MicroStrategy’s Slow Decline Accompanied by a Bitcoin Investment

May 20, 2023

Trending News 🌥️

MICROSTRATEGY ($NASDAQ:MSTR): MicroStrategy Incorporated is a business intelligence, mobile software, and cloud-based services company that has been in the market for over three decades. The company has seen a slow decline in its stock price recently, although its decision to invest in Bitcoin has caused some surprise. This move has been seen as a risky one, as the company is now heavily exposed to the volatile cryptocurrency market. MicroStrategy’s move into cryptocurrencies has been met with some trepidation by analysts and investors, as Bitcoin prices are known for their volatility.

It remains to be seen if this investment will prove to be beneficial for the company, or if it could lead to further losses if the value of Bitcoin declines. Only time will tell if MicroStrategy’s move into the cryptocurrency world will pay off.

Stock Price

On Friday, MICROSTRATEGY INCORPORATED stock opened at $290.9 and closed at $288.3, representing a slight increase of 0.2% from previous closing price of $287.6. This minor uptick in stock values belies a larger story of the company’s slow decline over the past few years. Recently, the company has made headlines not because of their analytics software, but because of their investment in Bitcoin.

This controversial move made waves in the investment community, but has yet to have a significant effect on the company’s stock value. With its current trajectory, it remains to be seen if the company can reverse its slow decline and benefit from its Bitcoin investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Microstrategy Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 501.9 | -877.85 | -7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Microstrategy Incorporated. More…

| Operations | Investing | Financing |

| -3.07 | -242.22 | 245.52 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Microstrategy Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.03k | 2.58k | 34.25 |

Key Ratios Snapshot

Some of the financial key ratios for Microstrategy Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | -1.1% | 40.1% |

| FCF Margin | ROE | ROA |

| -51.2% | 418.6% | 4.2% |

Analysis

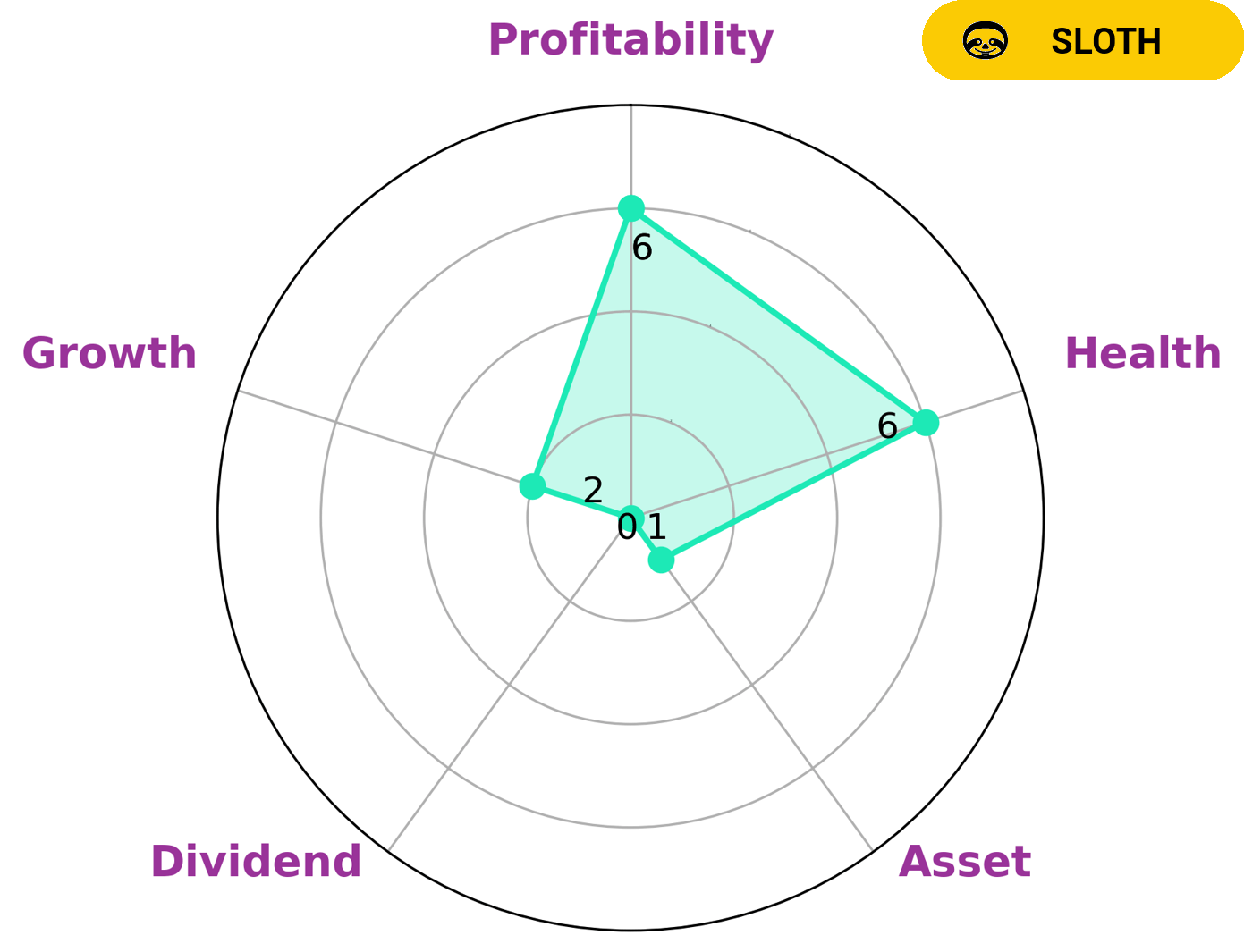

GoodWhale’s analysis of MICROSTRATEGY INCORPORATED‘s fundamentals reveals an intermediate health score of 6/10. This score takes into consideration the company’s cashflows and debt, indicating that MICROSTRATEGY INCORPORATED is likely to pay off debt and fund future operations. The company is strong in medium in profitability and weak in asset, dividend, and growth. MICROSTRATEGY INCORPORATED is classified as a ‘sloth’, meaning that its revenue or earnings growth has been slower than the overall economy. This type of company may be of interest to value investors, those who seek to buy stocks at a discount, or those who are looking for a company with a steady dividend. More…

Peers

The company’s main competitors are Coinbase Global Inc, Riot Blockchain Inc, Bakkt Holdings Inc.

– Coinbase Global Inc ($NASDAQ:COIN)

Coinbase Global Inc is a digital asset exchange company. The Company’s mission is to create an open financial system for the world. The Company operates a digital currency exchange platform for individual and institutional investors, traders, and developers. The Company offers its products and services through its online platform and mobile application. The Company serves customers in North America, Europe, Asia Pacific, South America, and the Middle East and Africa.

– Riot Blockchain Inc ($NASDAQ:RIOT)

Riot Blockchain Inc has a market cap of 893.37M as of 2022. The company’s ROE for the same year is -2.48%. Riot Blockchain Inc is a provider of blockchain technology solutions to the global financial markets. The company’s mission is to be the leading blockchain technology provider in the world.

– Bakkt Holdings Inc ($NYSE:BKKT)

Bakkt Holdings Inc is a company that provides digital asset custody, trading, and other financial services. As of 2022, the company had a market capitalization of 164.26 million and a return on equity of -26.03%. The company’s primary focus is on digital assets, such as Bitcoin, and providing custody, trading, and other financial services related to these assets.

Summary

Nevertheless, despite the recent downward pressure on its stock price, MicroStrategy’s management remains confident about the future potential of their investments in Bitcoin. As such, it is important for investors to remain vigilant when analyzing their investment options in the company.

Recent Posts