Texas Instruments’ First Quarter Preview – Capex Investment to Test Margin Performance

April 25, 2023

Trending News 🌥️

Texas Instruments ($NASDAQ:TXN) is a leading American technology and semiconductor manufacturer with a long history of success and innovation. As the company prepares to report its first quarter results, analysts are expecting a bottom for the company’s performance yet caution that capital expenditures may hinder its margin performance. An analysis of Texas Instruments’ upcoming first quarter results suggests that the company is likely to turn a corner this quarter, but investments in capital expenditures could test margin performance. With the global semiconductor market still weak and demand relatively low, any investment in capex could have a detrimental impact on TI’s margins.

This first quarter may prove to be a pivotal moment for Texas Instruments, as its performance will give investors a clearer indication of where the company is headed. With analysts predicting a bottom in sight and increased investment in capex, it remains to be seen how Texas Instruments can achieve a balance between short-term cost control and long-term growth.

Stock Price

Investors are closely monitoring the performance of the company, with its stock opening at $177.1 and closing at $175.9 on Monday, down by 0.6% from its previous closing price of 177.0. Analysts are expecting TI to report strong revenue growth in the first quarter, driven by increased demand for semiconductors and other products.

However, investors are also watching closely to see how TI manages its capital expenditure (Capex) investment, which is likely to have an impact on its margin performance. TI is expected to maintain a strong balance sheet and prudent financial discipline in order to drive further growth. TI’s performance in the first quarter will be an important indicator of its future prospects in the coming quarters. Investors will be looking for any signs of improvement in the company’s margins and cash flow, as well as evidence of increased market share and penetration into new markets. All eyes are on TI as it prepares to report its first-quarter results. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Texas Instruments. More…

| Total Revenues | Net Income | Net Margin |

| 20.03k | 8.71k | 44.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Texas Instruments. More…

| Operations | Investing | Financing |

| 8.72k | -3.58k | -6.72k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Texas Instruments. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.21k | 12.63k | 16.09 |

Key Ratios Snapshot

Some of the financial key ratios for Texas Instruments are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | 20.3% | 51.2% |

| FCF Margin | ROE | ROA |

| 29.6% | 44.0% | 23.5% |

Analysis

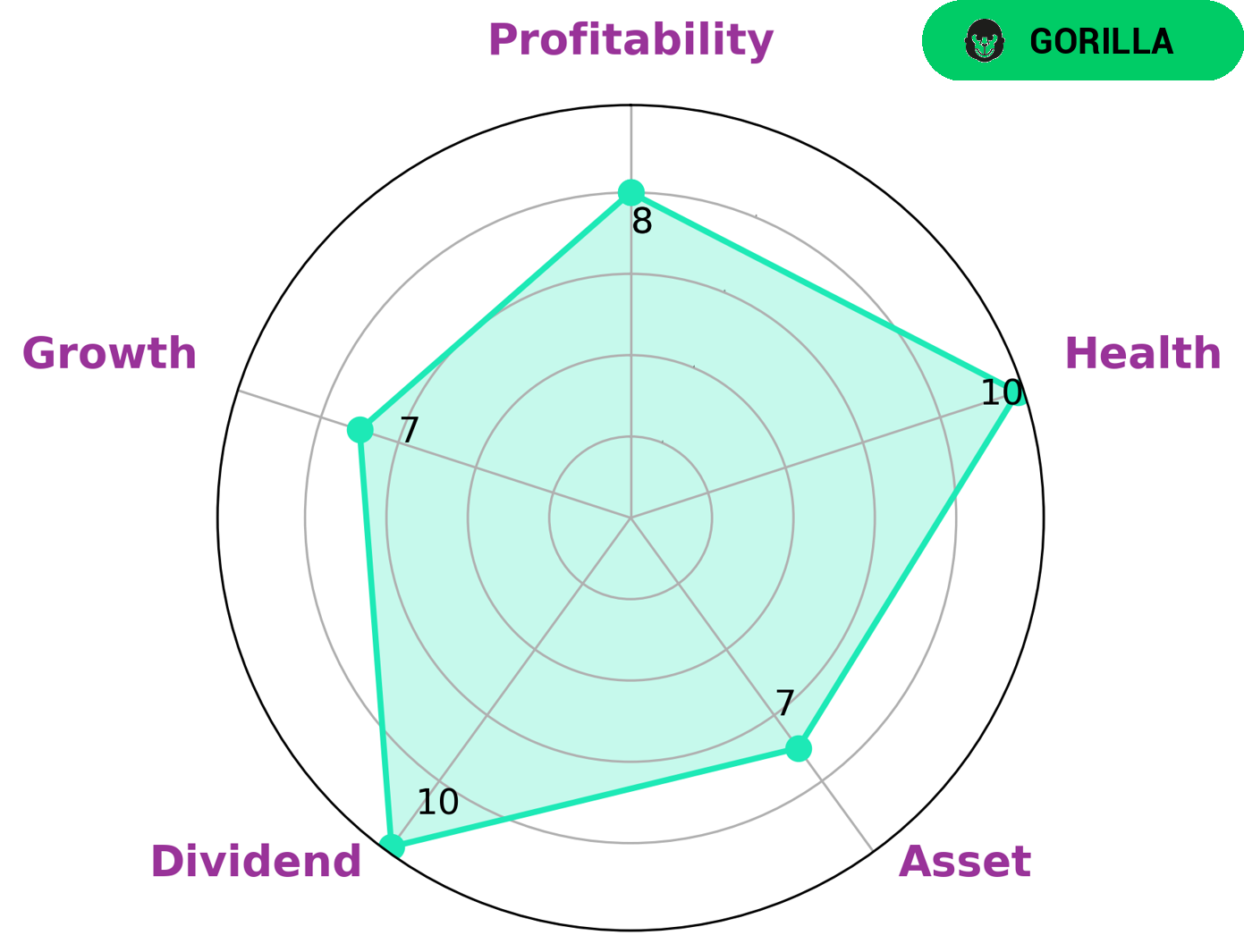

At GoodWhale, we recently conducted an analysis of Texas Instruments’ wellbeing. Our Star Chart shows that Texas Instruments is classified as a ‘Gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. For this reason, we believe that long-term investors looking for consistent returns with minimal risk would be interested in investing in Texas Instruments. Texas Instruments is strong in asset, dividend, growth, and profitability. According to our assessment, Texas Instruments scores highly in all these categories and has a high health score of 10/10 considering its cash flows and debt. This indicates that Texas Instruments is capable to safely ride out any crisis without the risk of bankruptcy. Overall, we believe Texas Instruments is a great option for long-term investors looking for consistent returns with minimal risk. More…

Peers

Texas Instruments Inc is one of the leading semiconductor companies in the world. Its competitors include SK Hynix Inc, Silergy Corp, and SPEL Semiconductor Ltd. Texas Instruments has a wide range of semiconductor products that are used in a variety of electronic devices.

– SK Hynix Inc ($KOSE:000660)

SK Hynix Inc is a South Korean company that manufactures and markets semiconductor memory products. The company has a market capitalization of $63.88 trillion as of 2022 and a return on equity of 15.68%. SK Hynix is the world’s second-largest manufacturer of dynamic random-access memory (DRAM) chips and the fifth-largest manufacturer of NAND flash memory chips. The company’s products are used in a variety of electronic devices, including computers, mobile phones, digital cameras, and game consoles.

– Silergy Corp ($TWSE:6415)

Silergy Corp is a global leader in the development and manufacture of high-performance, energy-efficient semiconductor solutions. The company’s products are used in a variety of applications, including mobile devices, computing, networking, and storage. Silergy Corp has a market cap of 159.26B as of 2022, a Return on Equity of 18.65%. The company’s products are used in a variety of applications, including mobile devices, computing, networking, and storage.

– SPEL Semiconductor Ltd ($BSE:517166)

SPEL Semiconductor Ltd is a fabless semiconductor company that designs, develops, and markets analog and mixed-signal integrated circuits (ICs) for a range of applications in the automotive, industrial, consumer, and computing markets. The company has a market cap of 2.66B as of 2022 and a Return on Equity of -6.07%. SPEL’s products include power management ICs, audio ICs, motor control ICs, and LED driver ICs. The company was founded in 1995 and is headquartered in Noida, India.

Summary

Though the bottom should be in sight, the company’s capital expenditures may pressure margins. The company is expecting strong demand in all its product categories, including semiconductors, embedded processors, and analog components.

Additionally, TI has been investing heavily in research & development to introduce new products that capture emerging markets. Overall, TI has a strong balance sheet and cash flow from operations to support further investments. Analysts are generally positive on the company’s outlook, projecting higher returns for shareholders in the coming quarters.

Recent Posts