Investors File Class Action Lawsuit Against Expensify,

December 30, 2023

🌧️Trending News

Expensify ($NASDAQ:EXFY), Inc., a leading financial management software provider, is facing a class action lawsuit filed by a nationally ranked investors’ rights firm on behalf of its investors. The lawsuit alleges that the company has made false and/or misleading statements about certain aspects of its business, resulting in investors suffering financial losses. Expensify is best known for its cloud-based expense management software, which allows users to track and manage their expenses while on the go. It also provides an employee spending platform, enabling businesses to track their employees’ spending and quickly reimburse them. The firm behind the class action lawsuit has stated that it believes the information provided to investors in the registration statement for the company’s IPO and in subsequent filings was not only false but also misleading.

The firm has requested an undisclosed amount of compensation for investors who have suffered losses as a result of these alleged misrepresentations. Investors who wish to join the class action lawsuit are encouraged to contact the firm in order to determine their eligibility. The firm is actively investigating the matter and seeking more potential claimants to join the lawsuit. As of now, no hearing or trial date has been set for this matter.

Share Price

On Thursday, a class action lawsuit was filed against Expensify, Inc. by its investors. The suit alleges that the company has engaged in securities fraud and mismanaged investor funds. At the start of the trading day, EXPENSIFY stock opened at $2.4 and closed at $2.5, representing a 3.7% increase from its prior closing price of $2.4.

This lawsuit has yet to be settled in court and the ultimate outcome is still unclear. It remains to be seen how this will affect the company’s stock price going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Expensify. More…

| Total Revenues | Net Income | Net Margin |

| 158.95 | -37.65 | -23.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Expensify. More…

| Operations | Investing | Financing |

| 8.75 | -5.66 | -16.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Expensify. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 212.31 | 117.26 | 1.14 |

Key Ratios Snapshot

Some of the financial key ratios for Expensify are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.2% | – | -17.5% |

| FCF Margin | ROE | ROA |

| 1.9% | -17.9% | -8.2% |

Analysis

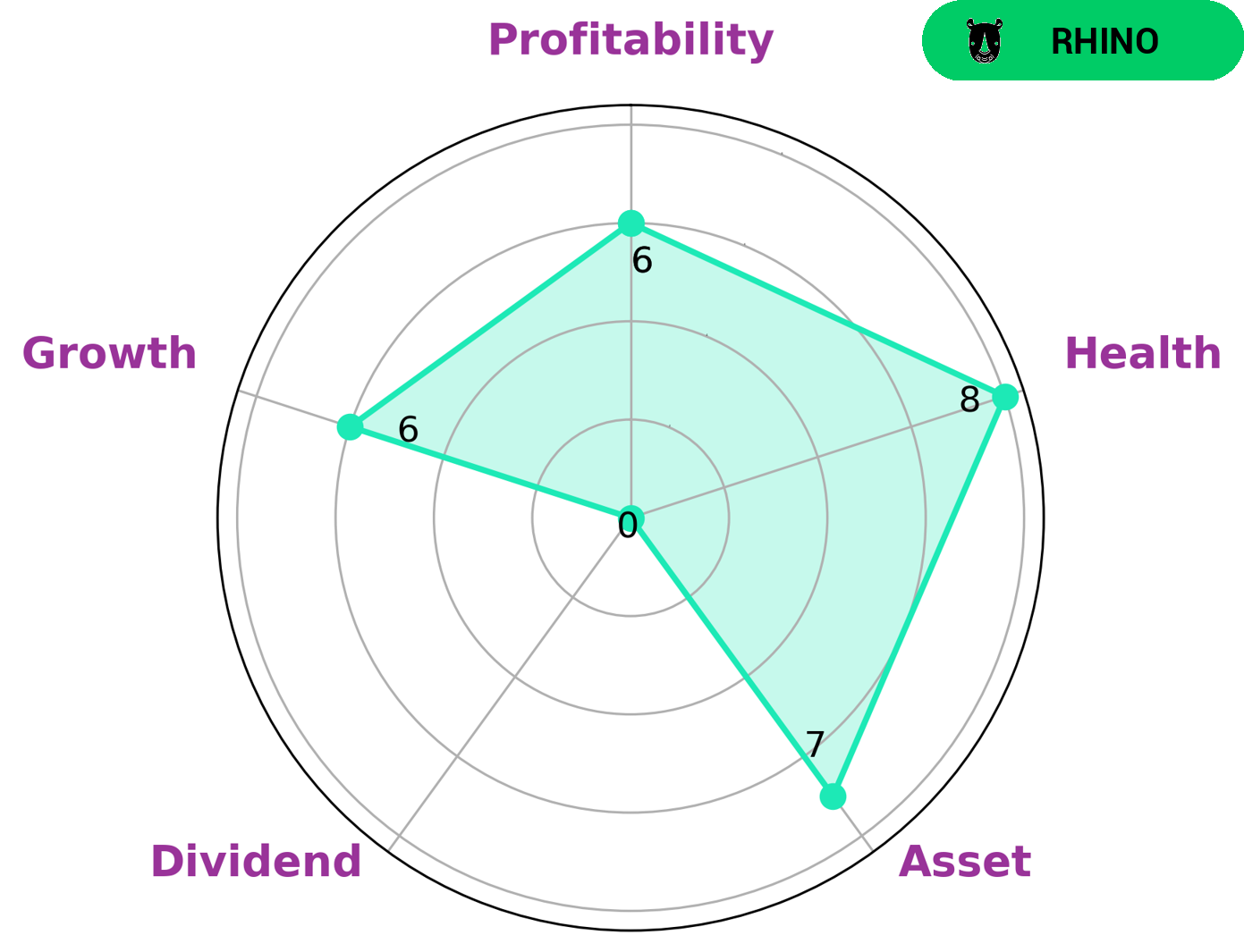

GoodWhale has conducted an examination of EXPENSIFY’s fundamentals and determined that they are classified as a ‘rhino’ type company, meaning they have achieved moderate revenue or earnings growth. We believe that this type of company may be of interest to investors looking for a solid and steady return. According to our Star Chart, EXPENSIFY is strong in asset growth, medium in profitability and weak in dividend. Additionally, we have given them an overall health score of 8/10, as their cashflows and debt are solid enough to weather any crisis. We believe this makes them an ideal candidate for those looking for a moderately successful investment. More…

Peers

Its main competitors are Thinkific Labs Inc, IODM Ltd, and DocuSign Inc.

– Thinkific Labs Inc ($TSX:THNC)

Thinkific Labs Inc is a Canadian company that provides an online course platform for entrepreneurs, businesses, and individuals. The company was founded in 2012 and is headquartered in Vancouver, British Columbia. As of 2022, the company has a market cap of 281.34M and a ROE of -21.73%. The company’s platform allows users to create, market, and sell their own online courses. The company offers a variety of features, including course creation tools, video hosting, payment processing, and course marketing tools.

– IODM Ltd ($ASX:IOD)

Period is a medical technology company that develops and commercializes innovative products for the treatment of heavy menstrual bleeding, or menorrhagia. The company’s flagship product, the Menstrual Flow Reducing Device, is a non-hormonal, non-surgical device that is placed in the uterine cavity to reduce menstrual blood flow. Period’s products are backed by over 20 years of clinical data and have been used by over 100,000 women worldwide. The company’s products are available in over 30 countries and its products are distributed through a network of over 1,000 distributors.

– DocuSign Inc ($NASDAQ:DOCU)

DocuSign Inc is a company that provides electronic signature technology and digital transaction management services. It has a market cap of 10.09B as of 2022 and a Return on Equity of -15.28%. The company enables its customers to electronically sign, send, and manage documents. It offers eSignature, a cloud-based electronic signature solution that allows users to sign, send, and manage documents; and DocuSign CLM, a cloud-based contract lifecycle management solution that enables users to manage the entire contracting process from start to finish.

Summary

Investors in Expensify, Inc. have filed a class action lawsuit over alleged breaches of fiduciary duties. The lawsuit claims that the company and its officers and directors caused damages to the investors, such as a decrease in stock price. On the same day the lawsuit was announced, Expensify’s stock price increased which suggests that investors believe the company may be able to successfully defend itself, or that the lawsuit may not have a significant impact on its operations. Nevertheless, investors should remain aware of the potential risks and rewards posed by this class action lawsuit and the developments of the case.

Recent Posts