TD Asset Management Sells Shares in Bumble

February 11, 2023

Trending News ☀️

TD Asset Management Inc. has recently sold off a portion of their stake in Bumble Inc ($NASDAQ:BMBL)., a dating and social app company. This follows a surge in Bumble Inc.’s stock price, which has nearly tripled since it’s initial public offering in February of this year. The stock has performed well as investors anticipate further growth and expansion as the company continues to invest in digital marketing, product development, and international expansion. The sale of shares by TD Asset Management Inc. highlights the increased interest in Bumble Inc., which is now valued at more than $8 billion.

In addition, the company is rapidly expanding into new markets, such as launching its first physical location in Manhattan, New York City. This physical presence is expected to further strengthen the company’s presence among users and investors alike. Bumble Inc.’s success is a testament to the creative vision of its founder, Whitney Wolfe Herd, who has carefully crafted an innovative product that offers users an opportunity to meet people safely and securely. With plans for continued expansion and increased investment, Bumble Inc. is well positioned to continue its impressive growth trajectory.

Share Price

TD Asset Management Inc. has sold their shares in Bumble Inc., with the stock market’s reaction to the news being mostly positive at the time of writing. On Friday, Bumble Inc.’s stock opened at $25.2 and closed at $24.3, down by 4.8% from the previous closing price of 25.5. This development has raised questions as to why TD Asset Management Inc. has decided to sell off their shares in Bumble Inc. The decision to sell their shares in Bumble Inc. is likely due to the company’s financial performance, which has been volatile in the past few months due to market uncertainty. The company’s stock price had seen a sharp decline in the second quarter of this year, leading to investors being wary of investing in the company.

The future of Bumble Inc. is uncertain and investors are advised to exercise caution while investing in the company’s stock. It is important to note that the company’s financial performance can change quickly depending on the market conditions and the company’s strategy going forward. Therefore, investors should research the company and its competitors before investing in Bumble Inc. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bumble Inc. More…

| Total Revenues | Net Income | Net Margin |

| 870.1 | 20.78 | 2.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bumble Inc. More…

| Operations | Investing | Financing |

| 173.15 | -84.16 | -19.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bumble Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.79k | 1.23k | 13.08 |

Key Ratios Snapshot

Some of the financial key ratios for Bumble Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.6% | – | 4.6% |

| FCF Margin | ROE | ROA |

| 18.1% | 1.5% | 0.7% |

Analysis

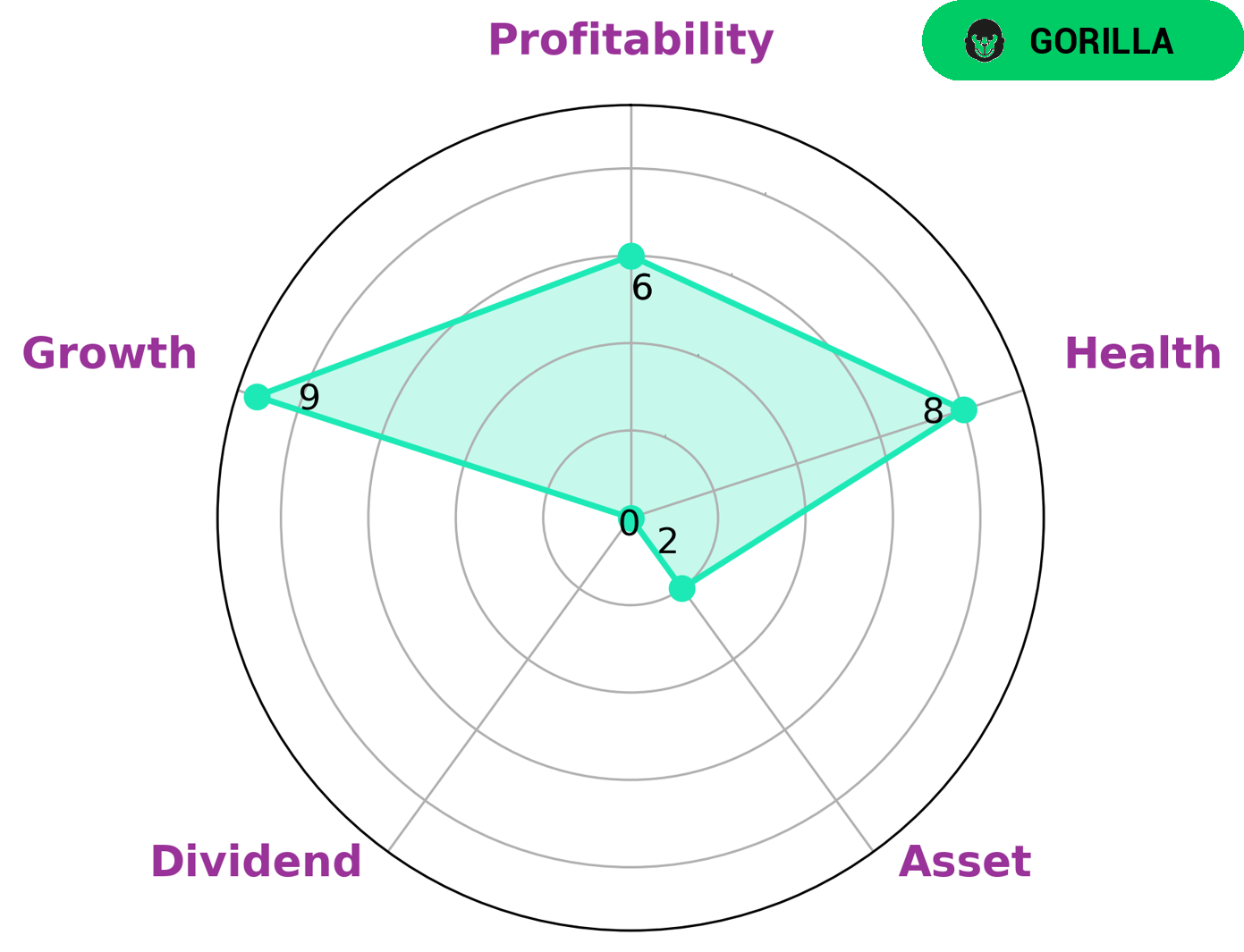

GoodWhale has conducted an analysis of BUMBLE INC and determined that the company has strong growth, medium profitability, and weak assets and dividends. BUMBLE INC falls into the category of ‘gorilla’, a term used to describe companies who have achieved a stable and high revenue or earning growth due to a strong competitive advantage. Investors who could be interested in such a company include those who are looking for long-term growth opportunities, such as venture capitalists and private equity firms, as well as those who are more risk-averse such as passive investors. BUMBLE INC also has a high health score of 8/10, indicating that it is capable of sustaining future operations even in times of crisis. This makes it attractive to investors who are looking for reliable investments. Overall, BUMBLE INC is an attractive investment for those who want to take on a higher risk profile for the potential of long-term growth. Although it carries a certain amount of risk, its strong competitive advantage and high health score indicate that it is capable of sustaining itself in difficult times. This makes it an attractive investment opportunity for those looking to diversify their portfolios. More…

Peers

The company was founded in 2014 by Whitney Wolfe Herd and is headquartered in Austin, Texas. Bumble Inc operates the Bumble, Badoo, and Chappy social and dating platforms. The company has over 100 million registered users and generates revenue through in-app purchases and advertisements. Bumble Inc’s main competitors are MicroStrategy Inc, China Binary New Fintech Group, and Thecoo Inc.

– MicroStrategy Inc ($NASDAQ:MSTR)

MicroStrategy Inc is a company that provides business intelligence, mobile software, and cloud-based services. It has a market cap of 3.14B and an ROE of 122.06%. The company was founded in 1989 and is headquartered in Tysons Corner, Virginia.

– China Binary New Fintech Group ($SEHK:08255)

Binary New Fintech Group is a leading provider of online financial services in China. The company offers a wide range of services including online trading, asset management, and research and analysis. It has a market cap of 40.8M as of 2022 and a return on equity of -23846.21%. The company is headquartered in Beijing, China.

– Thecoo Inc ($TSE:4255)

Thecoo Inc has a market cap of 4.15B as of 2022, a Return on Equity of -6.79%. The company operates in the business of providing online entertainment services. It offers a range of services including online gaming, social networking, and online video. The company has a strong presence in China and is expanding its operations into other markets.

Summary

Media coverage of the stock has been largely positive, with many investors excited about the potential of the app and its associated services. However, despite the initial enthusiasm, stock prices have dropped since the first day of trading and continue to be volatile. Analysts point to a combination of factors, including the markets’ overall volatility, the company’s smaller market cap compared to some of its peers, and questions about future growth potential. Investors should keep an eye on the stock’s performance, since sudden changes in the market could lead to further drops or provide a good opportunity to buy.

Recent Posts