ZM Intrinsic Stock Value – Zoom Communications Reports Record-Breaking Earnings and Revenue for Q3

November 27, 2023

🌥️Trending News

Zoom is a publicly traded company and a leading provider of modern enterprise video communications solutions, enabling face-to-face video experiences, and providing a secure platform for video conferences and online meetings. The company reported Non-GAAP earnings per share of $1.29, exceeding expectations by $0.21, and revenue of $1.14 billion, surpassing estimates by $20 million. This impressive performance was driven by the growth in demand for its products and services, and the company is expecting further growth over the coming quarters following the launch of new features such as Zoom Phone, which provides business communication solutions.

Overall, Zoom Video Communications ($NASDAQ:ZM) reported a very successful third quarter, with record-breaking earnings and revenue that exceeded Wall Street expectations. With increasing demand for its products and services, Zoom is expected to continue its strong performance in the coming quarters.

Earnings

According to their latest earning report of FY2024 Q2, the total revenue earned was 1021.5M USD, while the net income was 317.08M USD. Compared to the same period last year, there was a 7.1% decrease in total revenue, however a 593.1% increase in net income. In the last 3 years, ZOOM VIDEO COMMUNICATIONS’s total revenue increased from 1021.5M USD to 1138.68M USD. This remarkable growth is a testament to the company’s success and is a positive outlook for future growth.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ZM. More…

| Total Revenues | Net Income | Net Margin |

| 4.46k | 141.73 | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ZM. More…

| Operations | Investing | Financing |

| 1.26k | -310.11 | -506.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ZM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.92k | 1.92k | 23.53 |

Key Ratios Snapshot

Some of the financial key ratios for ZM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 49.1% | -17.4% | 2.8% |

| FCF Margin | ROE | ROA |

| 25.4% | 1.1% | 0.9% |

Stock Price

The company stock opened at $64.6 and closed at $66.0, up by 2.9% from the previous closing price of 64.1, signaling a strong market response to the news. Zoom Communications’ CEO Eric Yuan attributed the strong performance to the company’s “superior customer experience” and their “commitment to product innovation” which has allowed them to gain market share as more businesses shift to remote working. With businesses and individuals continuing to utilize Zoom’s platform for communication and collaboration, it is likely that the company will continue to post strong results in the coming quarters. Live Quote…

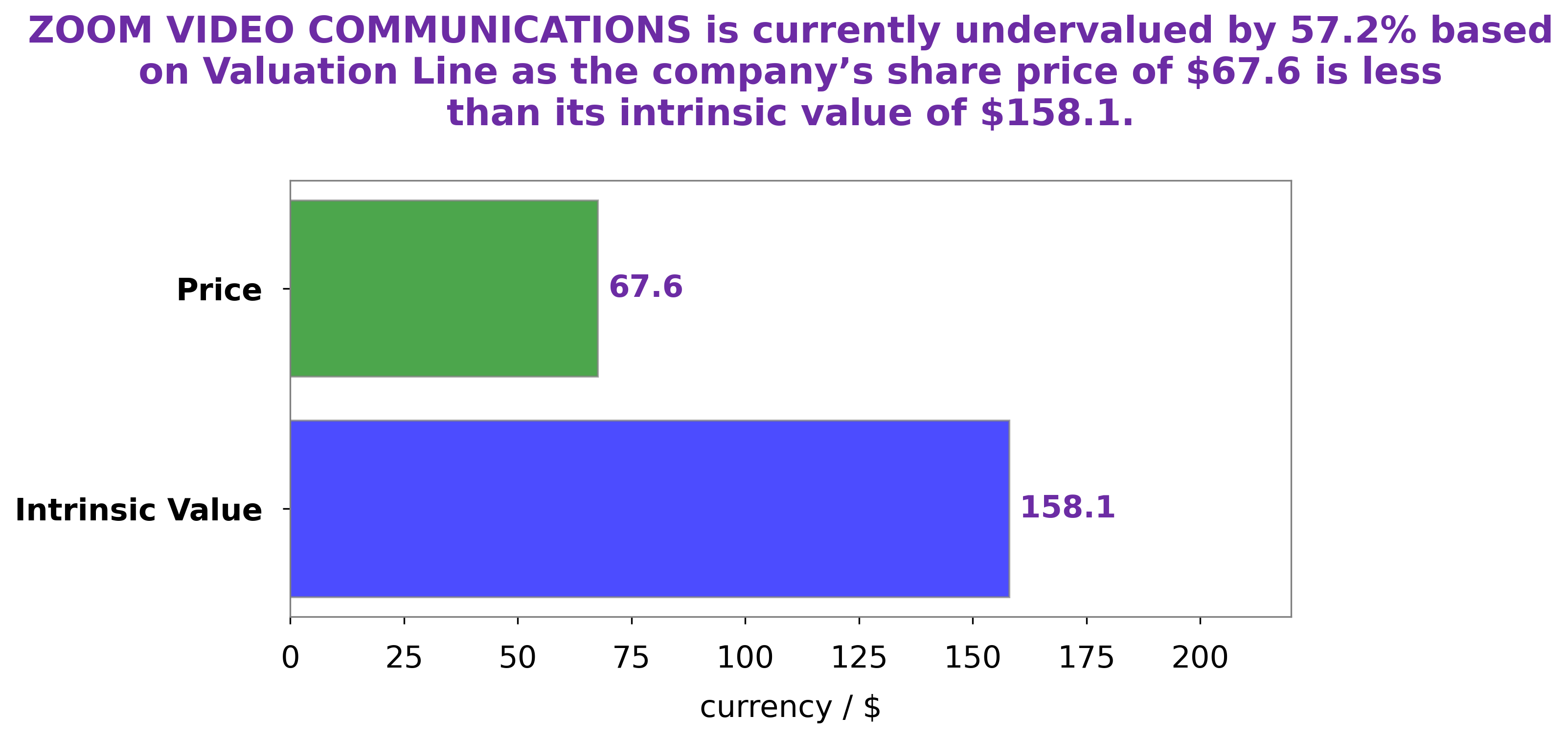

Analysis – ZM Intrinsic Stock Value

At GoodWhale, we recently conducted an analysis of ZOOM VIDEO COMMUNICATIONS’ wellbeing. Using our proprietary Valuation Line, we calculated that the intrinsic value of ZOOM VIDEO COMMUNICATIONS’ share is around $206.6. This means that the current stock price of $66.0 is undervalued by 68.1%. This presents a great opportunity for investors to consider investing in this company as there is strong potential for growth in the near future. More…

Peers

In recent years, the video conferencing market has been growing rapidly with the advent of new technologies. Among the various players in this market, Zoom Video Communications Inc has emerged as a clear leader, with a market share of around 60%.

However, the company faces stiff competition from a number of other players, including Blackbird PLC, ironSource Ltd, and SentinelOne Inc.

– Blackbird PLC ($LSE:BIRD)

Blackbird PLC is a 54.22M market cap company with a ROE of -8.0%. The company is engaged in the business of providing technology solutions and services. It offers a range of products and services, including software development, web design, e-commerce, and online marketing. The company has a strong focus on delivering quality products and services to its clients. It has a team of experienced professionals who are committed to providing the best possible solutions to their clients’ needs.

– ironSource Ltd ($NYSE:IS)

IronSource Ltd is a provider of software development tools. The company has a market cap of 3.26B as of 2022 and a return on equity of 4.06%. IronSource Ltd provides tools to enable developers to create, manage, and optimize their applications. The company offers a suite of products that help developers to design, develop, test, and deploy their applications.

– SentinelOne Inc ($NYSE:S)

SentinelOne Inc is a publicly traded cybersecurity company headquartered in Mountain View, California. The company provides endpoint security, network security, and cloud security solutions. As of 2022, the company has a market capitalization of 6.58 billion and a return on equity of -12.5%. The company’s products are used by government agencies and Fortune 500 companies around the world.

Summary

Revenue of $1.14B also beat expectations by $20M. These strong results suggest that Zoom is continuing to grow its user base and monetize its platform. Investors may want to consider investing in Zoom, given its impressive financial performance and potential for further growth.

Recent Posts