Graham Capital Wealth Management LLC Invests in DiamondHead Holdings Corp. in Fourth Quarter

May 9, 2023

Trending News ☀️

DIAMONDHEAD ($NASDAQ:DHHC): DiamondHead Holdings Corp. is a publicly traded company that specializes in oil and gas investments. During the fourth quarter, it was acquired by Graham Capital Wealth Management LLC, as stated in the most recent disclosure filing. This acquisition marks the latest in a series of investments in the company, helping to drive its growth and reach new heights. Graham Capital Wealth Management LLC is one of the leading investment managers in the United States, with a focus on providing strategic advice to companies and institutions. Their acquisition of DiamondHead Holdings Corp marks their most recent endeavor, allowing them to further diversify their portfolio and capitalize on lucrative investments.

The investment appears to be a wise one, as DiamondHead Holdings Corp has made a name for itself as a leader in oil and gas investments. With their latest acquisition, Graham Capital Wealth Management LLC will be able to tap into their expertise and knowledge, while also gaining access to a larger pool of resources. Overall, the acquisition of DiamondHead Holdings Corp by Graham Capital Wealth Management LLC marks an exciting new chapter for both companies. With the latest investment, both firms will be able to further expand their reach and take advantage of lucrative opportunities, while also helping to drive the growth of the industry.

Share Price

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Diamondhead Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 0 | 7.07 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Diamondhead Holdings. More…

| Operations | Investing | Financing |

| -1.26 | 0.92 | 0.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Diamondhead Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 349.21 | 5.98 | 7.96 |

Key Ratios Snapshot

Some of the financial key ratios for Diamondhead Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | 1.5% | 1.4% |

Analysis

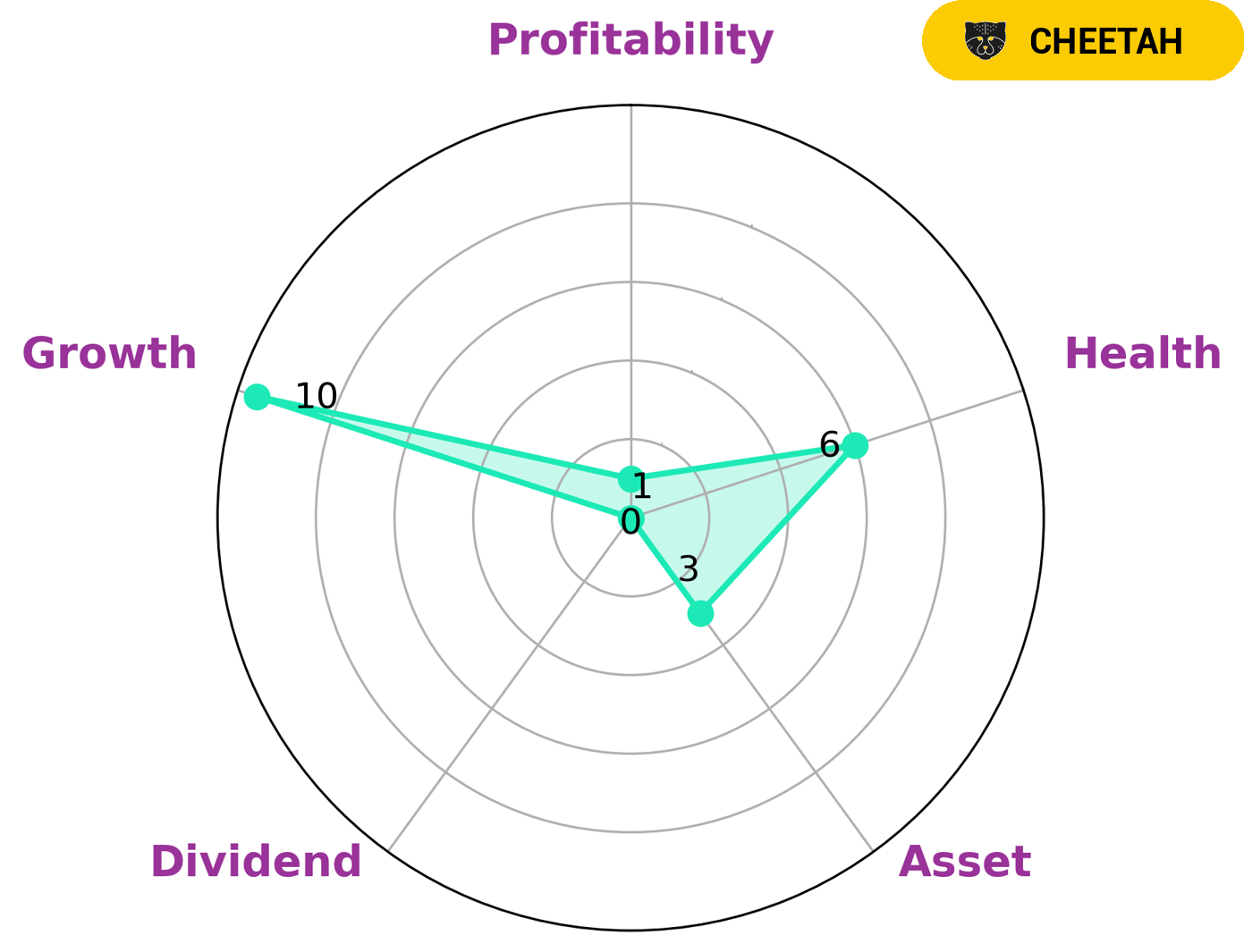

GoodWhale has conducted an evaluation of DIAMONDHEAD HOLDINGS‘ fundamentals and has provided a health score of 6/10 in terms of its cashflows and debt. This indicates that the company is likely to be able to withstand any crisis without the risk of bankruptcy. After analyzing the company’s performance, GoodWhale has also classified DIAMONDHEAD HOLDINGS as being a ‘cheetah’ type of company. This means that it has achieved high revenue and earnings growth, but is considered less stable due to lower profitability. Given this, investors who are interested in taking a gamble on companies with high growth potential but greater risk may be interested in investing in DIAMONDHEAD HOLDINGS. Despite its potential for growth, DIAMONDHEAD HOLDINGS does have some weaknesses such as a lack of assets, dividend and profitability. More…

Peers

They face stiff competition from Pontem Corp, HPX Corp and Levere Holdings Corp, all of which are well established and respected in their respective fields.

– Pontem Corp ($NYSE:PNTM)

Pontem Corp is a publicly traded company that specializes in the development and manufacturing of advanced medical equipment and technology. With a market cap of 884.06 million as of 2023, Pontem Corp is a major player in the medical equipment industry. The company has an impressive Return on Equity of -0.26%, which indicates that it has been successfully reinvesting its profits into its operations in order to drive future growth.

– HPX Corp ($NYSEAM:HPX)

HPX Corp is a leading technology company providing services in the areas of cloud computing, software development, and data analytics. The company has an impressive market cap of 84.65M as of 2023, reflecting the strong trust and confidence of investors in the future of HPX’s products and services. HPX’s Return on Equity (ROE) of -2.54% indicates that the company is not utilizing its shareholders’ investments efficiently to generate profits.

– Levere Holdings Corp ($NASDAQ:LVRA)

Levere Holdings Corp is a multinational conglomerate that operates in a variety of industries, including aerospace, defense, healthcare, and electronics. As of 2023, the company has a market cap of 343.85 million and a negative return on equity of -0.35%. This suggests that the company has been struggling to generate profits relative to its equity base. While the company’s market cap is relatively modest compared to larger competitors, it could potentially benefit from restructuring efforts or strategic acquisitions to improve its financial performance.

Summary

DiamondHead Holdings Corp. (DHHC) is a publicly-traded holding company focused on special purpose acquisition companies (SPACs) and other value creation strategies, such as mergers, acquisitions, and joint venture investments. Analysts suggest that this trend could be indicative of investor caution in the face of a saturated SPAC market, as many have seen their stock prices fall in recent weeks due to a lack of new deals. Although DHHC has yet to announce any major transactions, investors may be betting that their experienced management team will be able to capitalize on the current market conditions as the company continues to explore and pursue opportunities.

Recent Posts