Adobe Stock Soars as Sensei GenAI Generative AI Service is Introduced

June 12, 2023

🌥️Trending News

Adobe Inc ($NASDAQ:ADBE). is a leading software company, renowned for its graphic design, video editing, web development, and cloud-based solutions. Recently, the company’s stock has been performing exceptionally well following the launch of their artificial intelligence platform, Sensei GenAI. The service is based on generative AI technology, allowing for more accurate and efficient image editing and content creation. Sensei GenAI can automatically generate and edit high-quality visuals with minimal effort, as well as optimize existing images in both creative and digital marketing. It also provides real-time responses to user requests and can be used for tasks such as selection and masking of images, color adjustments, and more.

The platform has been praised by users for its ease-of-use and powerful features, further driving up the value of Adobe Inc.’s stock. With the introduction of Sensei GenAI, Adobe Inc. has established itself as a leader in AI-driven content creation solutions. The platform has seen tremendous success and is expected to continue driving up Adobe’s stock value in the coming months.

Market Price

On Thursday, ADOBE INC stock soared to new heights as they introduced their new artificial intelligence service, Sensei GenAI Generative AI. The stock opened at $424.2 and closed at $439.0, reflecting an impressive 5.0% jump from the previous closing price of 418.3. This news has sent positive signals to the market as investors are anticipating great things to come from the company’s AI service. Sensei GenAI Generative AI is expected to revolutionize the creative industries by providing personalized services and content experiences to customers.

It can also help tailor videos, images and other media, based on individual preferences. With the introduction of this new service, Adobe is sure to continue its trajectory of success and innovation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adobe Inc. More…

| Total Revenues | Net Income | Net Margin |

| 18k | 4.74k | 26.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adobe Inc. More…

| Operations | Investing | Financing |

| 7.76k | -154 | -6.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adobe Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 26.67k | 12.46k | 30.98 |

Key Ratios Snapshot

Some of the financial key ratios for Adobe Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.6% | 20.3% | 34.3% |

| FCF Margin | ROE | ROA |

| 40.7% | 27.3% | 14.5% |

Analysis

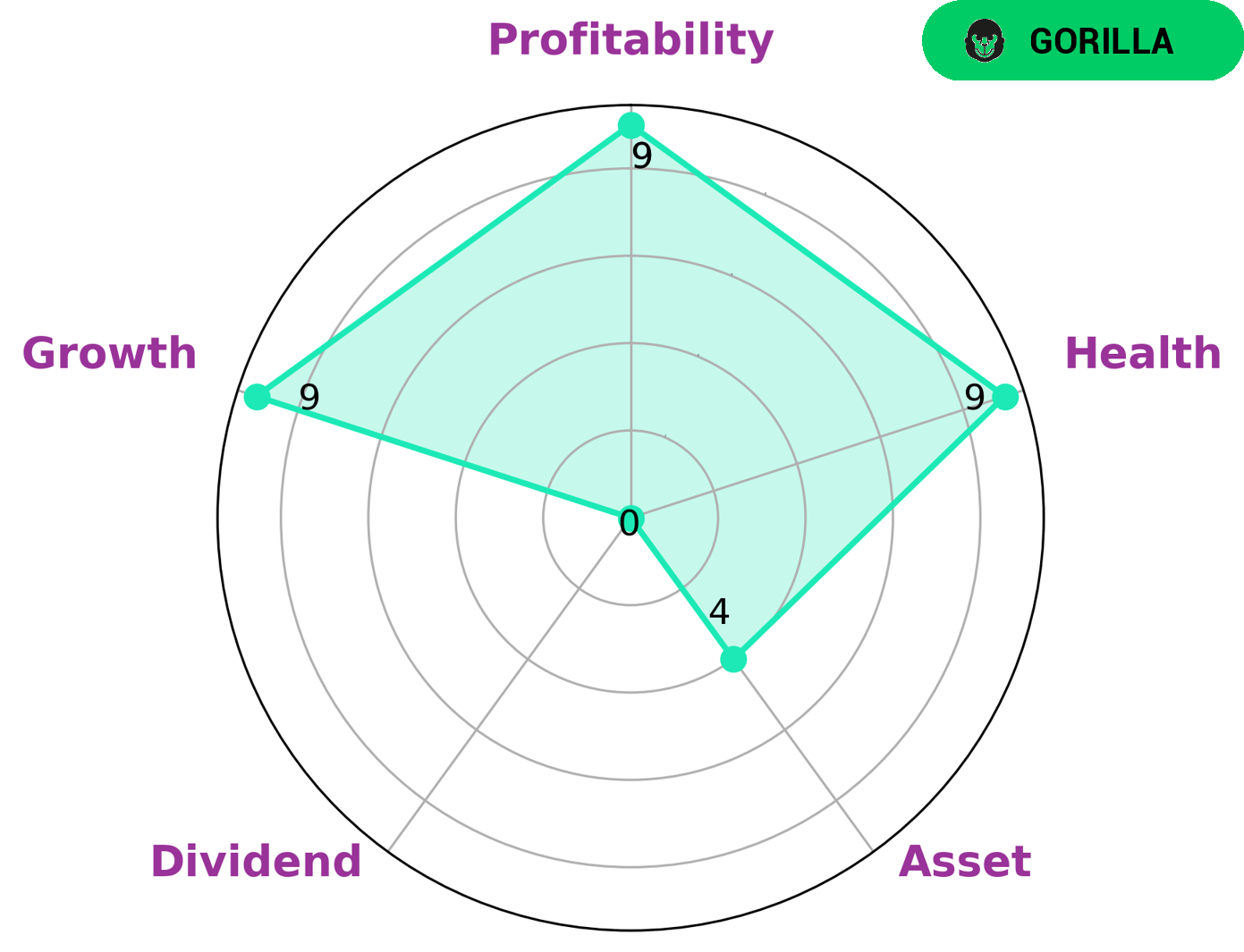

GoodWhale recently conducted an analysis of ADOBE INC‘s wellbeing. According to our Star Chart, ADOBE INC is classified as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. This means that ADOBE INC presents an attractive opportunity for investors looking for a reliable and profitable investment. As part of our wellbeing analysis, GoodWhale gave ADOBE INC a high health score of 9/10. This indicates that ADOBE INC is in a strong financial position, with healthy cashflows and low debt levels. In addition, the company is capable of both paying off its debt and funding future operations. GoodWhale’s analysis also found that ADOBE INC is strong in terms of growth and profitability, but is comparatively weaker in terms of dividends. For investors looking for a reliable and profitable investment, ADOBE INC presents an attractive opportunity considering its high health score and impressive growth and profitability metrics. More…

Peers

Adobe Inc is a leading software company that offers a range of products, including Creative Cloud, Photoshop, and Acrobat. Its main competitors are Crowd Media Holdings Ltd, Creative Realities Inc, and PT Solusi Sinergi Digital Tbk.

– Crowd Media Holdings Ltd ($ASX:CM8)

Crowd Media Holdings Ltd is a social media and technology company. The company has a market cap of 15.12M as of 2022 and a Return on Equity of -36.63%. The company enables brands and celebrities to connect with their fans and followers through social media. The company also provides technology solutions for social media marketing and management.

– Creative Realities Inc ($NASDAQ:CREX)

Creative Realities, Inc. is a digital customer engagement company that designs, develops, and sells customer engagement solutions in the retail, hospitality, and museums and exhibitions markets worldwide. The company offers a portfolio of customer engagement solutions, including AReality, a cloud-based content management system that provides users with the ability to create, manage, and deliver content to AR/VR devices; and InReality, an AR/VR platform that enables users to create, manage, and deliver AR/VR experiences. It also provides turnkey systems integration services. The company was formerly known as Creative Realities, LLC and changed its name to Creative Realities, Inc. in July 2015. Creative Realities, Inc. was founded in 2010 and is headquartered in New York, New York.

Creative Realities Inc has a market cap of 12.84M as of 2022 and a Return on Equity of 9.18%. The company offers a portfolio of customer engagement solutions, including AReality, a cloud-based content management system that provides users with the ability to create, manage, and deliver content to AR/VR devices; and InReality, an AR/VR platform that enables users to create, manage, and deliver AR/VR experiences. It also provides turnkey systems integration services.

– PT Solusi Sinergi Digital Tbk ($IDX:WIFI)

In 2022, PT Solusi Sinergi Digital Tbk had a market capitalization of 410.06 billion Indonesian rupiah and a return on equity of 23.38%. The company provides digital printing, document management, and other related services in Indonesia.

Summary

Adobe Inc. (NASDAQ:ADBE) is a leading software company, and its stock has seen a steady increase in recent months due to strong performance in the technology industry. Adobe’s stock has gained in value due to the company’s focus on digital transformation, which has been driven by its artificial intelligence (AI) and cloud-based services, such as Adobe Sensei. Investors are bullish on Adobe due to the potential for continued growth from these services. Adobe’s financial performance has been strong as well, with revenue increasing year-over-year, and the company reporting strong earnings growth in its last quarter. The company also has a robust portfolio of products and services that are well suited for the changing digital landscape.

Additionally, Adobe has a strong balance sheet, which provides investors with confidence that the company can handle any future challenges. As such, investors should continue to view Adobe as a good investment option.

Recent Posts