Analysts Agree: Bumble a Solid “Moderate Buy” Investment

April 21, 2023

Trending News ☀️

Bumble Inc ($NASDAQ:BMBL). is an online dating and social networking company located in Austin, Texas. With a focus on creating relationships for users, Bumble Inc. has become a leader in the dating field. Recently, analysts have taken a closer look at the stock of Bumble Inc. and have given it a “Moderate Buy” recommendation. On average, 23 analysts that are covering the stock have given it this rating. The analysts’ consensus was driven by positive reviews of the company’s product and services, as well as its growing user base.

Many believe that the company is well-positioned to capitalize on the demand for online dating services. Furthermore, Bumble Inc. has demonstrated strong financial performance in its most recent quarterly report. Overall, the Moderate Buy recommendation of Bumble Inc. indicates that analysts agree that the stock should be a good investment for investors looking for long-term potential. With its strong financials, growing user base, and innovative products and services, Bumble Inc. is an attractive option for those looking to invest in the online dating market.

Stock Price

Analysts have recently provided a moderate buy rating for BUMBLE INC stock, citing the tech giant’s strong market position and expected growth potential. On Thursday, BUMBLE INC stock opened at $17.3 and closed at $17.3, a 1.8% decline from the prior closing price of $17.6. This suggests that investors remain largely confident in the continued performance of the stock and the future prospects for the company. Analysts have cited the company’s strong product portfolio, which includes popular online and mobile applications, as a major factor in the positive outlook.

Additionally, their innovative marketing strategy has enabled them to be recognized as a leader in the social networking industry. The company’s strong market position and expected growth potential make it an attractive investment choice for both long-term and short-term investors. With its high quality products, sustained user growth and innovative marketing strategies, BUMBLE INC is well placed to continue delivering value to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bumble Inc. More…

| Total Revenues | Net Income | Net Margin |

| 903.5 | -79.75 | -8.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bumble Inc. More…

| Operations | Investing | Financing |

| 132.94 | -86.05 | -14.95 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bumble Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.69k | 1.24k | 13.08 |

Key Ratios Snapshot

Some of the financial key ratios for Bumble Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.7% | – | -11.4% |

| FCF Margin | ROE | ROA |

| 12.9% | -3.9% | -1.7% |

Analysis

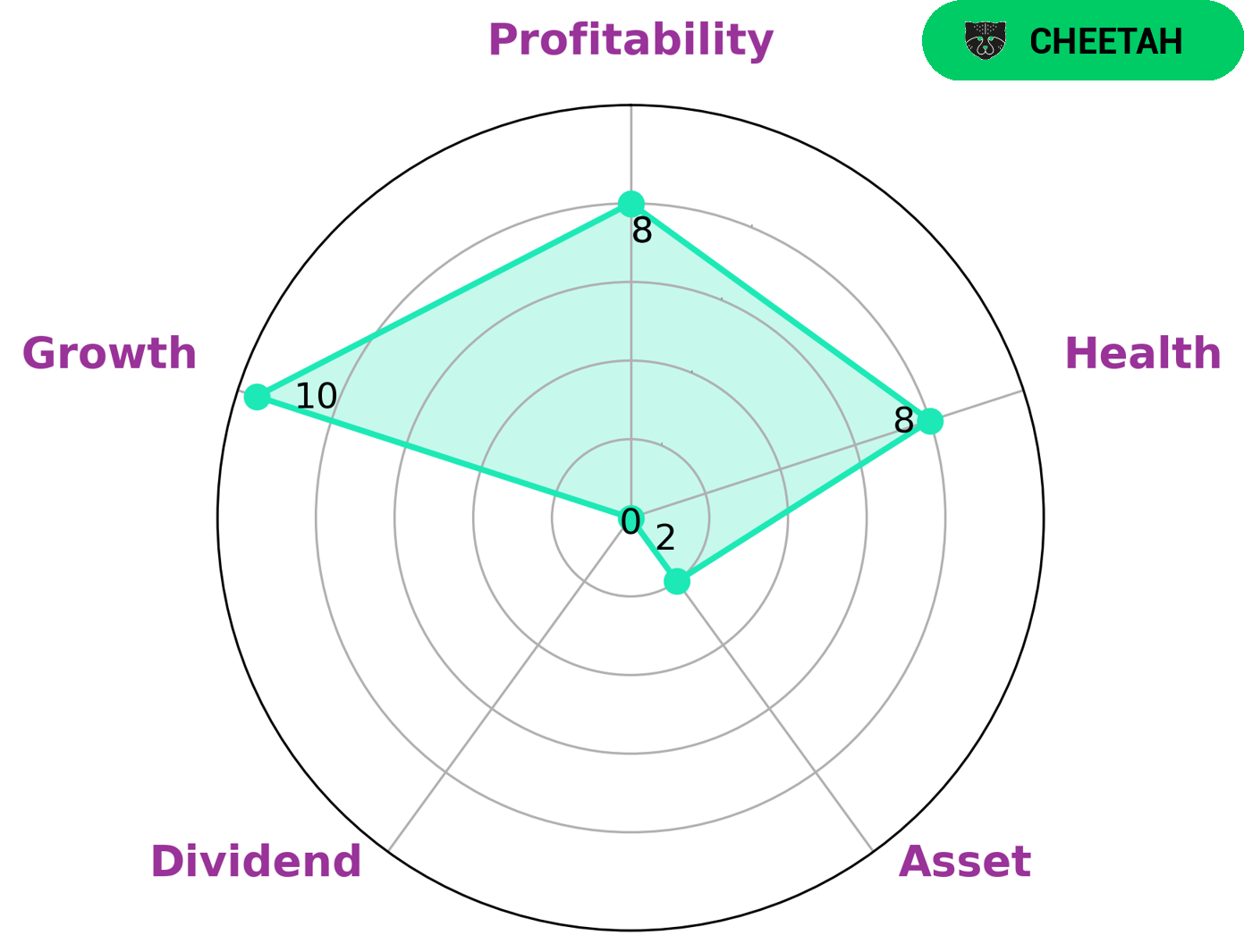

GoodWhale has conducted a thorough analysis of BUMBLE INC‘s fundamentals and the results are quite impressive. According to our Star Chart, BUMBLE INC has an impressive health score of 8/10, indicating that it is in good financial health and is capable of paying off debt and funding future operations. Furthermore, we have classified BUMBLE INC as a ‘cheetah’, because it has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Given BUMBLE INC’s strong growth, profitability, and weak asset and dividend figures, it may be attractive to investors looking for higher returns with higher risks. These may include venture capitalists, hedge funds and other institutional investors. Additionally, individual investors looking for higher returns may also be interested in investing in BUMBLE INC. More…

Peers

The company was founded in 2014 by Whitney Wolfe Herd and is headquartered in Austin, Texas. Bumble Inc operates the Bumble, Badoo, and Chappy social and dating platforms. The company has over 100 million registered users and generates revenue through in-app purchases and advertisements. Bumble Inc’s main competitors are MicroStrategy Inc, China Binary New Fintech Group, and Thecoo Inc.

– MicroStrategy Inc ($NASDAQ:MSTR)

MicroStrategy Inc is a company that provides business intelligence, mobile software, and cloud-based services. It has a market cap of 3.14B and an ROE of 122.06%. The company was founded in 1989 and is headquartered in Tysons Corner, Virginia.

– China Binary New Fintech Group ($SEHK:08255)

Binary New Fintech Group is a leading provider of online financial services in China. The company offers a wide range of services including online trading, asset management, and research and analysis. It has a market cap of 40.8M as of 2022 and a return on equity of -23846.21%. The company is headquartered in Beijing, China.

– Thecoo Inc ($TSE:4255)

Thecoo Inc has a market cap of 4.15B as of 2022, a Return on Equity of -6.79%. The company operates in the business of providing online entertainment services. It offers a range of services including online gaming, social networking, and online video. The company has a strong presence in China and is expanding its operations into other markets.

Summary

Investment analysts have given Bumble Inc. a “Moderate Buy” rating, with 23 analysts following the stock. This rating is based on the company’s strong fundamentals, such as its revenue growth, operating performance, and financial position. Investors should consider these factors when deciding whether to purchase shares in the company.

Additionally, analysts have noted that Bumble Inc. has a competitive advantage in its market, as it is well-positioned to benefit from current and future industry trends. Finally, the company’s products and services are expected to remain in-demand in the near-term, with potential for growth in the long-term.

Recent Posts