for the same period amounted to $86.8M, which is a 4.04M dollar increase from the analysts’ prediction. As a result, the stock price of AvidXchange Holdings moved up the same day.

This is an indication that investors are confident in the company’s financial performance and prospects. Analysts suggest that this is a positive sign for the company and its future prospects, and those interested in investing in the company should consider taking advantage of the current price level.

Recent Posts