after stock surge

April 15, 2023

Trending News ☀️

Microstrategy Incorporated ($NASDAQ:MSTR) saw its stock plunge today as traders took profits following a surge in price. The company, which is a leading provider of enterprise analytics, mobility and security software, has seen its share price rise significantly in the past year due to increased demand for its products.

However, investors have been keen to take profits from this growth and the share price dropped today as a result. The downturn in the share price came despite the company’s strong financials, which include strong revenue growth and healthy profits.

In addition, the company has made strides in the mobile space, with its MicroStrategy Mobile offering becoming increasingly popular. Despite this success, investors felt that the stock had become over-valued and decided to take their profits.

Market Price

On Friday, MICROSTRATEGY INCORPORATED stock opened at $342.8 and closed at $333.8, down by 2.0% from its previous closing price of $340.7. The losses are likely attributed to investors taking profits following the increase in price. Despite these announcements, MICROSTRATEGY INCORPORATED shares are currently trading lower than before the news was announced. The decline in share prices are reflective of investors cashing in their profits as the company continues to make its moves in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Microstrategy Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 499.26 | -1.47k | -139.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Microstrategy Incorporated. More…

| Operations | Investing | Financing |

| 3.21 | -278.59 | 265.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Microstrategy Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.41k | 2.79k | -33.17 |

Key Ratios Snapshot

Some of the financial key ratios for Microstrategy Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.9% | 126.2% | 2.1% |

| FCF Margin | ROE | ROA |

| -57.5% | -2.3% | 0.3% |

Analysis

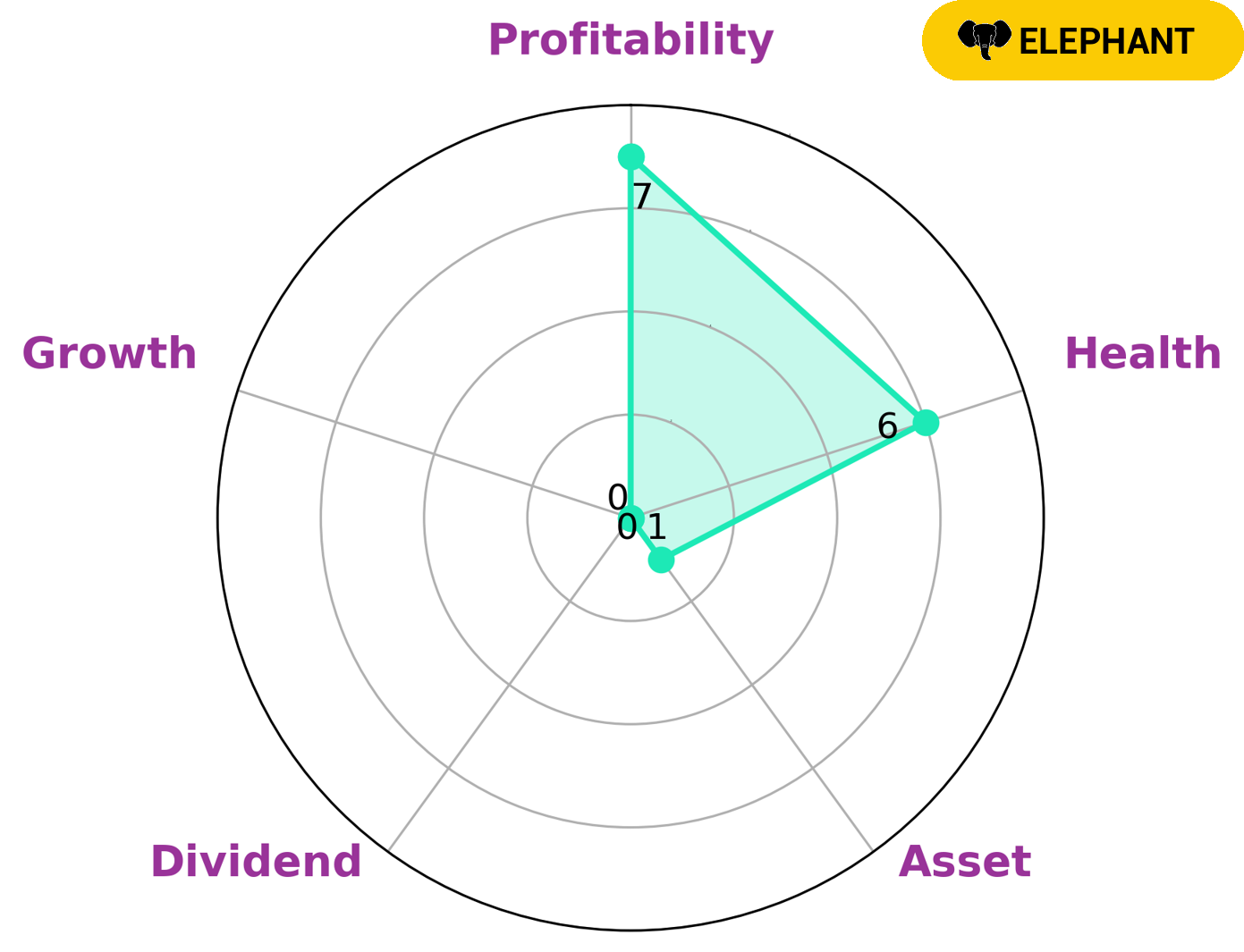

GoodWhale recently conducted an analysis of MICROSTRATEGY INCORPORATED‘s wellbeing. Our Star Chart revealed that MICROSTRATEGY INCORPORATED has an intermediate health score of 6/10 in terms of its cashflows and debt, indicating that it might be able to sustain its future operations in times of crisis. We classified MICROSTRATEGY INCORPORATED as an ‘elephant’, a type of company which we conclude is rich in assets after deducting off liabilities. Given this insight, we can determine the kind of investors who may be interested in MICROSTRATEGY INCORPORATED. The company is strong in terms of profitability, though it is weak in terms of asset, dividend, and growth. Therefore, investors looking for short-term gains or for companies with a strong potential for growth may not find this particular company very attractive. Meanwhile, long-term investors or those looking for companies with a steady stream of income may find MICROSTRATEGY INCORPORATED to be an interesting option. More…

Peers

The company’s main competitors are Coinbase Global Inc, Riot Blockchain Inc, Bakkt Holdings Inc.

– Coinbase Global Inc ($NASDAQ:COIN)

Coinbase Global Inc is a digital asset exchange company. The Company’s mission is to create an open financial system for the world. The Company operates a digital currency exchange platform for individual and institutional investors, traders, and developers. The Company offers its products and services through its online platform and mobile application. The Company serves customers in North America, Europe, Asia Pacific, South America, and the Middle East and Africa.

– Riot Blockchain Inc ($NASDAQ:RIOT)

Riot Blockchain Inc has a market cap of 893.37M as of 2022. The company’s ROE for the same year is -2.48%. Riot Blockchain Inc is a provider of blockchain technology solutions to the global financial markets. The company’s mission is to be the leading blockchain technology provider in the world.

– Bakkt Holdings Inc ($NYSE:BKKT)

Bakkt Holdings Inc is a company that provides digital asset custody, trading, and other financial services. As of 2022, the company had a market capitalization of 164.26 million and a return on equity of -26.03%. The company’s primary focus is on digital assets, such as Bitcoin, and providing custody, trading, and other financial services related to these assets.

Summary

MicroStrategy Incorporated is a publicly-traded software company that provides analytics and security solutions. Investing analysis of the company reveals that its stock price has been volatile in recent months, with investors booking profits as the stock has risen significantly. The company’s financials show that it has generated strong revenue growth, but profit margins have not kept pace with those of its peers. The company’s balance sheet is strong, and its board of directors has endorsed a share buyback and dividend program.

The company is also pursuing strategic initiatives such as developing new products and services, entering new markets, and executing cost-savings initiatives. Ultimately, investors must carefully weigh the risks and rewards of investing in MicroStrategy before making a decision.

Recent Posts