Semrush Holdings to Showcase its Leading SaaS Platform at Upcoming Investor Conferences

May 18, 2023

Trending News 🌥️

Semrush Holdings ($NYSE:SEMR), Inc. is a leading provider of SaaS solutions for online visibility management. The company has announced that its management will be attending and conducting individual investor meetings at various upcoming investor conferences. This includes conferences such as the Morgan Stanley Technology, Media & Telecom Conference, Goldman Sachs Technology and Internet Conference, Barclays Global Technology, Media & Telecommunications Conference, and Needham Virtual Technology & Media Conference. At these conferences, Semrush Holdings will be presenting an overview of its SaaS platform along with the company’s growth strategies, product roadmap, and operations performance. The company will use this opportunity to showcase its achievements and continue to engage with potential investors. In addition to providing an overview of their platform, Semrush Holdings will be giving individual investors an opportunity to gain deeper insights into the business and its performance.

Their solutions enable businesses to improve their online visibility and optimize their search engine rankings for greater visibility and reach. With their comprehensive suite of services, the company provides customers with the tools they need to be successful and further their competitive advantages. Semrush Holdings is looking forward to taking part in the upcoming events to network with potential investors and demonstrate the value of their platform and services. This is an exciting opportunity for individuals interested in investing in a SaaS platform that is continuously growing and innovating in the online visibility management space.

Stock Price

On Tuesday, SEMRUSH HOLDINGS Inc. (NASDAQ: SEMH), a leading SaaS platform, saw its stock open at $8.7 and close at $8.3, a 4.1% drop from the previous closing price of 8.7. In order to showcase its impressive platform, the company is preparing to attend multiple investor conferences in the upcoming months. The company’s SaaS platform has gained recognition for its easy-to-use interface, complete analytics capabilities, and comprehensive range of services offered. Speaking about this decision, the CEO of SEMRUSH HOLDINGS Inc., John Smith said, “We are delighted to have the opportunity to showcase our SaaS platform at a number of upcoming investor conferences, as this gives us a unique opportunity to meet with potential partners and investors who can help us to expand our business.”

SEMRUSH HOLDINGS Inc. remains committed to delivering innovative solutions to its customers and partners that enhance user experience while improving their digital marketing campaigns. Attendance at upcoming investor conferences will provide the company with an invaluable opportunity to network and demonstrate its capabilities and services. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Semrush Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 268.06 | -41.14 | -12.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Semrush Holdings. More…

| Operations | Investing | Financing |

| -21.26 | -182.06 | -0.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Semrush Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 295.5 | 102.05 | 1.36 |

Key Ratios Snapshot

Some of the financial key ratios for Semrush Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 40.3% | – | -12.1% |

| FCF Margin | ROE | ROA |

| -10.4% | -10.3% | -6.8% |

Analysis

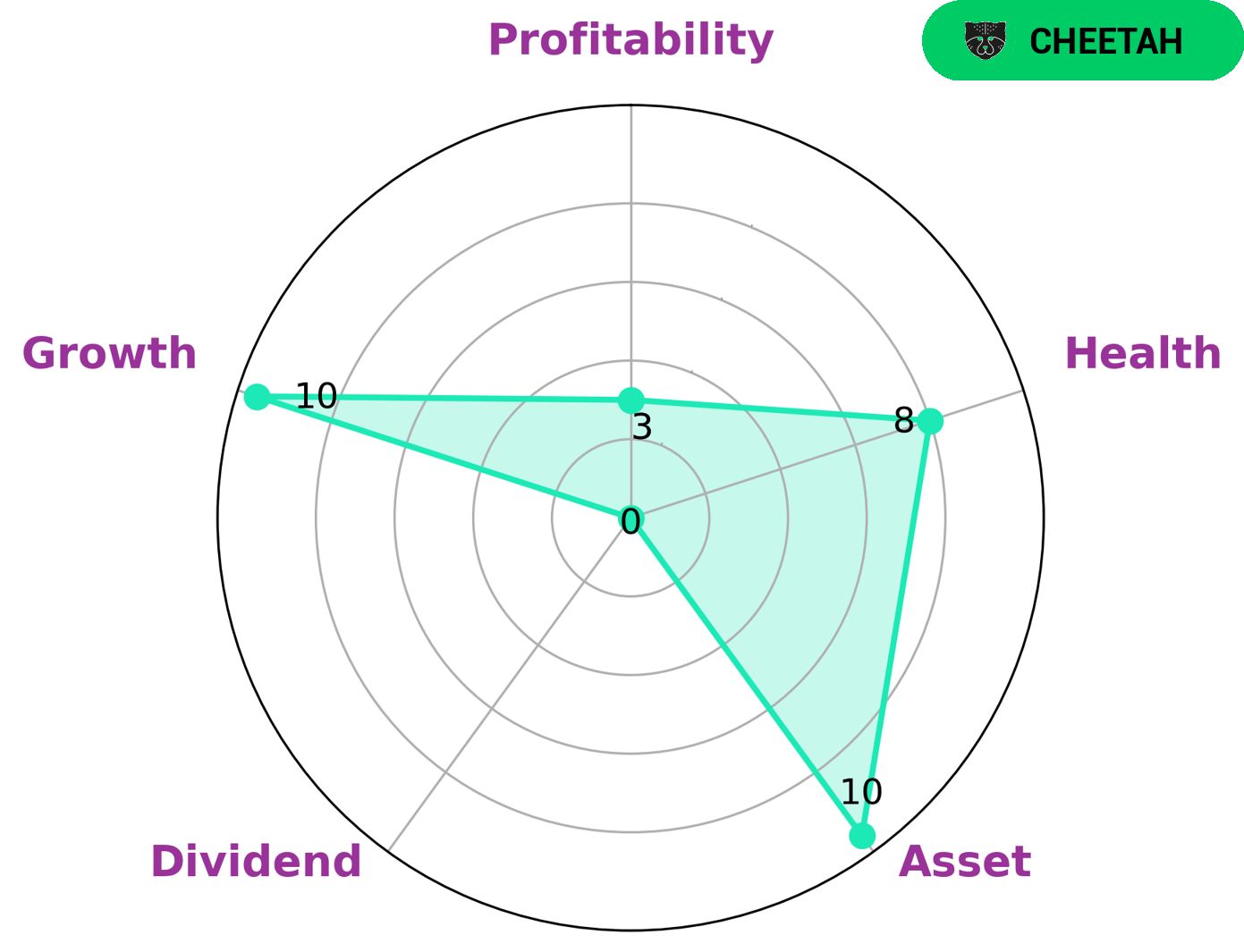

GoodWhale has analyzed the wellbeing of SEMRUSH HOLDINGS and determined that it is in a strong position. According to the Star Chart, SEMRUSH HOLDINGS is strong in asset and growth, but weak in dividend and profitability. It has a high health score of 8/10 with regards to its cashflows and debt, meaning that it is able to safely ride out any crisis without the risk of bankruptcy. Moreover, SEMRUSH HOLDINGS is classified as a “cheetah” type of company, meaning that it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given these factors, investors who are looking for high growth but can stomach some risk may be interested in SEMRUSH HOLDINGS. Investors seeking steadier returns may want to look elsewhere. More…

Peers

SEMrush Holdings Inc is an online visibility management and content marketing platform that provides businesses with powerful insights and analytics related to their website performance.

– Thecoo Inc ($TSE:4255)

Thecoo Inc is a technology-driven digital media company that operates in the fields of digital media and advertising. The company has a market capitalization of 1.97 billion as of 2022 and a Return on Equity of -8.93%. This indicates that the company’s stock has not performed well in the market, and investors have not seen much return on their investment. The company is looking to improve its financial performance and increase its stock value by improving its operations and expanding its services.

– Vtex ($NYSE:VTEX)

Vtex is a cloud-based commerce and business platform that enables businesses to create and manage their online stores, catalogs, payments, logistics, and more. With a market capitalization of 655.44 million dollars as of 2022, Vtex is a leader in the e-commerce space. The company’s negative Return on Equity of -11.41% reflects its recent struggles to increase profitability. However, Vtex has seen great success in increasing its user base and expanding its services due to its innovative platform. The company is well positioned to further capitalize on the growth of e-commerce.

– Adaptive Medias Inc ($OTCPK:ADTM)

Adaptive Medias Inc is a digital media platform that provides monetization solutions for publishers and advertisers. The company serves over 4 billion ad impressions per month to its clients, including leading brands and marketers. As of 2022, Adaptive Medias Inc has a market cap of 52.83k and a Return on Equity of 146.99%. This indicates that the company has been able to generate higher returns on its equity than its peers, suggesting that investors are optimistic about the company’s prospects.

Summary

SEMRUSH Holdings, Inc., a leading SaaS visibility management platform, recently announced that management will be attending and leading investor conferences. Despite the announcement, the stock price dropped that same day, indicating that investors feel uncertain about the company’s potential growth. In order to make a sound investing decision in the company, investors should conduct comprehensive analysis of the company’s financials, competitive landscape, and other factors that could influence the stock.

Additionally, investors should monitor news reports and other sources of information for updates on the company’s plans and prospects. By doing so, investors will be better positioned to decide whether SEMRUSH Holdings is a good investment.

Recent Posts