Envestnet: A Prime Infotech Software Investment Prospect for Professional Investors

February 1, 2023

Trending News ☀️

Envestnet ($NYSE:ENV) is an infotech software company that has recently been gaining attention from professional investors, who are looking for ways to capitalize on the potential of the investment industry. The company focuses on providing financial advisors with a range of tools and services to help them manage portfolios and analyze markets. In particular, Envestnet stands out for its innovative solutions that help advisors make informed decisions. Envestnet is a publicly traded stock (NYSE:ENV) and has seen an impressive increase in its share price over the past few years. This is due largely to the company’s success in creating a comprehensive platform for advisors to use, as well as its ability to adapt to the ever-changing needs of the financial markets. As a result, many investors have seen the potential in Envestnet and are now looking to capitalize on their near-term capital gains. In addition to providing innovative solutions for advisors, Envestnet also offers a suite of services to help investors manage their portfolios.

This includes portfolio management, risk analysis, and portfolio optimization tools. By leveraging these services, investors can make informed decisions and optimize their portfolios for maximum returns. Finally, Envestnet also offers an online platform, which allows investors to easily access their portfolios and make trades without having to contact their financial advisor. This helps investors stay informed and up-to-date with their investments, enabling them to maximize their gains. The company’s innovative solutions, comprehensive platform, and suite of services provide investors with a great opportunity to capitalize on the potential of the investment industry. With its impressive share price growth and wide range of offerings, Envestnet is definitely worth considering for those looking for near-term capital gains.

Stock Price

Envestnet is a prime infotech software investment prospect for professional investors, and right now news surrounding the company is mostly positive. On Tuesday, ENVESTNET stock opened at $65.5 and closed at $65.0, a slight dip of 0.8% from the last closing price of 65.5. Although the stock is down, investors are still optimistic about the company’s prospects in the long run. The company has been making impressive progress in its sector and has been delivering strong financial results over the past few quarters. Envestnet has been steadily expanding its product portfolio and expanding geographically to new markets. The company has also been making strategic acquisitions to strengthen its position in the market. Envestnet also has a strong management team with expertise in its sector. The company’s leadership team is highly experienced and capable of making decisions that are in the best interest of their shareholders. They have been able to navigate the challenges of a highly competitive marketplace and keep up with the changing dynamics of the industry.

In addition, Envestnet has an impressive track record of innovation, which has helped it stay ahead of competitors. The company has invested heavily in research and development and has developed cutting-edge technology to stay ahead of the curve. This has enabled them to develop products and services that meet the needs of their customers. Although the stock has seen a dip in recent days, investors should have confidence that the company will be able to continue to deliver strong performance going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Envestnet. More…

| Total Revenues | Net Income | Net Margin |

| 1.27k | -49.54 | -3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Envestnet. More…

| Operations | Investing | Financing |

| 166.84 | -267.85 | -48.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Envestnet. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.2k | 1.26k | 17 |

Key Ratios Snapshot

Some of the financial key ratios for Envestnet are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.3% | 42.0% | -4.0% |

| FCF Margin | ROE | ROA |

| 3.4% | -3.4% | -1.4% |

Analysis

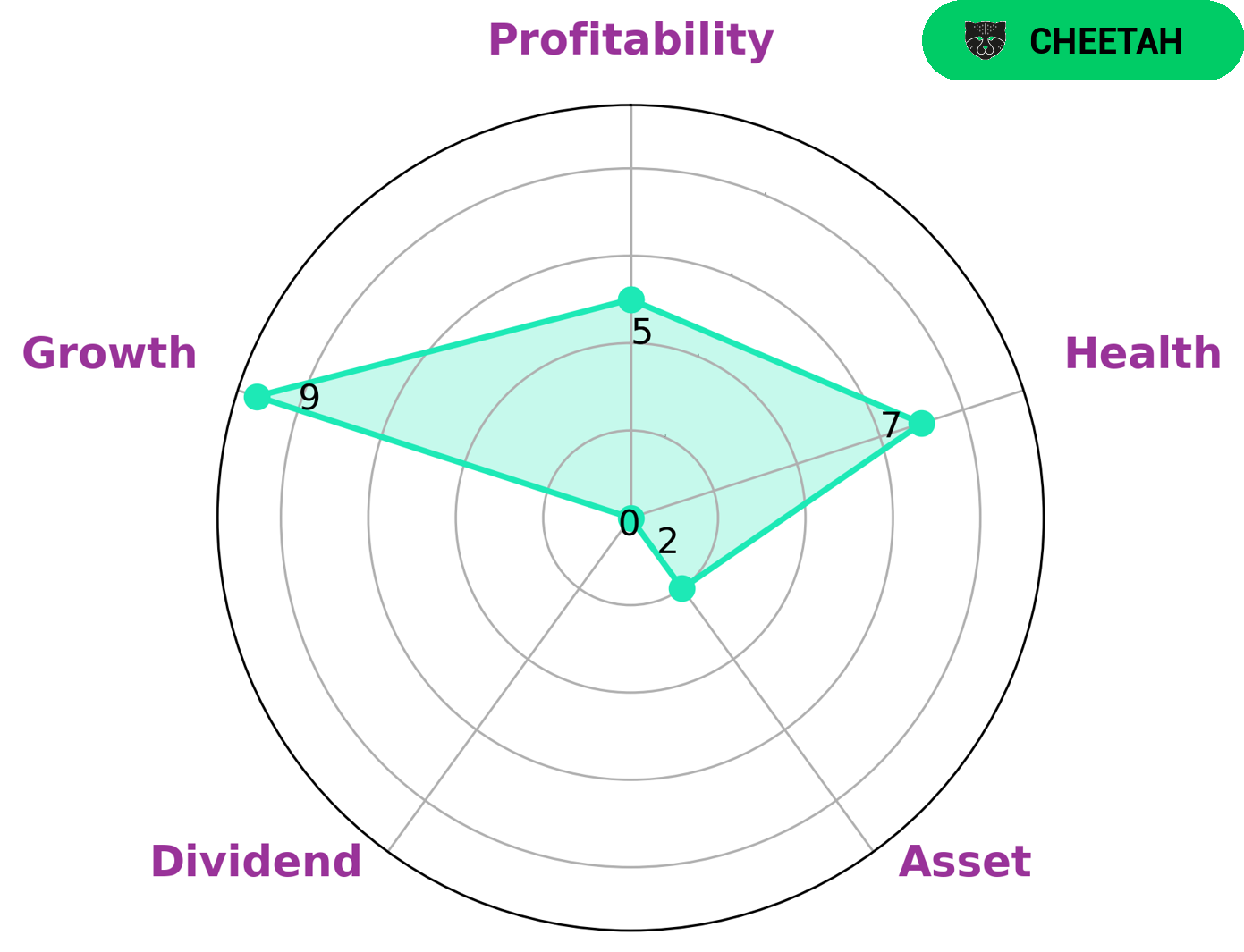

GoodWhale’s analysis of ENVESTNET‘s financials reveals a strong growth, medium profitability and weak asset and dividend. ENVESTNET is classified as a ‘cheetah’, a type of company that is able to achieve high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors who prioritize capital appreciation and are willing to accept higher risks. ENVESTNET has a health score of 7/10 considering its cashflows and debt, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. Investors should be aware of the higher risks associated with investing in ENVESTNET as it is likely more volatile than other more established firms. Additionally, investors should pay attention to the company’s dividend paying history as ENVESTNET does not have a track record of paying out dividends. When considering investing in ENVESTNET, investors should take into account the company’s financial performance, management’s ability to make the right decisions, and their outlook for the future. Investors should also consider the risk tolerance of their portfolio and the potential rewards associated with investing in ENVESTNET. By properly evaluating the risks and rewards associated with ENVESTNET, investors can determine if the company is right for them. More…

Peers

The competition between Envestnet Inc and its competitors is fierce. Each company is vying for market share and customer loyalty. Envestnet Inc has a strong product offering and a loyal customer base.

However, its competitors are not to be underestimated. Liquid Holdings Group Inc, Clearwater Analytics Holdings Inc, and Centergistic Solutions Inc are all viable competitors in the market.

– Liquid Holdings Group Inc ($OTCPK:LIQDQ)

Liquid Holdings Group Inc is a financial technology company that provides an integrated suite of cloud-based solutions for the global hedge fund and active trading markets. The company’s solutions include order and execution management, portfolio and risk management, and compliance and reporting. Liquid Holdings Group Inc is headquartered in New York, New York.

– Clearwater Analytics Holdings Inc ($NYSE:CWAN)

Clearwater Analytics Holdings Inc is a provider of cloud-based software solutions for the global insurance industry. The company’s software solutions are used by insurance companies and other financial institutions to manage their investment portfolios, including risk management and compliance. Clearwater’s software solutions are delivered through a software-as-a-service (SaaS) model and are available on a subscription basis.

Summary

Envestnet is an attractive investment prospect for professional investors. It is a Prime Infotech software solution that provides comprehensive portfolio management, risk management, analytics, and compliance solutions. The company has been recognized for its innovative technology and has consistently performed well in terms of financial performance. Investors have been attracted to Envestnet’s robust portfolio capabilities and the potential to leverage its data-driven insights to make informed decisions.

Analysts have noted its strong customer base and strong fundamentals, with a strong focus on risk management and compliance. It has been noted that Envestnet is well-positioned to benefit from the industry’s digital transformation, which is expected to drive growth in the coming years. With its leading technology and strong financials, Envestnet is an attractive option for investors looking for long-term returns.

Recent Posts