Bank of New York Mellon Corp Invests $44.87 Million in Synaptics Incorporated in 2023

March 18, 2023

Trending News 🌥️

Synaptics Incorporated ($NASDAQ:SYNA) has seen a major investment from Bank of New York Mellon Corp in 2023. The investment totals to a staggering $44.87 million and gives the bank a stake in the company. As a result, the company is set to benefit significantly from the new influx of funds. This investment is the latest in a series of moves the company has made to ensure their growth and stability in the future. With this massive injection of capital, Synaptics Incorporated is sure to see some major advances in their products and services in the coming months and years.

The investment is also a sign of confidence from the bank in the company’s ability to manage and grow their business. This move ensures that the company will have access to additional resources that will allow them to expand their operations and reach new heights in their industry. Overall, this investment from Bank of New York Mellon Corp is a major milestone for Synaptics Incorporated and will help further their mission of creating innovative products and solutions for the world. With this major injection of capital, the company is set to reach great heights in the years to come.

Stock Price

So far, the news has been met with a mostly positive sentiment. On Monday, the SYNAPTICS INCORPORATED stock opened at $105.8 and closed at $106.0, a 1.4% decrease from the prior closing price of $107.5. Despite this decline, the stock is still up year-over-year and investors seem to be confident in the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Synaptics Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 1.75k | 234.4 | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Synaptics Incorporated. More…

| Operations | Investing | Financing |

| 410.5 | 23.3 | -112.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Synaptics Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.73k | 1.42k | 32.85 |

Key Ratios Snapshot

Some of the financial key ratios for Synaptics Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.8% | 139.5% | 21.7% |

| FCF Margin | ROE | ROA |

| 19.8% | 18.0% | 8.7% |

Analysis

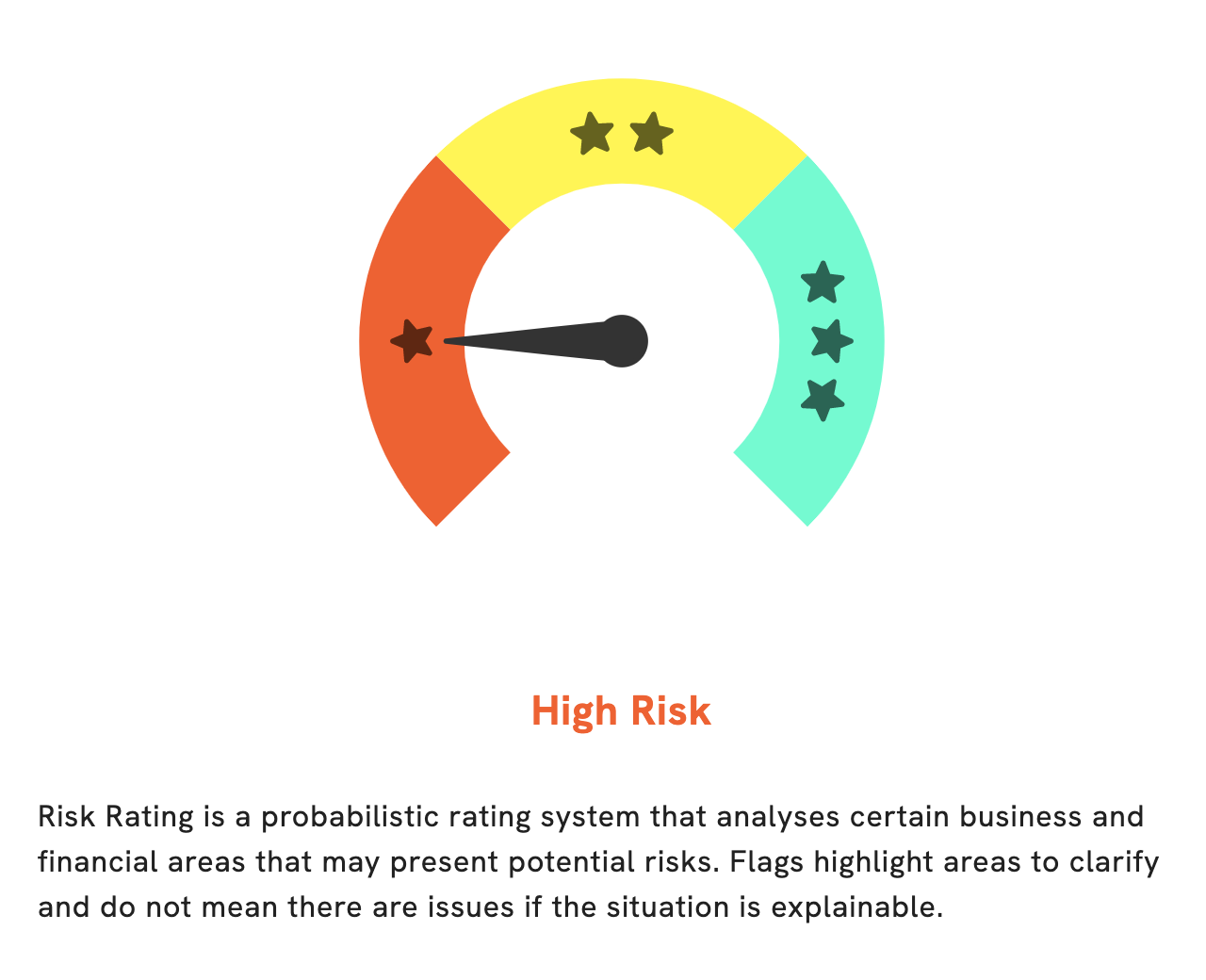

GoodWhale is your go-to source for analyzing SYNAPTICS INCORPORATED‘s financials. We’ve given this company a high risk rating due to a number of factors, including its financial and business aspects. To ensure that you get accurate and unbiased insights, we’ve conducted a thorough review of the company’s income sheet, balance sheet, and cashflow statement. As a result, we’ve identified three distinct risk warnings that could affect the performance of this investment. If you’re interested in digging deeper, become a registered user of GoodWhale to check out the details. More…

Peers

The company’s products are used in a variety of applications, including smartphones, tablets, notebook computers, automotive systems and industrial robotics. Synaptics’ competitors in the human interface solutions market include AP Memory Technology Corp, Giga Device Semiconductor (Beijing) Inc, Quantum eMotion Inc.

– AP Memory Technology Corp ($TWSE:6531)

Micron Technology, Inc. is an American producer of computer memory and computer data storage including dynamic random-access memory, flash memory, and USB flash drives. It is headquartered in Boise, Idaho. The company has manufacturing facilities in Asia, the United States, and Europe.

– Giga Device Semiconductor (Beijing) Inc ($SHSE:603986)

Giga Device Semiconductor (Beijing) Inc is a Chinese semiconductor company with a market cap of 57.27B as of 2022. The company has a Return on Equity of 14.43%. Giga Device Semiconductor (Beijing) Inc is a leading fabless semiconductor company that designs, develops, and markets high-performance integrated circuits (ICs). The company’s products are used in a wide range of applications, including mobile devices, computers, consumer electronics, and automotive electronics.

– Quantum eMotion Inc ($TSXV:QNC)

Quantum eMotion Inc is a publicly traded company with a market cap of 14.89M as of 2022. The company has a Return on Equity of -22.72%. Quantum eMotion Inc is a provider of digital motion capture solutions. The company’s products are used in the film, television, video game, and virtual reality industries.

Summary

In 2023, Bank of New York Mellon Corp invested $44.87 million in Synaptics Incorporated. The news has generally been received positively by the market and is seen as a strong show of confidence from one of the largest banks in the United States. Analysts have praised the move as a strategic investment. According to financial experts, Synaptics Incorporated is an attractive option due to its wide range of technological products and services that offer potential returns.

Furthermore, Synaptics Incorporated’s market position is seen as strong, with their products and services helping to drive innovation in the consumer electronics industry. Analysts are optimistic that the investment will prove to be a good opportunity for both parties involved.

Recent Posts