Capital Fund Management S.A. Boosts Investment in Cirrus Logic,

March 5, 2023

Trending News ☀️

Capital Fund Management S.A. has recently announced that they are boosting their investment in Cirrus Logic ($NASDAQ:CRUS), Inc. by increasing their stake in the company. This comes as a welcomed development for the Austin, Texas-based semiconductor manufacturer as they continue to expand their product offerings and international reach. The investment will allow Cirrus Logic to increase their production of chips and microcontrollers that are used in audio, automotive, and medical device applications. This new influx of capital will allow the company to continue increasing their market share in both the consumer and industrial markets. Cirrus Logic has seen recent success with their audio processor offerings and is hoping to capitalize on this by offering products to automotive and medical devices markets.

With the help of Capital Fund Management, Cirrus Logic will be able to grow their technology portfolio and expand into these other markets. Overall, it appears that the investment from Capital Fund Management will allow Cirrus Logic to reach new heights. The company is well-positioned to increase its ability to provide quality semiconductor solutions to its customers, while also leveraging its resources to enter new markets with its technology portfolio.

Stock Price

On Friday, CIRRUS LOGIC, Inc. saw a slight decrease in its stock price when it opened at $104.2 and closed at $103.7, a 0.6% dip from the prior closing price of 104.3. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cirrus Logic. More…

| Total Revenues | Net Income | Net Margin |

| 2.01k | 326.79 | 16.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cirrus Logic. More…

| Operations | Investing | Financing |

| 549.53 | -33 | -277.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cirrus Logic. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.17k | 449.57 | 31.09 |

Key Ratios Snapshot

Some of the financial key ratios for Cirrus Logic are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.5% | 36.3% | 21.0% |

| FCF Margin | ROE | ROA |

| 25.6% | 15.7% | 12.2% |

Analysis

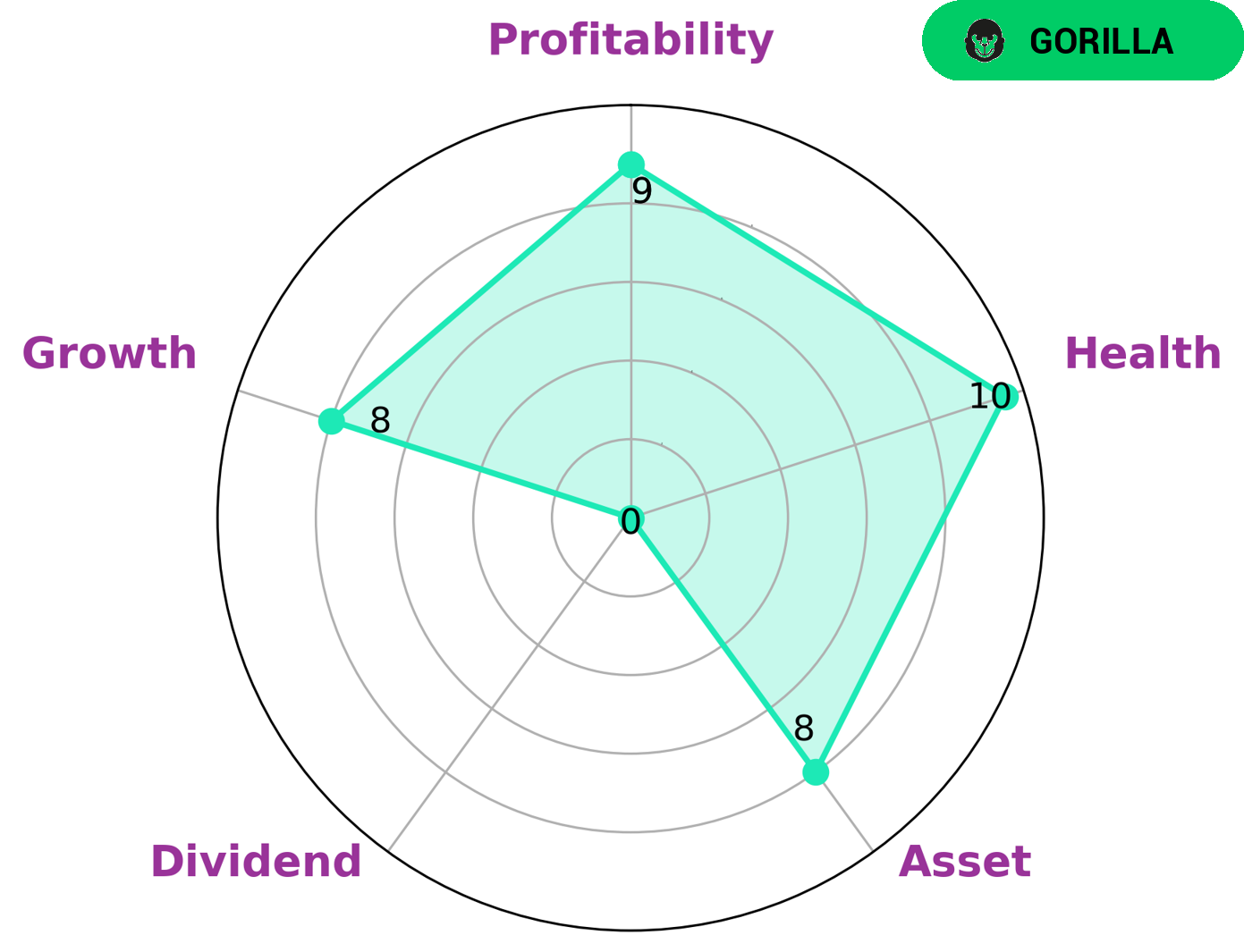

As GoodWhale, we conducted an analysis of CIRRUS LOGIC‘s wellbeing. Our observations revealed that CIRRUS LOGIC has a high health score of 10/10 with regard to its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. In addition to this, CIRRUS LOGIC showed strong performance in terms of asset and growth, as well as profitability. However, the company’s dividend score was weaker than the other areas. We also identified that CIRRUS LOGIC can be classified as ‘gorilla’, which is a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes it an attractive candidate for investors who are looking for long-term stable returns. Such investors may include individuals, venture capitalists, and large institutional investors who are seeking reliable returns. More…

Peers

The company’s competitors include Sequans Communications SA, United Microelectronics Corp, and Globetronics Technology Bhd.

– Sequans Communications SA ($NYSE:SQNS)

Sequans Communications S.A. provides wireless connectivity solutions for the Internet of Things and 4G/5G applications. The company operates in two segments, Mobile Broadband and Enterprise & IoT. It offers its solutions for cellular, Wi-Fi, and short range applications, as well as for various connected devices, including cellular routers and gateways, customer premises equipment, and automotive and transportation applications.

– United Microelectronics Corp ($TWSE:2303)

As of 2022, United Microelectronics Corp has a market cap of 501.15B and a Return on Equity of 18.27%. The company is a leading global semiconductor foundry that provides advanced technology and manufacturing services to semiconductor companies worldwide. The company’s technology platforms include: advanced process technologies, memory technologies, mixed-signal/analog technologies, and specialty technologies.

– Globetronics Technology Bhd ($KLSE:7022)

As of 2022, Globetronics Technology Bhd has a market cap of 769.86M and a Return on Equity of 11.1%. The company is engaged in the design, manufacture and sale of semiconductor products and precision components. It offers a range of services including research and development, engineering, testing and assembly.

Summary

Investment analysis for Cirrus Logic, Inc. has seen a boost from Capital Fund Management S.A., with the firm taking a stake in the company. Analysts have been positive on the company’s prospects, noting their strong balance sheet and good track record of cash flow generation. They point to the company’s broad portfolio of products as a major strength and point to a wide range of potential applications including audio, imaging, computer vision, and sensors. Cirrus Logic is also well positioned to benefit from the growth in the mobile and audio markets, along with a significant presence in automotive.

Furthermore, their increasing presence in new markets such as IoT systems and wearables could provide additional upside. In conclusion, Cirrus Logic looks to be an attractive investment opportunity with substantial upside potential.

Recent Posts