SIMO Intrinsic Value – SILICON MOTION TECHNOLOGY Beats Q3 Earnings Despite Year-on-Year Revenue Decline

November 8, 2023

🌥️Trending News

Silicon Motion Technology ($NASDAQ:SIMO) Corporation, an American-based technology company specializing in the design and production of embedded flash storage solutions, successfully beat its Q3 earnings expectations despite a year-over-year decline in revenues. This marks yet another successful quarter for Silicon Motion, who has seen steady growth despite the changing economic landscape. The company’s Q3 earnings exceeded expectations, despite the year-over-year decrease in revenues. The company attributes this success to their focus on expanding their product portfolio, as well as their ability to keep costs low in the face of declining revenue. Silicon Motion is a leader in the embedded Non-Volatile Memory market, offering a variety of products ranging from SSD controllers to embedded flash storage solutions. These products are used in a wide range of industries, from automotive to data centers.

Most recently, the company has also been focusing on expanding their presence in the mobile market, launching a series of mobile storage controllers and flash solutions tailored to this sector. Silicon Motion’s successful Q3 earnings are a testament to the company’s strength and resilience despite the changing global economic climate. The company’s record-high operating and non-GAAP net income demonstrate Silicon Motion’s ability to keep costs low while still providing quality products for their customers. With their focus on expanding their product portfolio and presence in the mobile market, Silicon Motion is well-positioned for continued success in the coming quarters.

Earnings

In its latest earnings report for the fiscal year of 2023 Q3 ending September 30, 2021, SILICON MOTION TECHNOLOGY reported total revenue of 254.24M USD and net income of 55.42M USD, representing a 1.4% increase in total revenue and 29.2% increase in net income compared to the same period last year. Despite the overall growth, SILICON MOTION TECHNOLOGY’s total revenue decreased from 254.24M USD to 172.33M USD in the past three years. These results demonstrate SILICON MOTION TECHNOLOGY’s ability to maintain profitability despite a decrease in revenue.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SIMO. More…

| Total Revenues | Net Income | Net Margin |

| 637.52 | 55.32 | 7.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SIMO. More…

| Operations | Investing | Financing |

| 147.94 | -48.48 | -0.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SIMO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 966.92 | 192.87 | 21.93 |

Key Ratios Snapshot

Some of the financial key ratios for SIMO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.1% | -23.6% | 7.3% |

| FCF Margin | ROE | ROA |

| 15.6% | 4.0% | 3.0% |

Price History

On Friday, SILICON MOTION TECHNOLOGY (SIMO) reported their third-quarter earnings and beat analyst expectations despite a year-on-year revenue decline. Despite this, SIMO stock opened at $56.3 and closed at $55.8, down by 0.6% from the previous closing price of 56.1. Overall, despite the slight decrease in revenue compared to prior year, SILICON MOTION TECHNOLOGY still managed to beat analyst expectations in terms of earnings and provided a positive outlook for their fourth quarter revenues. This has led to a moderately positive response in the markets as investors remain optimistic about the company’s future prospects. Live Quote…

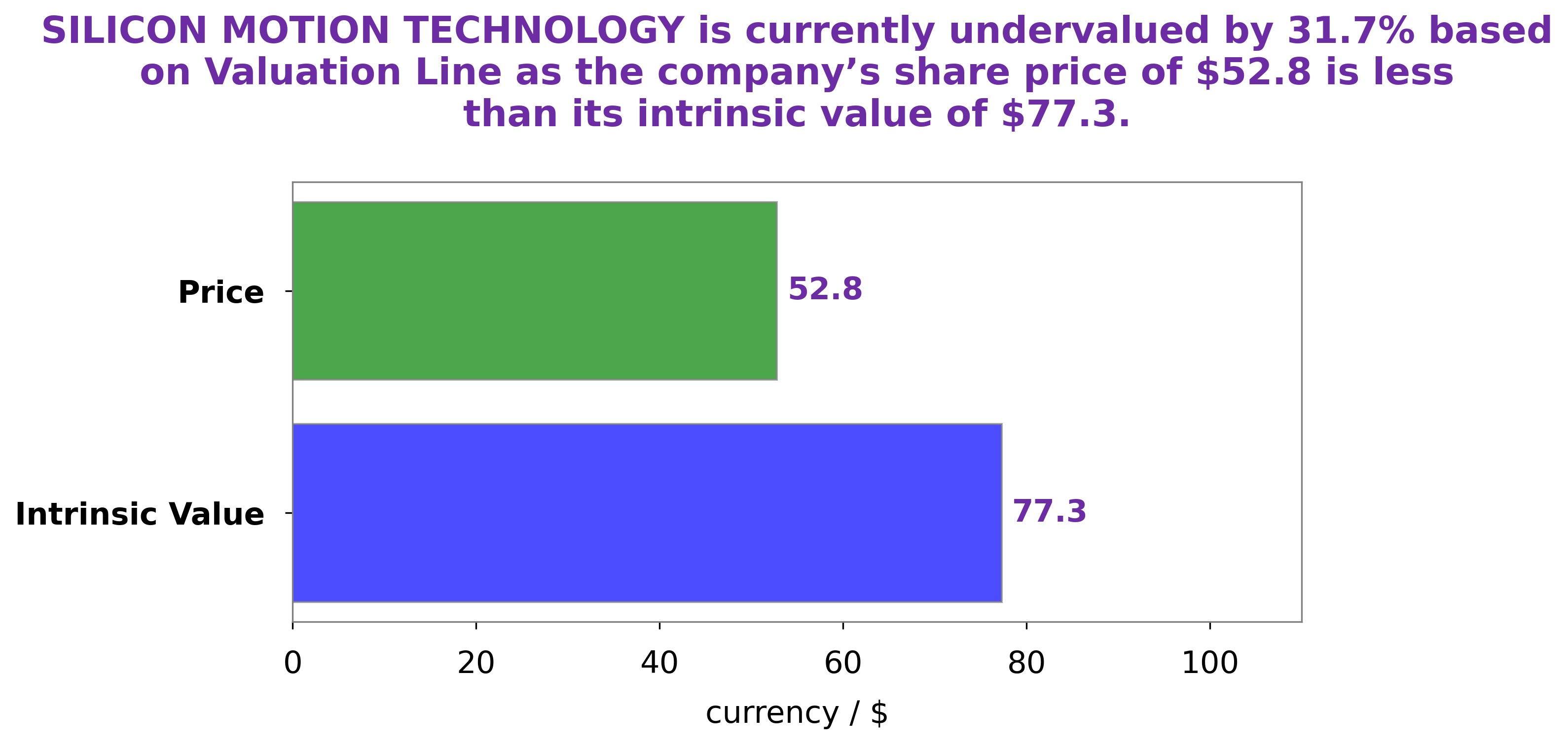

Analysis – SIMO Intrinsic Value

At GoodWhale, we have conducted an analysis of SILICON MOTION TECHNOLOGY’s wellbeing. After careful consideration, we have determined that the fair value of SILICON MOTION TECHNOLOGY share is around $23.6. This figure was calculated using our proprietary Valuation Line. However, at present, SILICON MOTION TECHNOLOGY stock is traded at $55.8, which means that the stock is overvalued by 136.1%. We believe that this discrepancy is likely due to a combination of market sentiment and speculation. More…

Peers

The company’s products are used in a wide range of devices, including digital cameras, camcorders, MP3 players, USB flash drives, and solid state drives. Silicon Motion Technology Corp competes with Marvell Technology Inc, Qualcomm Inc, and Microchip Technology Inc in the development and manufacture of NAND flash controllers.

– Marvell Technology Inc ($NASDAQ:MRVL)

With a market cap of 33.23B as of 2022 and a ROE of 0.5%, Marvell Technology Inc is a company that designs, develops, and markets analog, mixed-signal, digital signal processing, and embedded and standalone integrated circuits. The company’s products are used in a variety of end markets, including data storage, enterprise, cloud, automotive, industrial, consumer, mobile, and networking.

– Qualcomm Inc ($NASDAQ:QCOM)

Qualcomm Inc is a global semiconductor company that designs, manufactures, and markets digital wireless telecommunications products and services. The company has a market capitalization of 119.6 billion as of 2022 and a return on equity of 56.84%. Qualcomm’s products and services include wireless voice and data communications, multimedia, and business solutions. The company’s products are used in a variety of mobile devices, including cell phones, tablets, laptops, and cars.

– Microchip Technology Inc ($NASDAQ:MCHP)

Microchip Technology Inc. is a leading provider of microcontroller, mixed-signal, analog and Flash-IP solutions, providing low-risk product development, lower total system cost and faster time to market for thousands of diverse customer applications worldwide.

Summary

Overall, investors should be pleased with the company’s performance in the quarter and the outlook for future growth.

Recent Posts