Broadcom Inc Faces Setback as Intel Stock Plummets Due to Failed Silicon Wafer Tests

September 7, 2024

🌧️Trending News

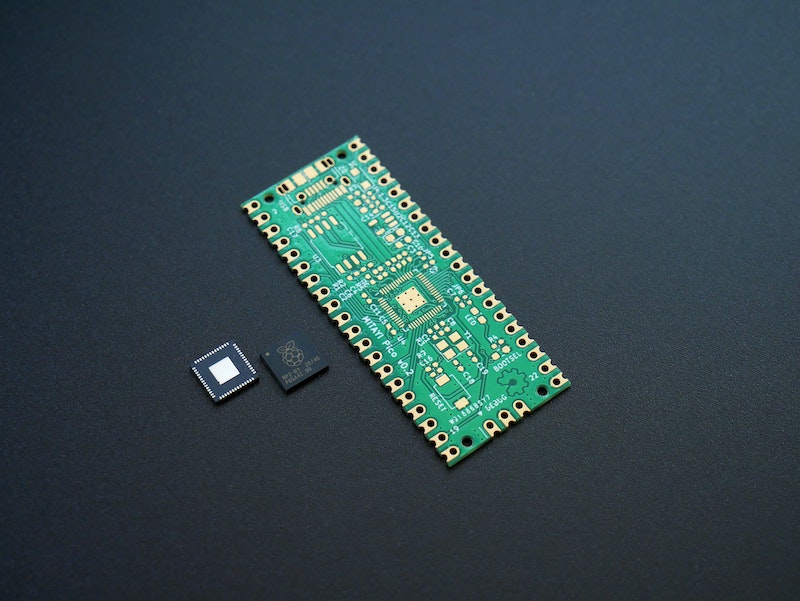

BROADCOM INC ($NASDAQ:AVGO), a leading provider of semiconductor solutions for wired and wireless communications, is facing a major setback as its competitor Intel Corporation’s stock plummets due to failed silicon wafer tests. This news comes at a time when BROADCOM INC was gaining traction in the market, with its stock value on the rise. A quick look at BROADCOM INC’s stock performance shows that the company has been consistently delivering strong financial results, with a steady increase in revenue and profits. This has been largely due to its strategic acquisitions and partnerships, along with a strong focus on research and development. BROADCOM INC’s stock has been a favorite among investors, with many seeing it as a promising long-term investment.

However, the recent decline of Intel stock has raised concerns among shareholders of BROADCOM INC. According to reports, during testing of silicon wafers, which are used in the production of semiconductors, Intel experienced a high failure rate. This has led to a significant drop in Intel’s stock price, causing a ripple effect in the industry. The failed silicon wafer tests have not only impacted Intel, but also its suppliers, including BROADCOM INC. This setback has caused a dip in BROADCOM INC’s stock value, as investors worry about the company’s reliance on Intel for its semiconductor production. This has also raised questions about BROADCOM INC’s own testing processes and quality control measures. The decline in Intel’s stock value can be attributed to the increasing competition in the semiconductor market. With more players entering the industry, companies like Intel and BROADCOM INC have to constantly innovate and keep up with technological advancements in order to stay ahead. In response to the news, BROADCOM INC has reassured investors that it is closely monitoring the situation and taking necessary steps to mitigate any potential impact on its business. The company also stated that it is committed to maintaining high standards of quality and reliability in its products. In conclusion, the recent failed silicon wafer tests at Intel have had a ripple effect on the semiconductor industry, causing a decline in both Intel and BROADCOM INC’s stock prices. However, with BROADCOM INC’s strong track record and strategic measures in place, it is likely that the company will bounce back from this setback and continue its growth in the market.

Stock Price

Broadcom Inc, a leading semiconductor company, faced a setback on Wednesday as its stock opened at $150.3 and closed at $154.12, up by 0.87% from the previous day’s closing price of $152.79. This came after news broke that Intel, one of Broadcom’s major clients, experienced a significant drop in their stock prices due to failed silicon wafer tests. Silicon wafers are an essential component in the production of microchips, which are used in a wide range of electronic devices. These wafers are thin discs made of pure silicon and are used as a base for creating integrated circuits.

However, Intel’s latest batch of wafers did not meet the expected quality standards, resulting in a steep decline in their stock prices. This failure in silicon wafer tests is a significant blow to Intel, as it may affect their production capabilities and delay the release of new products. This, in turn, has a direct impact on Broadcom, as they supply chips to Intel for use in their devices. The decline in Intel’s stock prices has caused uncertainty and concern among investors, resulting in a drop in Broadcom’s stock prices as well. This setback for Broadcom comes at a time when the company has been experiencing steady growth in its stock prices. The company has a strong portfolio of products, including chips for wireless communication, data centers, and enterprise storage solutions. However, with Intel as one of its major customers, any issues faced by the latter will undoubtedly have an impact on Broadcom’s financial performance as well. The situation is still developing, and it remains to be seen how this setback will affect both companies in the long run. However, it highlights the interdependence and interconnectedness of the technology industry, where one company’s struggles can have ripple effects on others. As for Broadcom, the company will have to monitor the situation closely and take necessary measures to mitigate any potential losses. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Broadcom Inc. More…

| Total Revenues | Net Income | Net Margin |

| 38.87k | 11.63k | 31.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Broadcom Inc. More…

| Operations | Investing | Financing |

| 18.86k | -26.06k | 6.42k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Broadcom Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 177.87k | 107.59k | 151.66 |

Key Ratios Snapshot

Some of the financial key ratios for Broadcom Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.3% | 41.1% | 37.9% |

| FCF Margin | ROE | ROA |

| 47.3% | 19.5% | 5.2% |

Analysis

I have analyzed the financials of BROADCOM INC as assessed by my team at GoodWhale. Our analysis presents a strong picture of the company’s financial health and performance. Based on our Star Chart methodology, we have classified BROADCOM INC as a ‘gorilla’ type of company. This means that the company has achieved stable and high revenue or earnings growth, due to its strong competitive advantage. This is a positive sign for investors, as it indicates that the company has a solid foundation and is capable of sustaining its success in the long term. As a result of its strong performance, BROADCOM INC may attract interest from a variety of investors. Those interested in stable and consistent growth may be drawn to the company’s ‘gorilla’ classification. Its strong competitive advantage may also appeal to growth-oriented investors who are looking for potential for further expansion. Additionally, BROADCOM INC may also be of interest to dividend investors, as it has a strong track record of paying out dividends to its shareholders. In terms of financial metrics, our analysis shows that BROADCOM INC is strong in areas such as dividend, growth, and profitability. This is a positive indication of the company’s overall financial performance and stability. However, we have also identified a weakness in the company’s asset management, which may be an area for improvement. Despite this weakness, BROADCOM INC’s overall financial health remains strong. In fact, our health score for BROADCOM INC is 8/10, indicating that the company is in a very good financial position. This takes into consideration factors such as cash flows and debt levels, which are important indicators of a company’s ability to weather any potential crises without the risk of bankruptcy. This high health score is reassuring for investors, as it suggests that BROADCOM INC is capable of safely riding out any challenges that may come its way. More…

Peers

Since its inception in 1991, Broadcom Inc has been a leading provider of semiconductor solutions. Its competitors, Qualcomm Inc, NVIDIA Corp, and Qorvo Inc, have all tried to keep up with Broadcom’s innovation and technology. While Qualcomm and NVIDIA have been able to maintain a strong presence in the market, Qorvo has struggled to keep up.

– Qualcomm Inc ($NASDAQ:QCOM)

Qualcomm Inc. is an American multinational semiconductor and telecommunications equipment company that designs and markets wireless telecommunications products and services. It has a market cap of 132.13B as of 2022 and a Return on Equity of 65.09%. The company was founded in 1985 and is headquartered in San Diego, California. Qualcomm is a leading provider of wireless technology and services for the mobile industry. It offers a comprehensive portfolio of products and services that enable mobile devices to connect to the Internet, including chipsets, modem and router technologies, and software and services.

– NVIDIA Corp ($NASDAQ:NVDA)

Nvidia is an American technology company that designs graphics processing units (GPUs) for the gaming and professional markets, as well as system on a chip units (SoCs) for the mobile computing and automotive market.

Nvidia’s market cap is currently $336.08B, with a ROE of 20.03%. The company has seen strong growth in recent years, driven by demand for its GPUs in the gaming market. Nvidia is also expanding into new markets such as autonomous vehicles and artificial intelligence.

– Qorvo Inc ($NASDAQ:QRVO)

Qorvo Inc is a company that provides radio frequency (RF) solutions for mobile, infrastructure, and defense applications. It has a market cap of 8.88B as of 2022 and a Return on Equity of 14.5%. The company’s products include power amplifiers, filters, and switches.

Summary

Investors in Broadcom Inc may want to take note of recent reported failures of Intel’s silicon wafers during Broadcom’s testing. This news has caused Intel’s stock to drop even further, highlighting potential concerns for the company’s product quality and manufacturing processes. This could also impact Intel’s ability to compete with other chipmakers, including Broadcom.

Investors may want to closely monitor Intel’s response and actions in addressing these issues, as well as keep an eye on Broadcom’s stock performance. Any further developments or news surrounding this issue could have a significant impact on the overall performance of both companies and the broader semiconductor industry.

Recent Posts