Analysts Agree: Silicon Laboratories Shares Receive ‘Hold’ Rating

May 31, 2023

☀️Trending News

Silicon Laboratories ($NASDAQ:SLAB) Inc. has recently received a consensus rating of “Hold” from the ten ratings firms covering the company. Silicon Laboratories is a leading provider of silicon, software, and solutions for a smarter, more connected world. They specialize in the design and development of analog-intensive, mixed-signal integrated circuits (ICs) for use in the automotive, industrial, consumer, communications, and computing markets. As a publicly traded company, Silicon Laboratories stock is traded on the NASDAQ Global Select Market under the symbol SLAB. Analysts that cover Silicon Laboratories have been consistently rating the stock as a “Hold” for the past few months.

This rating indicates that while there is no clear direction in the stock’s price, analysts believe that it is a good idea to hold onto any existing positions for now. They believe that longer term investors could potentially benefit from the company’s strong fundamentals and growth potential in the future. With that said, investors should still do their own research and due diligence before making any investment decisions about Silicon Laboratories.

Market Price

Analysts from various financial research firms have recently given SILICON LABORATORIES a “Hold” rating. On Tuesday, the company’s stock opened at $151.1 and closed at $145.2, representing a decline of 2.8% from its prior closing price of 149.3. The rating is based on the company’s performance over the past few months as well as its outlook for the upcoming year.

While the stock has seen some downswings, analysts think that it is likely to remain stable in the near future. This rating is based on a combination of the company’s financial performance and market sentiment, and could be subject to change if there are any significant developments in either metric. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Silicon Laboratories. More…

| Total Revenues | Net Income | Net Margin |

| 1.04k | 82.46 | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Silicon Laboratories. More…

| Operations | Investing | Financing |

| -16.68 | 712.21 | -745.06 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Silicon Laboratories. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.16k | 741.99 | 44.36 |

Key Ratios Snapshot

Some of the financial key ratios for Silicon Laboratories are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.3% | 23.7% | 11.8% |

| FCF Margin | ROE | ROA |

| -4.5% | 5.4% | 3.5% |

Analysis

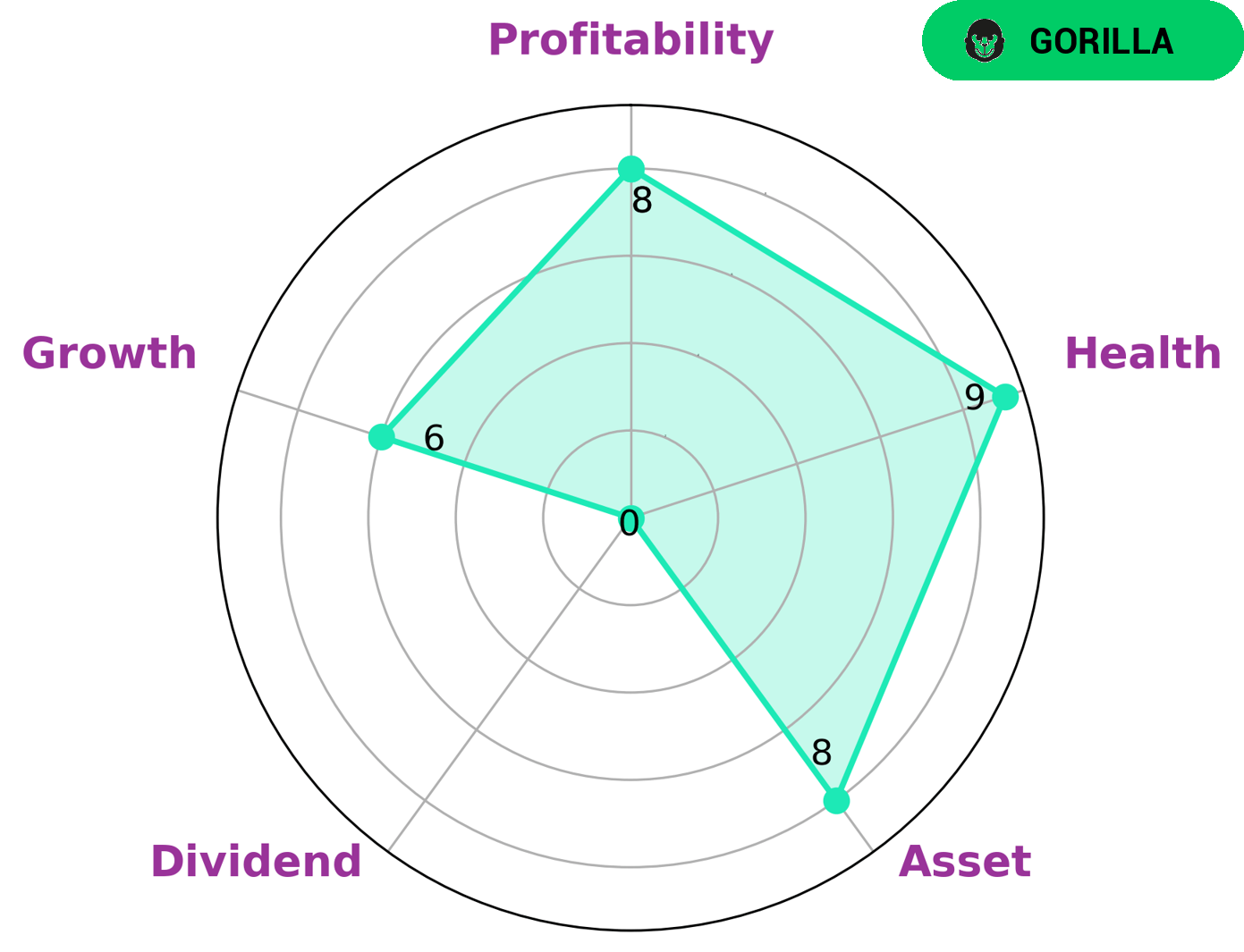

GoodWhale has conducted an analysis of SILICON LABORATORIES‘s fundamentals, and determined that the company has a high health score of 9/10 with regard to its cashflows and debt, indicating a capability to pay off debt and fund future operations. Furthermore, its Star Chart classification is ‘gorilla’, which we interpret as a firm that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given the company’s strong asset position, profitability and medium growth, we believe that SILICON LABORATORIES may be attractive to a variety of investors looking for a balance between safety and returns. While the company is weak in dividend yield, its potential for generating capital gains may make up for this deficiency. More…

Peers

The company’s competitors include NXP Semiconductors NV, Synaptics Inc, and Qualcomm Inc.

– NXP Semiconductors NV ($NASDAQ:NXPI)

NXP Semiconductors NV, a Dutch company, is a leading semiconductor manufacturer with a market cap of 38.06B as of 2022. The company’s ROE is 41.87%. NXP Semiconductors NV designs, manufactures and markets a broad range of semiconductor products, including microcontrollers, digital signal processors, memories, RF power amplifiers and mixed-signal integrated circuits.

– Synaptics Inc ($NASDAQ:SYNA)

Synaptics Inc is a publicly traded company that designs, develops and markets human interface solutions. The company’s products are used in mobile phones, PCs, and other electronic devices. Synaptics’ human interface solutions include touch controllers, display drivers, fingerprint sensors, biometrics and security solutions.

Synaptics has a market capitalization of $3.48 billion as of 2022 and a return on equity of 18.08%. The company’s products are used in a variety of electronic devices, including mobile phones, PCs and other consumer electronics. Synaptics is a leading provider of human interface solutions that enable people to interact with electronic devices.

– Qualcomm Inc ($NASDAQ:QCOM)

Qualcomm Inc is an American multinational semiconductor and telecommunications equipment company that designs and markets wireless telecommunications products and services. It has a market cap of 130.69B as of 2022 and a Return on Equity of 90.42%. The company was founded in 1985 and is headquartered in San Diego, California.

Summary

Silicon Laboratories Inc. is a company that specializes in the design and manufacture of integrated circuits for various markets, including consumer electronics, communications, and the Internet of Things. According to a consensus rating by ten ratings firms, Silicon Laboratories, Inc. should be considered a “Hold”. This indicates that analysts are not expecting large returns or losses from the stock in the short-term.

Investors should research the company and its market position in order to make an informed decision regarding investment in Silicon Laboratories. Factors such as its financial performance, competitive edge, and potential for growth should all be taken into consideration when deciding whether or not to invest in the company.

Recent Posts