Adobe to Pay $3 Million to Settle DOJ Kickback Allegations

April 14, 2023

Trending News 🌧️

Adobe Inc ($NASDAQ:ADBE)., a multinational software company based in San Jose, California, is currently facing justice after agreeing to a $3 million settlement with the Department of Justice (DOJ). This settlement is in relation to allegations of kickbacks to a middle-man company, which was owned by former Adobe employees. The DOJ alleges that these kickbacks were used to influence the sale of Adobe products and services. Adobe is a leading provider of digital media and marketing solutions, offering products and services such as Adobe Creative Cloud, Adobe Document Cloud, and Adobe Experience Cloud. Adobe has worked hard to maintain a good reputation and had not been previously accused of any wrongdoing. The company’s board of directors has taken action to ensure that similar situations do not arise again in the future. They have implemented new internal controls, policies and procedures in order to prevent similar kickback schemes from occurring. The company’s current predicament will undoubtedly take its toll on their reputation.

However, by taking responsibility for their actions and committing to preventing further similar occurrences, Adobe Inc. will be able to restore the trust of its customers and remain a leader in the digital media and marketing industry.

Share Price

On Thursday, ADOBE INC stock opened at $373.2 and closed at $378.8, up by 2.4% from last closing price of 369.9. This was in light of the company agreeing to pay a $3 million settlement to the Department of Justice (DOJ). The settlement resolves allegations that ADOBE INC violated the False Claims Act by engaging in a kickback scheme with two of its resellers. ADOBE INC was accused of providing discounts to resellers contingent upon their agreement to buy the company’s products and services. This is a violation of Federal Anti-Kickback Statute and False Claims Act, which prohibits any form of kickback, bribe or rebate for influencing or rewarding referrals for federal health care program business.

Additionally, ADOBE INC must also enter into a corporate integrity agreement with the Inspector General of the United States Department of Health and Human Services. The agreement will ensure that all future sales and marketing practices comply with Federal health care program requirements. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adobe Inc. More…

| Total Revenues | Net Income | Net Margin |

| 18k | 4.74k | 26.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adobe Inc. More…

| Operations | Investing | Financing |

| 7.76k | -154 | -6.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adobe Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 26.67k | 12.46k | 30.98 |

Key Ratios Snapshot

Some of the financial key ratios for Adobe Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.6% | 20.3% | 34.3% |

| FCF Margin | ROE | ROA |

| 40.7% | 27.3% | 14.5% |

Analysis

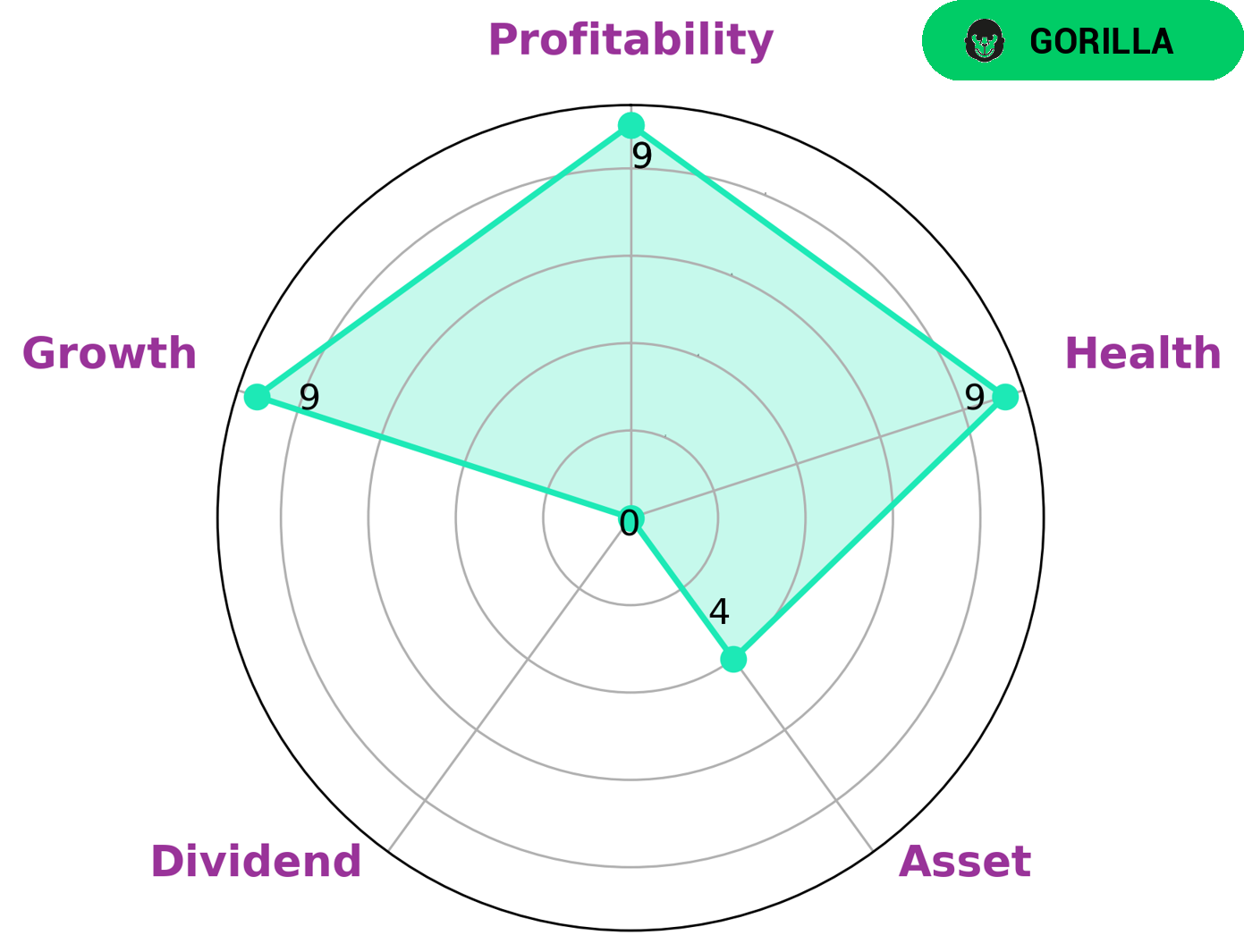

GoodWhale’s analysis of Adobe Inc.’s financials shows that the company is doing very well, with a high health score of 9/10 with regard to its cashflows and debt. This indicates that Adobe Inc. is capable of paying off its debts and funding future operations. GoodWhale has also determined that Adobe Inc. is strong in growth, profitability, and medium in assets; however, it is weak in dividend. This has led us to classify Adobe Inc. as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Such a strong financial performance will be attractive to investors looking for quality stocks to invest in. These investors may include value investors who are looking for long-term gains, income investors who are looking for dividend paying stocks, or growth investors who are looking for stable and increasing earnings growth. More…

Peers

Adobe Inc is a leading software company that offers a range of products, including Creative Cloud, Photoshop, and Acrobat. Its main competitors are Crowd Media Holdings Ltd, Creative Realities Inc, and PT Solusi Sinergi Digital Tbk.

– Crowd Media Holdings Ltd ($ASX:CM8)

Crowd Media Holdings Ltd is a social media and technology company. The company has a market cap of 15.12M as of 2022 and a Return on Equity of -36.63%. The company enables brands and celebrities to connect with their fans and followers through social media. The company also provides technology solutions for social media marketing and management.

– Creative Realities Inc ($NASDAQ:CREX)

Creative Realities, Inc. is a digital customer engagement company that designs, develops, and sells customer engagement solutions in the retail, hospitality, and museums and exhibitions markets worldwide. The company offers a portfolio of customer engagement solutions, including AReality, a cloud-based content management system that provides users with the ability to create, manage, and deliver content to AR/VR devices; and InReality, an AR/VR platform that enables users to create, manage, and deliver AR/VR experiences. It also provides turnkey systems integration services. The company was formerly known as Creative Realities, LLC and changed its name to Creative Realities, Inc. in July 2015. Creative Realities, Inc. was founded in 2010 and is headquartered in New York, New York.

Creative Realities Inc has a market cap of 12.84M as of 2022 and a Return on Equity of 9.18%. The company offers a portfolio of customer engagement solutions, including AReality, a cloud-based content management system that provides users with the ability to create, manage, and deliver content to AR/VR devices; and InReality, an AR/VR platform that enables users to create, manage, and deliver AR/VR experiences. It also provides turnkey systems integration services.

– PT Solusi Sinergi Digital Tbk ($IDX:WIFI)

In 2022, PT Solusi Sinergi Digital Tbk had a market capitalization of 410.06 billion Indonesian rupiah and a return on equity of 23.38%. The company provides digital printing, document management, and other related services in Indonesia.

Summary

Adobe Inc. (ADBE) is a leading software company having a broad portfolio of products in the digital media and digital marketing industry. The settlement does not include any admission of wrongdoing.

Investing in ADBE offers an opportunity for potential investors to gain exposure to a market leader in the creative and digital marketing space. With a continually expanding product range and a strong customer base, Adobe remains a leader in the sector and stands to benefit from the continued growth in online advertising and consumer demand for digital content.

Recent Posts