Maxlinear Intrinsic Value Calculation – MaxLinear Reports Better-Than-Expected Earnings Despite Lower-Than-Expected Revenue

April 27, 2023

Trending News 🌥️

MAXLINEAR ($NASDAQ:MXL): According to the results, MaxLinear’s non-GAAP earnings per share of $0.74 exceeded expectations by $0.04, while total revenue of $248.4M fell short of the forecast by $1.72M. This performance highlights MaxLinear’s ability to maintain steady growth despite challenging market conditions. The company’s strategy of diversifying its product portfolio and expanding into new markets appears to be paying off.

The strong earnings result was driven by higher gross margins and cost savings initiatives, which helped offset lower-than-expected revenue. The company’s long-term outlook remains positive and investors will be watching the stock to see if the trend continues.

Share Price

On Wednesday, MaxLinear Inc. reported better-than-expected earnings despite lower-than-expected revenue. The company opened at $29.4, up 0.4% from the last closing price of 29.2 and closed at the same price. Nonetheless, investors seem unfazed as MaxLinear’s stock price maintained its upwards momentum. Going forward, it will be interesting to see how MaxLinear’s performance fares as it strives to consistently exceed expectations. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Maxlinear. More…

| Total Revenues | Net Income | Net Margin |

| 1.12k | 125.04 | 11.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Maxlinear. More…

| Operations | Investing | Financing |

| 388.73 | -91.76 | -240.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Maxlinear. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.18k | 503.64 | 8.59 |

Key Ratios Snapshot

Some of the financial key ratios for Maxlinear are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 52.3% | – | 16.4% |

| FCF Margin | ROE | ROA |

| 30.0% | 17.8% | 9.7% |

Analysis – Maxlinear Intrinsic Value Calculation

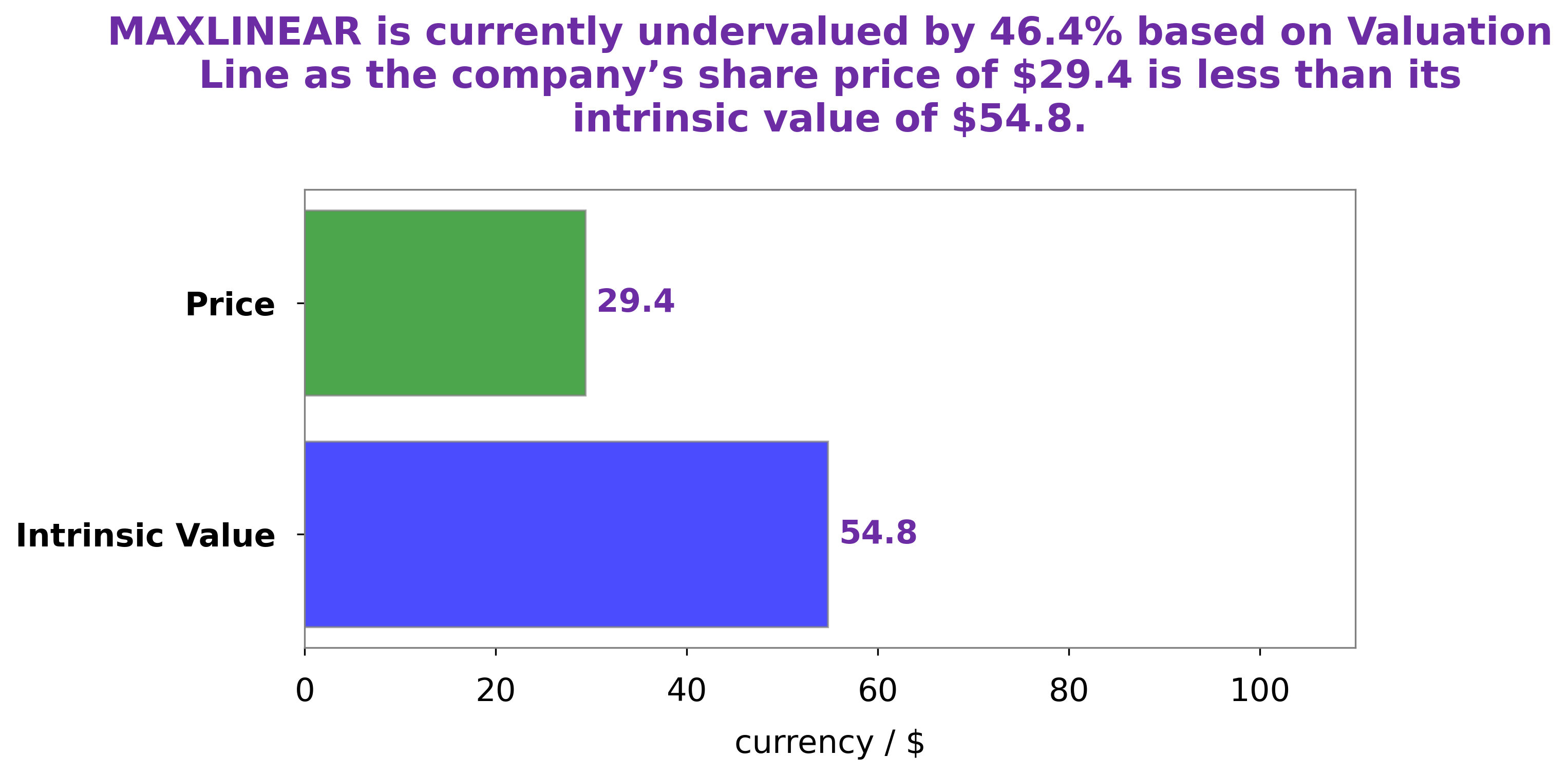

GoodWhale has conducted an analysis of MAXLINEAR‘s financials and have determined that its fair value should be around $54.8. Our proprietary Valuation Line shows that the current trading price of MAXLINEAR stock ($29.4) is significantly lower than its fair value, representing an undervaluation of 46.4%. In other words, MAXLINEAR stock is undervalued and represents an opportunity for investors seeking to capitalize on this discrepancy. More…

Peers

MaxLinear Inc is a leading provider of high-performance radio-frequency (RF), analog, and mixed-signal integrated circuits (ICs) for the cable television (CATV), satellite, terrestrial, and fiber-to-the-home (FTTH) markets. The company’s products are used in a wide variety of end applications including cable and satellite set-top boxes, cable modems, optical network terminals, routers, and gateways. MaxLinear is headquartered in Carlsbad, California.

MaxLinear’s competitors include Applied Optoelectronics Inc, Realtek Semiconductor Corp, and TranSwitch Corp. These companies are also leading providers of high-performance RF, analog, and mixed-signal ICs.

– Applied Optoelectronics Inc ($NASDAQ:AAOI)

Applied Optoelectronics Inc. is a vertically integrated provider of LED solutions for lighting, display and optical communications applications. The company designs, manufactures and markets a broad range of high-performance light emitting diodes (LEDs), laser diodes, photodiodes and optoelectronics products.

The company’s products are used in a variety of applications including indoor and outdoor lighting, automotive, electronics, signs and displays, and communications.

Applied Optoelectronics Inc has a market cap of 81.42M as of 2022. The company’s return on equity is -24.05%.

The company’s products are used in a variety of applications including indoor and outdoor lighting, automotive, electronics, signs and displays, and communications.

– Realtek Semiconductor Corp ($TWSE:2379)

With a market cap of 129.24B as of 2022, Realtek Semiconductor Corp is a company that designs, manufactures and markets a wide variety of semiconductor products. Its products include communications network ICs, computer peripheral ICs, and multimedia ICs. The company’s return on equity is 29.82%. Realtek has a long history of innovation and is one of the leading IC providers in the world. The company’s products are used in a wide range of applications, including communication networks, computers, and multimedia devices.

– TranSwitch Corp ($OTCPK:TXCCQ)

TranSwitch Corporation is a publicly traded company that designs, develops and markets integrated circuit solutions for the networking, communications and consumer electronics markets. Its products enable voice, video and data communications over converged Internet Protocol (IP) networks. The company’s solutions are used in a variety of end-user applications, including broadband access, set-top boxes, routers, switches, base stations, wireless LANs, VoIP phones and HDTVs.

Summary

The company’s stock has seen an overall increase in value following the announcement. Investment analysts have generally viewed the news positively, praising the strong EPS performance, but noting the potential for improved revenue in future quarters.

Recent Posts