TD Asset Management Boosts Investment in Texas Instruments Incorporated

May 3, 2023

Trending News ☀️

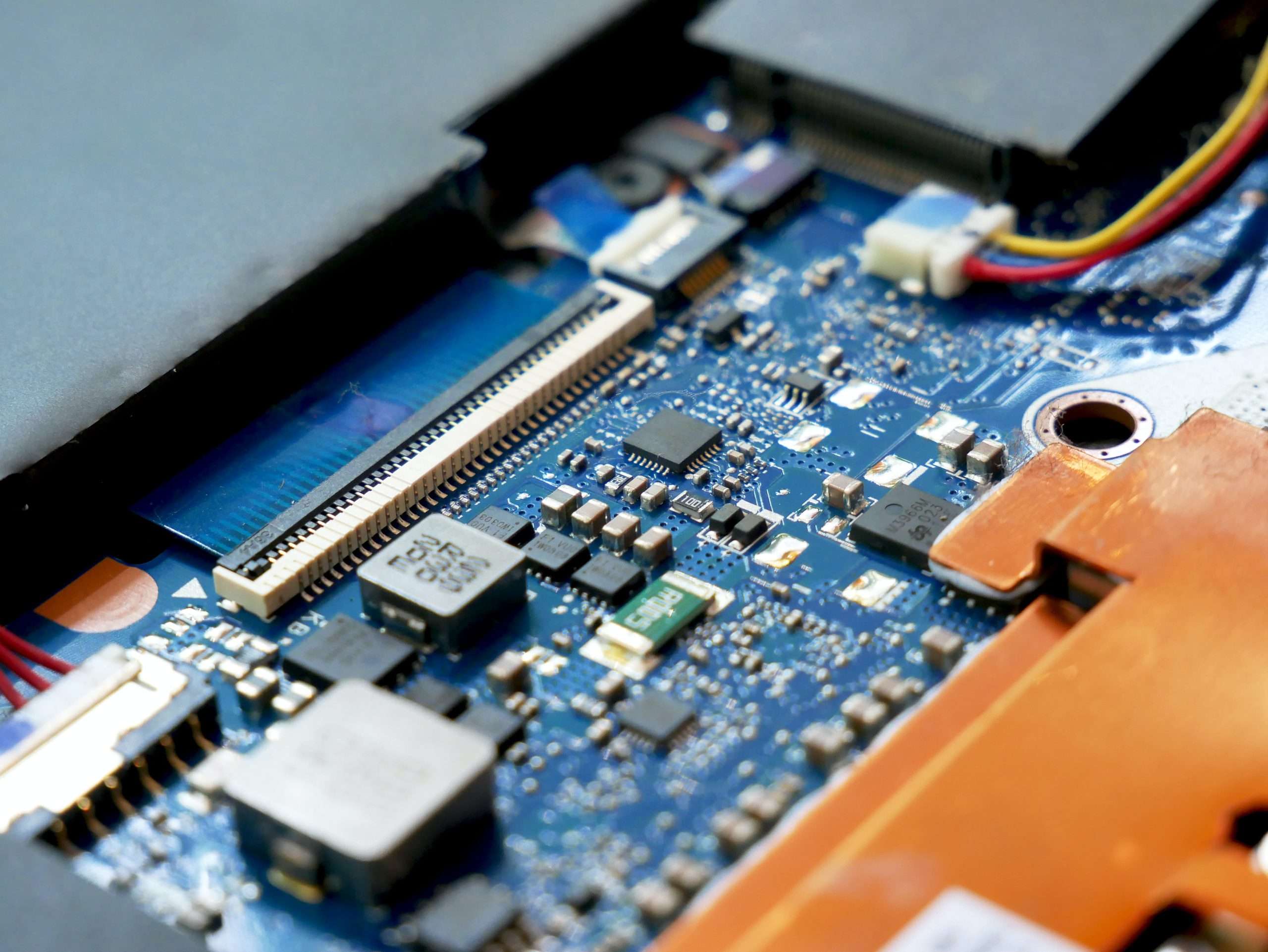

TD Asset Management Inc is one of the leading Canadian fund management companies that has recently been making headlines with its announcement of a major investment in Texas Instruments ($NASDAQ:TXN) Incorporated. It is a leading producer of analog and digital signal processing technology, as well as embedded processors, which are the primary components used in consumer electronics and industrial automation systems. TI has a wide range of products that are used in areas such as consumer electronics, automotive, health care, and communications, and its focus on innovation has made it one of the most successful organizations in the semiconductor industry. TD Asset Management’s decision to increase its investment in TI shows the company’s confidence in their products and potential for growth.

The increased investment is expected to help TI become even more of a leader in the semiconductor industry. This is great news for those who are looking to invest in TI, as the company will now be able to continue investing in new technologies, increasing their chances to be successful in the long run.

Share Price

On Monday, TD Asset Management announced a major investment in Texas Instruments Incorporated (TI). The stock opened at $168.2 and closed at $166.7, a 0.3% drop from the previous day’s closing price of $167.2. Despite the slight dip, the move indicates positive support for TI and its long-term potential.

TD Asset Management’s investment is reflective of the confidence in TI’s business model, financials, and strategic positioning. This move by TD Asset Management is a strong endorsement of TI’s future prospects and provides additional capital to enable the company to pursue its initiatives. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Texas Instruments. More…

| Total Revenues | Net Income | Net Margin |

| 19.5k | 8.22k | 43.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Texas Instruments. More…

| Operations | Investing | Financing |

| 7.74k | -1.89k | -4.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Texas Instruments. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.22k | 13.98k | 16.8 |

Key Ratios Snapshot

Some of the financial key ratios for Texas Instruments are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.4% | 18.6% | 49.6% |

| FCF Margin | ROE | ROA |

| 22.6% | 40.6% | 20.7% |

Analysis

At GoodWhale, we are proud to provide a comprehensive financial evaluation of Texas Instruments. Our Risk Rating system has assigned the company a low risk rating, meaning it is considered a relatively safe investment. Our analysis takes into consideration all important financial and business aspects and our evaluation is based on the most up-to-date data available. GoodWhale has also detected two risk warnings in the company’s income sheet and balance sheet. This could be indicative of potential issues that should be taken into consideration before investing. If you’re interested in learning more about these warnings, become a registered user and you can access this information. More…

Peers

Texas Instruments Inc is one of the leading semiconductor companies in the world. Its competitors include SK Hynix Inc, Silergy Corp, and SPEL Semiconductor Ltd. Texas Instruments has a wide range of semiconductor products that are used in a variety of electronic devices.

– SK Hynix Inc ($KOSE:000660)

SK Hynix Inc is a South Korean company that manufactures and markets semiconductor memory products. The company has a market capitalization of $63.88 trillion as of 2022 and a return on equity of 15.68%. SK Hynix is the world’s second-largest manufacturer of dynamic random-access memory (DRAM) chips and the fifth-largest manufacturer of NAND flash memory chips. The company’s products are used in a variety of electronic devices, including computers, mobile phones, digital cameras, and game consoles.

– Silergy Corp ($TWSE:6415)

Silergy Corp is a global leader in the development and manufacture of high-performance, energy-efficient semiconductor solutions. The company’s products are used in a variety of applications, including mobile devices, computing, networking, and storage. Silergy Corp has a market cap of 159.26B as of 2022, a Return on Equity of 18.65%. The company’s products are used in a variety of applications, including mobile devices, computing, networking, and storage.

– SPEL Semiconductor Ltd ($BSE:517166)

SPEL Semiconductor Ltd is a fabless semiconductor company that designs, develops, and markets analog and mixed-signal integrated circuits (ICs) for a range of applications in the automotive, industrial, consumer, and computing markets. The company has a market cap of 2.66B as of 2022 and a Return on Equity of -6.07%. SPEL’s products include power management ICs, audio ICs, motor control ICs, and LED driver ICs. The company was founded in 1995 and is headquartered in Noida, India.

Summary

Texas Instruments Incorporated (TI) is a global leader in designing and manufacturing semiconductors, analog technology, and embedded processors. Its products are found in applications ranging from consumer electronics to automotive, industrial, and communications equipment. TI has a strong presence in the technology sector and is a favorite among investors. TI’s fundamentals remain strong, with a solid balance sheet and ample cash reserves. TI’s return on assets also remains strong and its debt/equity ratio is low, making it a safe investment.

Additionally, the company’s earnings per share (EPS) has grown steadily over the past few years and is expected to continue to increase in the future. Given these strong fundamentals, it is no surprise that TD Asset Management Inc has recently increased its holdings in the company.

Recent Posts