Trade Desk Intrinsic Value Calculation – Trade Desk Reaches $2B Revenue Forecast, But Early Growth Cycle Continues

April 20, 2023

Trending News ☀️

Rowan Street’s Trade Desk ($NASDAQ:TTD) is estimated to generate $2 billion in revenue this year, but the company is still in the early stages of its growth cycle. Trade Desk is a technology company specialist in advertising and marketing. It has developed a programmatic advertising platform that helps users to purchase digital advertising programmatically. The platform is used by marketers and agencies worldwide to buy and manage digital advertising campaigns. The company’s growth has been driven largely by its marketing automation platform, which helps marketers and agencies optimize campaigns across different platforms and devices. This has allowed it to capture a larger share of the programmatic advertising market, increasing its revenue significantly in the last few years.

Trade Desk also offers a suite of analytics and reporting products to help its customers better understand their campaigns’ performance and make better decisions about their marketing strategies. This has helped the company to increase its customer base and grow its business. Overall, Trade Desk is expected to reach its $2 billion revenue forecast this year despite being in the early stages of its growth cycle. With its innovative products and services, the company looks set to continue to be a leader in the programmatic advertising market.

Price History

On Wednesday, The Trade Desk Inc. (TRAD) reached its revenue forecast of $2 billion, yet its early growth cycle has not ended. The stock opened at $60.9 and closed at $61.6, falling by 0.8% from its previous closing price of 62.1. Analysts expressed concerns about the company’s ability to maintain its current growth rate. The Trade Desk has seen impressive growth in the past year, driven largely by the increasing demand for advertising on digital platforms. The company’s success was due to an increase in demand for programmatic advertising technology by marketers and agencies. Despite the positive news, The Trade Desk may experience some challenges going forward as competition in the programmatic advertising market intensifies.

However, the company is well-positioned to continue its strong performance, with a strong focus on product innovation and customer service. Overall, The Trade Desk has reached its forecast of $2 billion in revenue and proven its ability to grow in the digital advertising space. The company is expected to remain a leader in the industry, as it continues to battle the intensifying competition in the programmatic advertising market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Trade Desk. More…

| Total Revenues | Net Income | Net Margin |

| 1.58k | 53.38 | 3.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Trade Desk. More…

| Operations | Investing | Financing |

| 548.73 | -304.37 | 31.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Trade Desk. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.38k | 2.27k | 3.91 |

Key Ratios Snapshot

Some of the financial key ratios for Trade Desk are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 33.6% | 0.4% | 7.2% |

| FCF Margin | ROE | ROA |

| 29.0% | 3.5% | 1.6% |

Analysis – Trade Desk Intrinsic Value Calculation

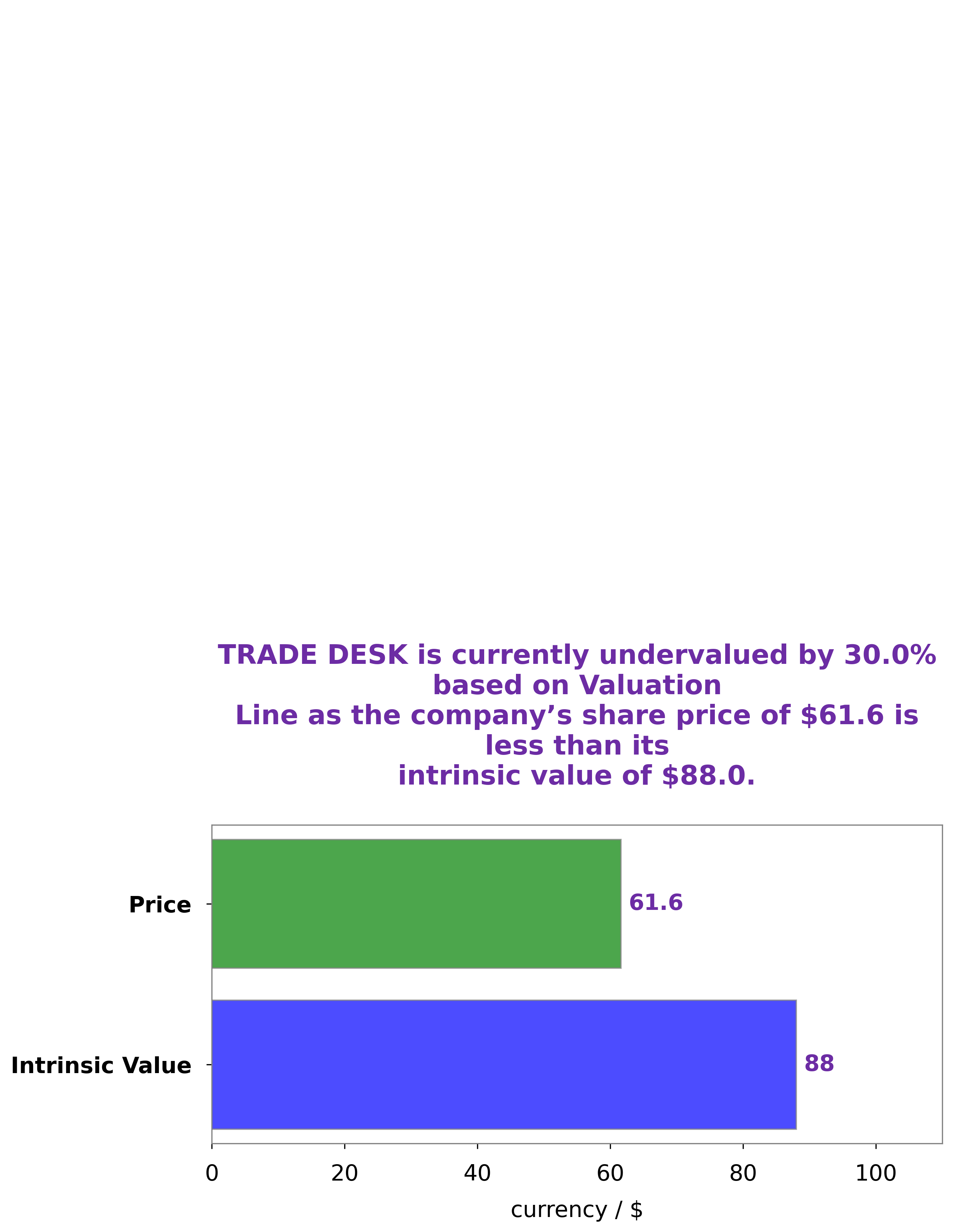

GoodWhale has conducted an in-depth analysis of TRADE DESK‘s fundamentals and found that its fair value is around $88.0. This value is calculated using GoodWhale’s proprietary Valuation Line. Currently, the stock is traded at $61.6, which means it is undervalued by 30.0%. This provides a good opportunity for investors to take long positions in the stock. Overall, GoodWhale’s analysis indicates that TRADE DESK is an attractive investment option. More…

Peers

The Trade Desk Inc is a company that provides a platform for programmatic advertising. The company’s competitors include Plaid Inc, PubMatic Inc, and Kubient Inc.

– Plaid Inc ($TSE:4165)

Plaid Inc is a financial technology company that provides an API platform that enables applications to connect with users’ bank accounts. The company has a market cap of 25.8 billion as of 2022 and a return on equity of -10.39%. Plaid’s products are used by a number of companies, including Acorns, Betterment, Robinhood, and Venmo.

– PubMatic Inc ($NASDAQ:PUBM)

PubMatic is a global technology company that provides a software platform for digital publishers. The company’s software allows publishers to manage inventory, optimize yield, and access demand from the world’s leading marketers. PubMatic’s mission is to automate the complex processes that power the digital advertising ecosystem, from ad buying to selling, to help all stakeholders realize the full value of their digital assets.

PubMatic has a market cap of 928.74M as of 2022 and a Return on Equity of 17.37%. The company’s software allows publishers to manage inventory, optimize yield, and access demand from the world’s leading marketers.

– Kubient Inc ($NASDAQ:KBNT)

Kubient Inc is a publicly traded company with a market capitalization of 18.15 million as of 2022. The company has a negative return on equity of 52.06% due to its high debt levels. Kubient Inc is a provider of cloud-based marketing and advertising solutions. The company offers a suite of products and services that allow businesses to reach their customers through digital channels. Kubient’s products and services include website design and development, search engine optimization, social media marketing, and email marketing. The company has a strong focus on small and medium-sized businesses.

Summary

The Trade Desk (TTD) is an advertising technology company that offers software tools and services to buyers and sellers of digital media. TTD’s market capitalization is valued at over $30 billion, making it one of the leading companies in the digital advertising space. TTD’s platform serves as a broker between publishers and advertisers on its network, allowing advertisers to purchase display and video ads across digital channels such as mobile, desktop, audio, and broadcast.

TTD’s growth prospects are promising, with a unique business model combined with increasing demand for online advertising from businesses. Investors may be interested in the potential of TTD’s platform to drive long-term revenue growth as well as its position in the digital advertising market.

Recent Posts