Mixed Analyst Reactions as Cirrus Logic Shares Open at $77.30

June 11, 2023

☀️Trending News

On June 7, 2023, shares of Cirrus Logic ($NASDAQ:CRUS) Inc. opened at $77.30, sparking mixed reactions from analysts. Cirrus Logic Inc. is a semiconductor company that produces analog and mixed-signal integrated circuits for consumer and industrial markets. This opening price was much closer to the company’s 52-week low of $61.94 than its high of $111.15. Analysts had a range of opinions on the stock, with some expressing optimism while others voiced concerns. Those in the optimistic camp argued that the share price was an attractive entry point, given the potential for future growth. They noted the company’s strong lineup of products and its diversified customer base as reasons to be bullish on the stock.

Meanwhile, more pessimistic analysts saw the opening price as an indication that the stock could be overvalued. They cited the uncertain economic climate and potential competition from other semiconductor companies as reasons to be wary of buying into Cirrus Logic Inc. shares. Ultimately, the success of Cirrus Logic Inc.’s stock will depend on the company’s ability to navigate the current market conditions and sustain its competitive edge. As such, investors should proceed with caution when considering whether or not to buy into this stock.

Share Price

On Thursday, shares of Cirrus Logic Inc. opened at $77.30 and closed at $77.1, a decrease of 0.2% from its previous closing price of $77.3. The mixed reactions from analysts created a lot of uncertainty surrounding the stock. Some analysts believe the company’s fundamentals are strong enough to support its current market value while others feel that Cirrus Logic Inc. has yet to show sufficient growth and may be overvalued. The market’s reaction to the opening of the stock reflects this sentiment of uncertainty, as the stock’s performance only slightly decreased from its opening to its closing price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cirrus Logic. More…

| Total Revenues | Net Income | Net Margin |

| 1.9k | 176.7 | 12.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cirrus Logic. More…

| Operations | Investing | Financing |

| 339.57 | -33.33 | -230.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cirrus Logic. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.06k | 405.68 | 31.09 |

Key Ratios Snapshot

Some of the financial key ratios for Cirrus Logic are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.0% | 20.9% | 18.2% |

| FCF Margin | ROE | ROA |

| 16.0% | 12.8% | 10.5% |

Analysis

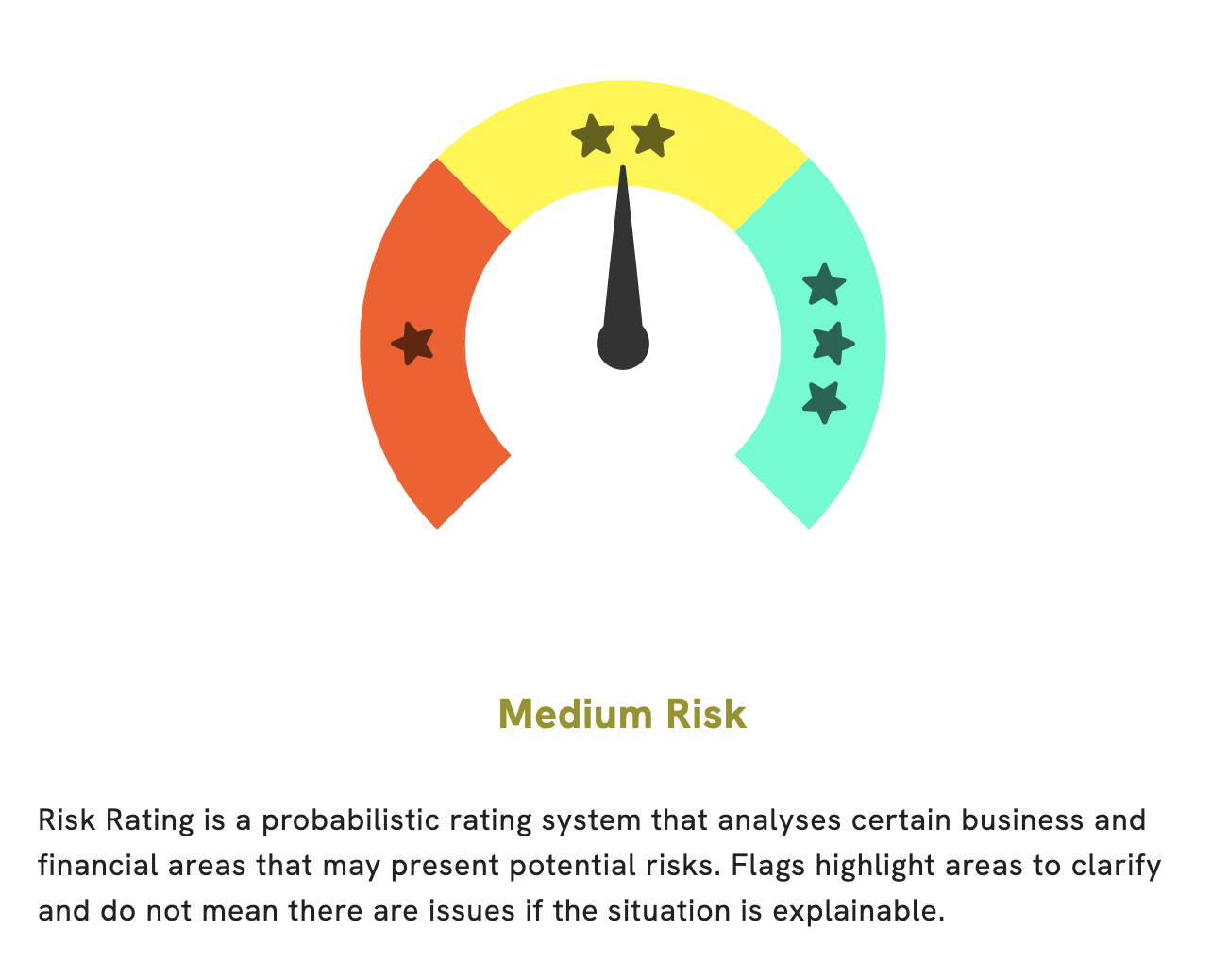

GoodWhale recently took an in-depth look at CIRRUS LOGIC‘s fundamentals and found that, overall, it’s a medium risk investment in terms of financial and business aspects. Our Risk Rating tool looked at the company’s debt to equity ratio, and other factors related to the company’s financial health, and found that CIRRUS LOGIC is in a fairly safe position. Nonetheless, GoodWhale did detect 1 risk warnings in the company’s balance sheet. These warnings indicate that there may be some issues with the company’s financial health that investors should be aware of. If you’re interested in learning more about this risk warning, please register with us to access our detailed report. More…

Peers

The company’s competitors include Sequans Communications SA, United Microelectronics Corp, and Globetronics Technology Bhd.

– Sequans Communications SA ($NYSE:SQNS)

Sequans Communications S.A. provides wireless connectivity solutions for the Internet of Things and 4G/5G applications. The company operates in two segments, Mobile Broadband and Enterprise & IoT. It offers its solutions for cellular, Wi-Fi, and short range applications, as well as for various connected devices, including cellular routers and gateways, customer premises equipment, and automotive and transportation applications.

– United Microelectronics Corp ($TWSE:2303)

As of 2022, United Microelectronics Corp has a market cap of 501.15B and a Return on Equity of 18.27%. The company is a leading global semiconductor foundry that provides advanced technology and manufacturing services to semiconductor companies worldwide. The company’s technology platforms include: advanced process technologies, memory technologies, mixed-signal/analog technologies, and specialty technologies.

– Globetronics Technology Bhd ($KLSE:7022)

As of 2022, Globetronics Technology Bhd has a market cap of 769.86M and a Return on Equity of 11.1%. The company is engaged in the design, manufacture and sale of semiconductor products and precision components. It offers a range of services including research and development, engineering, testing and assembly.

Summary

Cirrus Logic Inc. is a technology company specializing in audio and mixed-signal integrated circuits. Recently, the stock has been trading close to its 52-week low of $61.94, creating a cautious atmosphere among investors and analysts alike. While some consider the current prices an attractive entry point for long-term investments, others are not so sure. Investors should research the company and its financials thoroughly before making any decisions.

Recent Posts