Zoom Video Communications Reports Record Q4 2023 Non-GAAP EPS of $1.22, Beating Expectations by $0.40.

February 28, 2023

Trending News 🌧️

ZOOM ($NASDAQ:ZM): Z o o m V i d e o C o m m u n i c a t i o n s r e p o r t e d a r e c o r d f o u r t h q u a r t e r N o n – G A A P e a r n i n g s p e r s h a r e o f $ 1 . T h i s i s a s i g n i f i c a n t a c c o m p l i s h m e n t f o r Z o o m V i d e o C o m m u n i c a t i o n s , a s t h e c o m p a n y h a d f a c e d c h a l l e n g i n g c i r c u m s t a n c e s t h r o u g h o u t t h e y e a r d u e t o t h e c o r o n a v i r u s p a n d e m i c . D e s p i t e t h e s e c h a l l e n g e s , Z o o m w a s a b l e t o n o t o n l y d e l i v e r i m p r e s s i v e f i n a n c i a l r e s u l t s , b u t a l s o c o n t i n u e t o g r o w a n d e x p a n d i t s p r o d u c t s a n d s e r v i c e s . I t s t o t a l c a s h a n d c a s h e q u i v a l e n t s a l s o r o s e t o $ 3 . 3 b i l l i o n , u p f r o m $ 2 b i l l i o n i n t h e p r i o r q u a r t e r . Z o o m ’ s i m p r e s s i v e r e s u l t s w e r e d r i v e n b y i t s d i v e r s e s u i t e o f p r o d u c t s a n d s e r v i c e s w h i c h a l l o w c u s t o m e r s t o c o n n e c t v i a v i d e o , c h a t , w e b c o n f e r e n c e s , a n d a u d i o m e e t i n g s .

I t s u s e r – f r i e n d l y p l a t f o r m h a s e n a b l e d i t t o b e c o m e t h e g o – t o s o l u t i o n f o r i n d i v i d u a l s a n d b u s i n e s s e s l o o k i n g t o c o l l a b o r a t e a n d c o m m u n i c a t e r e m o t e l y . T h e c o m p a n y ’ s p o p u l a r i t y c a n b e a t t r i b u t e d t o i t s e a s e o f u s e a s w e l l a s i t s s c a l a b i l i t y , a s i t i s a b l e t o s u p p o r t l a r g e n u m b e r s o f g r o u p s a n d u s e r s s i m u l t a n e o u s l y . T h e c o m p a n y ’ s i m p r e s s i v e p e r f o r m a n c e w a s d r i v e n b y i t s r o b u s t s u i t e o f p r o d u c t s a n d s e r v i c e s a s w e l l a s i t s d e d i c a t i o n t o i m p r o v i n g t h e u s e r e x p e r i e n c e . A s m o r e b u s i n e s s e s e m b r a c e r e m o t e w o r k i n g , Z o o m i s s e t t o p l a y a n i n c r e a s i n g l y i m p o r t a n t r o l e i n e n a b l i n g c o m m u n i c a t i o n a n d c o l l a b o r a t i o n a c r o s s d i f f e r e n t t y p e s o f o r g a n i z a t i o n s.

Stock Price

Zoom Video Communications, Inc. reported a record-breaking non-GAAP earnings per share (EPS) of $1.22 for the fourth quarter of 2023, beating analysts’ expectations by $0.40, according to a recent article by Yahoo! Finance. The company’s stock price opened at $74.9 on Monday and closed at $73.7, decreasing 0.3% from its opening.

Reactions to the news have primarily been positive with the majority of media outlets applauding the impressive performance. This marks another significant milestone for the company and is expected to attract more investors in the upcoming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ZM. More…

| Total Revenues | Net Income | Net Margin |

| 4.35k | 698.23 | 18.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ZM. More…

| Operations | Investing | Financing |

| 1.29k | -552.61 | -935.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ZM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.84k | 2.08k | 20.13 |

Key Ratios Snapshot

Some of the financial key ratios for ZM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 100.4% | 334.7% | 10.9% |

| FCF Margin | ROE | ROA |

| 27.1% | 5.0% | 3.8% |

Analysis

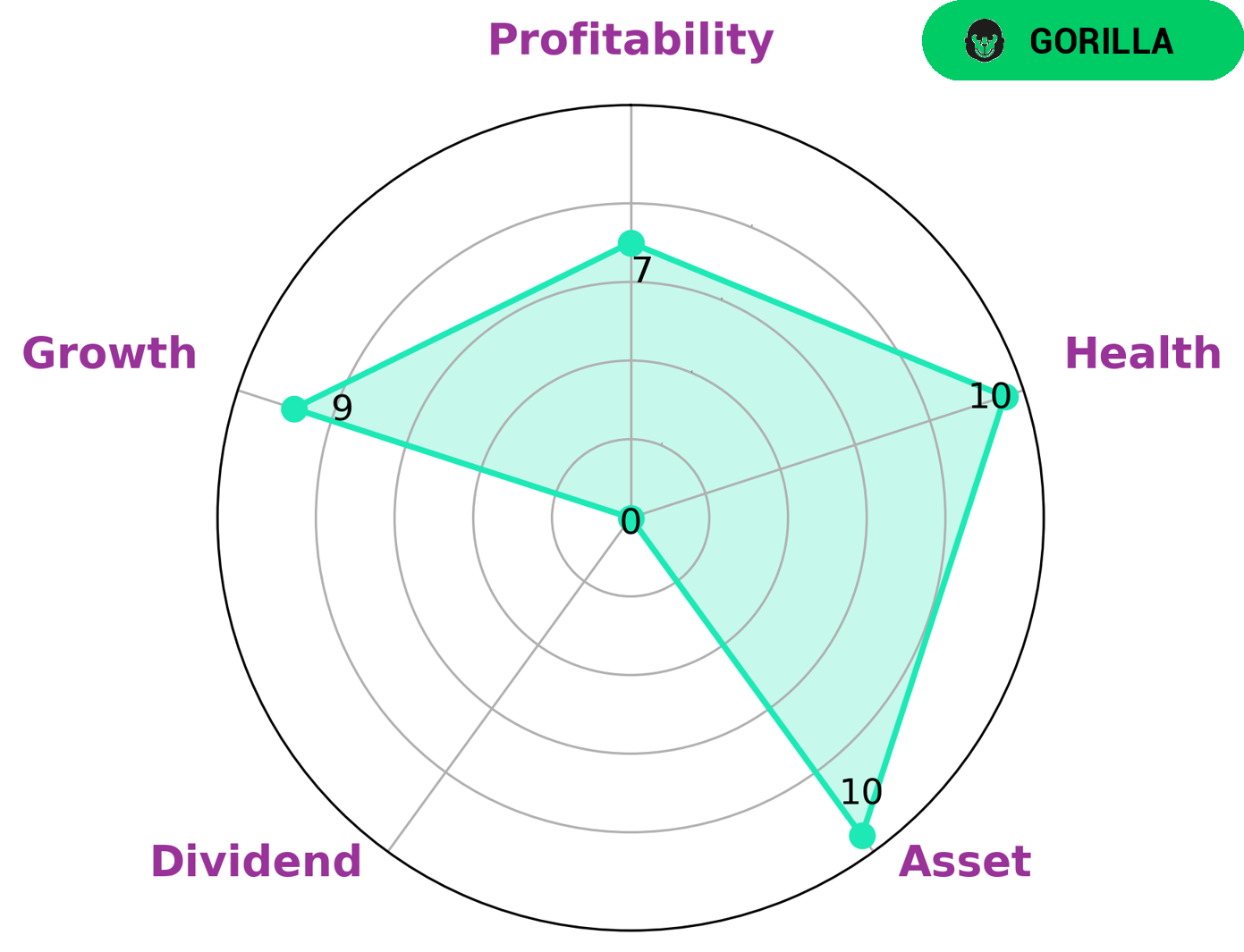

GoodWhale has completed an analysis of the wellbeing of ZOOM VIDEO COMMUNICATIONS. Our Star Chart rating gave them a health score of 10/10, indicating that they are in a very strong cashflow and debt position and are likely to be able to sustain future operations in times of crisis. Our analysis classified ZOOM VIDEO COMMUNICATIONS as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earnings growth due to their strong competitive advantage. For investors looking for such companies, ZOOM VIDEO COMMUNICATIONS may be an attractive investment opportunity. When looking at the four core areas of asset, growth, profitability and dividend, ZOOM VIDEO COMMUNICATIONS is strong in the first three, but weak in dividend. For investors who are seeking strong asset and revenue performance, this could make ZOOM VIDEO COMMUNICATIONS a particularly attractive choice. More…

Peers

In recent years, the video conferencing market has been growing rapidly with the advent of new technologies. Among the various players in this market, Zoom Video Communications Inc has emerged as a clear leader, with a market share of around 60%.

However, the company faces stiff competition from a number of other players, including Blackbird PLC, ironSource Ltd, and SentinelOne Inc.

– Blackbird PLC ($LSE:BIRD)

Blackbird PLC is a 54.22M market cap company with a ROE of -8.0%. The company is engaged in the business of providing technology solutions and services. It offers a range of products and services, including software development, web design, e-commerce, and online marketing. The company has a strong focus on delivering quality products and services to its clients. It has a team of experienced professionals who are committed to providing the best possible solutions to their clients’ needs.

– ironSource Ltd ($NYSE:IS)

IronSource Ltd is a provider of software development tools. The company has a market cap of 3.26B as of 2022 and a return on equity of 4.06%. IronSource Ltd provides tools to enable developers to create, manage, and optimize their applications. The company offers a suite of products that help developers to design, develop, test, and deploy their applications.

– SentinelOne Inc ($NYSE:S)

SentinelOne Inc is a publicly traded cybersecurity company headquartered in Mountain View, California. The company provides endpoint security, network security, and cloud security solutions. As of 2022, the company has a market capitalization of 6.58 billion and a return on equity of -12.5%. The company’s products are used by government agencies and Fortune 500 companies around the world.

Summary

This impressive performance comes on the back of increased investor interest in the company and its products. In the past few months, Zoom has seen a surge in demand for its video conferencing solutions, with many businesses turning to the platform to facilitate remote work during the pandemic. Analysts expect Zoom’s growth to continue, given its strong position in the market and its ability to capitalize on demand for its services.

Recent Posts