LYFT Shares Plunge 75%, Missing Earnings and Lowering Guidance for Q4 2022

February 14, 2023

Trending News 🌧️

LYFT ($NASDAQ:LYFT) is a ride-hailing company that facilitates transportation services across the United States. The company’s shares initially dropped 36% the following day, and this was only the beginning of the decline. Recently, Lyft shares have plummeted by 75% from their high in October, shortly after management provided lower guidance for the company’s future performance in Q4 2022. This news has caused many investors to jump ship and has resulted in a sharp decline in Lyft’s stock price. Given the overall economic climate amid the global pandemic, it is no surprise that Lyft has been struggling to make ends meet.

However, many are hopeful that the company will be able to turn things around in the future and eventually recover from this setback. Until then, investors are watching closely to see how the stock performs and whether or not it can make a comeback.

Stock Price

On Monday, news of LYFT shares plunging a whopping 75% rocked the stock market. This dramatic decline was a result of the company missing their earnings expectations and lowering guidance for the fourth quarter of 2022. Specifically, LYFT opened on Monday at $10.3 and closed at $10.5, up only marginally by 1.5% from last closing price. Analysts stated that the company’s poor performance can be linked to its failure to increase revenues, as well as its inability to cut costs.

Additionally, investors have also been concerned about whether or not the company can compete with Uber in terms of market share. Unfortunately, due to the ongoing pandemic, these estimates were not met and revenue growth stalled. Furthermore, due to these missed estimates, the company has also lowered its revenue guidance for Q4 2022 and warned investors of further losses in the coming quarters. Overall, the decline in LYFT’s stock has been a disappointing outcome for investors and shareholders alike. As the future of the company remains uncertain, investors are hoping that it can quickly recover from this set back and once again become a profitable venture. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lyft. More…

| Total Revenues | Net Income | Net Margin |

| 4.1k | -1.58k | -38.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lyft. More…

| Operations | Investing | Financing |

| -237.28 | 186.04 | -87.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lyft. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.56k | 4.17k | 1.05 |

Key Ratios Snapshot

Some of the financial key ratios for Lyft are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.2% | – | -38.1% |

| FCF Margin | ROE | ROA |

| -8.6% | -168.8% | -21.4% |

Analysis

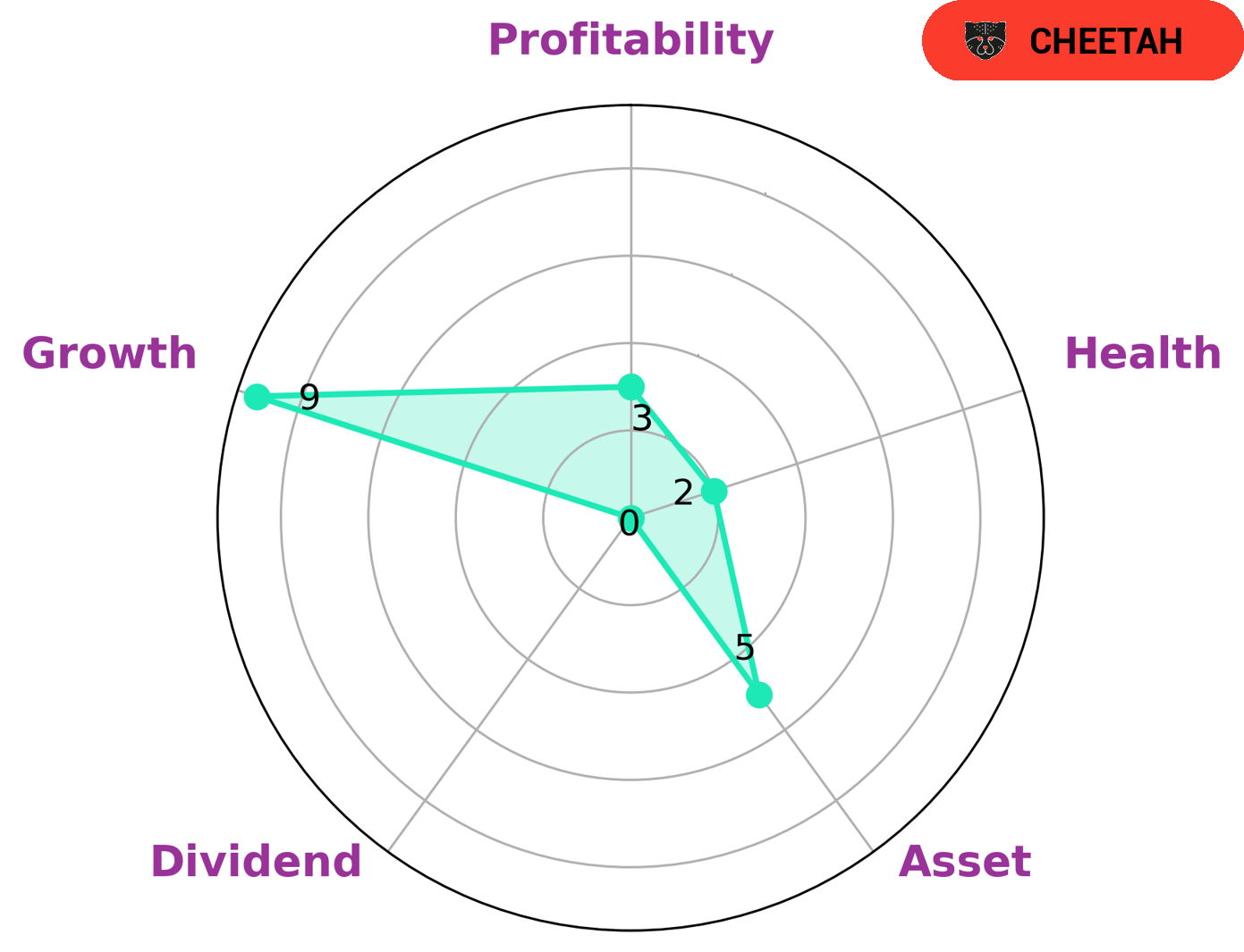

According to GoodWhale’s analysis of LYFT‘s well-being, the company is classified as ‘cheetah’ on their Star Chart, meaning it has achieved high revenue or earnings growth, yet is considered less stable due to lower profitability. This type of company may be attractive to certain types of investors who value growth over stability. Specifically, LYFT is strong in growth and medium in asset, but weak in dividend and profitability. Additionally, given that LYFT has a low health score of 2/10 considering its cashflows and debt, it is less likely to safely ride out any crisis without the risk of bankruptcy. However, it remains to be seen if the company’s lack of profitability will lead to long-term financial trouble. Investors should consider both the risks and rewards of investing in such a company. Overall, while LYFT has seen impressive growth in the past few years, its weak financials suggest that there may be major risks associated with investing in the company. Investors should take these risks into account when deciding whether or not to invest in LYFT. Only by carefully evaluating all of the factors can investors make an informed decision about whether or not to invest in this company. More…

Peers

The competition among Lyft Inc, Forge Global Holdings Inc, SK Hynix Inc, and CE Info Systems Ltd is fierce. All four companies are vying for a share of the market, and each has its own strengths and weaknesses. Lyft Inc is a relative newcomer to the market, but it has quickly established itself as a major player. Forge Global Holdings Inc is a large company with a long history in the industry. SK Hynix Inc is a smaller company, but it has a strong reputation for quality. CE Info Systems Ltd is a small company, but it has a very innovative product.

– Forge Global Holdings Inc ($NYSE:FRGE)

Founded in 2001, Forge Global Holdings Inc is a provider of investment banking and capital markets services. The company has a market cap of 301.72M as of 2022 and a Return on Equity of -4.23%. The company offers a range of services, including mergers and acquisitions, public and private placement of debt and equity securities, and advising on restructurings and other corporate finance matters.

– SK Hynix Inc ($KOSE:000660)

SK Hynix is a South Korean semiconductor company that produces dynamic random-access memory (DRAM) chips and flash memory chips. SK Hynix is the world’s second-largest memory chipmaker after Samsung Electronics. The company has a market capitalization of US$65.46 billion as of March 2021.

SK Hynix was founded in 1983 as a joint venture between Hyundai Electronics and Samsung Electronics. The company’s main manufacturing facility is located in Icheon, South Korea. SK Hynix also has fabrication plants in China, the United States, and Taiwan.

The company’s products are used in a variety of electronic devices, including personal computers, servers, mobile devices, and digital cameras. SK Hynix is a major supplier of DRAM chips to companies such as Apple, Samsung, and Dell.

SK Hynix reported a 15.68% return on equity for the year ended December 31, 2020.

– CE Info Systems Ltd ($BSE:543425)

HCL Technologies Ltd, a leading global technology company, has a market cap of $70.19 billion as of March 2022. The company’s return on equity (ROE) is 18.0%. HCL Technologies is a provider of IT services, including digital, technology, consulting, and operations services. The company has a strong presence in India, the United States, Europe, and Asia Pacific.

Summary

Lyft has experienced a significant plunge in its stock price, dropping by 75% after the company released their Q4 2022 earnings and lowered their guidance. This has caused worry among investors, who are now uncertain about the company’s future prospects. Analysts are cautioning investors to be mindful of Lyft’s financials and potential risks before investing in the company. It is important to do proper due diligence before investing, as this may help to mitigate any losses that may be incurred from investing in Lyft.

Recent Posts