Progress Software Corp Achieves Impressive Rating of 80 in Software – Application Industry

April 22, 2023

Trending News ☀️

Progress Software ($NASDAQ:PRGS) Corp is an innovative software provider that has achieved an impressive rating of 80 in the Software – Application industry. The company works to develop applications that increase productivity and enable businesses to deliver custom solutions to their customers. They have a long history of creating innovative software solutions, such as their popular OpenEdge platform, which makes it easier to build and maintain custom applications.

In addition, they offer cloud-based services that can be integrated into existing systems, as well as an extensive range of technical support services. As a result of these services, Progress Software Corp has made a name for itself in the industry and continues to be a leader in software solutions.

Share Price

This rise in rating is a positive indication for the company’s overall performance and future outlook. The stock opened at $56.5 and closed at $56.7, up by 0.5% from its prior closing price of 56.4. This growth validates the fact that Progress Software Corp continues to be a reliable and successful company in the Software – Application industry.

The company’s consistent success and impressive rating is a testament to its outstanding products, services, and commitment to customer satisfaction. As the company continues to focus on its core competencies, it is likely to maintain this strong rating and further progress in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Progress Software. More…

| Total Revenues | Net Income | Net Margin |

| 621.32 | 98.29 | 15.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Progress Software. More…

| Operations | Investing | Financing |

| 194.83 | -333.68 | 102.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Progress Software. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.64k | 1.23k | 9.21 |

Key Ratios Snapshot

Some of the financial key ratios for Progress Software are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.8% | 15.1% | 22.9% |

| FCF Margin | ROE | ROA |

| 30.4% | 21.9% | 5.4% |

Analysis

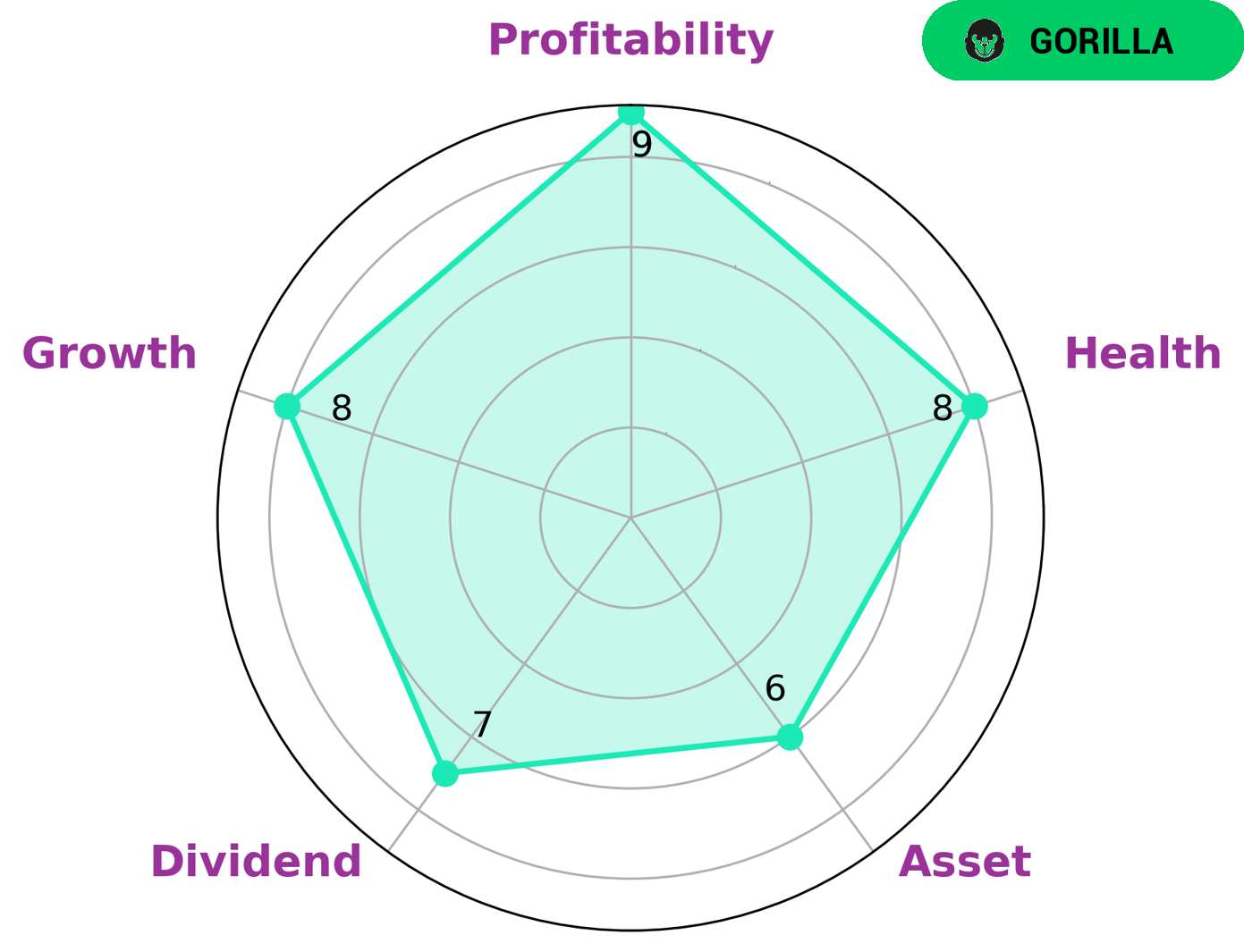

GoodWhale’s analysis of PROGRESS SOFTWARE’s fundamentals reveals a company that is strong in dividend, growth, profitability, and medium in asset. Considering these metrics, we classify PROGRESS SOFTWARE as a ‘gorilla’—a type of company that has achieved a stable and high growth rate in revenue or earnings due to its strong competitive advantage. Investors who are interested in strong companies with a long track record of success may find PROGRESS SOFTWARE attractive. Additionally, PROGRESS SOFTWARE scores an 8/10 on GoodWhale’s health score, which suggests that the company is very capable of weathering any financial storm or crisis without the risk of bankruptcy. More…

Peers

Progress Software Corporation is an American publicly traded company headquartered in Bedford, Massachusetts. The company develops software products and services for businesses. Progress Software’s main competitors are DocuSign Inc, Pros Holdings Inc, and Sprout Social Inc.

– DocuSign Inc ($NASDAQ:DOCU)

DocuSign Inc is a US provider of electronic signature technology and digital transaction management services, founded in 2003. The company’s software allows users to electronically sign, send, and manage documents. As of 2022, DocuSign has a market cap of 8.52B and a ROE of -15.28%.

– Pros Holdings Inc ($NYSE:PRO)

A market cap of 1.17B means that the company is worth 1.17 billion dollars. The company’s ROE is 195.47%, which means that the company has made 195.47% profit on every dollar that it has invested. The company does business in the healthcare industry.

– Sprout Social Inc ($NASDAQ:SPT)

Sprout Social is a social media management platform that helps brands grow their social media presence. The company has a market cap of $2.61B and a ROE of -17.92%. Sprout Social’s platform helps brands with tasks such as scheduling and publishing content, analyzing social media analytics, andEngaging with their audience.

Summary

Progress Software Corp is a great investment opportunity for those looking to diversify their portfolios. With an impressive rating of 80, it is one of the best performing companies in the Software – Application industry. The company has strong financials and a solid track record of profitability and share price growth over the years. Their products and services have been well-received by customers, giving them a strong competitive advantage in the industry. Looking at their financial statements, they have a healthy balance sheet and low debt compared to their peers.

Additionally, their growth prospects appear to be healthy, with plans to continue focusing on innovative solutions for their customers.

Recent Posts