Qorvo Reports Record Q3 2023 Non-GAAP EPS of $0.75, Surpassing Expectations by $0.12.

February 2, 2023

Trending News 🌥️

Qorvo ($NASDAQ:QRVO) Inc., a radio-frequency semiconductor company, recently reported a record Non-GAAP EPS of $0.75 for their third quarter of 2023. Qorvo is a leading provider of radio-frequency semiconductors and technologies to the mobile, infrastructure, and defense and aerospace markets. Their portfolio includes power amplifiers, switches, tuners, filters, and integrated modules. The higher-than-expected earnings were attributed to product sales in several end markets including mobile, infrastructure and defense. Going forward, Qorvo expects non-GAAP earnings to remain strong in the fourth quarter of 2023.

However, their outlook for the full year of 2023 remains unchanged. Overall, Qorvo reported record non-GAAP EPS for the third quarter of 2023 that exceeded expectations by $0.12. This was mainly due to strong demand for their products across mobile, infrastructure and defense end markets.

Price History

On Wednesday, QORVO, a leading provider of innovative RF solutions, reported record non-GAAP earnings per share (EPS) of $0.75 for their third quarter of 2023, surpassing market expectations by $0.12. The impressive results sent their stock soaring, opening at $109.3 and closing at $113.5, up 4.5% from the prior closing price of 108.7. The strong performance of QORVO was driven primarily by their Mobile Products business segment, as well as their Infrastructure and Defense Products segment. Their Mobile Products segment continued to be one of their primary sources of revenue, with strong demand in both China and North America. Meanwhile, the Infrastructure and Defense Products segment continued to remain a reliable source of income for QORVO, thanks to their focus on providing innovative RF solutions for a variety of applications, ranging from defense to industrial.

In addition to the strong performance of their two primary segments, QORVO also benefitted from their cost-cutting measures and focus on operational efficiency. This allowed them to reduce their operating expenses, resulting in higher profits and higher margins. With their impressive financial results and focus on providing innovative solutions, QORVO is well-positioned to continue delivering positive results in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Qorvo. More…

| Total Revenues | Net Income | Net Margin |

| 4.47k | 686.04 | 15.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Qorvo. More…

| Operations | Investing | Financing |

| 1k | -412.64 | -825.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Qorvo. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.37k | 3.05k | 42.63 |

Key Ratios Snapshot

Some of the financial key ratios for Qorvo are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.1% | 43.7% | 20.7% |

| FCF Margin | ROE | ROA |

| 18.1% | 13.4% | 7.8% |

Analysis

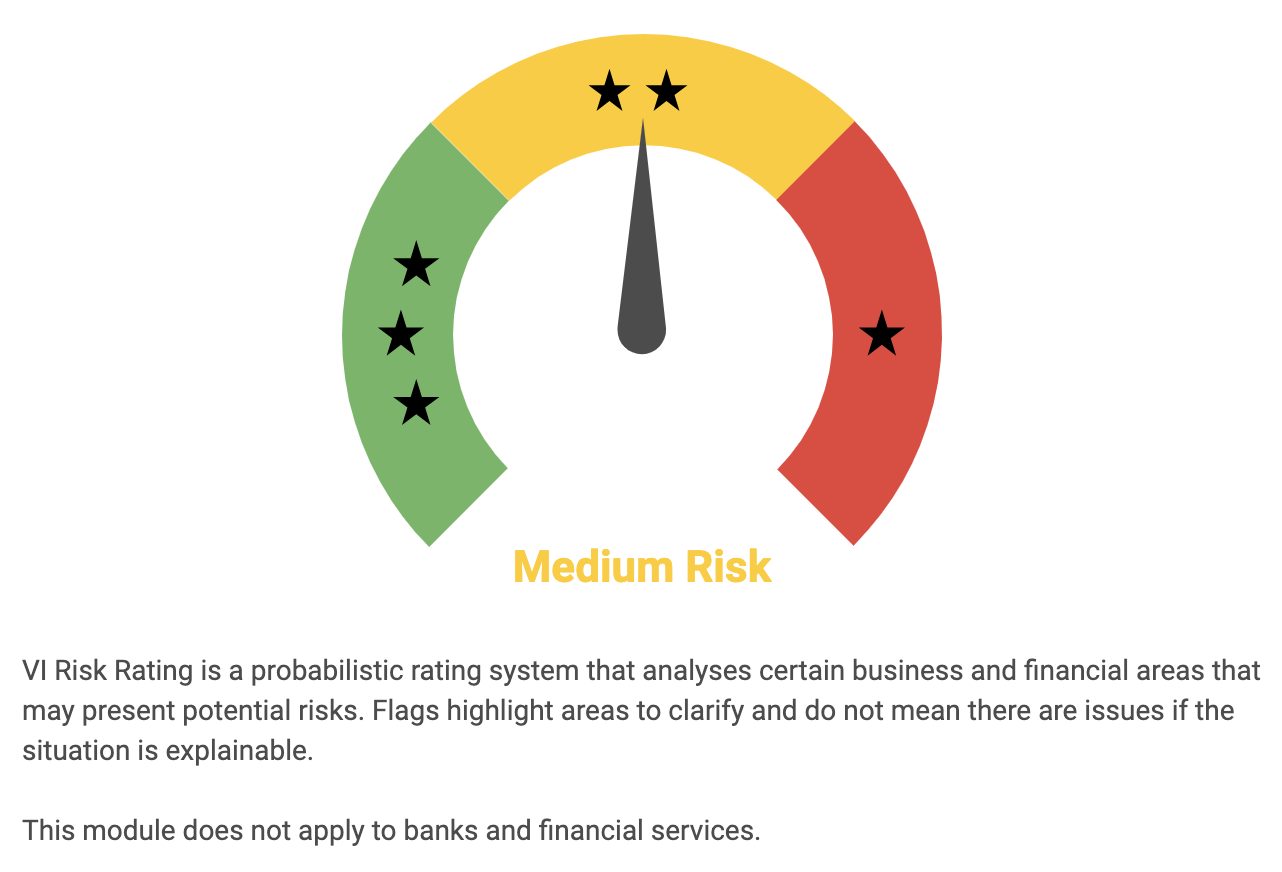

GoodWhale conducted an analysis of QORVO‘s financials and assigned it a medium risk rating. This means that investors should be aware of both financial and business risks when considering investing in QORVO. The analysis identified one risk warning in QORVO’s balance sheet, which can be reviewed on goodwhale.com by registering. Generally, medium risk investments require further due diligence to identify and mitigate risks. Investors should analyze the company’s financials, including balance sheet, income statement, cash flow statement and key ratios to assess its financial health. They should also consider factors such as the company’s management, competitive environment, industry trends, customer loyalty and potential threats and opportunities. In addition to these aspects, investors should pay attention to the company’s debt structure, liquidity and solvency ratios, operating costs and profitability metrics. They should look into the company’s operations and understand the sources of revenue, expenses and earnings. Understanding the company’s strategy and financial statements is essential for making an informed investment decision. Ultimately, investors need to make sure that they are comfortable with the level of risk associated with the company before investing in it. It is important to assess the company’s financial performance and prospects over time to determine whether it can outperform other investments and provide an acceptable return. More…

Peers

In the world of semiconductor companies that provide radio frequency products, Qorvo Inc. has stiff competition. Its main competitors are Skyworks Solutions Inc, Broadcom Inc, and Qualcomm Inc. All of these companies are vying for a share of the market in order to provide their customers with the best products possible.

– Skyworks Solutions Inc ($NASDAQ:SWKS)

Skyworks Solutions Inc is a semiconductor company that designs, manufactures, and markets radio frequency and mixed signal semiconductor solutions for mobile, base station, satellite communications, WiFi, cable television, and other wireless communications applications. The company has a market cap of 13.87B as of 2022 and a return on equity of 17.47%.

– Broadcom Inc ($NASDAQ:AVGO)

Broadcom Inc is a global technology leader that designs, develops and supplies semiconductor and infrastructure software solutions. The company’s products enable the delivery of voice, video, data and multimedia content over fixed and mobile networks to homes, businesses and public places. Broadcom’s product portfolio includes switching, routing, security and storage solutions. The company markets its products to enterprises, service providers and consumers worldwide.

– Qualcomm Inc ($NASDAQ:QCOM)

Qualcomm Inc is a leading telecommunications company with a market cap of 131.76B as of 2022. The company has a strong focus on research and development and has a return on equity of 65.09%. Qualcomm’s products and services include chipsets, modems, and other technology solutions for the wireless industry. The company has a strong presence in the global market and is a major player in the development of 5G technology.

Summary

Qorvo (QRVO) reported a record non-GAAP earnings per share (EPS) of $0.75 for the third quarter of 2023, surpassing analyst expectations by $0.12. This strong report was met with an immediate increase in stock price, indicating investor confidence in the company’s performance. As a result, Qorvo remains well-positioned for future success and is an attractive investment for those looking to add a semiconductor company to their portfolio. With its impressive portfolio of products, leading market share, and continuing focus on research and development, Qorvo is well-positioned in the industry and primed to take advantage of future growth opportunities.

Recent Posts