Analyzing LivePerson Performance Against Industry Rivals

April 6, 2023

Trending News 🌥️

LIVEPERSON ($NASDAQ:LPSN): Analyzing LivePerson Inc. performance against industry rivals is an important task for investors and analysts alike. LivePerson Inc. is a publicly-traded technology company that provides a comprehensive set of real-time communication and engagement solutions. The company focuses on the development and deployment of AI-powered messaging solutions to facilitate customer-to-business conversations through mobile, web and messaging applications. By leveraging the power of artificial intelligence, LivePerson Inc. aims to maximize customer engagement and satisfaction while delivering superior customer service. A comparison of LivePerson Inc. with its peers is essential in understanding the company’s performance in the market and determining its leadership potential in the industry.

From a financial perspective, LivePerson Inc. has consistently outperformed its peers in terms of revenue growth, profitability and return on equity over the past few years. Overall, LivePerson Inc. has emerged as a leading player in the real-time communication and engagement solutions space and continues to demonstrate a strong track record of financial performance and stock market performance. As such, investors looking for an attractive investment opportunity in the technology sector should consider taking a closer look at LivePerson Inc.

Share Price

On Thursday, LIVEPERSON stock opened at $4.2 and closed at $4.2, down by 2.1% from the prior closing price of 4.2. This indicates a lower stock value than many of its rivals, suggesting that LivePerson Inc. may not be performing as well as other companies. It is worth noting, however, that stock prices can be affected by a variety of factors and may not always be an accurate indication of a company’s true performance. Further analysis is needed to determine the underlying factors behind this decrease in stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Liveperson. LivePerson_Performance_Against_Industry_Rivals”>More…

| Total Revenues | Net Income | Net Margin |

| 514.8 | -225.75 | -41.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Liveperson. LivePerson_Performance_Against_Industry_Rivals”>More…

| Operations | Investing | Financing |

| -62.1 | -56.86 | 1.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Liveperson. LivePerson_Performance_Against_Industry_Rivals”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.09k | 1.02k | 1.19 |

Key Ratios Snapshot

Some of the financial key ratios for Liveperson are shown below. LivePerson_Performance_Against_Industry_Rivals”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.9% | – | -39.2% |

| FCF Margin | ROE | ROA |

| -22.0% | -141.0% | -11.6% |

Analysis

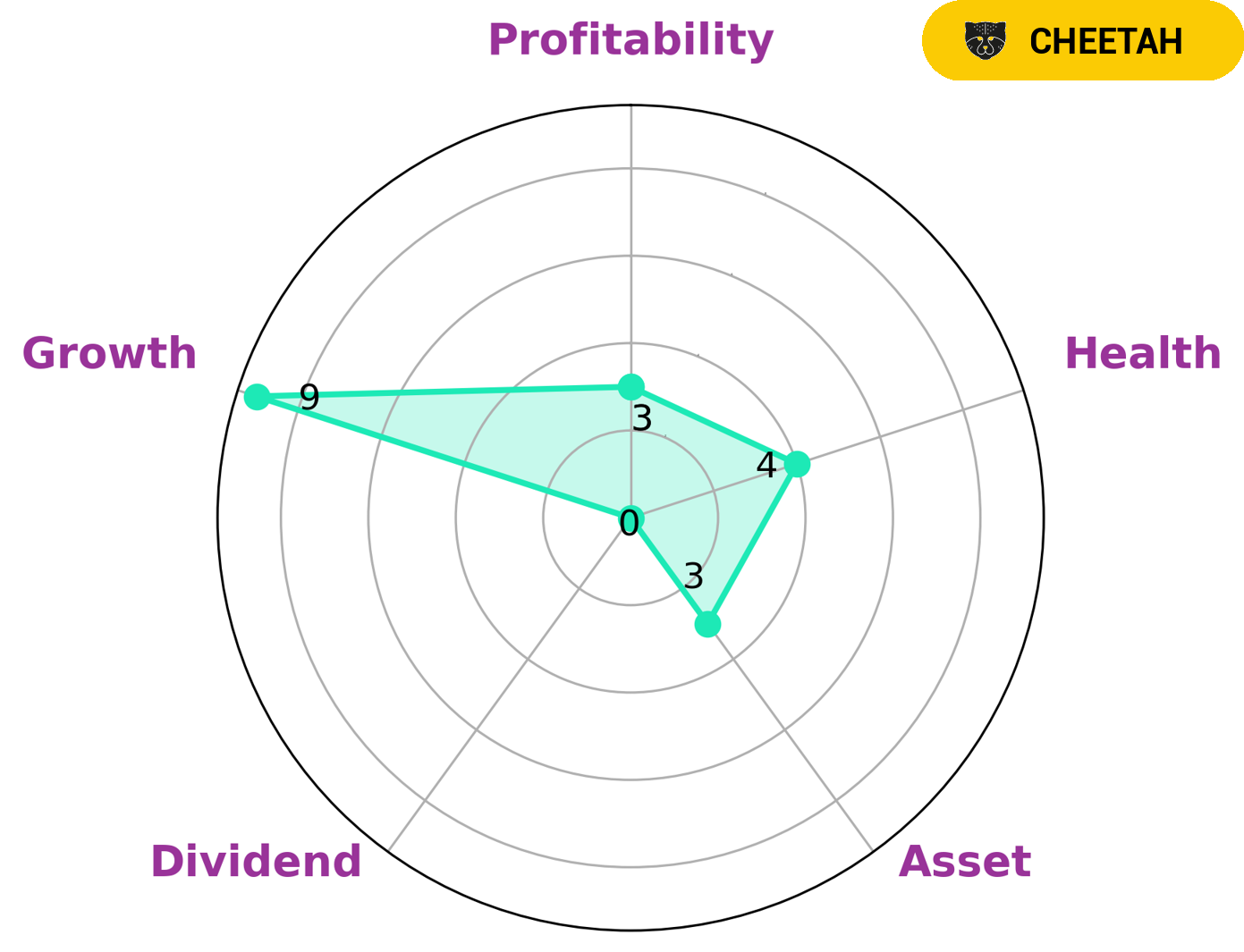

At GoodWhale, we analyzed the fundamentals of LIVEPERSON to help investors determine if it is an investment worth looking into. Based on our Star Chart model, LIVEPERSON is classified as a ‘cheetah’ which indicates that it has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. As such, investors who have an appetite for risk and potential rewards may be interested in this company. We see that LIVEPERSON has a strong performance in terms of growth, with a weaker performance when it comes to assets, dividends, and profitability. Its intermediate health score of 4/10 with regards to cashflows and debt suggests that it might be able to pay off debt and fund future operations. More…

Peers

The competition between LivePerson Inc and its competitors is fierce. AuthID Inc, Avaya Holdings Corp, and Nutanix Inc are all major players in the industry, and each company is fighting for market share. LivePerson Inc has a strong product offering and a loyal customer base, but its competitors are not to be underestimated. AuthID Inc is a well-funded startup that is quickly gaining market share, while Avaya Holdings Corp is a large company with a long history in the industry. Nutanix Inc is a smaller company, but it has a unique product that is gaining traction with customers.

– AuthID Inc ($NASDAQ:AUID)

IDEMIA is a French multinational company that provides identity solutions. The company has a market cap of 27.76M and a ROE of -150.97%. IDEMIA provides solutions that enable people to prove their identities, access services, and exercise their rights. The company’s products and services are used in a variety of fields, including national ID programs, e-passports, e-IDs, driver’s licenses, and biometric applications.

– Avaya Holdings Corp ($NYSE:AVYA)

Avaya Holdings Corp is a publicly traded company with a market capitalization of 131.14 million as of 2022. The company has a return on equity of 658.8%. Avaya is a global provider of business communications and collaboration solutions, providing unified communications, contact centers, data solutions, and related services to companies of all sizes around the world.

– Nutanix Inc ($NASDAQ:NTNX)

Nutanix Inc is a cloud computing company that provides a web-scale converged infrastructure platform that combines compute, storage, and networking resources into a single integrated solution. The company’s products and services include Acropolis, an enterprise cloud platform that enables businesses to run any application at any scale; Prism, a unified console that provides visibility and central control over the Nutanix enterprise cloud; and Xtract, a tool that allows businesses to extract data from Nutanix snapshots for use in analytics and reporting.

Summary

LivePerson Inc. is an online conversational commerce provider that enables businesses to provide personalized customer support through its proprietary natural language processing (NLP) and artificial intelligence (AI) technologies. LIVEPERSON‘s performance is largely driven by its strong customer base, which consists of large companies such as Facebook and Microsoft. Furthermore, their innovative AI-driven products such as their chatbot platform, Conversation Builder, have been driving revenue growth. Compared to peers, LivePerson Inc. has consistently outperformed with regards to stock performance, demonstrating its potential for long-term growth. In conclusion, LivePerson Inc. appears to be a worthwhile investment option and has the potential to offer investors a secure, profitable return on their investments.

Recent Posts