LivePerson Inc Shares Plunge After Disappointing Q4 Earnings in 2023

March 21, 2023

Trending News 🌧️

LIVEPERSON ($NASDAQ:LPSN): This week, investors of LivePerson Inc, a major provider of customer engagement software, were stunned to see the company’s stock price plunge after the release of its Q4 earnings results. The earnings report revealed that the company had failed to meet expectations, resulting in a dramatic decrease in the stock price. This comes as a surprise, given that LivePerson Inc had seen a steady growth in their stock price over the past few years. This is especially concerning considering that the company had seen a period of strong performance throughout 2023, with promising growth projections for the final quarter of the year. Analysts are now speculating on what caused the sudden downturn in LivePerson Inc’s stock price. It is possible that the company overestimated their growth projections, or that there were unexpected market forces at play.

Whatever the cause, investors are now faced with a difficult decision as to whether to hold or sell their shares in the company. Going forward, LivePerson Inc must now prove to its shareholders that it can recover from this setback. If the company is able to demonstrate a solid rebound, then investors may be willing to take another look at the stock price. Until then, LivePerson Inc shares will remain in a state of flux.

Market Price

LivePerson Inc, a provider of digital customer engagement solutions, saw its shares plunge after the company reported its disappointing fourth quarter earnings for the year 2023. On Friday, LIVEPERSON‘s stock opened at $4.1 and closed at $4.2, representing a 1.9% increase from the previous closing price of $4.1. Additionally, the company’s net income was below analysts’ estimates due to higher expenses incurred during the quarter. This resulted in a sharp sell-off in its stock prices, with investors fearing that the company’s growth could be affected going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Liveperson. More…

| Total Revenues | Net Income | Net Margin |

| 514.8 | -225.75 | -41.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Liveperson. More…

| Operations | Investing | Financing |

| -62.1 | -56.86 | 1.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Liveperson. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.09k | 1.02k | 1.19 |

Key Ratios Snapshot

Some of the financial key ratios for Liveperson are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.9% | – | -39.2% |

| FCF Margin | ROE | ROA |

| -22.0% | -141.0% | -11.6% |

Analysis

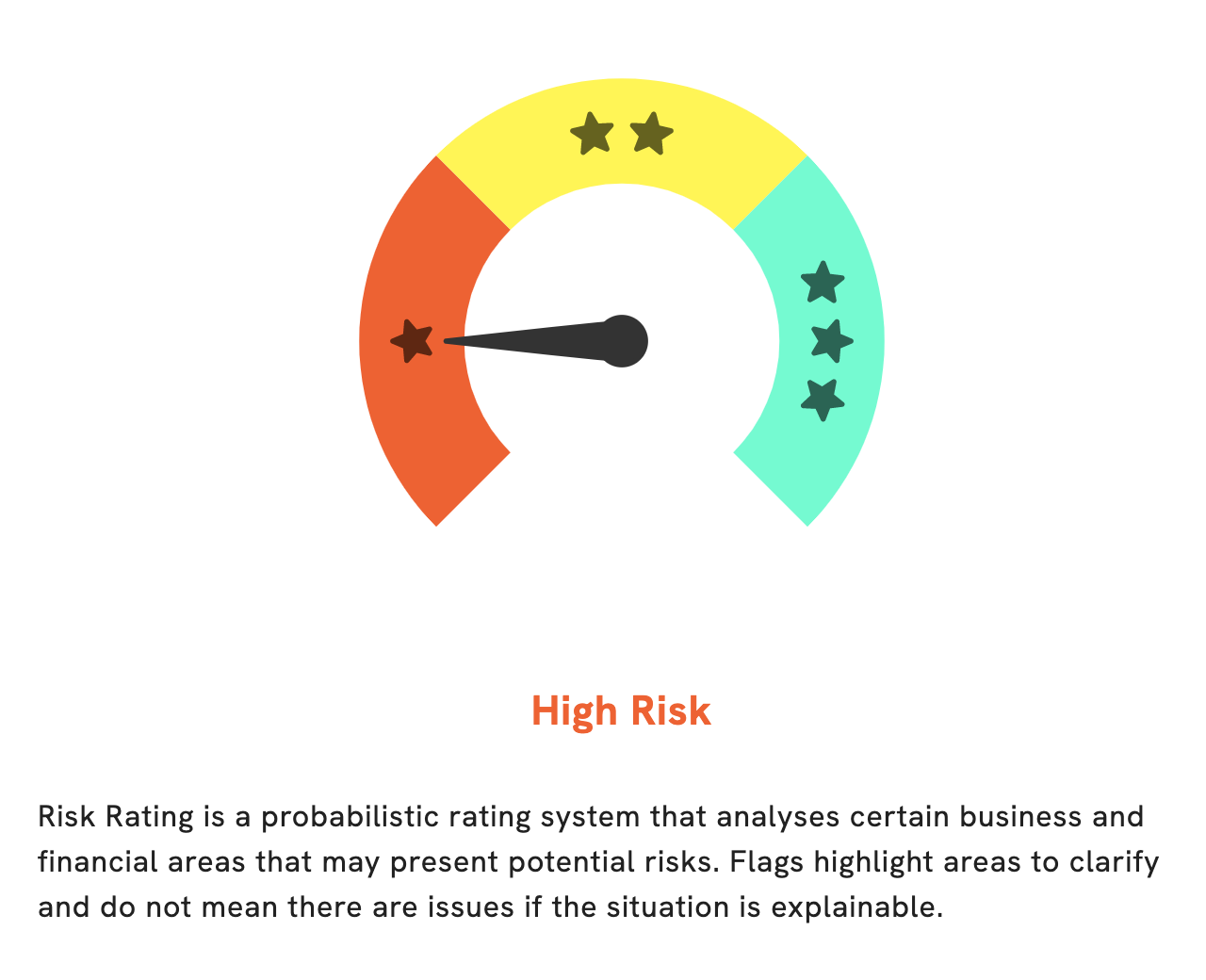

At GoodWhale, we have conducted an analysis of LIVEPERSON‘s well-being using our Risk Rating tool. Based on our findings, LIVEPERSON is a high risk investment from both a financial and business perspective. The Risk Rating tool revealed three risk warnings in the income sheet, cashflow statement, and non-financial aspects of the company. To gain access to more detailed findings, become a registered user on GoodWhale to check it out. More…

Peers

The competition between LivePerson Inc and its competitors is fierce. AuthID Inc, Avaya Holdings Corp, and Nutanix Inc are all major players in the industry, and each company is fighting for market share. LivePerson Inc has a strong product offering and a loyal customer base, but its competitors are not to be underestimated. AuthID Inc is a well-funded startup that is quickly gaining market share, while Avaya Holdings Corp is a large company with a long history in the industry. Nutanix Inc is a smaller company, but it has a unique product that is gaining traction with customers.

– AuthID Inc ($NASDAQ:AUID)

IDEMIA is a French multinational company that provides identity solutions. The company has a market cap of 27.76M and a ROE of -150.97%. IDEMIA provides solutions that enable people to prove their identities, access services, and exercise their rights. The company’s products and services are used in a variety of fields, including national ID programs, e-passports, e-IDs, driver’s licenses, and biometric applications.

– Avaya Holdings Corp ($NYSE:AVYA)

Avaya Holdings Corp is a publicly traded company with a market capitalization of 131.14 million as of 2022. The company has a return on equity of 658.8%. Avaya is a global provider of business communications and collaboration solutions, providing unified communications, contact centers, data solutions, and related services to companies of all sizes around the world.

– Nutanix Inc ($NASDAQ:NTNX)

Nutanix Inc is a cloud computing company that provides a web-scale converged infrastructure platform that combines compute, storage, and networking resources into a single integrated solution. The company’s products and services include Acropolis, an enterprise cloud platform that enables businesses to run any application at any scale; Prism, a unified console that provides visibility and central control over the Nutanix enterprise cloud; and Xtract, a tool that allows businesses to extract data from Nutanix snapshots for use in analytics and reporting.

Summary

LivePerson Inc. suffered a dramatic drop in share prices after reporting its Q4 earnings for 2023. The company saw a significant decline year-over-year in both its revenue and profit, missing analyst expectations and erasing investor gains made earlier in the year. The disappointing performance has raised concerns about LivePerson’s future growth prospects and caused its share price to plummet. As a result, investors are advised to re-evaluate their investment strategies and assess the risk of investing in LivePerson stock.

Recent Posts