Monday.Com Ltd. Earns Impressive Rating of 95, Proving It Has What It Takes for Your Portfolio Tuesday

June 3, 2023

☀️Trending News

Monday.Com Ltd has proved itself as a high-performing stock in the software – application industry, earning an impressive rating of 95. This rating shows that Monday.Com Ltd has what it takes to make it into your portfolio on Tuesday. Monday.Com Ltd is a company that provides an enterprise-grade project management platform designed to help teams of all sizes work smarter, collaborate more efficiently, and achieve results faster. With its user-friendly interface and intuitive features, Monday.com helps teams stay organized, remain on top of their tasks, and track progress in one place. The platform also offers integrations with popular software such as Slack, Trello, and Basecamp to help increase collaboration and make it easier to manage projects.

Monday.com’s stock offers a great opportunity for investors looking to diversify their portfolio and benefit from the company’s success. The company has also recently announced plans to expand its services into new markets, which could potentially provide further growth opportunities for investors. For those looking for a reliable stock with the potential for strong returns, Monday.com Ltd ($NASDAQ:MNDY) is definitely worth considering. With its impressive rating of 95 in the software – application industry, Monday.com Ltd is sure to be an attractive investment for Tuesday’s portfolio.

Share Price

On Wednesday, the stock opened at $168.9 and closed at $180.2, representing a 7.8% increase from its previous closing price of 167.2. This bullish sentiment has investors looking to add MONDAY.COM LTD to their portfolios. The strong performance in Tuesday’s trading is a testament to the company’s commitment to delivering quality products and services to its customers.

This jump in MONDAY.COM LTD’s stock could be a great opportunity for investors to add the company to their portfolios. With its impressive rating and strong performance, MONDAY.COM LTD could be a great addition for any investor looking for long-term growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Monday.com Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 572.79 | -84.86 | -15.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Monday.com Ltd. More…

| Operations | Investing | Financing |

| 82.78 | -19.77 | 22.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Monday.com Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.1k | 402.39 | 14.24 |

Key Ratios Snapshot

Some of the financial key ratios for Monday.com Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 88.0% | – | -14.8% |

| FCF Margin | ROE | ROA |

| 11.0% | -7.7% | -4.8% |

Analysis

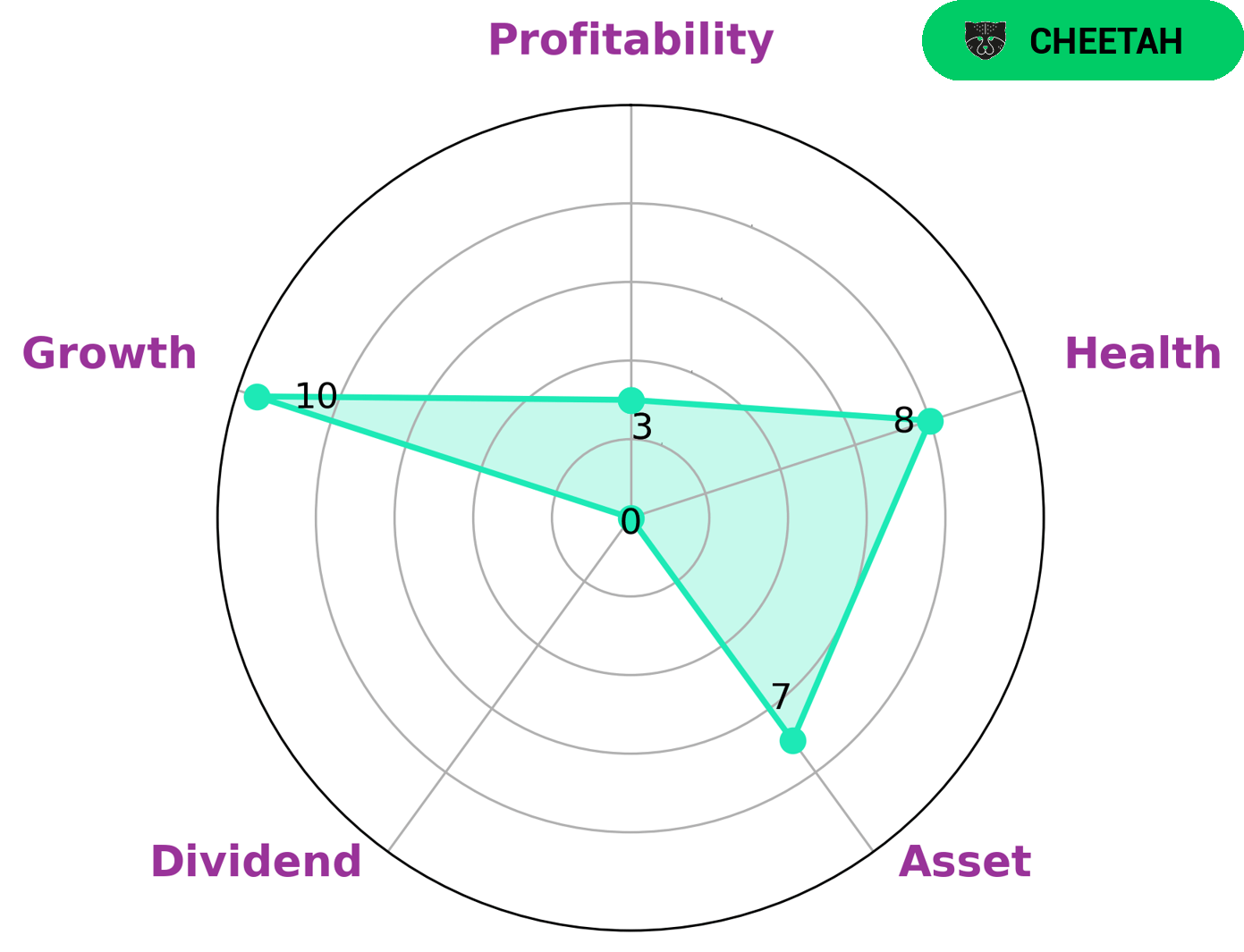

At GoodWhale, we have conducted an in-depth analysis of MONDAY.COM LTD‘s wellbeing and identified key areas of strength and areas where the company could benefit from improvement. Based on our Star Chart, MONDAY.COM LTD has a high health score of 8/10 with regard to its cashflows and debt, indicating that the company is capable to sustain future operations in times of crisis. Moreover, MONDAY.COM LTD is classified as ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. In terms of financial performance, MONDAY.COM LTD is strong in asset, growth, and weak in dividend, profitability. Therefore, investors with higher risk tolerance may be more likely to show interest in MONDAY.COM LTD due to its growth potential but may be wary of the risks associated with its low dividend and profitability. More…

Peers

The company was founded in 2012 and is headquartered in Tel Aviv, Israel. Monday.com has over 1,000 employees and serves customers in over 180 countries. The company offers a free trial of its software and has a monthly subscription model. Monday.com competes with Asana, Salesforce, and Atlassian Corporation.

– Asana Inc ($NYSE:ASAN)

Asana is a work management platform that helps teams organize, track, and manage their work. It has a market cap of 3.63B as of 2022 and a Return on Equity of -184.09%. The company was founded in 2008 and is headquartered in San Francisco, California.

– Salesforce Inc ($NYSE:CRM)

Salesforce Inc is a cloud-based software company that provides customer relationship management (CRM) and other enterprise software applications. As of 2022, the company has a market capitalization of 139.77 billion dollars and a return on equity of 0.08%. Salesforce was founded in 1999 and is headquartered in San Francisco, California.

– Atlassian Corporation PLC ($NASDAQ:TEAM)

Atlassian Corporation PLC is a publicly traded company with a market capitalization of over 31 billion as of early 2021. The company provides software development and collaboration tools to businesses and organizations of all sizes. Its products include the JIRA software development tool, Confluence collaboration software, and HipChat messaging service. The company has been profitable since its inception in 2002 and has a strong track record of delivering shareholder value.

Summary

Monday.com Ltd is an attractive stock for investors looking to diversify their portfolios. With a rating of 95, it is near the top of the Software – Application industry. The stock price has moved up significantly in recent days, indicating investor confidence in its growth prospects.

Investors looking to invest in Monday.com Ltd should consider its financials, management team, competitive landscape, and potential risks before making a final decision. Monday.com Ltd is a solid option for those looking for mid- to long-term growth potential in the Software – Application industry.

Recent Posts