ON Semiconductor Empowers the Future with Intelligent Power and Sensing Solutions

June 12, 2023

☀️Trending News

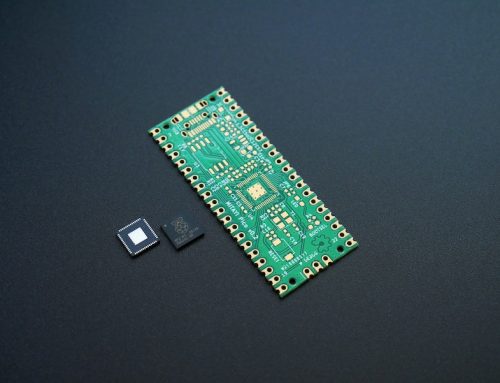

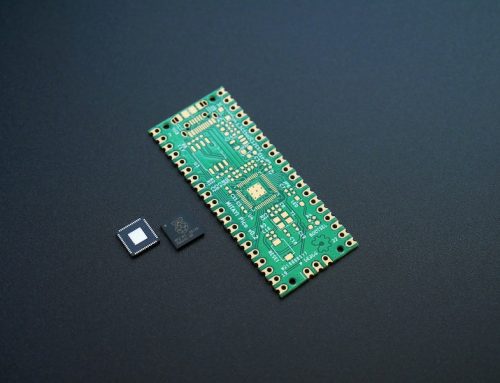

ON ($NASDAQ:ON) Semiconductor is a leading innovator in the field of power and sensing solutions. Their mission is to provide customers with reliable, cost-effective, and energy-efficient products that empower them to create the future. By leveraging their expansive portfolio of integrated circuits, sensors, and discrete components, ON Semiconductor is able to develop reliable, intelligent solutions for a variety of applications. They specialize in power management solutions, including renewable energy and battery management systems, as well as high performance sensing solutions, such as their Time-of-Flight (ToF) and Long Range (LR) sensing solutions.

ON Semiconductor also offers deep application expertise, a broad product portfolio, and a commitment to customer service that sets them apart from the competition. Their products are designed to meet the needs of customers in a variety of markets, from consumer electronics to automotive applications. They have established a reputation for reliable, cost-effective solutions, and are committed to helping customers create innovative products that will shape the future.

Market Price

On Monday, its stock opened at $87.1 and closed at $85.6, down by 1.4% from the previous closing price of $86.8. This demonstrates the current market volatility within the semiconductor industry and its effects on ON SEMICONDUCTOR. The company is providing cutting-edge solutions to its customers and remains a leader in the industry, despite the market’s challenges. By continuing to develop and offer innovative products, ON SEMICONDUCTOR is well-positioned to capitalize on upcoming opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for On Semiconductor. More…

| Total Revenues | Net Income | Net Margin |

| 8.34k | 1.83k | 26.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for On Semiconductor. More…

| Operations | Investing | Financing |

| 2.56k | -1.14k | -376.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for On Semiconductor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.27k | 5.81k | 14.94 |

Key Ratios Snapshot

Some of the financial key ratios for On Semiconductor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.5% | 76.7% | 28.5% |

| FCF Margin | ROE | ROA |

| 16.3% | 23.5% | 12.1% |

Analysis

At GoodWhale, we have conducted a financial analysis of ON SEMICONDUCTOR. Based on our Risk Rating assessment, ON SEMICONDUCTOR is a medium risk investment. We have identified one issue of concern in their balance sheet. If you are interested in learning more detail about this, register with us and we will provide you with additional information. We are committed to providing accurate and comprehensive analyses to help you make informed decisions about your investments. With our comprehensive financial assessments, you can be sure that you are investing in the right company. More…

Peers

The semiconductor industry is highly competitive, with a large number of companies vying for market share. ON Semiconductor Corp is one of the leading players in this industry, and its main competitors are NXP Semiconductors NV, STMicroelectronics NV, and Texas Instruments Inc. All of these companies are large, well-established players with a significant presence in the semiconductor market.

– NXP Semiconductors NV ($NASDAQ:NXPI)

NXP Semiconductors NV is a global semiconductor company with a market cap of 37.11B as of 2022. The company’s return on equity (ROE) is 41.87%. NXP Semiconductors NV designs, manufactures and supplies semiconductor and system solutions for automotive, identification, wireless infrastructure, lighting, industrial, mobile, consumer and computing markets.

– STMicroelectronics NV ($LTS:0INB)

STMicroelectronics is a global semiconductor company that designs, develops, manufactures and markets a broad range of semiconductor products, including integrated circuits, discrete and analog devices. Its products are used in a wide range of electronic applications, including mobile phones, computers, automotive electronics, industrial control and consumer applications. The company has a market cap of $29.74 billion and a return on equity of 20.91%.

– Texas Instruments Inc ($NASDAQ:TXN)

As of 2022, Texas Instruments Inc has a market cap of 139.48B and a Return on Equity of 62.22%. Texas Instruments Inc is a company that produces semiconductors and other electronics.

Summary

ON Semiconductor is a reliable and trusted investment option in the semiconductor industry. Its strong portfolio of products and solutions has enabled it to gain a competitive edge in the market. The company offers a wide range of intelligent power and sensing solutions that cater to a variety of applications including consumer electronics, automotive, industrial, and many more.

These products are highly reliable and cost-effective, which provide long-term value for investors. All these factors make ON Semiconductor an attractive long-term investment opportunity for investors.

Recent Posts