MRVL: Marvell Technology Offering Complete Solutions for the Digital Future.

February 10, 2023

Trending News ☀️

Marvell Technology ($NASDAQ:MRVL) Inc is a leading global semiconductor company dedicated to providing complete solutions for the digital future. MARVELL’s portfolio of products includes integrated circuits, system-on-chip (SoC) solutions, storage solutions, and much more. MARVELL’s products are used by many companies around the world, from large enterprises to small businesses. MARVELL’s products are used in a wide range of applications, including enterprise networking, storage, multimedia, wireless and mobile devices. In addition to its core product offering, MARVELL also provides products and services to help customers develop their own digital future.

MARVELL’s design services team works with customers to develop custom solutions that meet their specific needs. MARVELL also offers a range of software solutions and platforms to help customers create and manage their digital products. MARVELL’s stock has been a popular investment choice over the years and has seen significant growth over time. With its innovative products and services, MARVELL is an ideal choice for those looking to invest in the future of technology.

Price History

On Wednesday, MARVELL TECHNOLOGY stock opened at $46.5 and closed at $45.1, down by 3.6% from last closing price of 46.8. MARVELL TECHNOLOGY’s portfolio includes a broad range of products that enable the digital home, digital office, digital health, and digital networking. These products include processors, network switches, storage solutions, wireless and wired connectivity solutions, and other consumer electronics. The company’s portfolio also includes software and services for cloud, security, analytics, and artificial intelligence (AI). MARVELL TECHNOLOGY is committed to providing customers with innovative and reliable products that meet their needs. The company is focused on providing the best customer experience and delivering superior value to its customers.

MARVELL TECHNOLOGY is also dedicated to investing in research and development in order to deliver cutting-edge products. The company is committed to helping customers create products that will help them stay ahead of the competition in today’s digital world. The company’s products are designed to be flexible, scalable, and secure, enabling customers to create innovative solutions quickly and cost-effectively. The company is investing heavily in research and development to deliver innovative products and services that will meet the needs of its customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Marvell Technology. More…

| Total Revenues | Net Income | Net Margin |

| 5.84k | -141.93 | -1.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Marvell Technology. More…

| Operations | Investing | Financing |

| 1.28k | -327.29 | -756.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Marvell Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 22.52k | 6.96k | 18.22 |

Key Ratios Snapshot

Some of the financial key ratios for Marvell Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.9% | 7.6% | 4.6% |

| FCF Margin | ROE | ROA |

| 18.4% | 1.1% | 0.7% |

Analysis

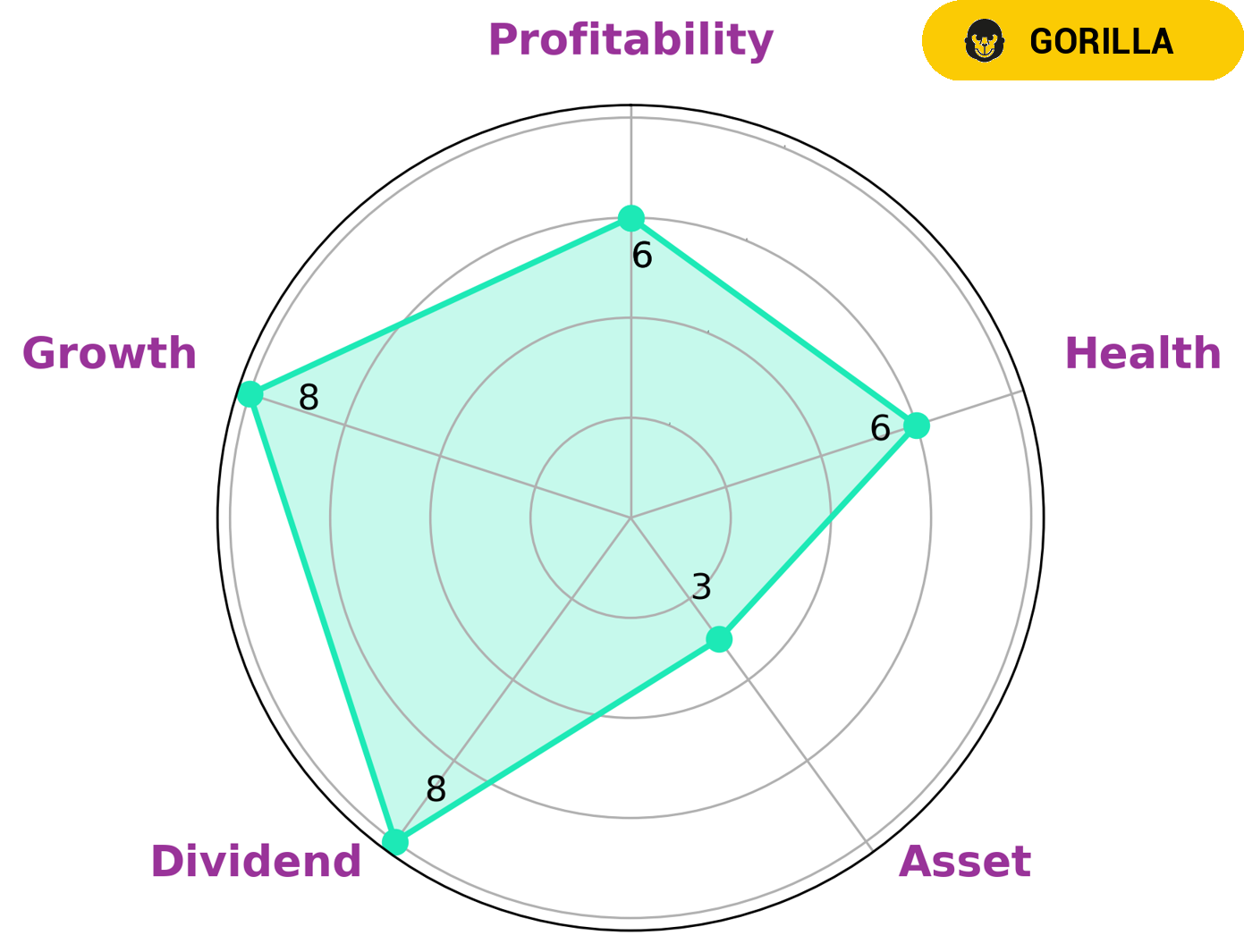

GoodWhale’s analysis of MARVELL TECHNOLOGY‘s wellbeing reveals that the company is strong in dividend and growth and medium in profitability, but weak in asset. It is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors interested in such a company may be looking for long-term growth opportunities and a relatively safe investment. MARVELL TECHNOLOGY has an intermediate health score of 6 out of 10 with regard to its cashflows and debt, indicating that it might have the ability to sustain future operations in times of crisis. Investors may be looking for a company with low debt and stable cash flows, as well as the potential for long-term growth. MARVELL TECHNOLOGY may also be attractive to investors who are looking for a dividend-paying stock. The company has a strong dividend policy, which may be attractive to income-oriented investors. Additionally, MARVELL TECHNOLOGY has a strong competitive advantage, which may make it attractive to growth-oriented investors who are looking for long-term growth. Overall, MARVELL TECHNOLOGY may be an attractive investment for investors who are looking for long-term growth opportunities and a relatively safe investment. Its strong competitive advantage, stable cash flows, and strong dividend policy make it an attractive choice for many types of investors. More…

Peers

Marvell Technology Inc is a fabless semiconductor company that designs, develops, and markets analog, mixed-signal, digital signal processing, and embedded and standalone integrated circuits. Its main competitors are Advanced Micro Devices Inc, GLOBALFOUNDRIES Inc, and Intel Corp.

– Advanced Micro Devices Inc ($NASDAQ:AMD)

Advanced Micro Devices Inc is a technology company that designs and produces semiconductor products. The company has a market capitalization of 92.39 billion as of 2022 and a return on equity of 4.13%. The company’s products are used in a variety of electronic devices, including personal computers, game consoles, and servers.

– GLOBALFOUNDRIES Inc ($NASDAQ:GFS)

GLOBALFOUNDRIES Inc is a leading provider of semiconductor manufacturing services. The company has a market cap of 28.43B as of 2022 and a Return on Equity of 5.09%. The company offers a wide range of services, including manufacturing, design, and testing. GLOBALFOUNDRIES is a trusted partner for many of the world’s leading companies.

– Intel Corp ($NASDAQ:INTC)

Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California, in the Silicon Valley. It is the world’s largest and highest valued semiconductor chip manufacturer based on revenue, and is the inventor of the x86 series of microprocessors, the processors found in most personal computers (PCs). Intel supplies processors for computer system manufacturers such as Apple, Lenovo, HP, and Dell. Intel also manufactures motherboard chipsets, network interface controllers and integrated circuits, flash memory, graphics chips, embedded processors and other devices related to communications and computing.

Summary

Marvell Technology Inc. (MRVL) is a global leader in providing complete solutions for the digital future. The company offers a range of products and services in the areas of storage, networking, and computing, and is focused on delivering superior performance and innovative solutions to customers. Despite the stock price moving down on the same day, investing in Marvell Technology may still be a lucrative option. The company has a long-standing record of success and a strong financial position with excellent cash flow generation.

Additionally, Marvell Technology has a well-diversified product portfolio and experienced management team, which can support its long-term growth prospects. Furthermore, the company has a strong customer base and robust customer relationships, which can help it to remain competitive in the long run. All in all, investing in Marvell Technology may be a wise choice for those looking for a promising long-term return.

Recent Posts